The full slideset can be found here

drive.google.com/file/d/1wAj6QE…

#Chainlink $LINK

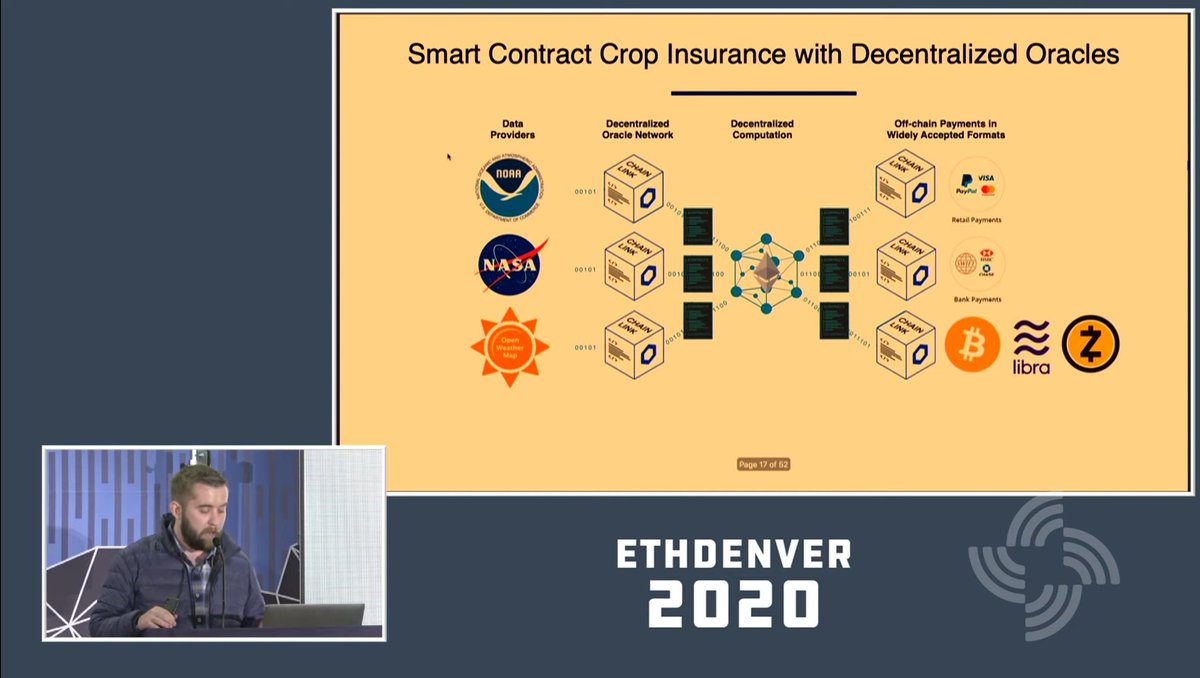

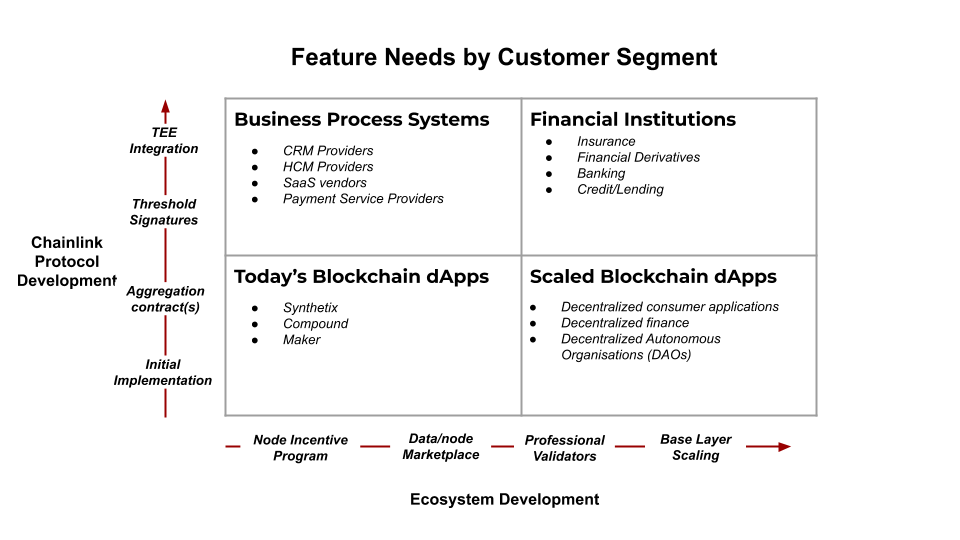

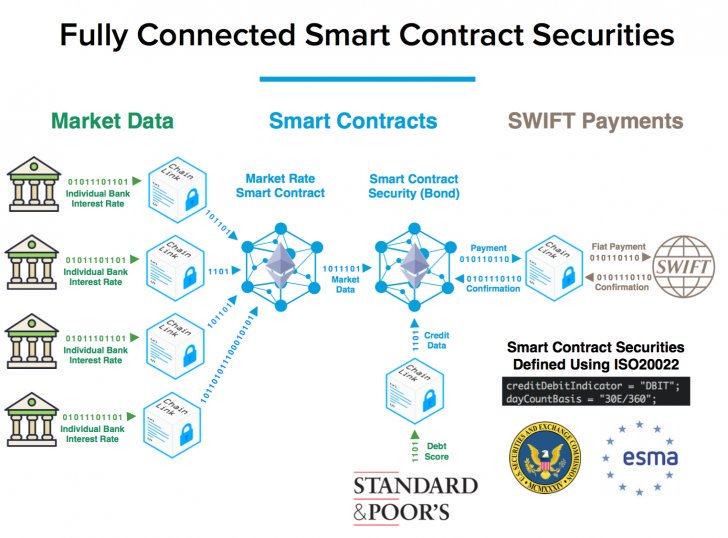

