"None of the assumptions about capital asset returns that would have been taken as a given before 1914 proved to be true." (p. 24)

amazon.com/Ivy-Portfolio-…

"Over the very long run, risky assets have a return, but not too much, or they will attract a flood of money, bidding up prices and lowering future returns." (p. 30)

In theory, institutions can use leverage to implement risk parity, as low volatility assets tend to have higher Sharpe ratios:

In the recent past (2009-2018), the S&P 500's Sharpe ratio was at the 99.4th percentile (unlikely to repeat in our lifetimes):

"To gain a full understanding of a manager's performance, investors should use alternative metrics (Sortino ratio, Sterling ratio, MAR, Ulcer index).

"The endowment's worst enemy is inflation. Commodities perform much better in inflationary environments (1972-1981 as opposed to 1982-2007).

"Historical returns of commodity indexes have been in line with stocks' with similar volatility." (p. 69)

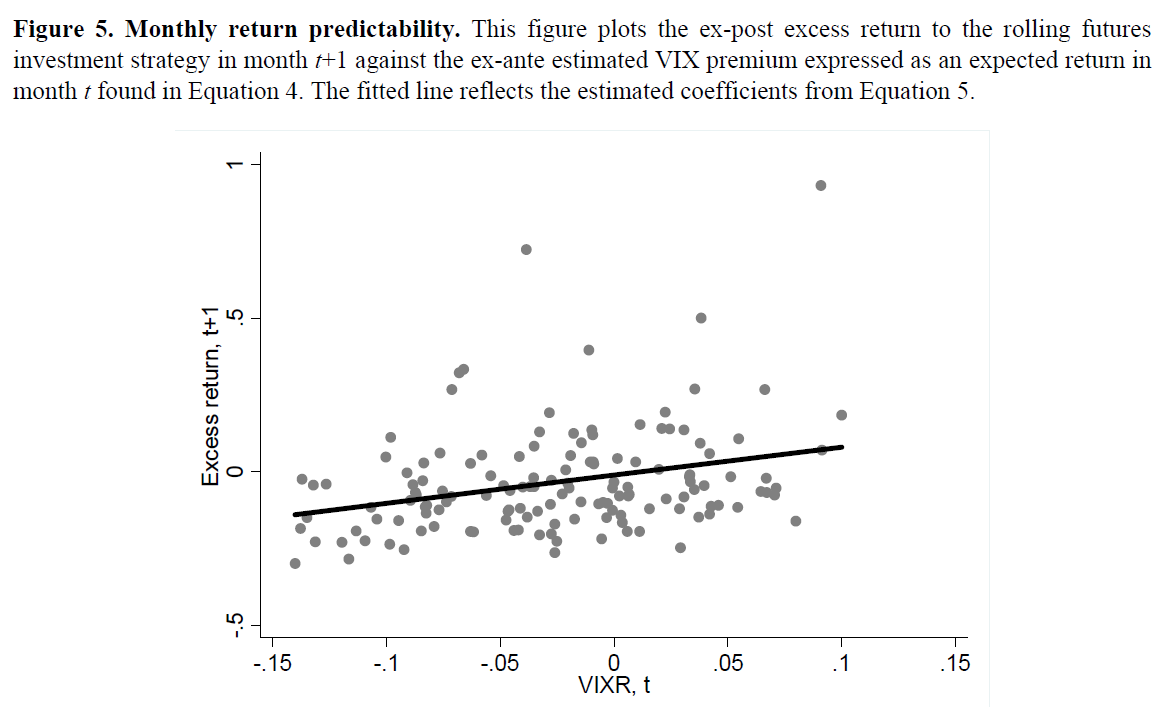

The Commodity Futures Risk Premium: 1871–2018

Commodities for the Long Run

Related research:

Time-Series Momentum

Two Centuries of Trend Following

Two Centuries of Commodity Futures Premia: Momentum, Value and Basis

Strategic Allocation to Commodity Factor Premiums

Return Seasonalities

Anatomy of Commodity Futures Risk Premia

"A miniscule 4% of funds produce market-beating after-tax results with a scant 0.6% annual margin of gain. The 96% that fail to match the Vanguard 500 Index Fund lose by a wealth-destroying margin of 4.8% per annum.

