Engineer, Positional trader, Passionate developer.

Telegram: https://t.co/uvD99UGqne

FB: https://t.co/YJEJjxFL1M

YT: https://t.co/7TAWVH4Wdn

How to get URL link on X (Twitter) App

3. Target can be 2% or 3% or 4%

3. Target can be 2% or 3% or 4%

The scanner is available in the

The scanner is available in the

Now open the chart of #BLUESTARCO,

Now open the chart of #BLUESTARCO,

What it means?

What it means?

2. Price and volume falling

2. Price and volume falling

Exit rules:

Exit rules:

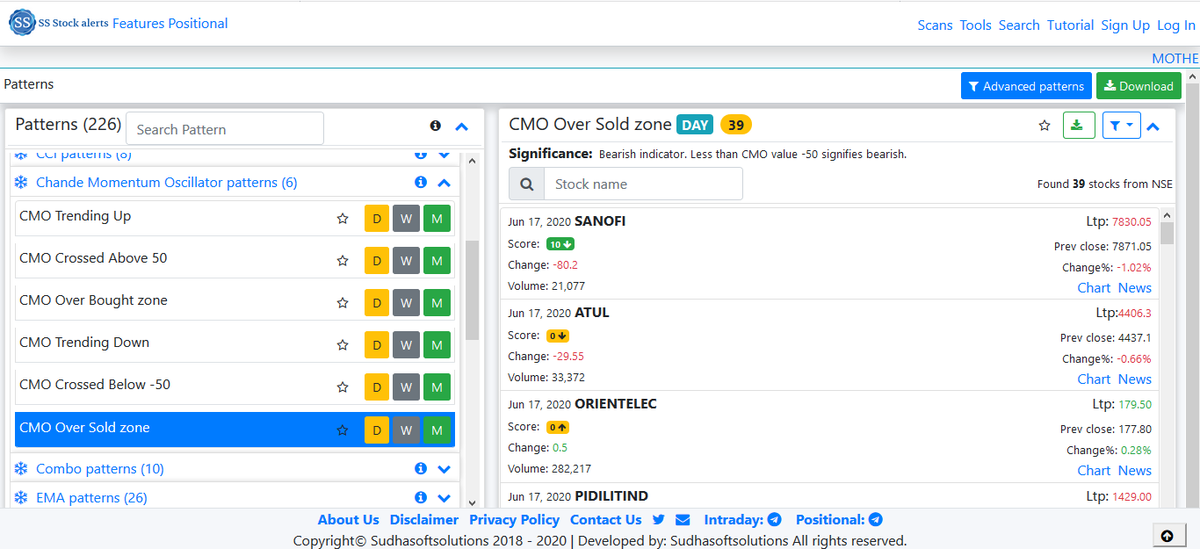

Scanner:-

