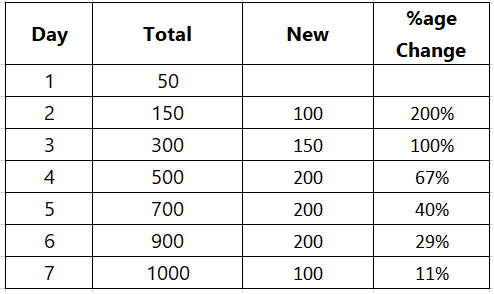

(Hypothetical case)

A country has 50 infected people on day 1

150 on day 2

300 on day 3

500 on day 4

700 on day 5

900 on day 6

1000 on day 7

It is apparent that that the numbers are increasing every day.

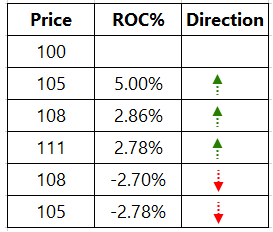

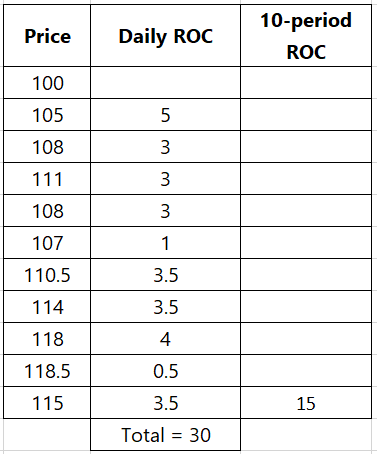

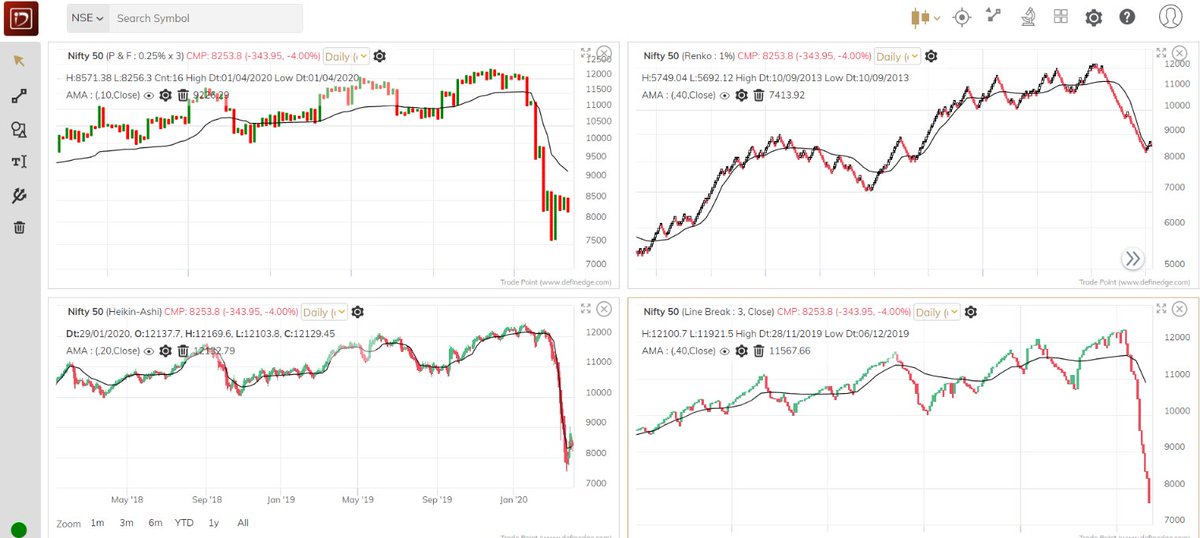