"Add on the poor timing of individual investors, and over the past 25 years, they underperformed indexes by 5%/year." (p. 71)

"The majority of this time frame includes one of the biggest bull markets in history." (p. 72)

"The blind odds of picking a winner more accurately than the index against you.

Related research:

Do Stocks Outperform Treasury Bills?

Enduring Effect of Time-Series Momentum on Stock Returns Over Nearly 100 Years

"A simple rebalance can add 0.1 to 0.2 to the Sharpe ratio." (p. 77)

"Financial advisors could justify their entire fee by implementing a simple tax loss harvesting strategy." (p. 78)

Related research (thread):

"This is a positive feedback loop: because the fund performed well in the beginning,

Median IRR by LP type:

Endowments 23.6%

Advisors 20%

Public pension funds 12.3%

Other investors 7.7%

Insurance companies 5.7%

Corporate pension funds 3.2%

Banks and finance companies -0.1%

Overall 12%

"Unless you are an endowment or can pick the top 20% of private equity funds, you are better off buying a stock index and not dealing with all the headaches." (p. 90)

Financial advisors as a group add no alpha before fees. (Based on Meb's math, the vast majority have fees that are not justified by the value-add.)

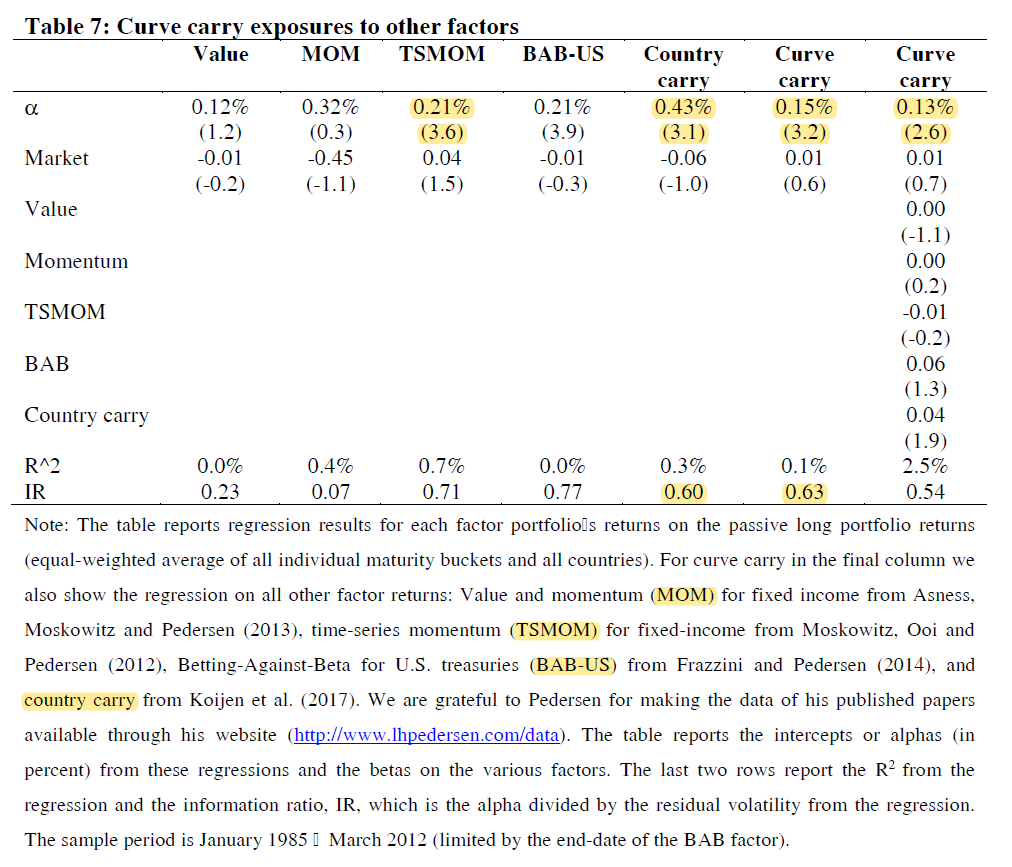

Hedge fund alphas have declined and are now about zero:

"Hedge fund indices no longer resemble hedge funds but are mainly composed of stock and bond risk. You do not want to pay high fees for beta exposure." (p. 107)

"Once you factor in the underperformance of the investable version [and large beta loadings], little appeal remains." (p. 110)

"The payout yield has remained a robust indicator for excess stock return.

