In the thread, I've assumed that Tesla sells all its credits to FCA and FCA buys all from #Tesla.

Let's dig further.

a) Tesla has recognized more sales in Europe

b) sold more ZEV/GHG in the US

c) they've started selling NEV credits in China

( d) sheer fraud)

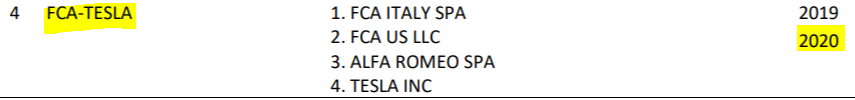

In Europe, there is no direct sales of credits. You need to sign a yearly pooling agreement (and you can obviously ask for $$ to do so). These agreements need to be filed with the EU, and they are public.

This raises two questions.

seekingalpha.com/article/429718…

There are 2 types of reg credits in China: NEV and CAFC. The system is complicated, but to make it simple: NEV credits can be traded, while CAFC cannot, but a deficit can be satisfied with NEV credits. So the market is in NEV credits.

If an OEM is in deficit, the production or sales of their most polluting vehicles could be stopped to make up for the deficit. Actually, I find this smart.

So if an OEM makes 1M ICE's and 0 BEV's, and in 2020 12% NEV credits are required, they need 1M*12%/6=20k Teslas worth of credits.

So even if Tesla hasn't sold its credits in 2019, which I find unlikely, they could have booked only ~$28M in Q1.

We know from the filings that Tesla sells to FCA in the US too, and most probably, the two can adjust sales in Europe and the US according to their needs.