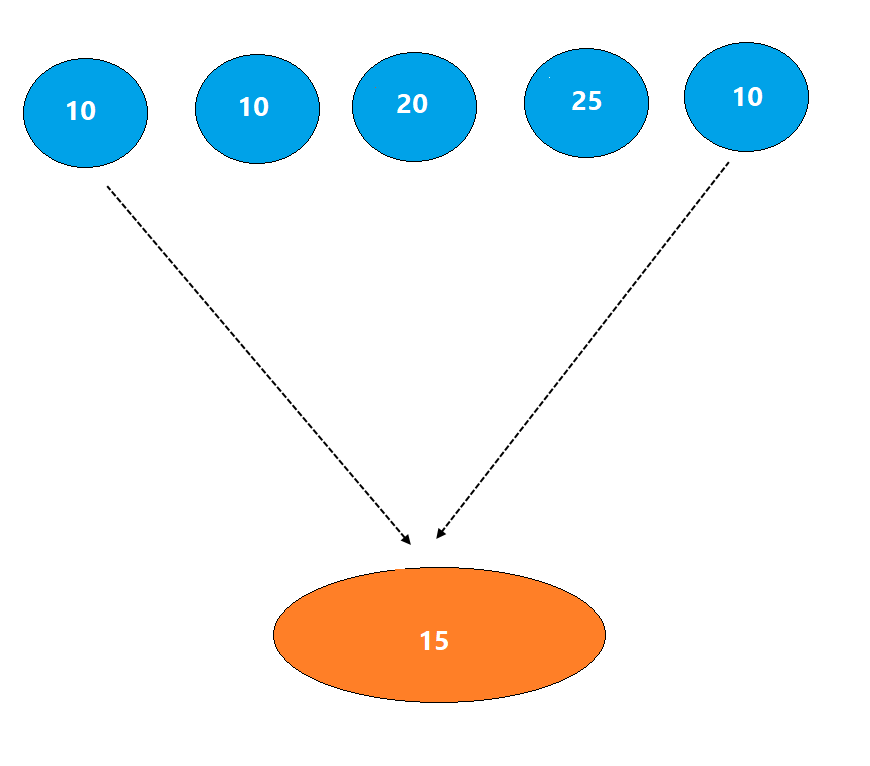

MACD line calculates the difference between two averages.

So,

When the Short-term MA > Long-term MA, the MACD line will be above zero

When the Short-term MA < Long-term MA, the MACD line will be below zero

In simple words,

MACD line above zero is bullish & MACD line below zero is bearish

Rising MACD lines means the distance between ave is increasing & falling MACD line means the distance is reducing.

MACD line > 0 + Falling = Trend is bullish but distance between averages is reducing

MACD line < 0 + Rising = Trend is bearish but distance between them is reducing

It was realised that one can read and interpret the difference between MACD line and signal line as well.

Bullish MACD Histogram bar = MACD line > Signal line

Bearish MACD Histogram bar = MACD line < Signal line

Rising histogram = Difference between MACD line and signal line is rising

Falling histogram = Difference between MACD line and signal line is falling

But remember, at times, averages converge even during strong trends and then resume the trend.

The typical and popular settings for MACD indicator is 12-period for ST MA, 26-period for long term MA and 9-period for the Signal line

Disparity index calculates distance between price and Moving average.

<End of Thread>