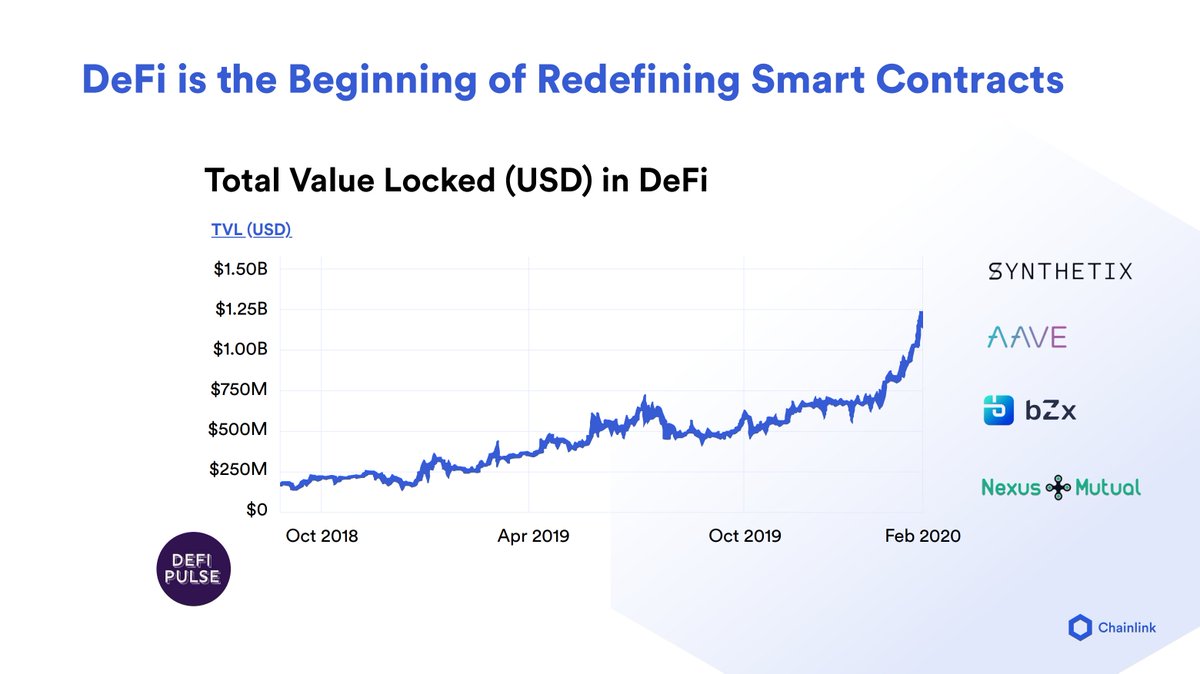

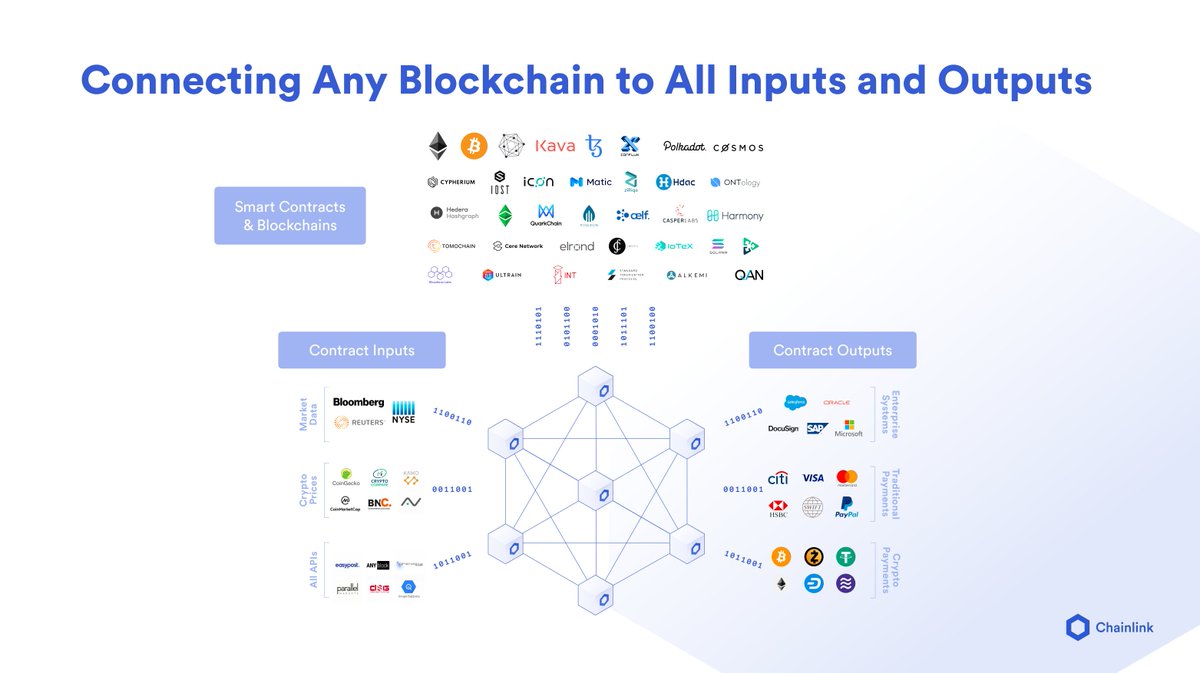

90%+ of DeFi inlcuding @MakerDAO @synthetix_io @compoundfinance @AaveAave @bzxHQ @NexusMutual and more REQUIRE external oracles to exist

