Dear Friends,

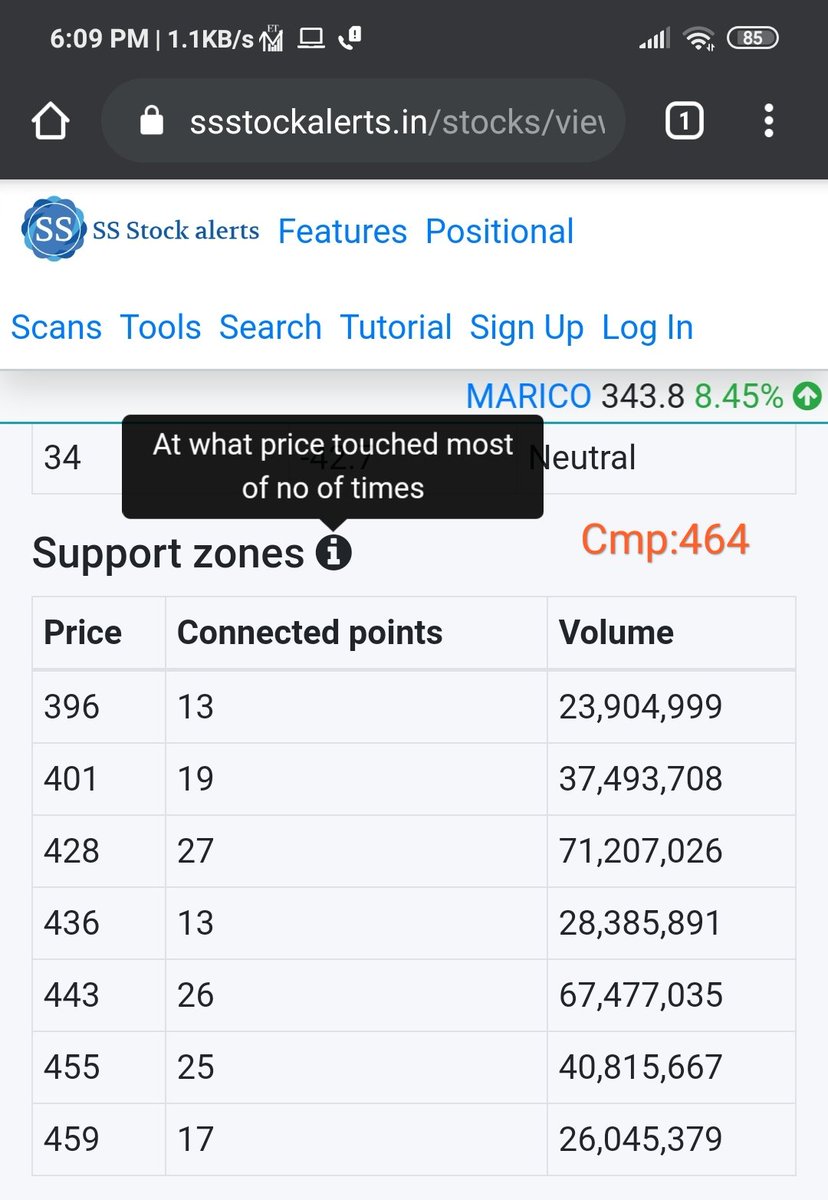

When ever you enter into long position, it is make sure that price is near support zone.

