THREAD TIME!

🚨Breaking News🚨

The #IRS has just released Notice 2020-50 which provides new guidance for Coronavirus-Related Distributions and CARES Act-created Enhanced Plan Loans.

Will be tweeting while reading...

Full document: lnks.gd/l/eyJhbGciOiJI…

Quick note that both items addressed in this Notice related to relief provided to retirement savers under Section 2202 of the CARES Act (Full text: govtrack.us/congress/bills…)

OK, now let's get to the Notice. I quickly glanced and see it answers at least SEVERAL open Qs...

First big news from the Notice is an expansion of how an individual can qualify to be eligible for a Coronavirus-Related Distribution.

CARES Act explicitly defined a variety of ways an individual can become eligible for such a distribution... (see kitces.com/blog/corona-vi…)

...but it also left open the door for the IRS to allow such distributions to additional persons.

Using that authority, the IRS will now allow Coronavirus-Related Distributions to be taken by individuals who, as a result of COVID-19, meet any of the following:

...

✅Reduced pay or self-employment income (CARES Act has listed reduced hours, but NOT reduced pay)

✅Job offer rescinded

✅Job start delayed

✅An individual spouse or a member of the individual's household being impacted as described above, or as outlined in the CARES Act

...

✅Closing or reduced hours of a biz owned by the spouse of member of a household

For these purposes, a member of the household is someone who shares the same primary residence.

...

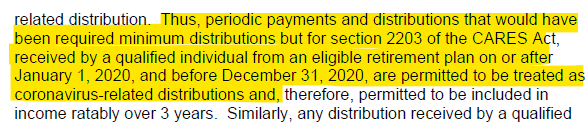

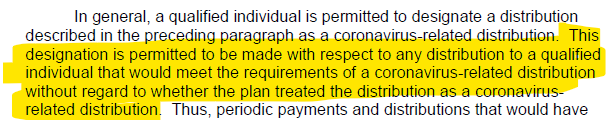

Notice confirms that even if a plan fails to treat a distribution as a Coronavirus-Related Distribution, if an individual is otherwise eligible, THEY may treat the distribution as such.

(See my answer to this @TheStreet reader Q yesterday for more thestreet.com/retirement-dai…)

More BIG news, this time for beneficiaries. BENEFICIARIES CAN TREAT DISTRIBUTIONS AS CORONAVIRUS-RELATED DISTRIBUTIONS.

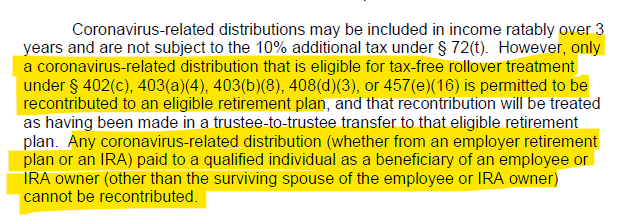

Means that they can spread income over 3 years, but...

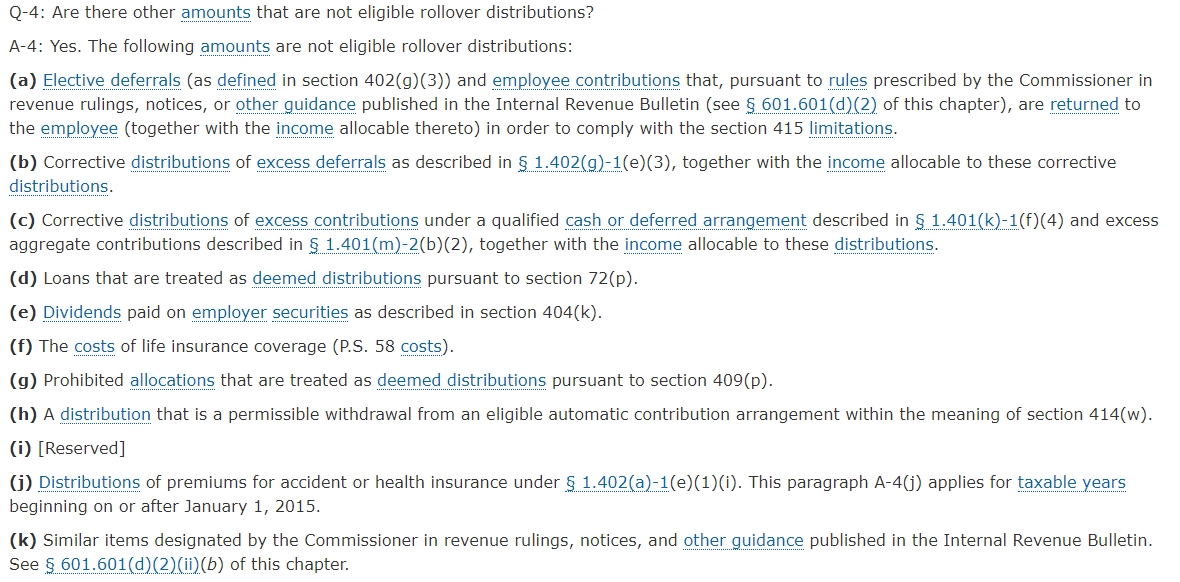

Bene ARE NOT ELIGIBLE TO RECONTRIBUTE coronavirus-related distributions an inherited IRA...

That said, even though hardship distributions are ineligible for rollover, if such distributions can also qualify to be treated as a Coronavirus-Related Distribution, they CAN be treated as such + recontributed w/in the 3 year period (unless from NQ deferred comp)...

The Notice emphasizes that employers are free to adopt whatever aspects of the Coronavirus-Related Distribution and Enhanced Plan Loan provisions it wants, but such adoption is NOT mandatory.

Plans must, however, be consistent. (No preferential treatment)

...should generally assume that their 1099-R will be issued with Code 1 (No Known Exception), and that 'explaining' the penalty-free nature of the distribution will be up to the taxpayer when they complete their 2020 return (using Form 5329)...

Also addressed is another Q I've been asked a lot... "How does my IRA/plan know the amount I'm rolling back in is really a Coronavirus-Related Distribution, and that they can take it?"

In short... You just tell them it is! They should rely on your word unless somehow...

they have knowledge to the contrary. And it's hard to imagine a situation where that would apply. IRA custodians and employer retirement plans are not the retirement account police.

So don't worry. They'll take you money. Happily...

In terms of reducing income if a contribution occurs...

Recontributed amounts FIRST offset Coronavirus-Related Distribution income for the prior year, if that return has not been filed.

If the return was filed, those amounts next offset CURRENT YEAR income.

If there is...

...an excess of returned amounts over the prior/current year's income, than a taxpayer can choose to carry back (and amend) prior year's returns with the excess or carryforwards that amount.

TAX PLANNING OPPORTUNITY!

Carryback/forward to the year w/ higher income tax rate!

A few miscellaneous items here...

- If you die, any remaining portion of the distribution is taxable that year.

- You CAN take a Coronavirus-Related Distribution WITHOUT creating a modification in an existing 72(t) schedule

That's is for now...

There IS more info in the Notice on plan loans, but I gotta, you know... do some 'real' work. 👊