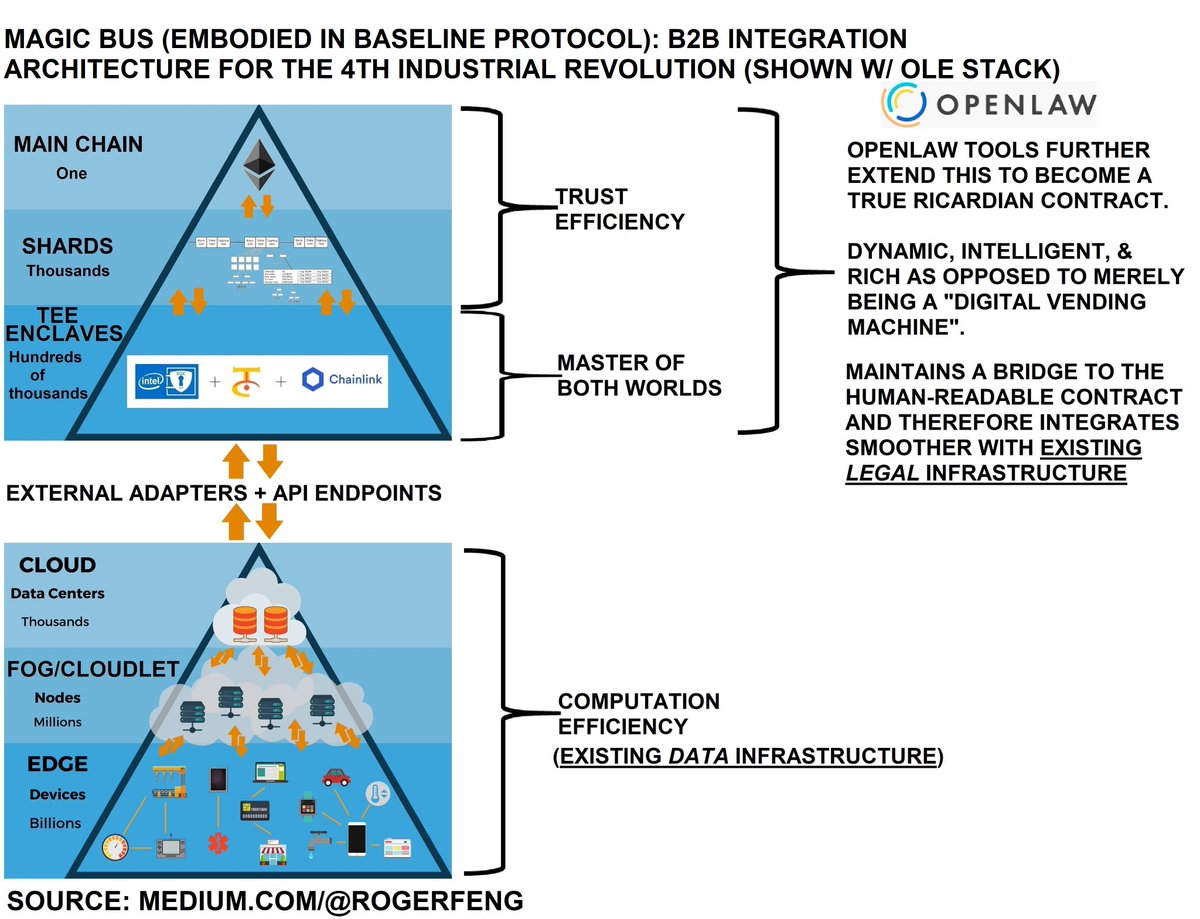

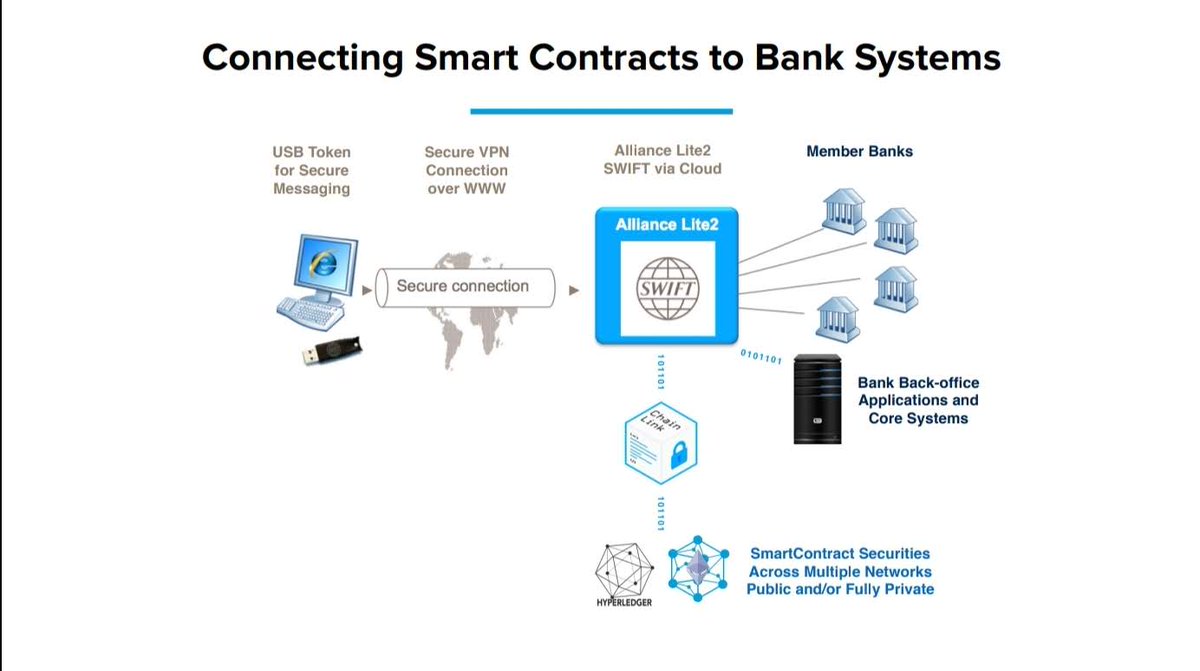

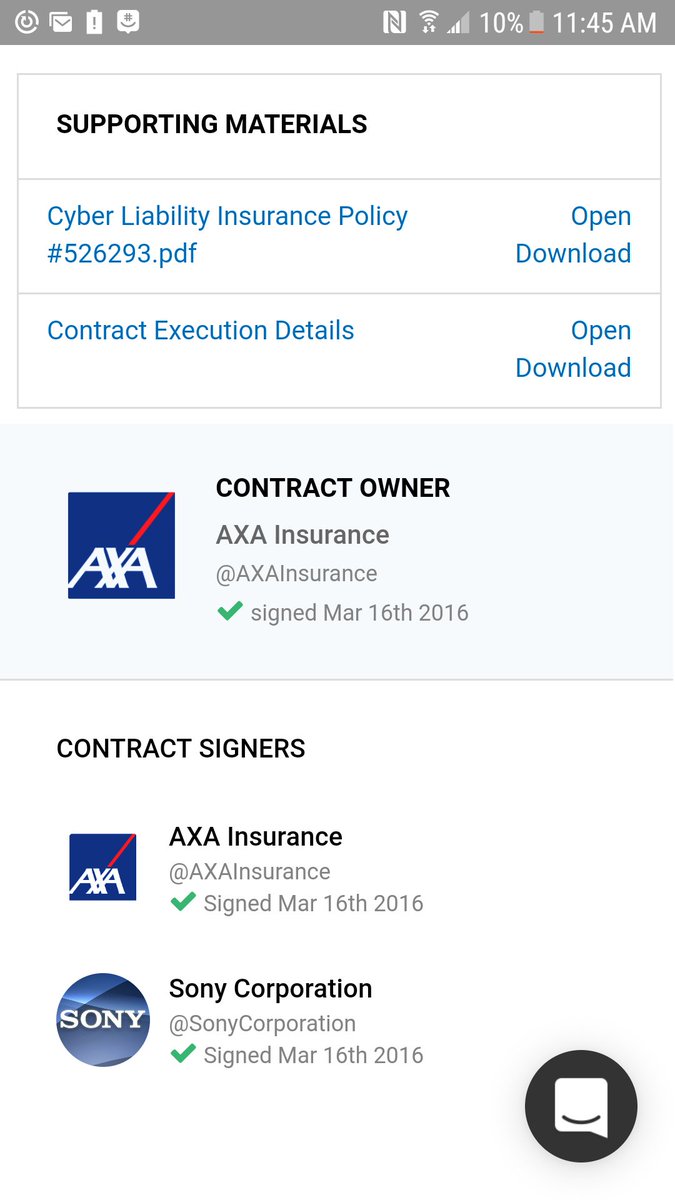

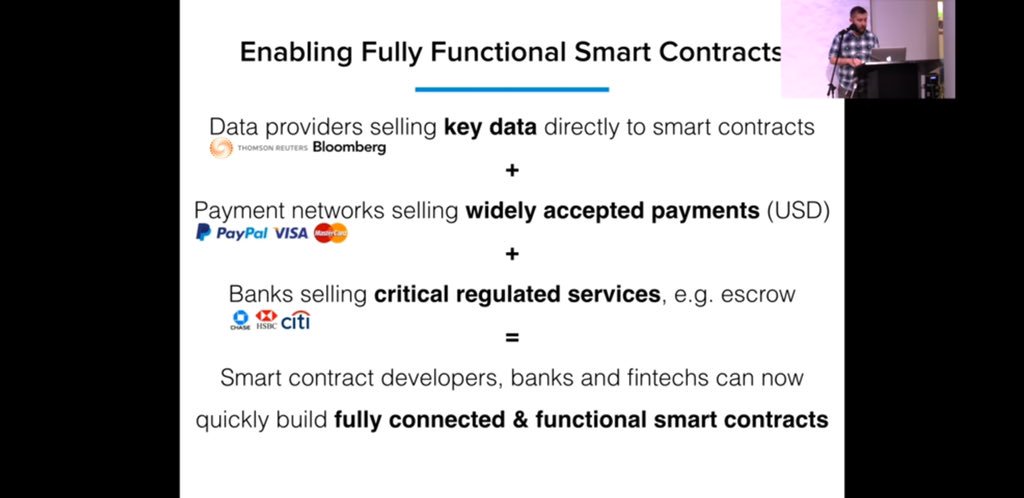

Enterprise systems includes Salesforce, Oracle, SAP, Microsoft, Docusign, etc

