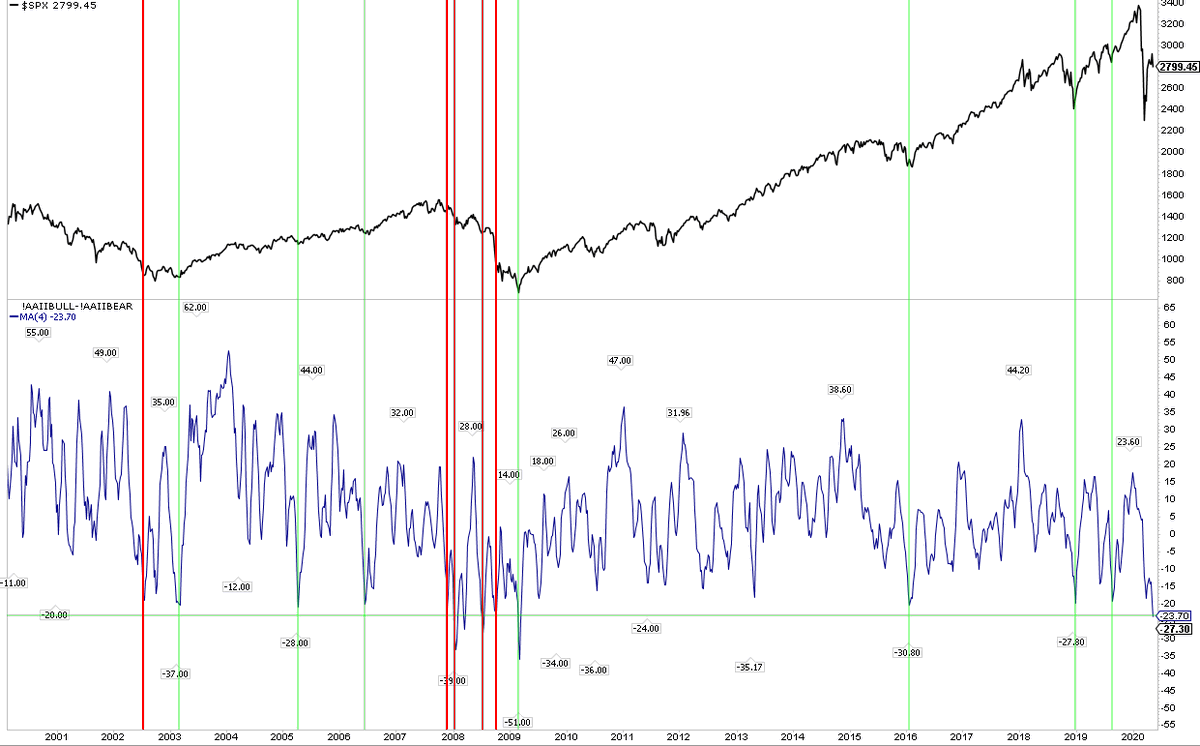

Two weeks later and ‘retail’ sentiment is still weak (-29%). Same conclusion $spx