"The unfortunate mathematics of a 75% decline require an investor to realize a 300% gain just to get back to even: the equivalent of compounding at 10% for 15 years.

"Buying asset classes for the long run is a good idea if you are a Sequoia tree or an endowment, but individuals usually do not have a 20-year time frame to recover." (p. 136)

"There is nothing worse than watching a portfolio experience a long and painful decline. Human biases return even worse than when times are normal." (p. 138)

"Stock funds accounted for 99% and 123% of mutual fund flows in 1999 and 2000, respectively: people were selling off their other holdings to plow money into stocks.

"From 1973-2002, the NASDAQ gained 9.6%/year, but because most investors pumped money in from 1998-2000, the typical dollar invested earned only 4.3%/year." (p. 138)

"Overconfidence: 82% of drivers say they are in the top 30% of drivers, and 80% of students think they will finish in the top half of their class.

"People who pay close attention to news updates earn lower returns (excessive trading) than people who seldom follow the news.

"More money has probably been lost by investors holding a stock until they could 'at least come out even' than from any other single reason.

"A simple quantitative approach helps avoid behavioral biases." (p. 140)

"A loss never bothers me after I take it. I forget it overnight. But being wrong—not taking the loss—that is what does damage to the pocketbook and to the soul."

1. Simple, purely mechanical logic

2. The same model and parameters for every asset class

3. Price-based only" (p.141)

"Self-control and discipline." (p. 143)

"The compounded returns are 9.21% and 10.45%, respectively. Buy-and-hold takes a 199 bps hit due to higher volatility diminishing geometric returns." (p. 144)

"A trend-following model will underperform during a roaring bull market; the value-add needs to be recognized over an entire business cycle." (p. 146)

Related research:

Dual Momentum – A Craftsman’s Perspective

"Further dividing up an index can create additional reductions in volatility." (p. 158)

Trend following on individual stocks:

Conversely, tax loss harvesting adds a momentum tilt:

It can offset short-term gains generated by other strategies:

...

1. Do you have the necessary perseverance?

2. Are you independent and self-assured enough to resist constantly looking over your shoulder to see how someone else is doing?

4. Can you accept that your timing system will be imperfect?

5. Can you ignore the mass media?

6. Are you decisive?

...

For example:

Value and Momentum Everywhere

For example:

* Missing the ten best days: 14.24%/year

* Missing the ten worst days: 24.17%year

* Missing both the best and the worst days: 20.31% (and likely with less volatility)

(p. 169)

"The real secret is defense, defense.

"If investors could just eliminate their larger losses, the good results would take care of themselves. We remind ourselves of the great advantage of staying out of trouble." (p. 169)

"The best investors to choose for this analysis are those with long-term holding periods so that the 45-day delay in reporting times is not a major factor." (p. 174)

"With a 13F strategy, the investor controls and is aware of the exact holdings at all times, eliminating fraud risk.

"However, he does not have access to the timing and portfolio trading activities of the manager.

AQR formed a Buffett-replicating portfolio based on Berkshire's factor exposures:

"Investors could also hedge by buying puts or shorting various indices." (p. 183)

"In many cases, the investor is exposed to incredible amounts of risk without even knowing it.

"If you believe the behavioral research, losses and downside volatility should become much more of a focus than pure return." (p. 187)

"Isn't that the point at the end of the day? The investment portfolio is a means to an end, not an end in itself." (p. 190)

"H.M. Gartley (1945) mentions methods of relative strength stock selection.

"Robert Levy (1968) identified his own relative strength system.

"Even using the top 100 U.K. stocks since 1900, they found 10.3%/year outperformance.

"Chan, Harmee, and Tong (2000): international stock indexes exhibit momentum

"Two of the oldest trend-following systems are Dow Theory (Charles Dow) and the Four Percent Model (Ned Davis)." (p. 196)

"Now, I know all kinds of shrewd people who, by staying within a narrow area, can do very well without reading. But investment is a broad area."