J. Welles Wilder has also developed popular indicators such as RSI and ADX.

Formula for Wilder’s averaging method if you are plotting a 14-period average:

((Prev reading x (13)) + Current reading) / 14

Wilder method of averaging is used for calculating ATR and other averages in the indicator.

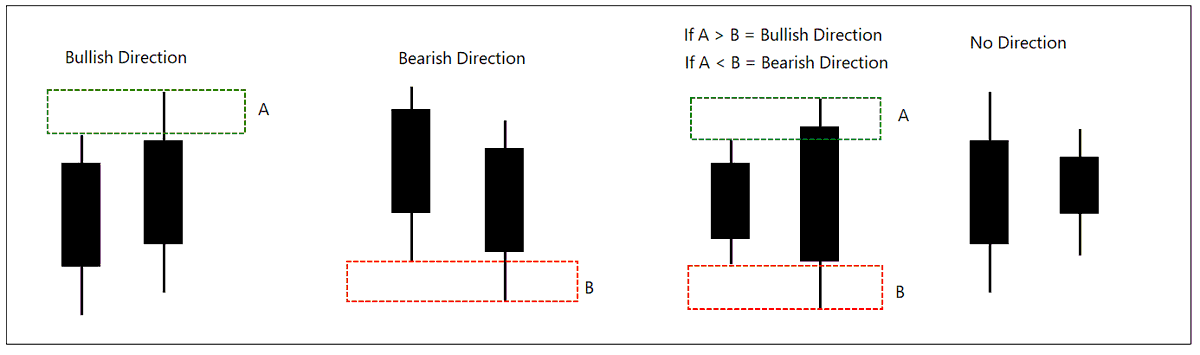

How to know who in control and how much?

How to know what is the trend? The positioning of the DMI lines shows us that.