A thread on my current macro view on USD:

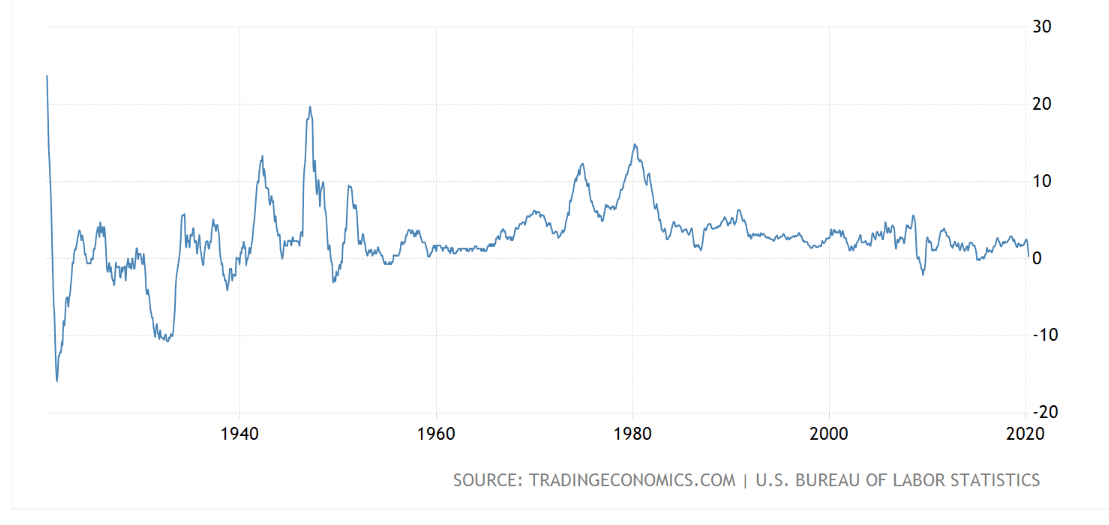

PHASE 1: As demand returns, we will realize that for the first time in decades there is inadequate industrial capacity (due to supply chain interruptions) to satisfy it.

