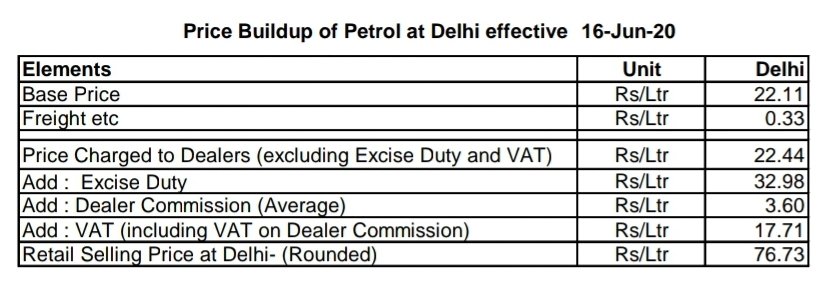

Petrol's base price is Rs. 22.44/-

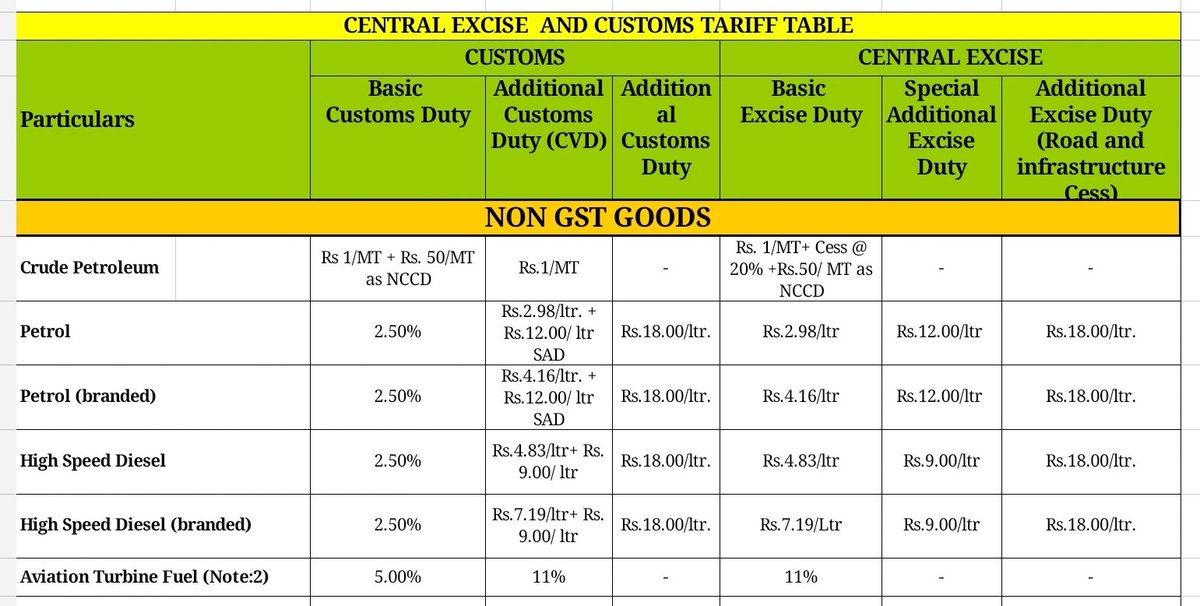

Excise duty charged by Centre is Rs.32.98/-

Dealer Commission (Average) is Rs. 3.60

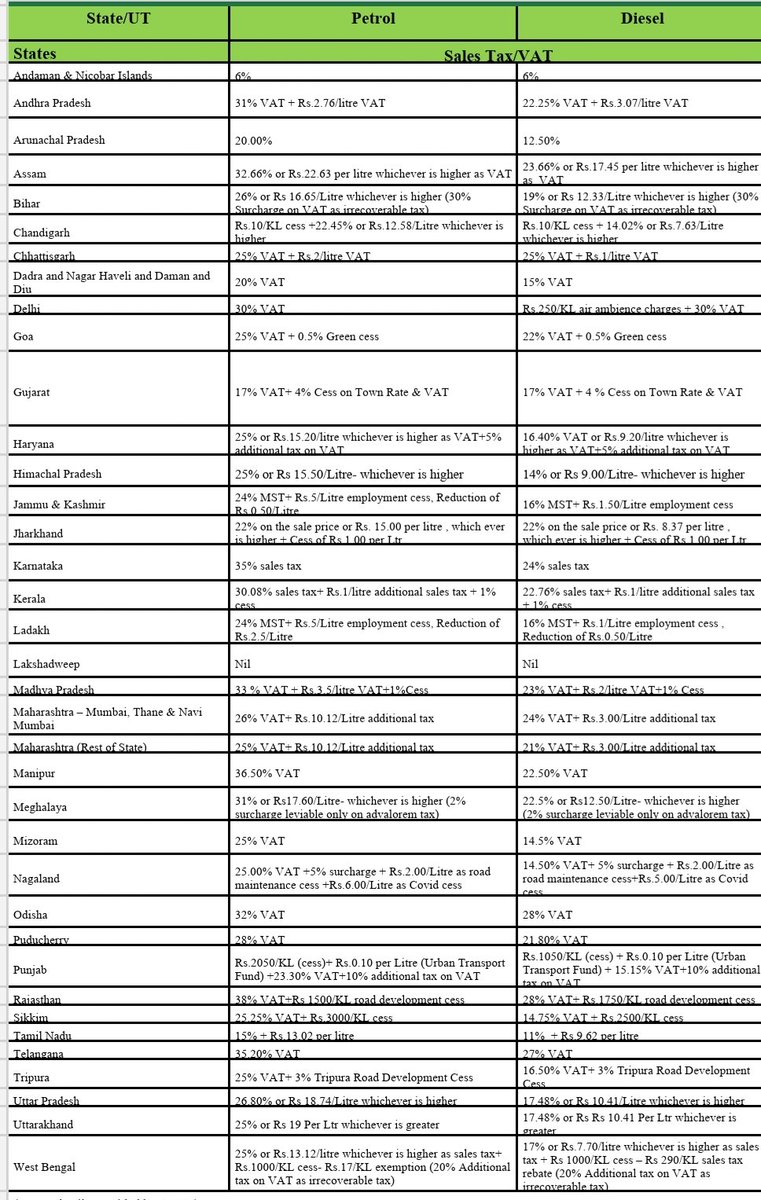

State VAT differs among States

In case of Kerala

30.08% Salea Tax + 1Rs. Additional tax + 1% flood cess = Rs.19.34

Centre charges Rs.32.98/- per litre of Petrol & it shows instead Rs.13/-.

So naturally it is easy to understand who is behind this infographics! A mallu IT cell 🤣

Or file an RTI with Rs.10/-, you will get the data!

Never get carried away with infographics peddled by the vested interests!

Union Excise Duty is a specific tax, ie, they charge a fixed amount per litre for fuel and it is not swing with international crude oil prices.

So excise duty is insulated from crude oil market variations...But...

It is charged as per the philosophy of VAT, so it is a tax over (Basic Petrol Price + Freight charges+ Excise duty + Dealer Commission).

So States suffer when oil prices fall & benefits when it shoots up, but they didn't share!

I think before making a cry for GST on fuel, we should ask States also to shift to such a regime.

It will also check Union to increase excise heavily when crude prices falls in international markets.

So centre will not take undue advantage of falling petrol price & increase excise as now varying component reduced from 57% to 29%!

Solace will be these fake news infographics to confuse us!

Ask questions, understand nuances, push for reforms, don't eat propaganda!

END

When both Centre & States together tax us between 67-70% of Petrol prices & this is one major revenue, ask who will take bite the bullet?

Unless they find alternative tax avenues, don't wish for GST!