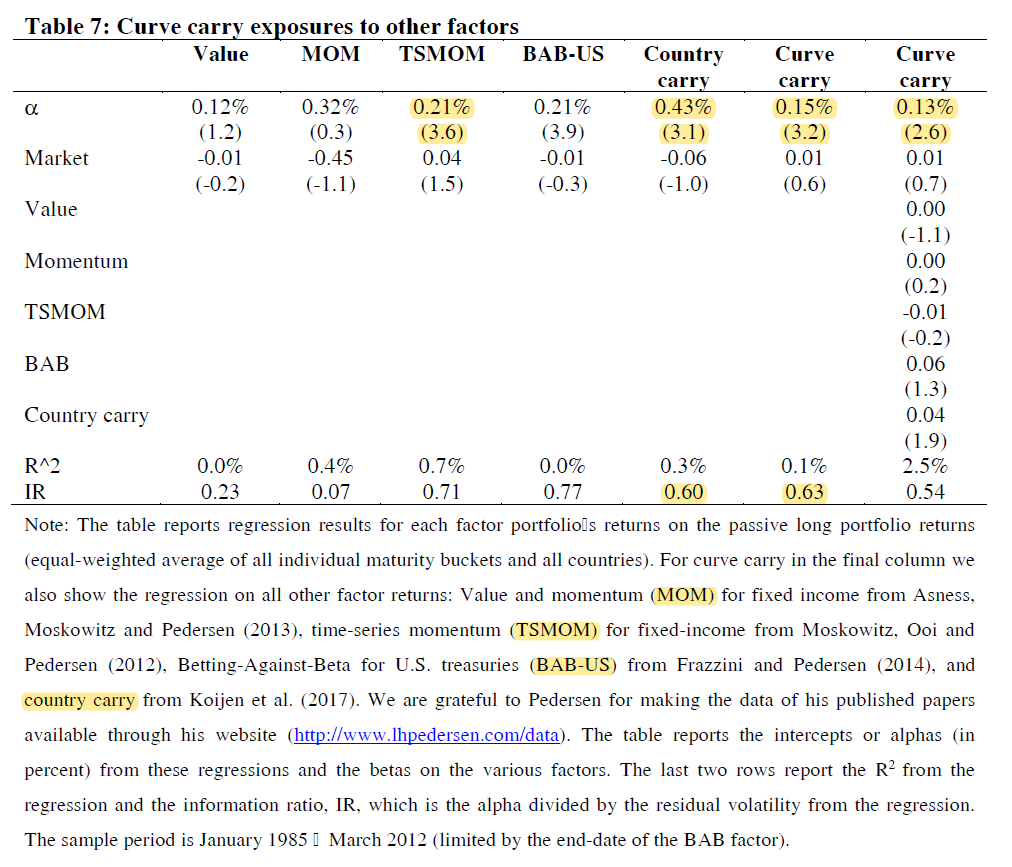

"Global curve carry has strong performance that cannot be explained by other factors. Bond BAB has no added value for an investor who already invests in curve carry."

wp.lancs.ac.uk/fofi2018/files…

Value and Momentum Everywhere (Asness et. al.)

(findings for bonds)

Time-Series Momentum (Moskowitz et. al.)

Carry (Koijen et. al.)