#cryptocapital #gts #RIP . . with much more important things going on. I havent checked my alerts

#globaltradesolutions monitor pulled the pin. Liquidation approved on 26 Feb. The register dates lodgement at 27 Mar. Im a bit rusty on Swiss insolvency law....

#globaltradesolutions monitor pulled the pin. Liquidation approved on 26 Feb. The register dates lodgement at 27 Mar. Im a bit rusty on Swiss insolvency law....

but I'd say monitor found no assets, doubt #cryptocapital #panama was revived....pretty hard to recover funds without entities being in good standing let alone being more degrees of seperation than kevin bacon from the $$

Summary of Swiss liquidation process kmu.admin.ch/kmu/en/home/co…

True to form...#ravidyosef #finnovative holdings will be struck off next month without ever having made a filing.

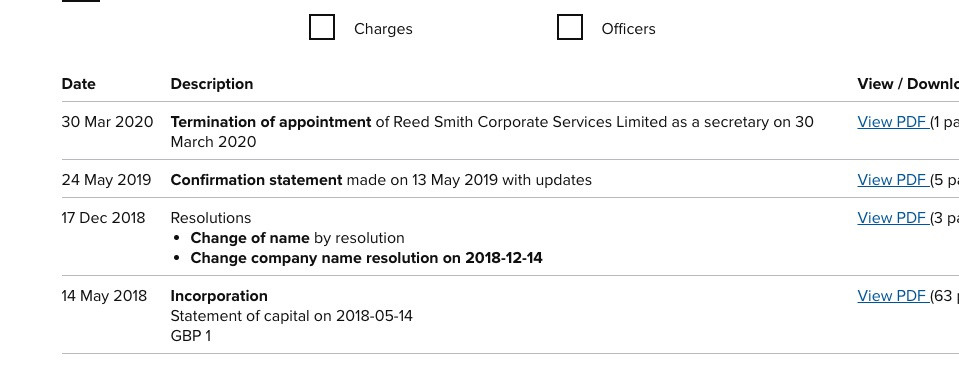

Why am I not suprised that Spiral development (aka GTS resources) is also clearly heading towards being struck off as well. No lodgements and the secretary terminated appointment end of March....

beta.companieshouse.gov.uk/company/113610…

beta.companieshouse.gov.uk/company/113610…

my original scratchings So out of all entities - GTS in liquidation, #cryptocapital struck off, GTS resources which was meant to be holding $300m is on its way to be strruck office. The acquisition by NFM was cancelled.....oh and Rohn Monroe's name has never been corrected

search for domains re: Arizona Bank and Trust quickly flagged arizbankandtrust.com as highly unusual. A domain unrelated to the actual bank, hosted on servers in #panama and taken offline mid Feb 2019 (not just the site the actual domain) #smellslike #bank #spoofing

Quite possible that domain was setup for the sole purpose of mimicking arizbank.com so #davidstafford and his #tcabank buddies could move some of the #cryptocapital funds. some data here >> bit.ly/2KeD8dH h/t to offshore alert @DEM_Offshore @OffshoreAlert

• • •

Missing some Tweet in this thread? You can try to

force a refresh