https://twitter.com/ukarlewitz/status/1253320745289003008

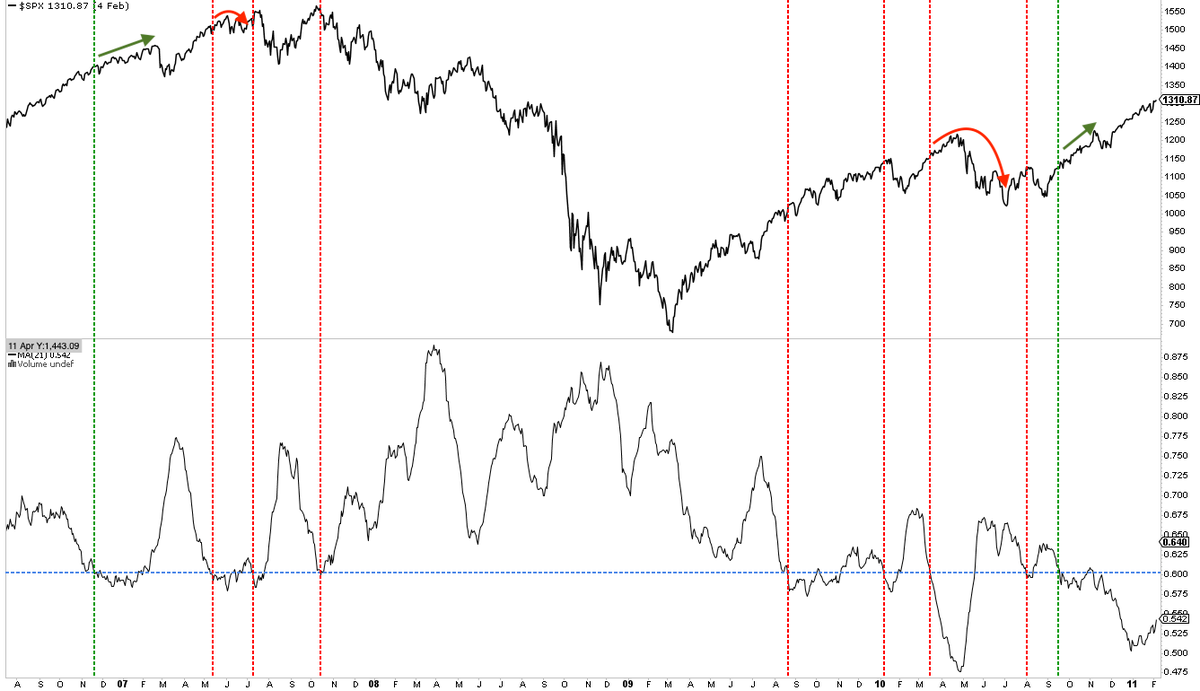

4 week retail sentiment (AAII) now lowest since March 2009. Meaningful in a bull market, not in a bear market

