1 neutral (CNN)

2 complacent (VIX TS)

3 "mild" greed (Equity PCR & Volume divergence)

Plus many breadth divergences

- most important hidden sentiment: what smart money has been doing under the radar

I report, you decide. 🧐😎

F&G reached 97 (intra-day 98) on Jan 2🧐

In Fed we trust

Repo & notQE in full swing

near ZIRP

Tons of liquidity

SPX won't be allowed to drop 10 pts in election year

In Trump we trust

FOMO buy👌😷

Total Equity Put/Call ratio from all 16 options exchanges.

not CBOE put/call ratio that I post everyday

CBOE is about 12% of all equity options & 98% of all Index options

"There are a number of concerns and risks exist that we believe, and our client discussions confirm, investors are downplaying."

- Wait, that's my target. Haha. following me? 😎🤔

zerohedge.com/markets/6-reas…

I will need to change my 2,425 target because of 😷

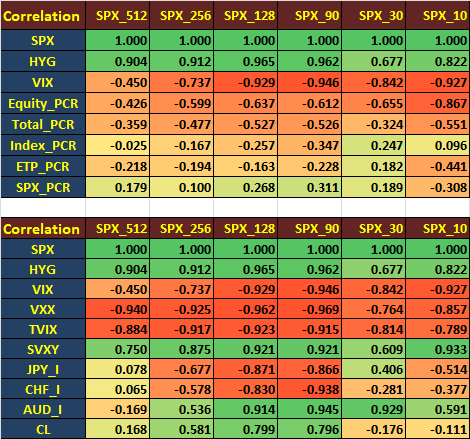

512-day to 10-day correlation.

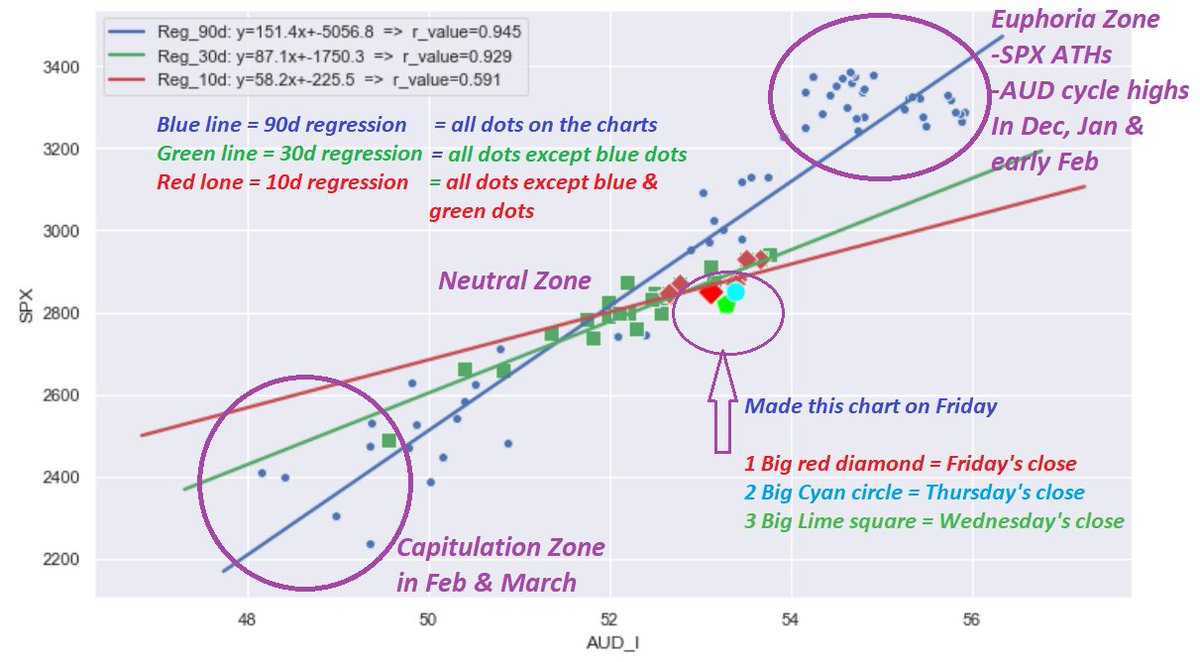

index (#AUDUSD also) is the new FX correlation star: highly correlated with from 128d to 30d

& are no brainer.

But, In trading, if you add more corre confluence, finding divergences👌🧐💯

2 Need a 3D to see the corr overtime, finding the divergence from the norm in shorter timeframe

3 A corr table with diff periods among assets would easily spot div in real-time

1 for swing trading, look for divergences in daily chart

2 for scalping, if last 10 days' dots were near regression line (correlated), looking for divergence in 15-min, confirmed by more cross-asset diverg🧐

Why would market crash?

1 "maximum FOMO optimism" just before the crash

2 irratianal exuberance drives stonks super overvaluation

3 taxi drivers all-in buying stonk calls

4 smart money on the other side waiting patiently

5 wealth transfer

fut & stonk options are derivatives

For every buyer there is a seller

Who are on the other side of the trades?

dealers & smart money

When retails FOMO buying #ES_F & calls, smart money with deep pocket would just wait for the rug pull