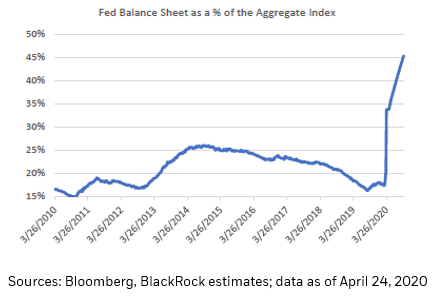

Our expectation is that the #Fed will purchase roughly equivalent to at least $1.5 trillion in #Treasuries over the remainder of the year (~$200 billion per month).

With asset purchasing in roughly these amounts, as well as everything the #Fed has already done, the magnitude of the #policy response to this #economic crisis is simply stunning.

In fact, by year end, we anticipate the #Fed’s balance sheet will have grown by a staggering $7 trillion in an effort to deal with the fallout of the #CoronavirusCrisis, or a pace of nearly $26 billion per day over a 270-day window.

For context, this equates to near one third of U.S. #GDP, or looked at differently, #Fed purchases through year-end will amount to near 28% of the Index market capitalization or 20% of the U.S. Aggregate #Bond Index.

• • •

Missing some Tweet in this thread? You can try to

force a refresh