This thread is a distillation of those notes, let's begin⏬

medium.com/@breedlove22/a…

medium.com/@breedlove22/t…

The Idea Meritocracy = Radical Truth + Radical Transparency + Believability-Weighted Decision Making

Which correlates to a free market formula:

This severed the “skin in the game” of money, and gave central banks a mechanism for perpetually privatizing...

Rule of Law (which gives us a means of nonviolent dispute resolution). Private Property Rights (which gives us respect for relationships between people and assets)...

How many dollars are there in existence?

How many will be issued in years to come?

Who gets to decide?

What are their criteria for deciding?, and...

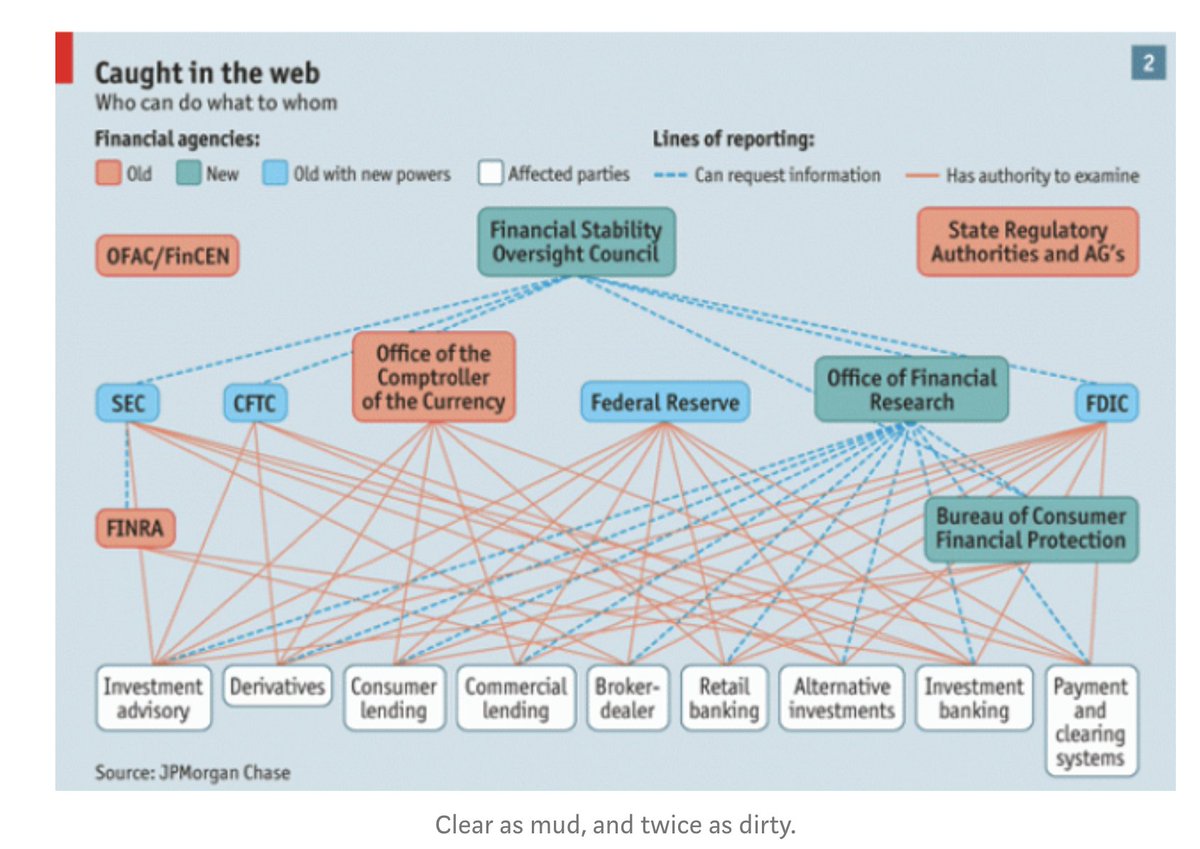

1. Maintaining monetary policy.

2. Reaching consensus as to account balances.

3. Facilitating international value flows

And Regardless of what they say or think, Central bankers have been stuffing their portfolios with gold lately

