He wrote a popular book during 1960 “How I made $2000000 in Stock Market” in which he explained his Box theory. It is a must read.

He used a combination fundamental and technical approach for investing.

>Buy companies whose growth & earnings prospects look highly promising

>Check overall market trend to ascertain whether stocks in general are in an uptrend

>Check whether stock belongs to the strong industry or group

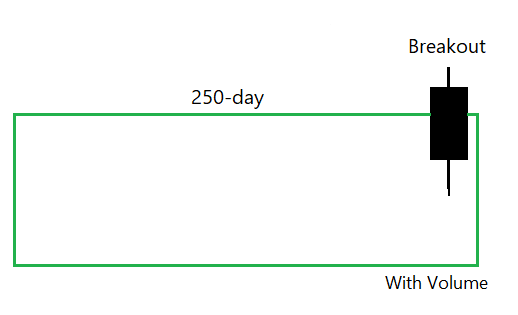

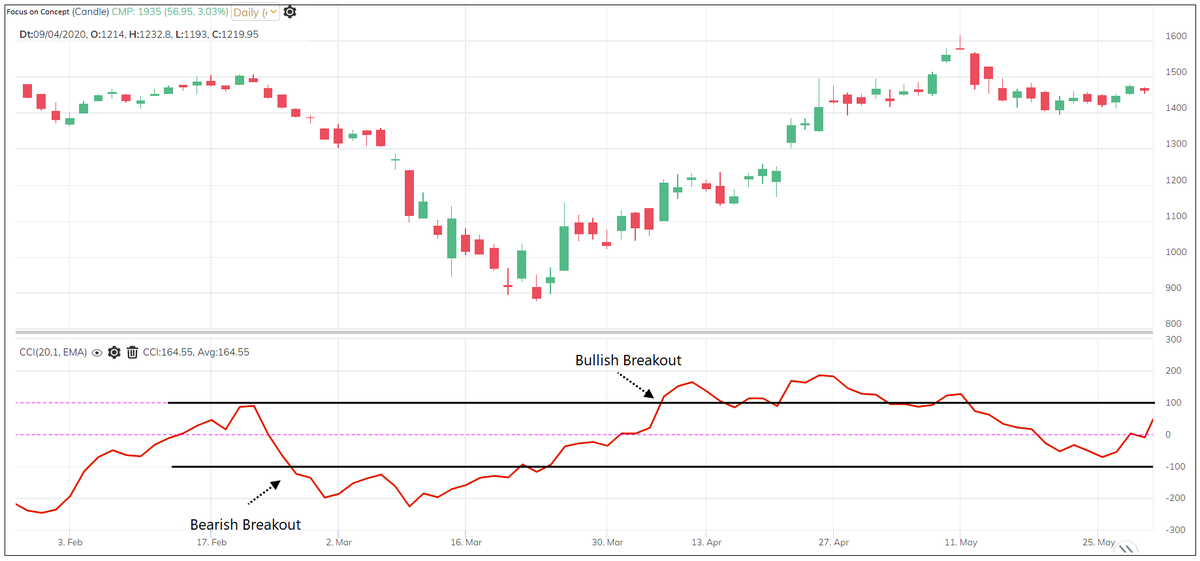

>The price breakout is backed by higher volume

He had his own share of a bad phase in trading career. At

one point of time, he lost $100000 in a matter of month. But he was a quick learner and an intelligent guy.

He explains in the book the lessons that he learned after

that huge loss. He said he realised that “his ears were his enemy”!

