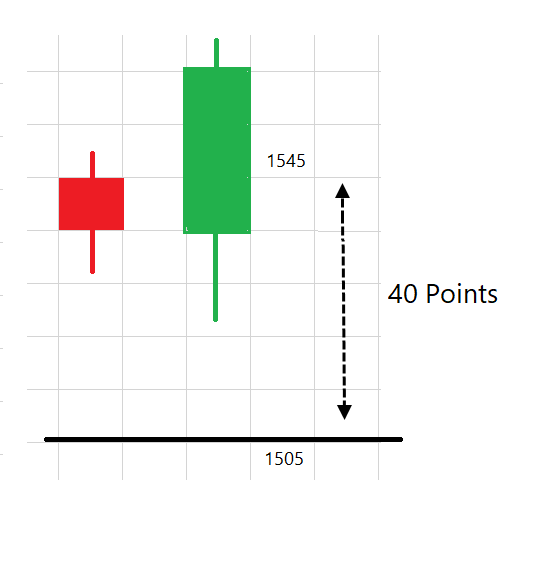

1: Range-price.

In every bar or candle, we have four prices - Open, High, Low, Close.

We have the option to select any price of above to define the trend.

We have discussed ATR in past threads (ADX and ATR%). ATR (Average True Range) is an indicator developed by J.Welles Wilder.

Trend even if bullish, volatility can interrupt and make it difficult for us to follow it. To be able to read trend clearly, we need to discount the vol.

The Trend indicator = Price minus ATR.

The price in the above formula is the Median price or Range price. So, we will calculate Trend indicator using the Range price.

1- ATR is not sufficient as volatility can expand and the indicator line can turn volatile. To handle this, we can multiply ATR value by a constant. Let us multiply it by 3 and place a line at 3x of ATR value.

Recommended values are 10 and 3. We take a look at the ATR of last 10 bars and multiply it by 3.

Example: 1545 - (3 x 40) = 1425

Bearish Trend indicator Value = Range price + (3 x ATR)

Example: 1545 + (3 x 40) = 1665

Clear so far?

But there is a catch here!!

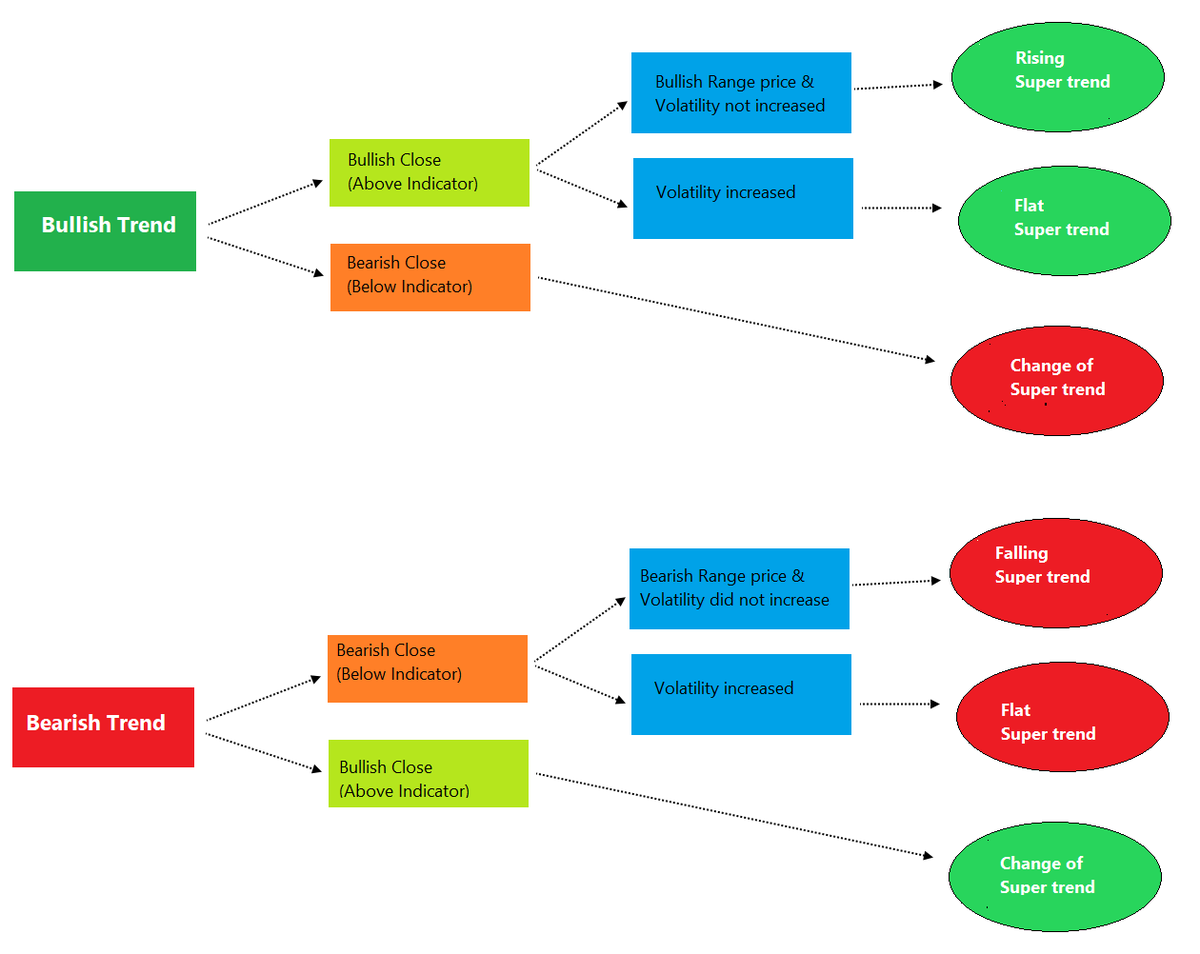

If price is trading above the Super Trend line and if the current close remains above that it is bullish. If the range price is bullish, super trend line will be rising.

Understood the logic? 10 and 3 are the default values. What if I chose multiplier 2 instead of 3? How will that change its behaviour?

End of thread.