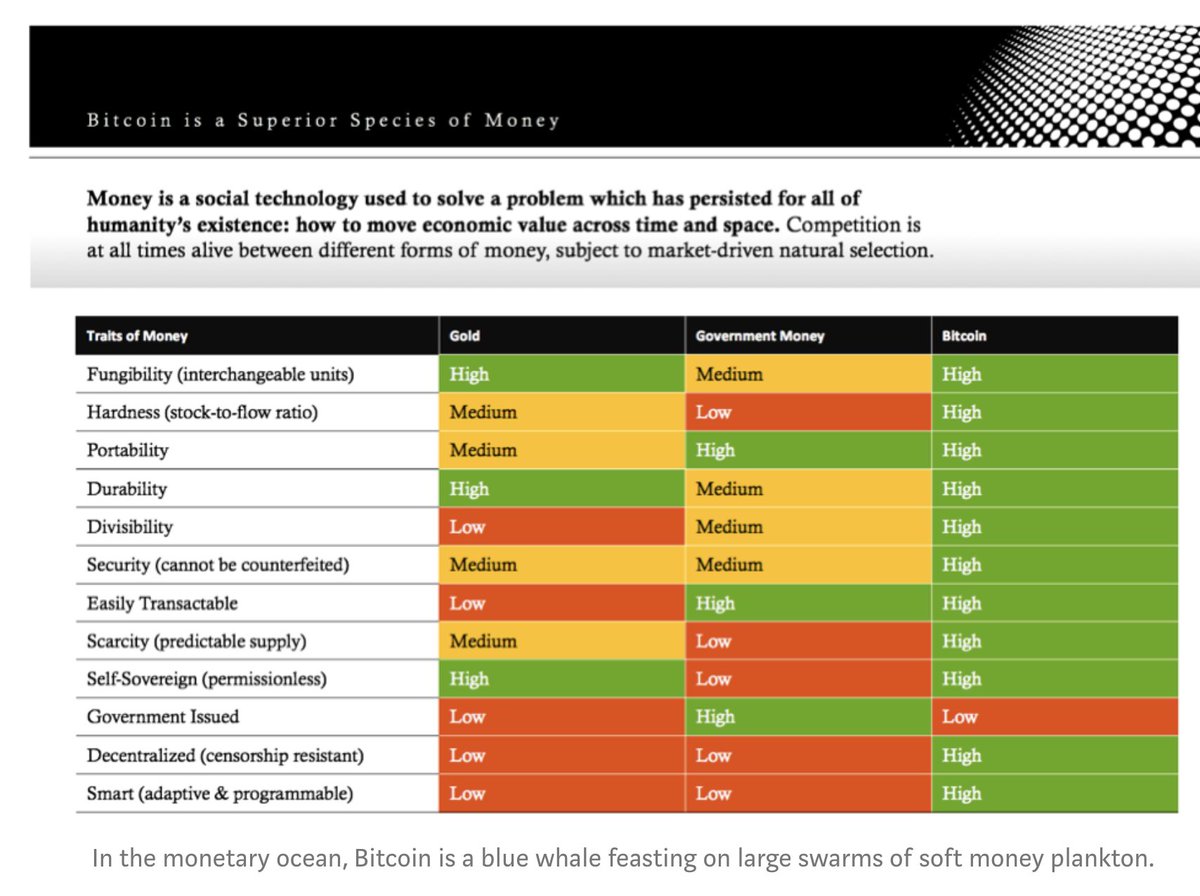

Money, which is the largest and most...

Simply, if you lack skin in the game then you lack believability.

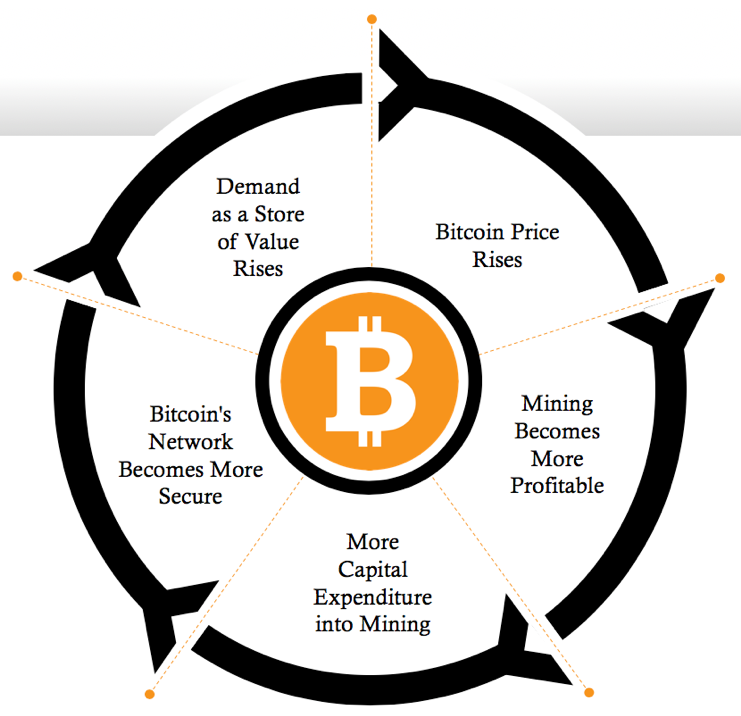

On the other hand, all market participants in Bitcoin have skin in the game Node operators are incentivized to maintain the rules...

Going back to Ray’s formula for the IM and its free market equivalent, we have the…

Idea Meritocracy = Radical Truth + Radical Transparency + Believability-Weighted Decision Making

Free Markets = Truthful Price Signals + Transparent and Reliable Rule of Law, Private Property Rights, and Hard Money + “Skin in the Game”-Weighted Decision Making

Central Banking = Untruthful Price Signals + Transparent and Reliable Rule of Law, Marginalized Private Property Rights (due to violations via inflation), and Soft Money + “Agency Problem”-Weighted Decision Making

Bitcoin = (Absolutely) Truthful Price Signals + Transparent and Reliable Rule of Law, Private Property Rights, and (Absolutely) Hard Money + “Skin in the Game”-Weighted Decision Making

Finally, going back to Ray’s assessment of Bitcoin…

Assuming Ray’s Principles are stated forthrightly, how can he possibly be a non-believer in Bitcoin?

As you said @RayDalio, (p.379) “When someone says ‘I believe X,’ ask them: What data are you looking at? What reasoning are you using to draw your conclusion?”

It’s had over 99.98% uptime,

It’s never been hacked,

It’s evolved into the most secure computing network in the world,

It is storing roughly $200B in market value, and...

what data and reasoning are you using to draw your conclusion about #Bitcoin?