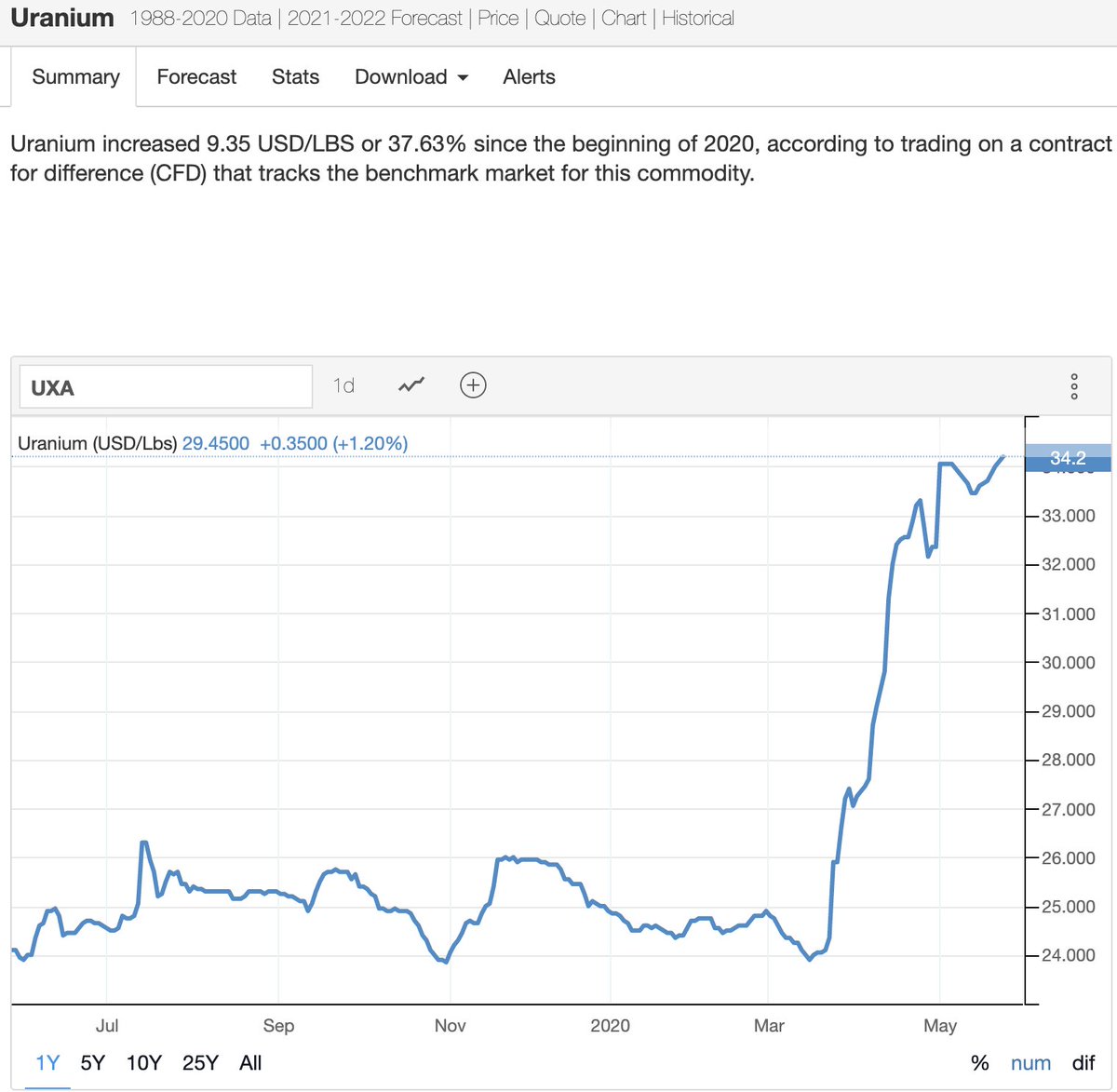

2. Uranium (Nuclear power is one of the most efficient forms of energy production)

3. #Bitcoin—scarcest liquid asset in the world that is virtually immune to all government action

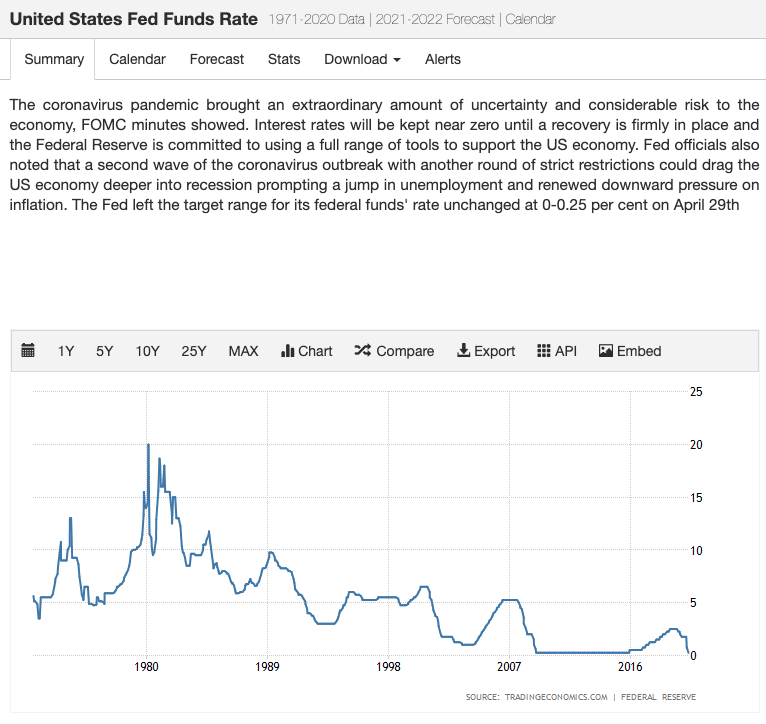

- Deflation: Bitcoin’s exponential deflation will always outpace USD deflation

- Inflation: Bitcoin was purpose-built to countermeasure "expansionary monetary policy" (aka time-theft)

Stay Safe. Stay humble. Stack Sats (for Salvation).