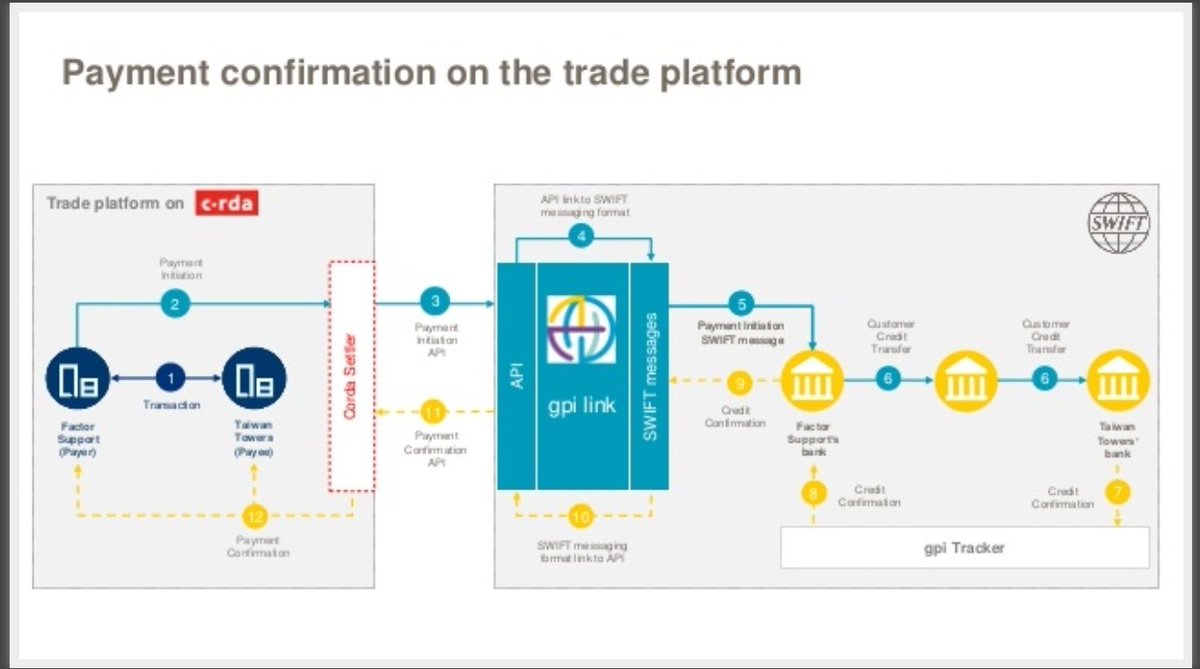

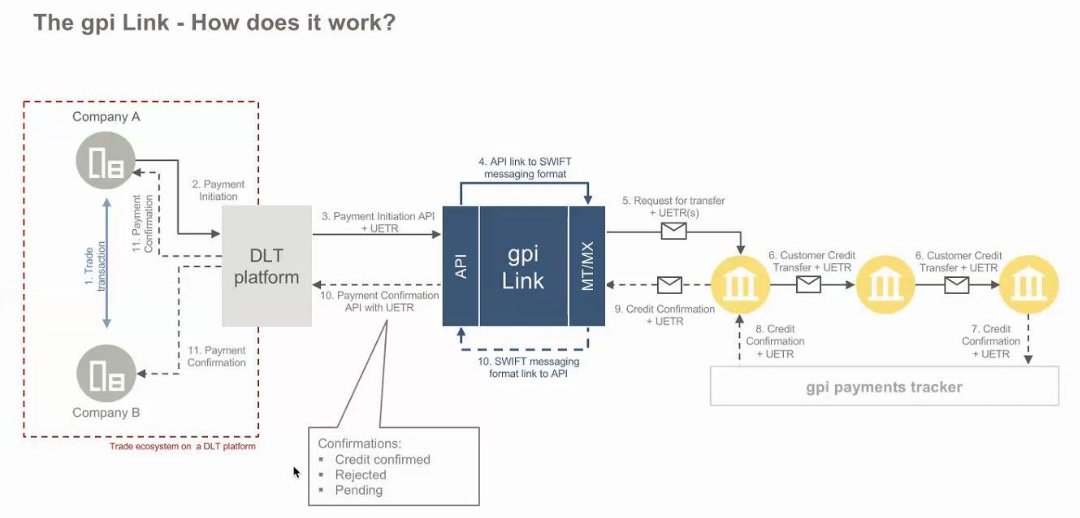

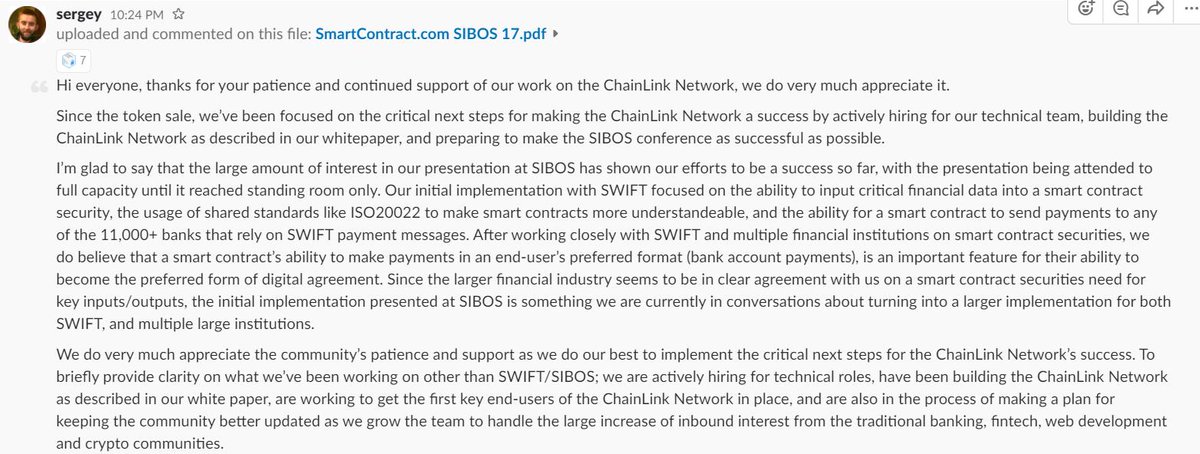

Traditional payments includes Citi, Visa, Mastercard, HSBC, SWIFT, Paypal, etc

