A simplified thread on the deal, Jio platfrom and competition.

1/n

Landmark deal:

📝Largest investment for a minority stake by a technology company ANYWHERE in the world

📝Largest FDI in the technology sector in India.

📝Values Jio Platforms amongst the top 5 largest listed cos. in India

📝Improves India's $ reserves & fiscal balances

Deal rationale - Facebook had $50B of cash on B/S making practically no money. Deploying $5.7 bn in Jio gives them broader access to India and India 2 retail users. For Reliance, it strengthens their consumer wallet share and brings big ability to cross service clients.

Cross selling using Reliance Retail: Commercial partnership between Reliance Retail and WhatsApp to accelerate Reliance Retail’s New Commerce business on the JioMart platform using WhatsApp.

Reliance has denied has relevance of relation to this deal to the "super app" plan

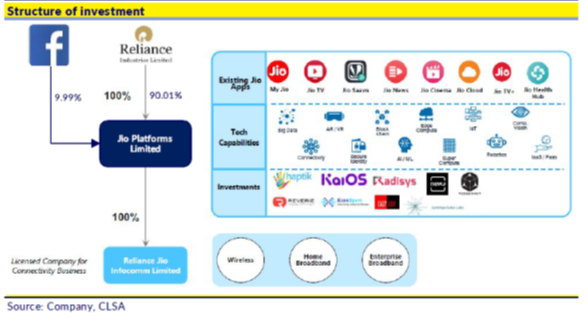

Relevant subsidiaries of RIL:

🏦Jio Platforms: Wholly-owned subsidiary of RIL that gets 15K crores

🏦Reliance Jio Infocomm: Provides connectivity platform to over 388 mn subscribers, will continue to be a wholly-owned subsidiary of Jio Platforms. Gets zero from this deal.

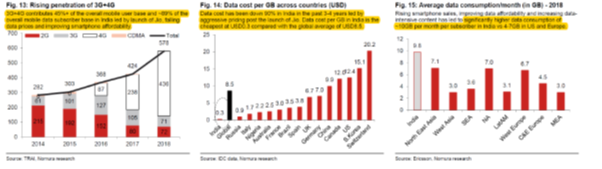

Saturation in target market?

Churn in Q3 FY20 was the highest at 6.3%. This may depict high price sensitivity of Jio’s customers, being a late entrant and tapping the bottom of pyramid. This affects Jio’s ability to onboard new ones from here "organically"

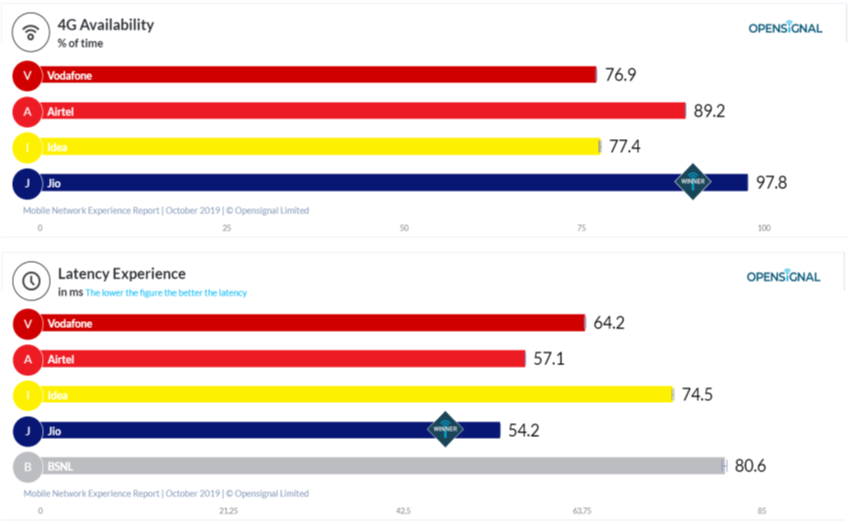

AGR issues and Airtel: Clarity on the issue of AGR dues should emerge soon with Airtel already having announced their intent to settle the same by Mar’20 post their successful QIP of $3 bn in Jan’20

For Vodafone-Idea, its’ ability to negotiate a deferred payment schedule would be key to their survival. Inability to do this would mean they will file for bankruptcy and Jio and Airtel would be best placed to share the additional 325 mm odd customers

Implication for Telecom competition (Airtel and Vodafone) - there are both pros and cons for the peers. Suggest one to read this insightful write-up for details by @mobis_philipose

livemint.com/market/mark-to…

For a deeper perspective on the investment, please read @akm1410's note (behind paywall). Recommended.

End/

themorningcontext.com/a-note-on-the-…

Addendum: Good details on possible WhatsApp synergies in this note by Rahil

Read: One year of talks, Covid-19 hurdles and more. The backstory about the Facebook-Jio deal.

vccircle.com/one-year-of-ta…

4 lesser known truths about the #FacebookRelJiodeal #FacebookJioDeal

Some good insights by Tanvi and I concur. The end game is large here.

Interestingly, this is Facebook’s second largest investment to date.

Largest acquistions:

WhatsApp: $19 bn

Jio Platforms: $5.7 bn (10% stake)

Oculus VR: $2 bn

Instagram: $1 bn

CTRL-Labs: $1 bn

LiveRail: $500 mn

Onavo: $200 mn

Atlas: $100 mn

RedKix: $100 mn

An insightful thread on the background of the multi billion dollar transaction. Covers a lot beyond what meets the eye.