It would capture how far the closing price is from the lowest price of last five sessions – right?

Let us call it CL.

In above example, closing price is 100 and Low is 80 so CL is 20.

So in the earlier Example, CL is 20 and range is 40: K is 50%. (20 / 40 x 100).

K shows us how strong or weak the CL is.

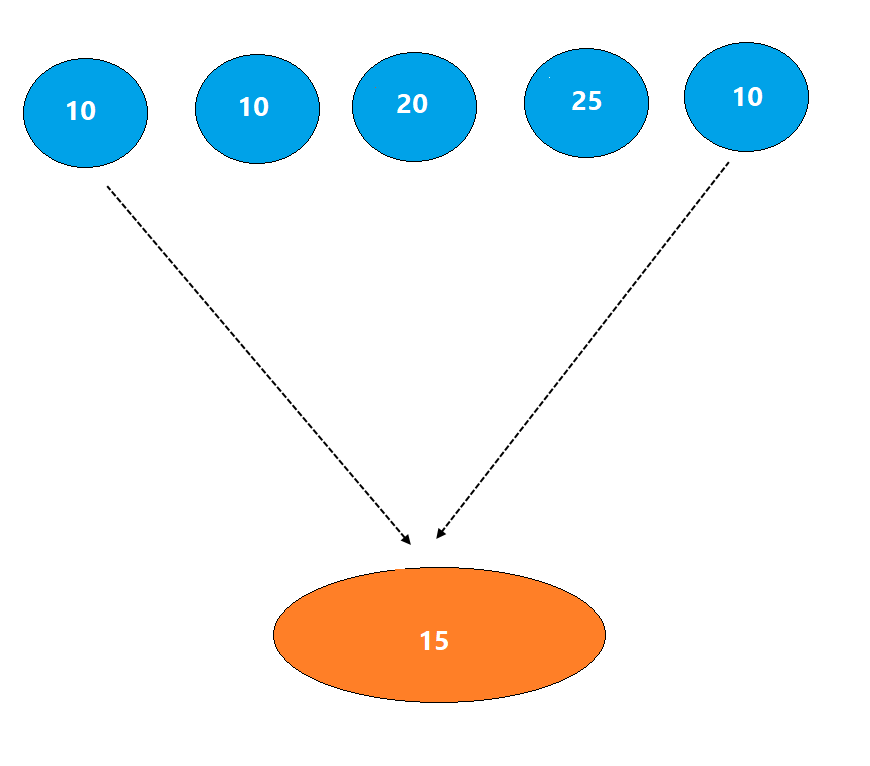

If CL is 10 and range is 40, K is 25%. This is bearish because current price is near the low of last 5 sessions.

Got it?

George Lane developed Stochastic indicator during late 1950s.

If Stochastic parameter are 5, 3, 3:

CL and Range is calculated over last 5 bars.

Average of CL and Range is calculated over last 3 bars.

%D = 3-bar average of %K.

Simple average method is used in all calculations. Stochastic indicator oscillates between 0 and 100.

Bullish momentum = price is near its high in a given time period

Bearish momentum = price is near its low in a given time period

So, Rising Stochastics and above 50% indicate bullish momentum and falling Stochastics below 50% indicate bearish momentum.

5,3,3 and 14,3,3 are popular parameters.