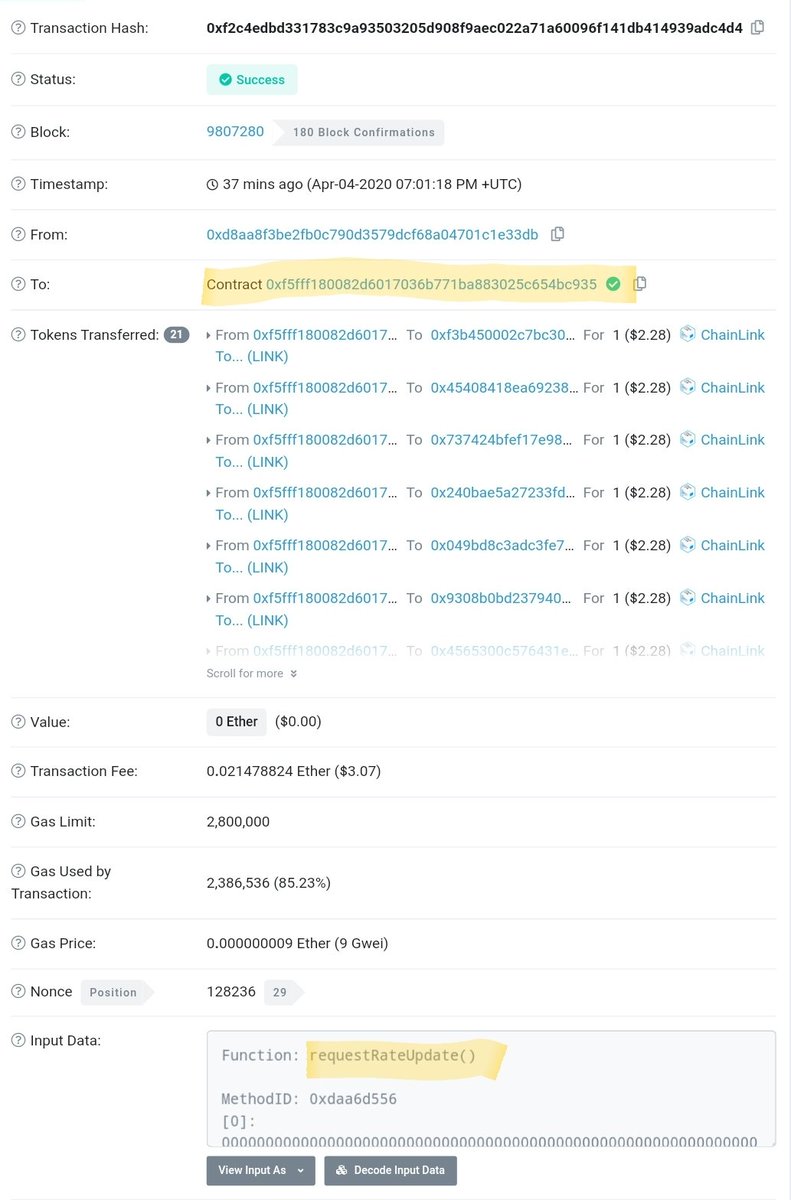

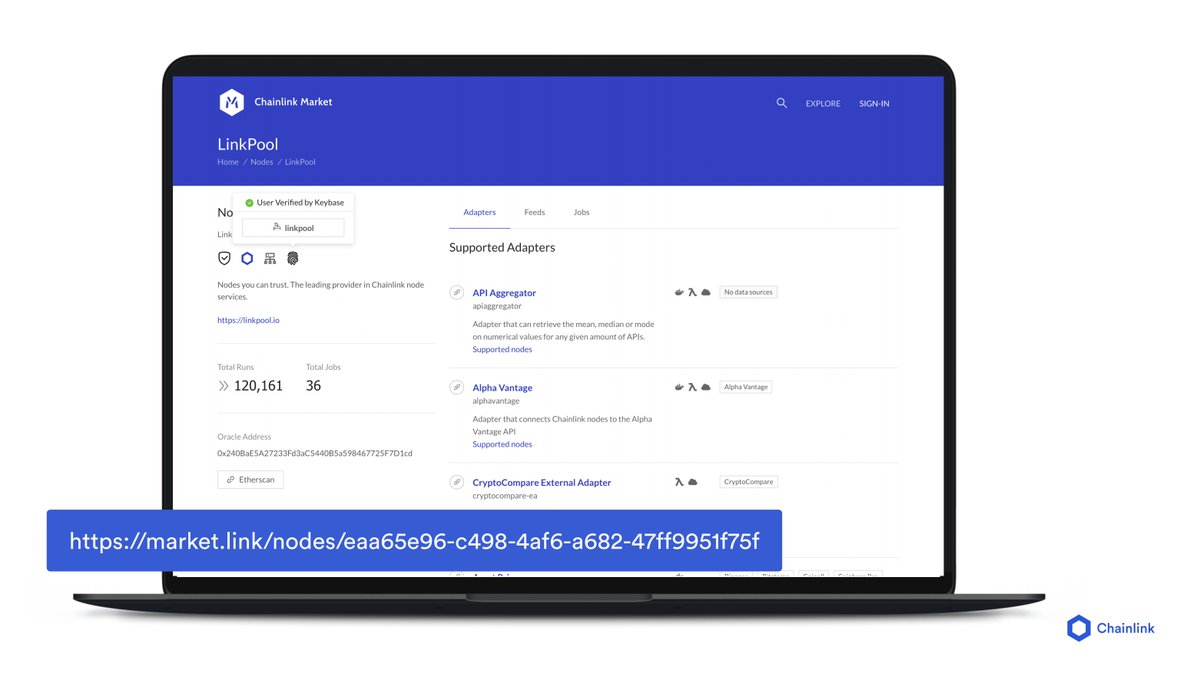

market.link/nodes/eaa65e96…

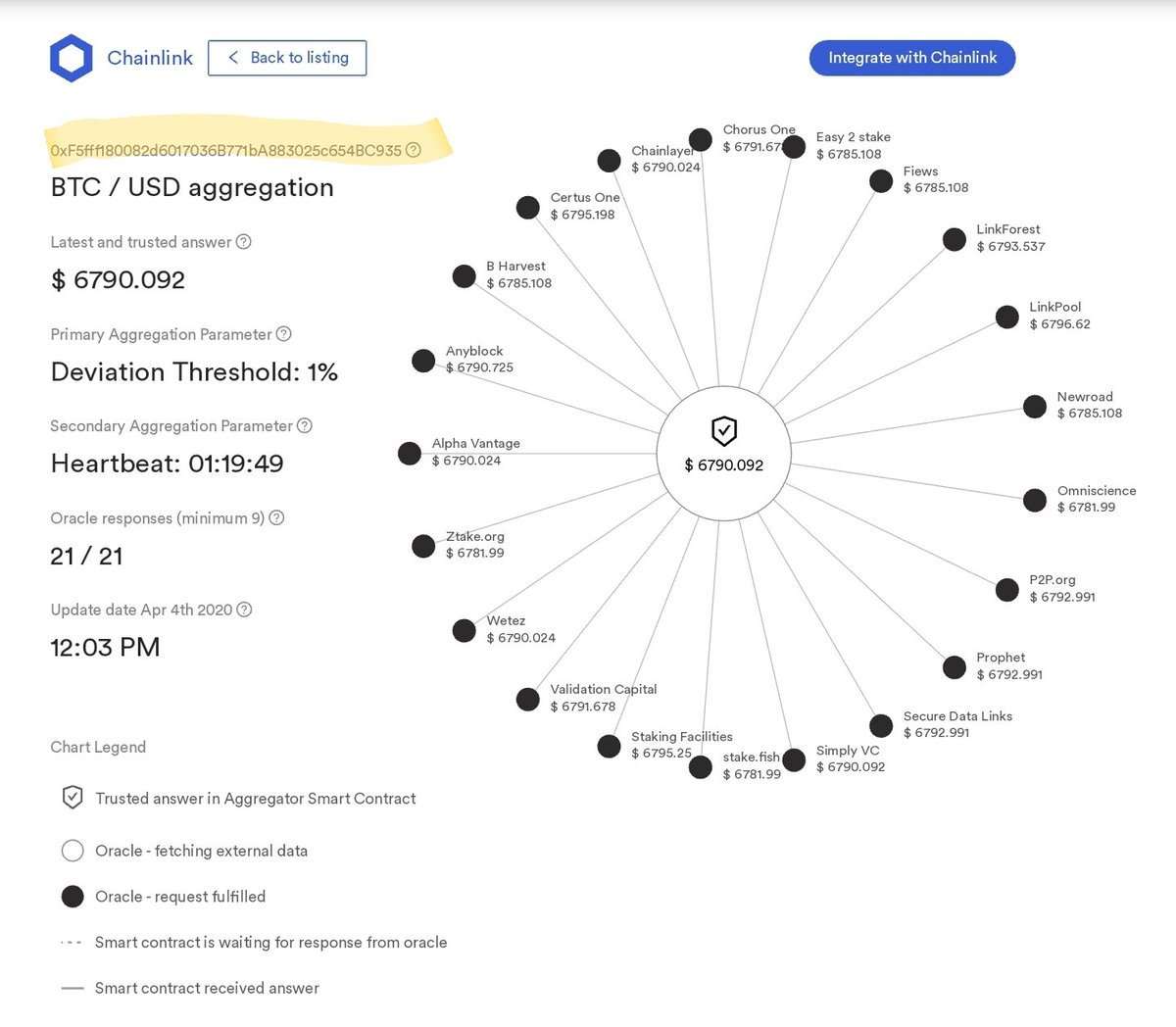

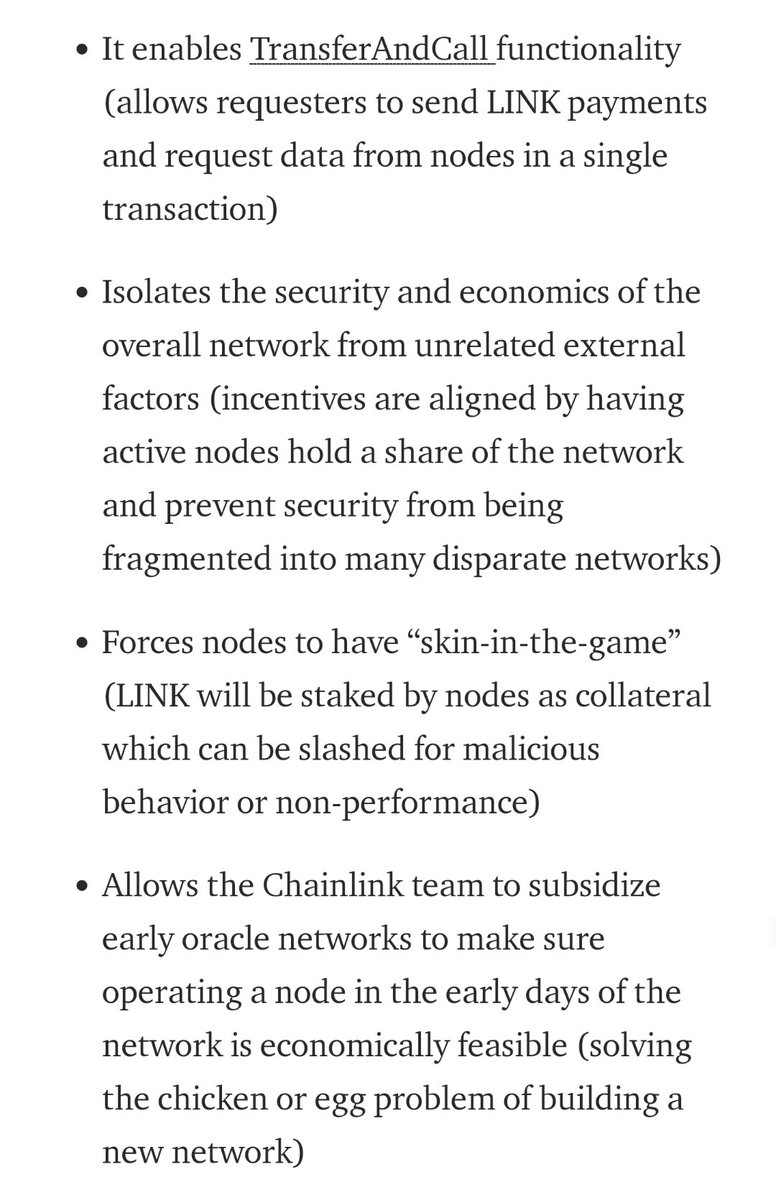

