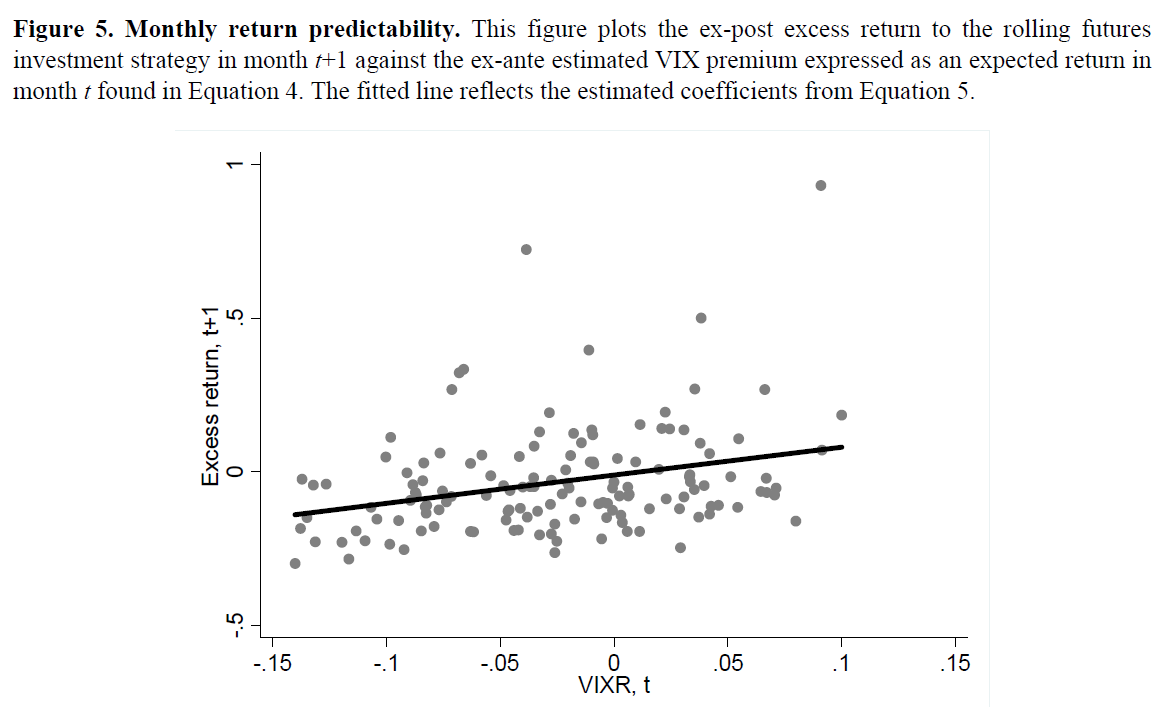

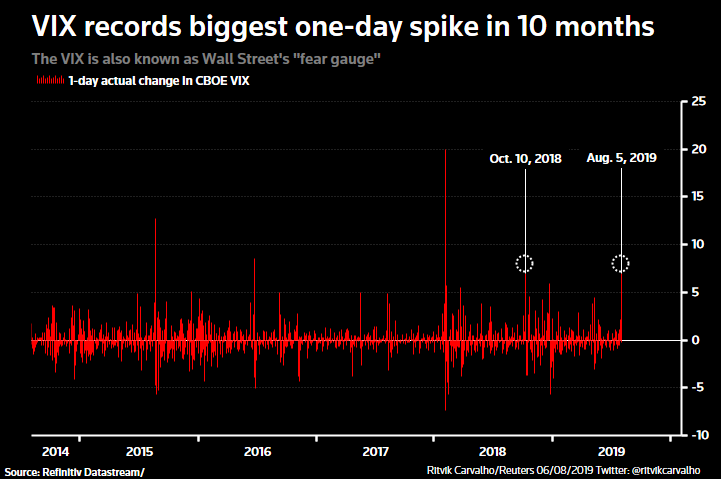

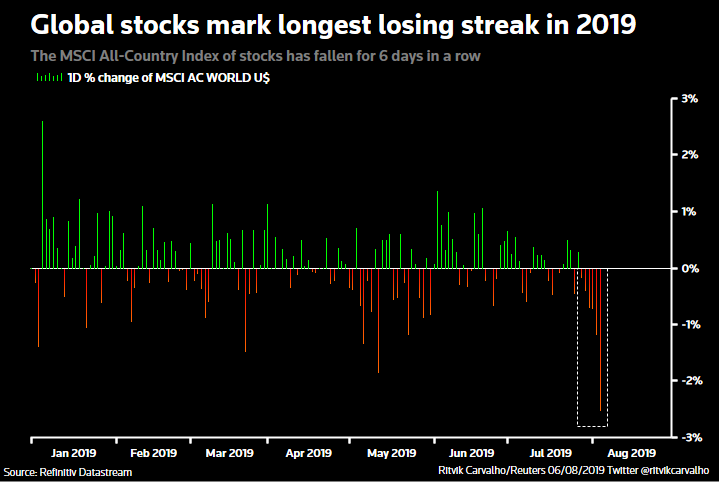

"Ex-ante estimated premiums predict ex-post returns to VIX futures with a coefficient near one, and falling ex-ante premiums predict increasing ex-post market and investment risk, creating profitable trading opportunities."

papers.ssrn.com/sol3/papers.cf…