Sentiment round-up

Bearish: AAII, Consensus, fund flows, Fear & Greed

Bullish: II, Panic/Euphoria, one-month CPCE

Neutral: NAAIM, DSI, 10-day CPCE

Bearish: AAII, Consensus, fund flows, Fear & Greed

Bullish: II, Panic/Euphoria, one-month CPCE

Neutral: NAAIM, DSI, 10-day CPCE

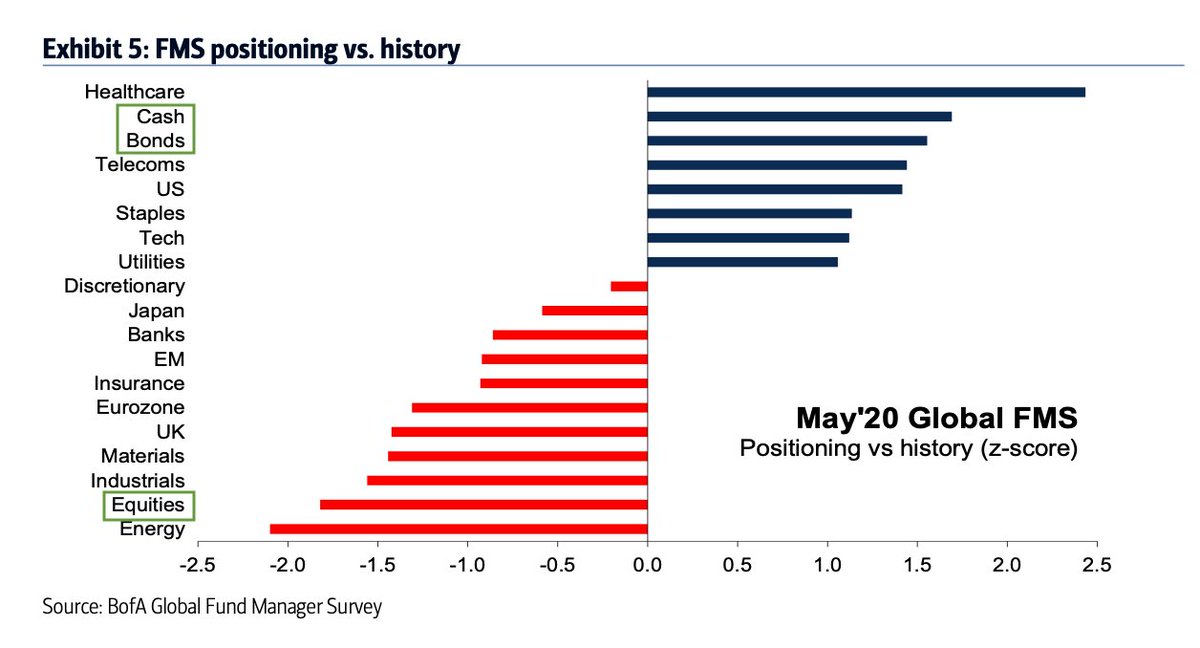

Fund managers surveyed by BAML:

- High cash (5.7%)

- Bond weight highest in 10 yrs

- Still high equity underweight (1.8% std dev below mean)

- Within equities: US weight highest in 5 yrs, Europe lowest in 8 yrs (flight to safety)

- High cash (5.7%)

- Bond weight highest in 10 yrs

- Still high equity underweight (1.8% std dev below mean)

- Within equities: US weight highest in 5 yrs, Europe lowest in 8 yrs (flight to safety)

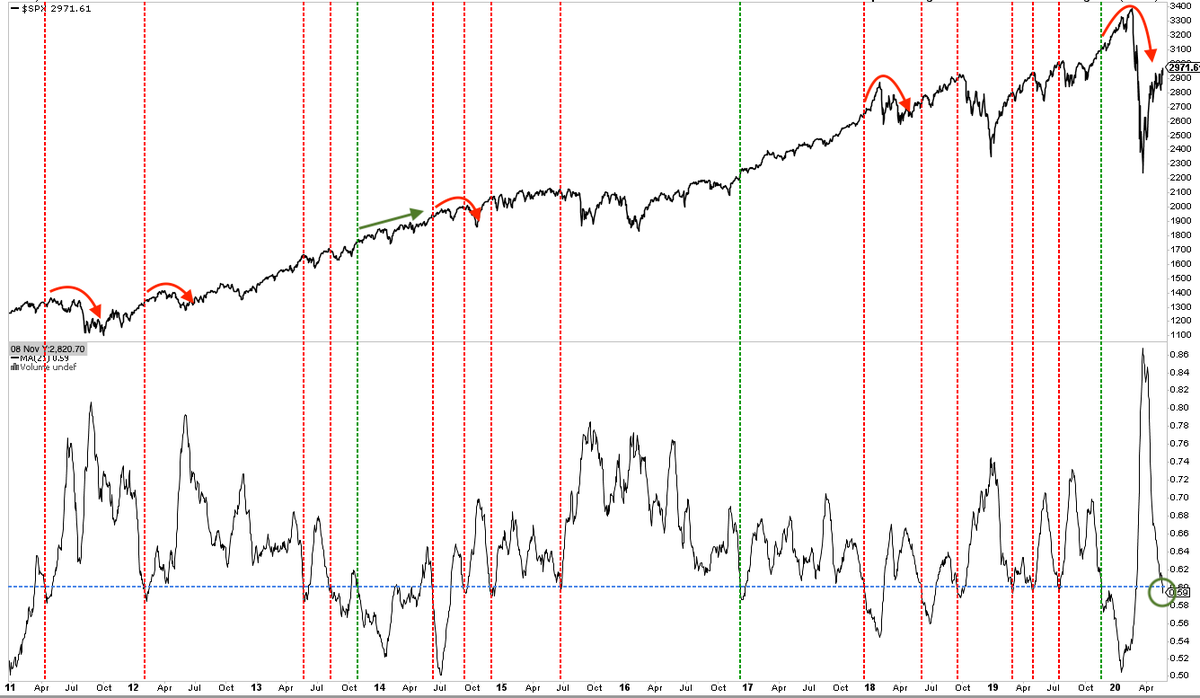

One month equity only put/call (0.59) at a level where $SPX often runs into some turbulence. If it runs higher now, those gains usually (but not always) given back

• • •

Missing some Tweet in this thread? You can try to

force a refresh