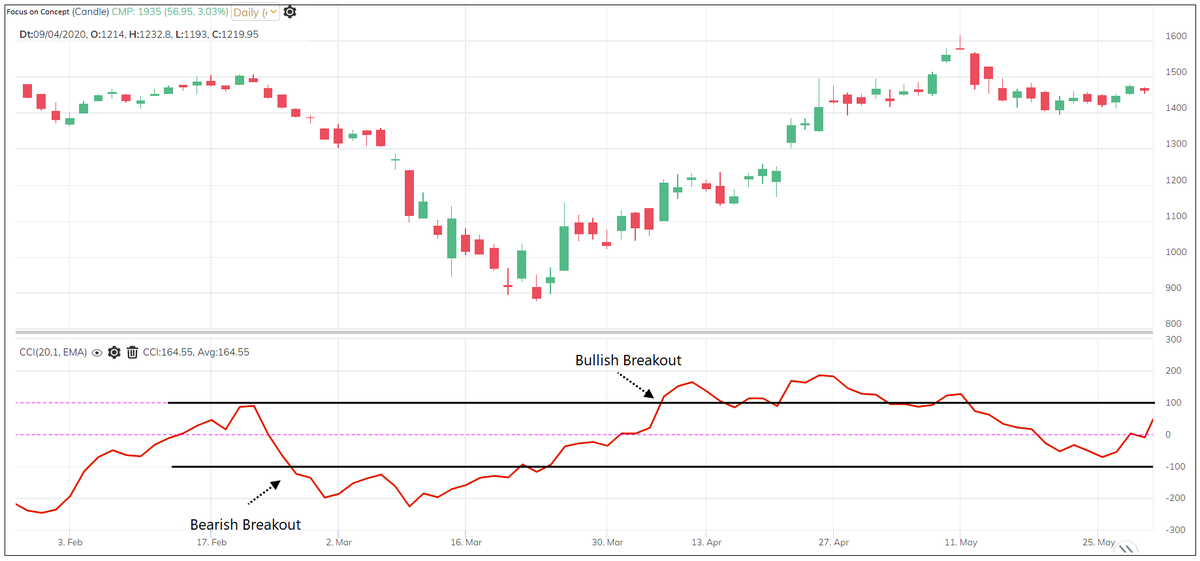

There are many indicators based on ROC but I will discuss three-indicators just for reference.

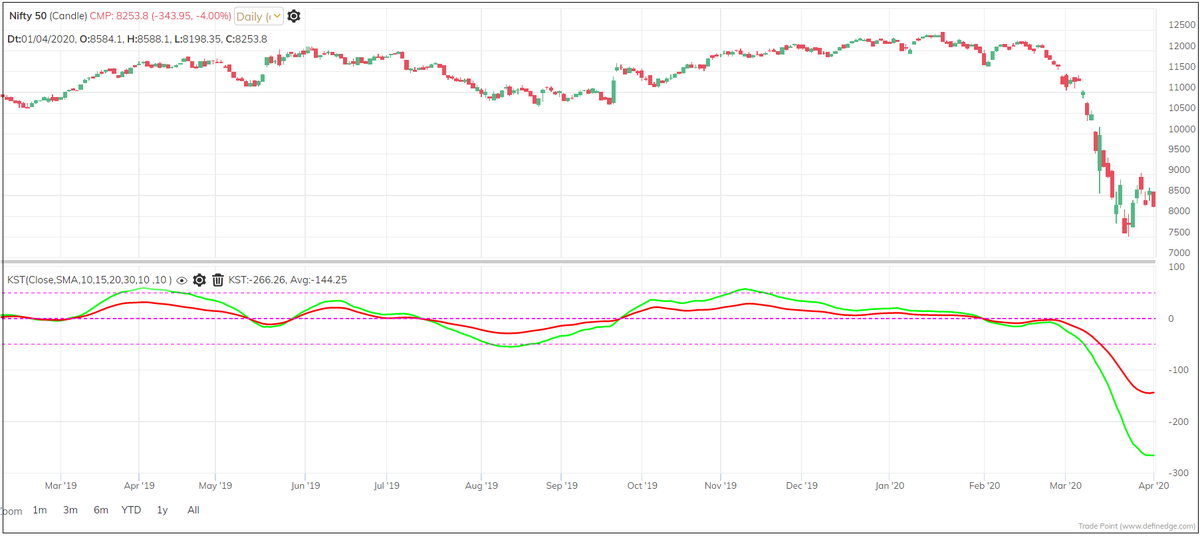

Martin Pring calculated KST (Know Sure Thing) indicator based on ROC. It is simply a weighted average of four different rate-of-change values that have been smoothed.

End of Thread.