Scanner:-

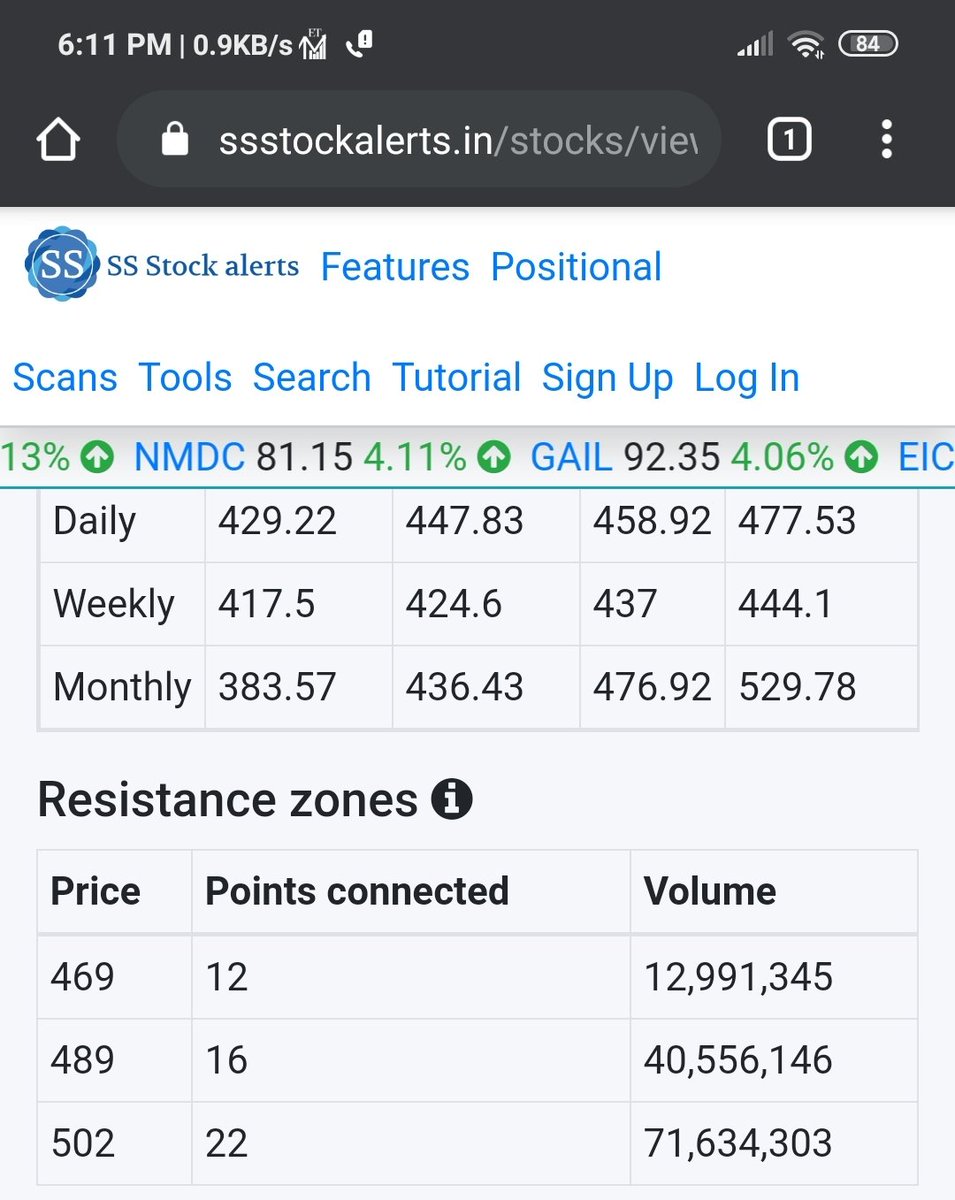

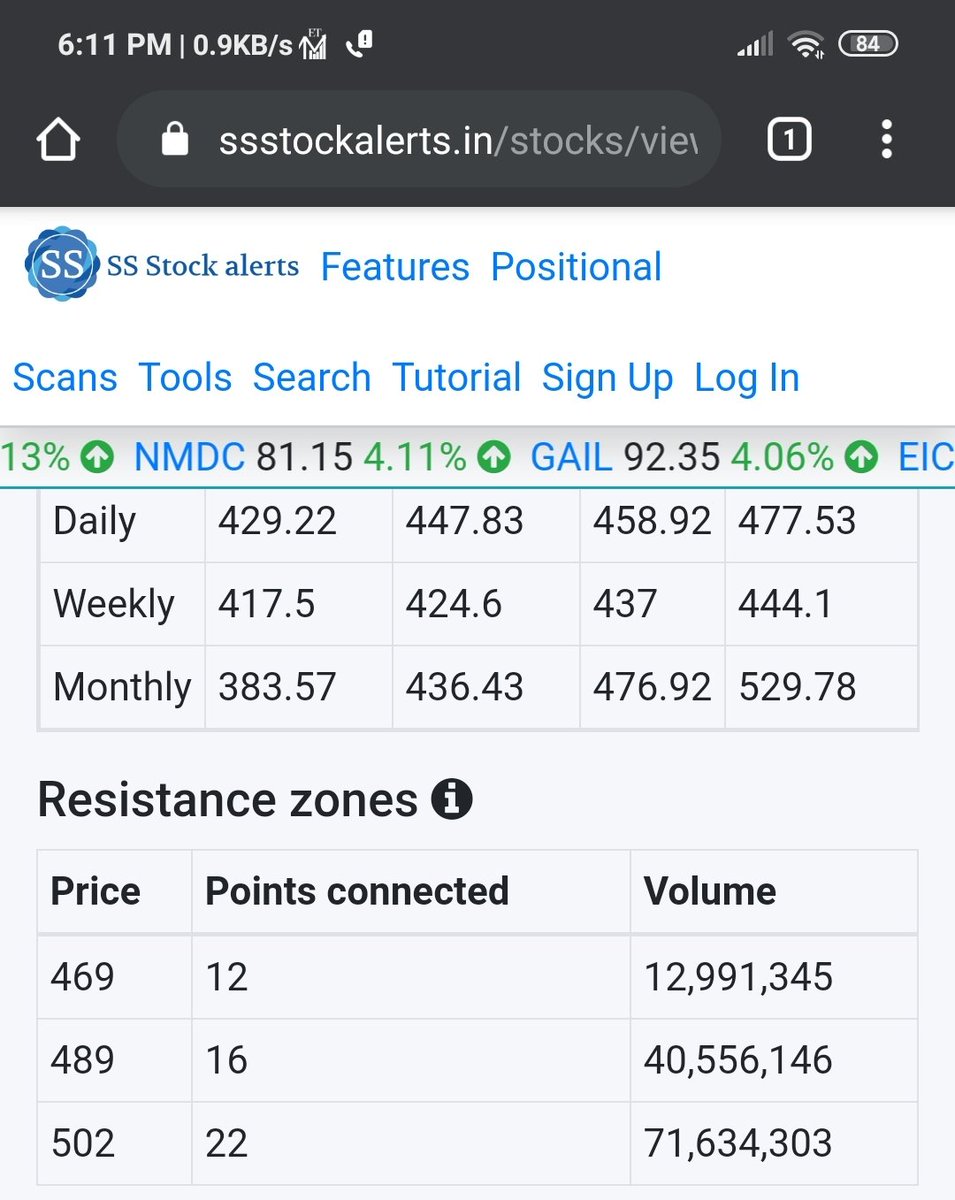

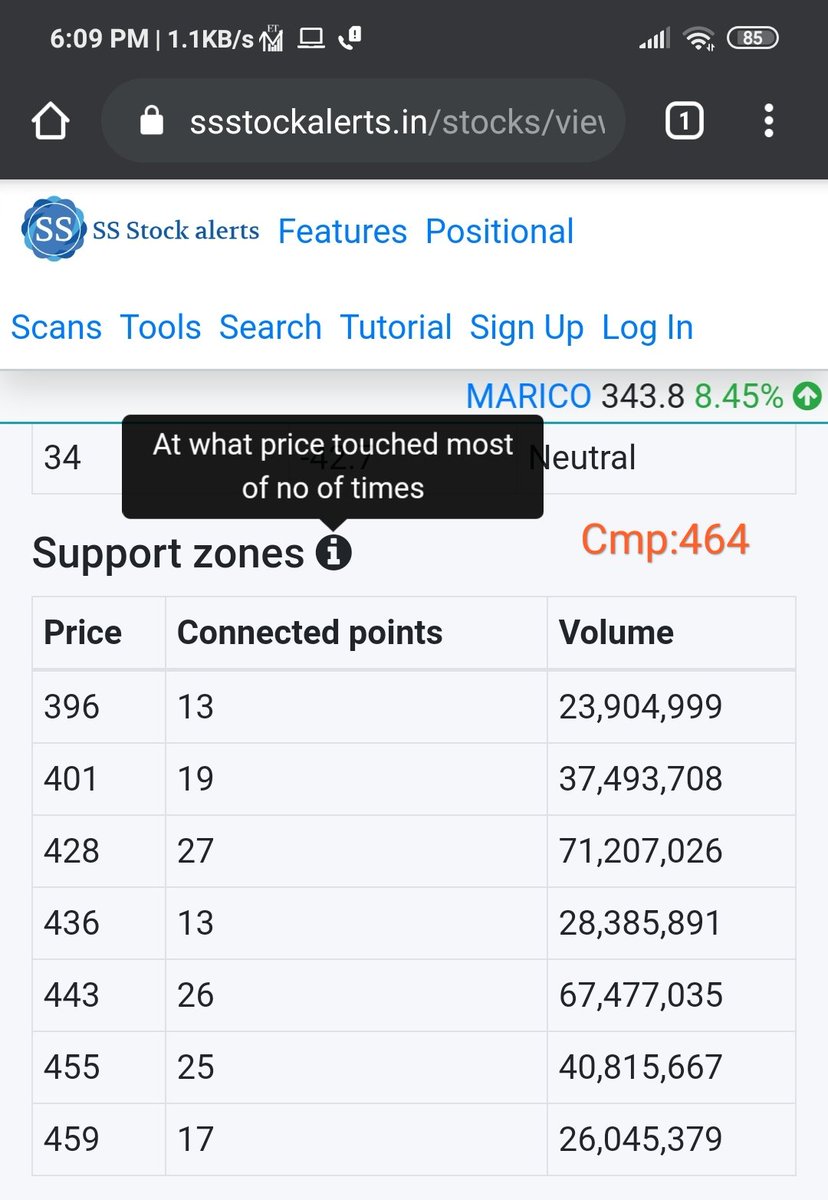

#supportzone

#supportzone

#Vortex

#Vortex

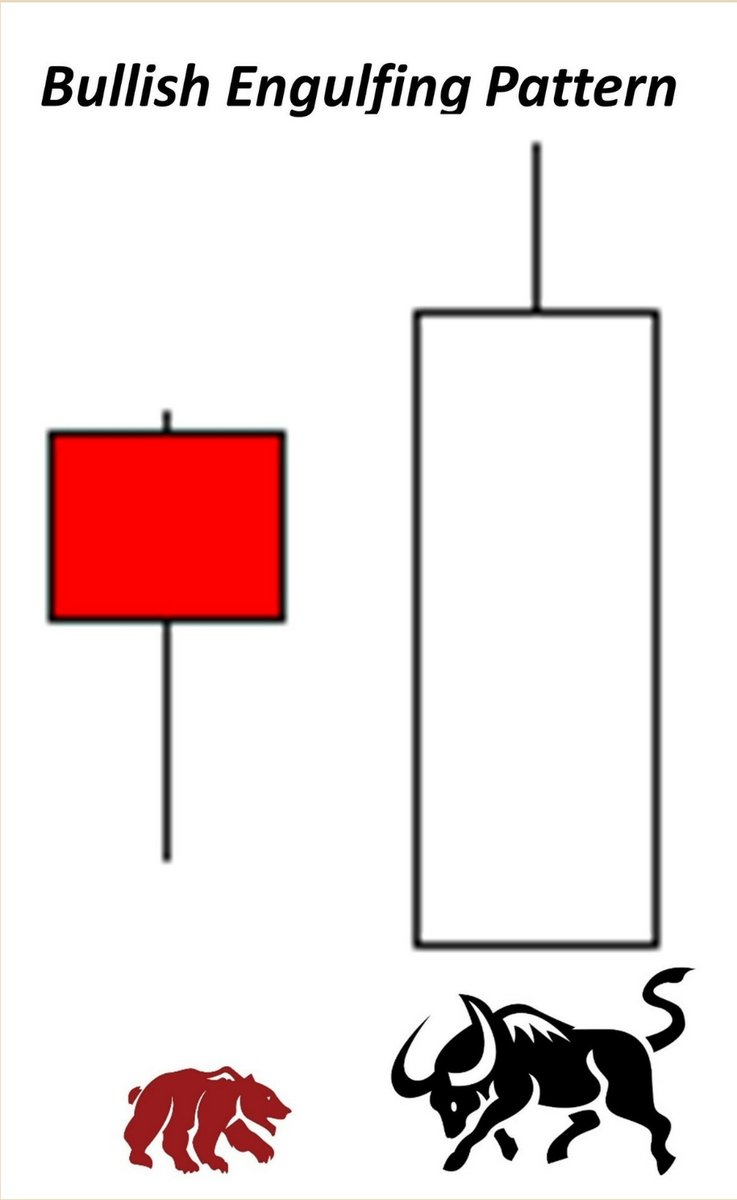

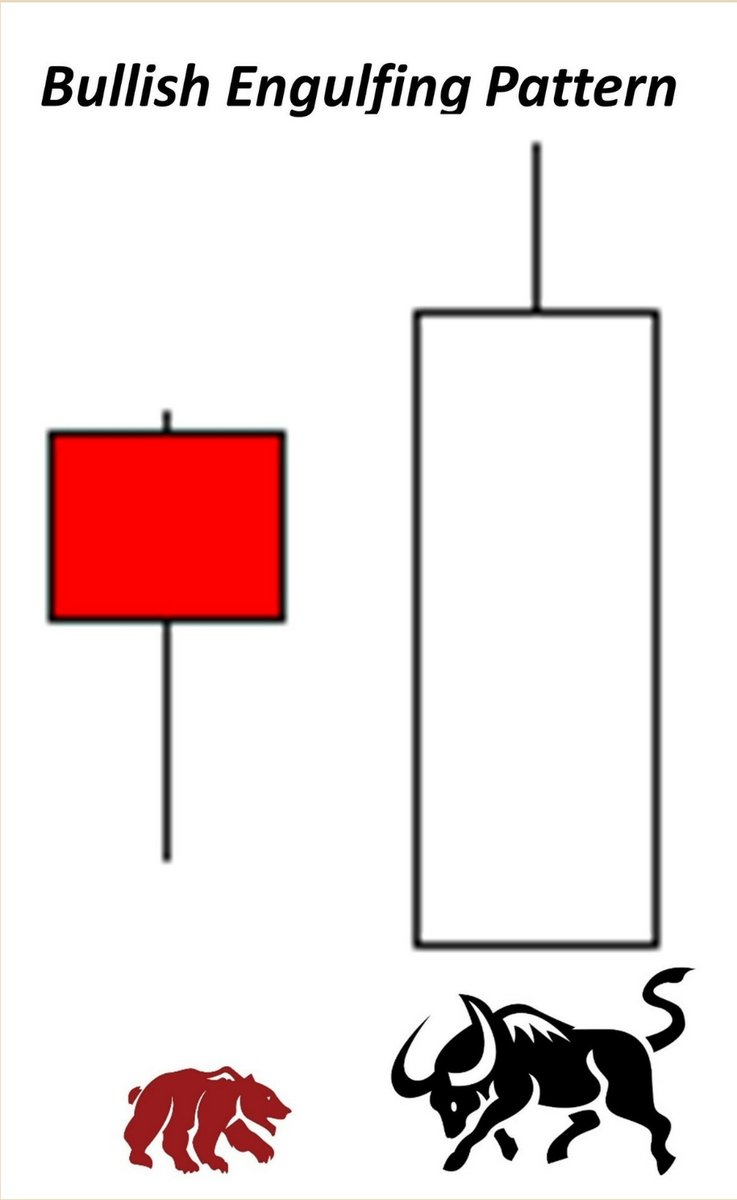

It represents a major defeat, so to speak, for the sellers and/or short sellers (the bears). When the second candlestick bar opens, the sellers are already pushing the prices below the prior candlestick’s close.

It represents a major defeat, so to speak, for the sellers and/or short sellers (the bears). When the second candlestick bar opens, the sellers are already pushing the prices below the prior candlestick’s close.

#Ichimoku

#Ichimoku

#MFI

#MFI

3. Get the stock info with detail analysts and score.

3. Get the stock info with detail analysts and score.

#ADX

#ADX