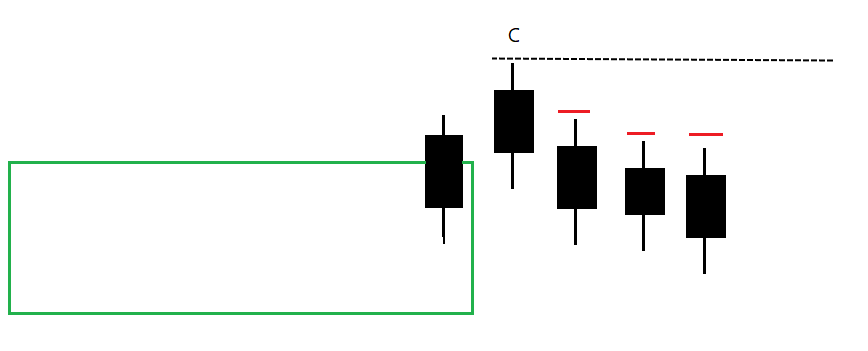

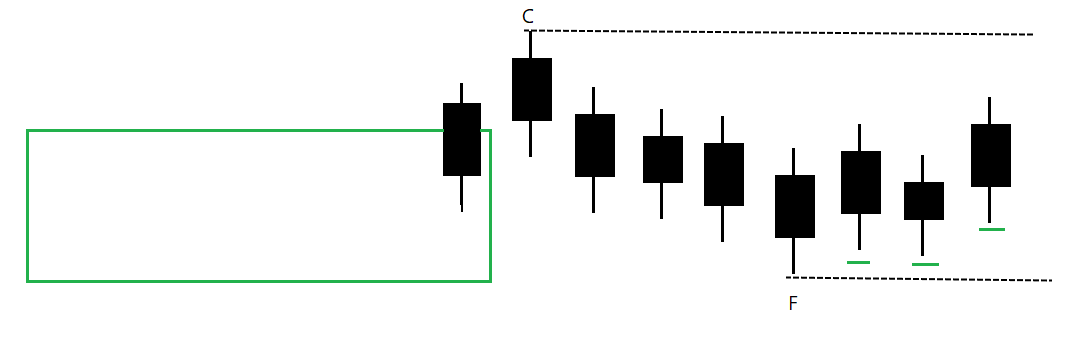

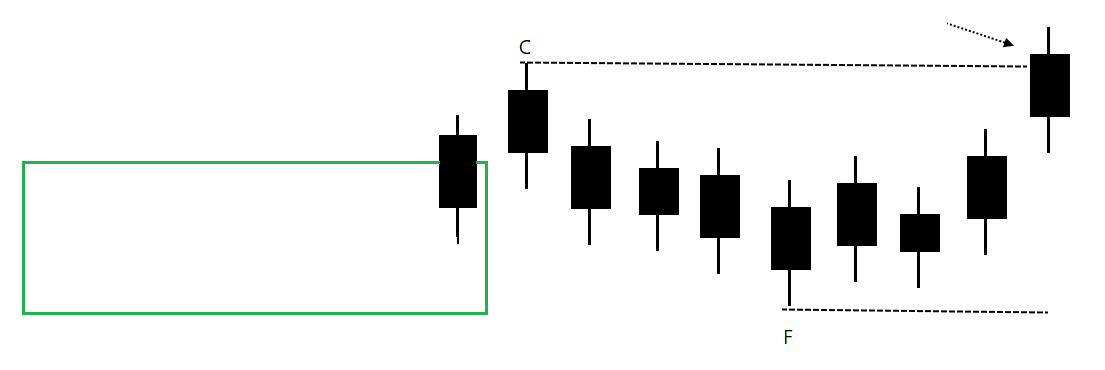

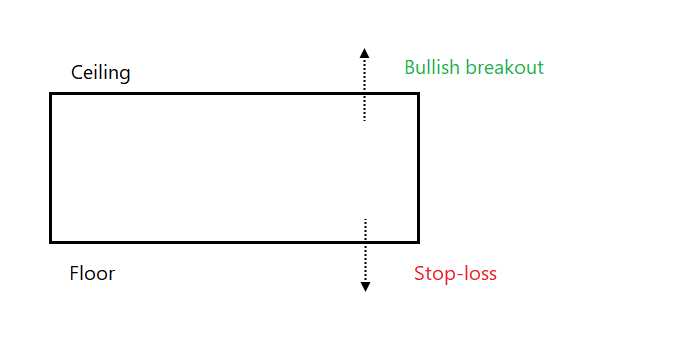

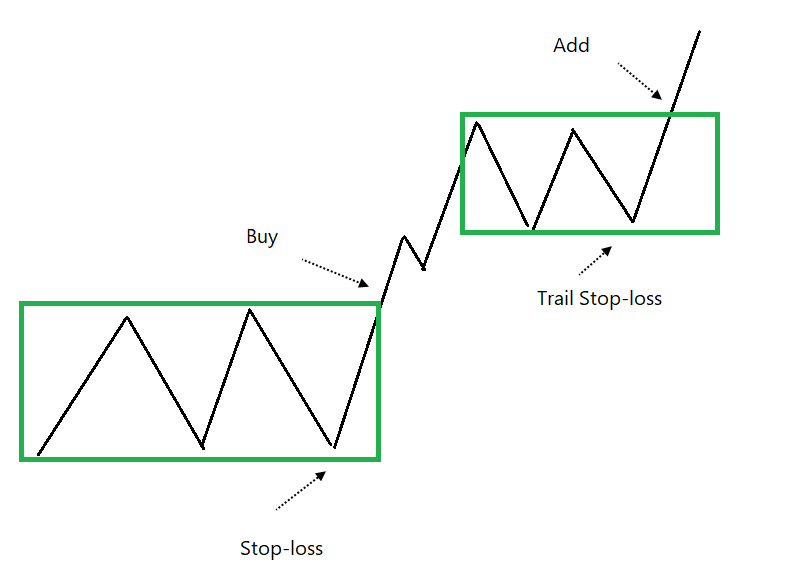

He said, before a dancer leaps into the air he goes into a crouch to set himself for the spring. Stocks behave same way after the breakout.