Unreliable nodes will no longer be selected due to their poor performance and they will lose all future revenue

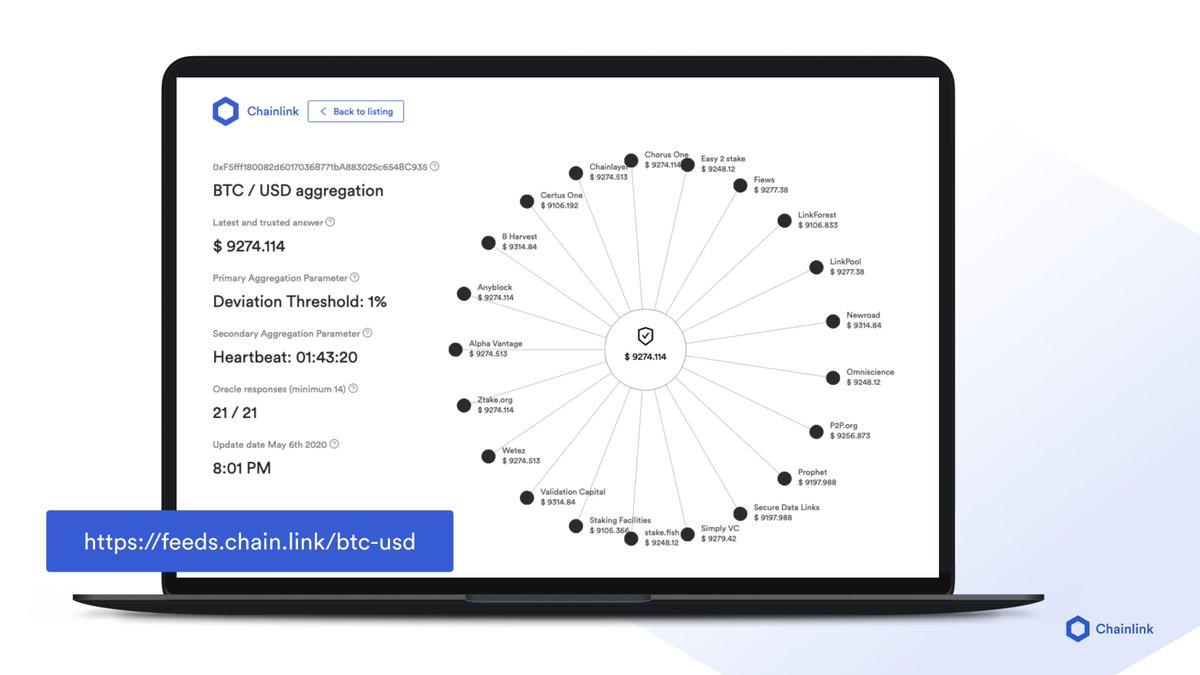

This includes USD and ETH base pairing for assets including cryptocurrencies, stablecoins, commodities, indices, and more

Check them out at feeds.chain.link

Flexibility and diversity is key here, data providers can now sell data to every blockchain

Hope you enjoyed reading this brain dump my frens, these are some incredibly informative slides overall, you can make your own conclusions

The great part is that this is just a tiny fraction of what Chainlink can and will be leveraged for :)