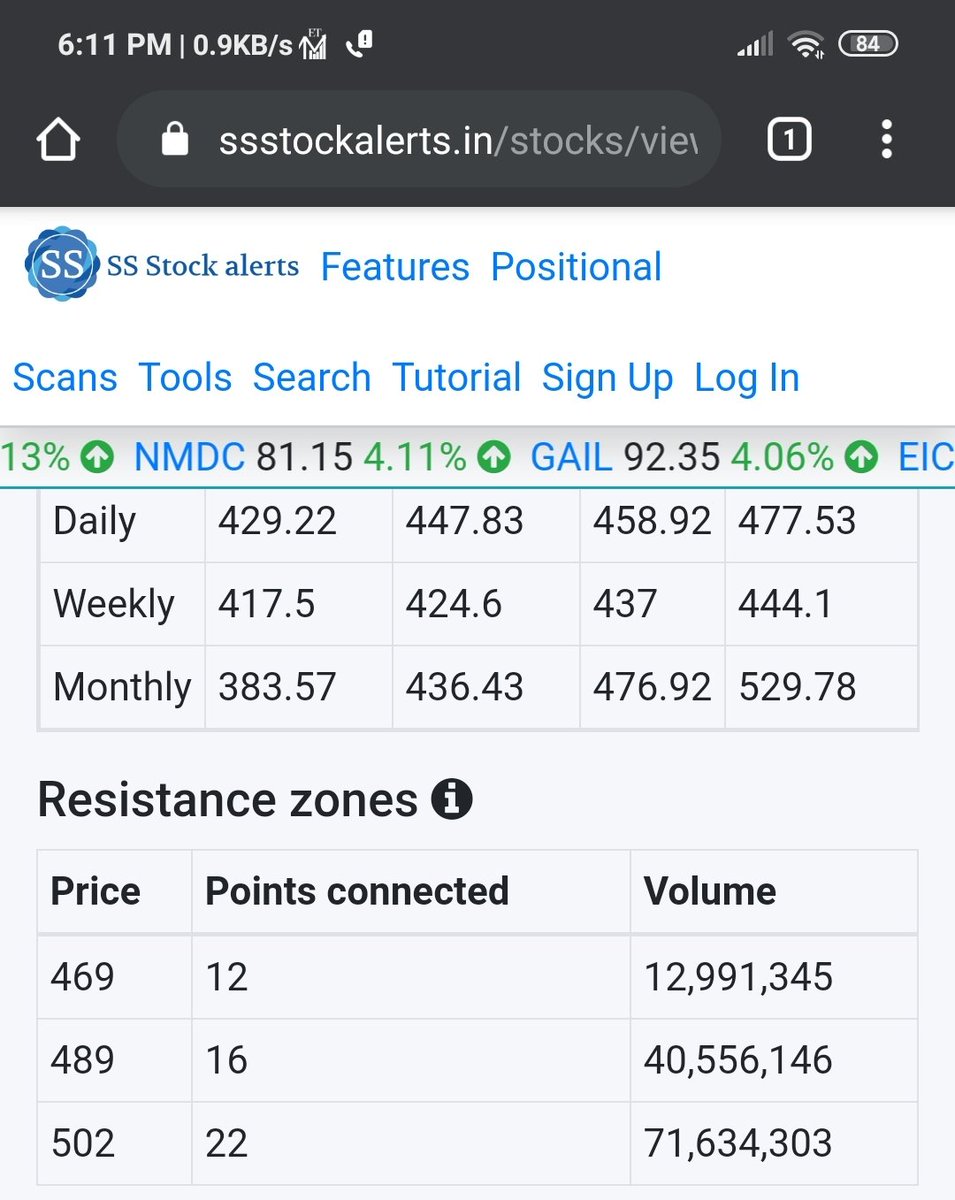

Take partial profits near resistance zone.

#supportzone

#ResistanceZone

How to get support and resistance zones for any stock?

Search stock > see the support and resistance

When ever you enter into long position, it is make sure that price is near support zone.

Take partial profits near resistance zone.

#supportzone

#ResistanceZone

How to get support and resistance zones for any stock?

Search stock > see the support and resistance

#supportzone

How we calculated these data?

> These are calculated based 12 - 14 months (280 daily candles).

> Calculate how many times a price closed at a particular price.

> If a price closed 420, 421 422, 419 in different times then consider 420 occurs 4 times(1% approx)

How we calculated these data?

> These are calculated based 12 - 14 months (280 daily candles).

> Calculate how many times a price closed at a particular price.

> If a price closed 420, 421 422, 419 in different times then consider 420 occurs 4 times(1% approx)

#resistancezone

Resistance points also calculated as shown above.

There could be multiple resistance points.

> Select a point which has more connected points

> Then select a point which has huge volume.

This is available only Daily candles soon will add them for week & month

Resistance points also calculated as shown above.

There could be multiple resistance points.

> Select a point which has more connected points

> Then select a point which has huge volume.

This is available only Daily candles soon will add them for week & month

Where this data available?

> go to this page ssstockalerts.in/stocks/view/#/…

> Search for any NSE stock,

> you will get full info

1. Score

2. Technical summary

3. Pivot points

4. Support zone

5. Resistance zone

6. Patters for daily, weekly and monthly

7. OHLC with volume.

> go to this page ssstockalerts.in/stocks/view/#/…

> Search for any NSE stock,

> you will get full info

1. Score

2. Technical summary

3. Pivot points

4. Support zone

5. Resistance zone

6. Patters for daily, weekly and monthly

7. OHLC with volume.

• • •

Missing some Tweet in this thread? You can try to

force a refresh