#Quora Question - What is the best “I QUIT” moment you have ever witnessed an employee do?

I along with my assistant resigned in the best way I remember. It is no secret that I lost heavily in #Nifty #BankNifty and futures in whole during 2009. I decided to do MBA in finance 1/n

I along with my assistant resigned in the best way I remember. It is no secret that I lost heavily in #Nifty #BankNifty and futures in whole during 2009. I decided to do MBA in finance 1/n

Like that would have helped. By the time I completed MBA, I was broke. In the hopes of a good job and having faced life realities, I did my MBA with utmost sincerity. Up for marketing jobs. Best in communication skills. Ready to relocate and learn new things. I was placed at 2/n

A package of 18 lakh per annum in a Singapore based company. It was huge for me. Suddenly dreams coming true. Turned out, this was a period of fake placements in Punjab. It turned out to be a fake placement. College management realized their mistake and tried to placate me. 3/n

They offered me a meagre package of 3.6 lpa in marketing. I had to take it as it was best available. Being placed at 18 lpa, I was not allowed to take part in interview of other companies. I tried working smart and hard, but when you work for companies run by lala's 4/n

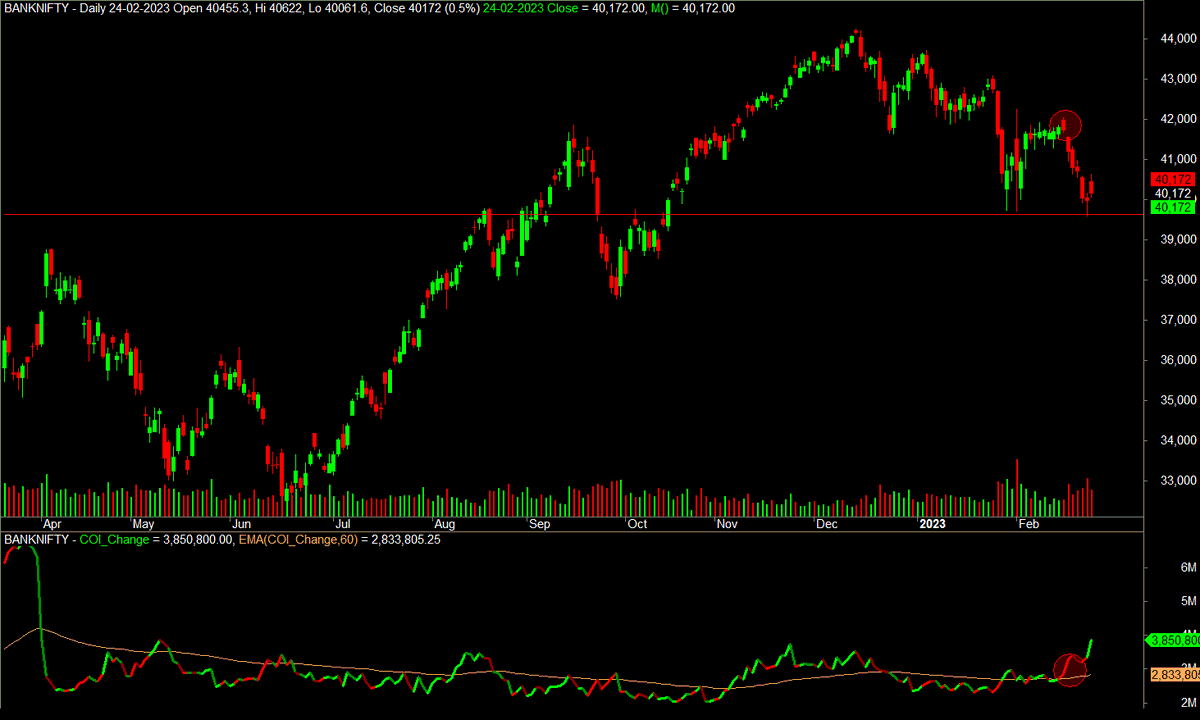

And no professionalism, you get fake promises. I kept slogging at 30k per month which was 3 months delayed and also kept #BackTesting in #OptionsTrading. For 4+ years I kept asking for promotions but always the fake promises. In Feb 2017, me and my assistant were sitting 5/n

And casually talking with one of our colleague.

He said - Sir, Lets Resign.

I said - Okay

We wrote our resignation with 3 month notice period and immediately sent it. Our colleague thought it was a PJ for next hour or so when finally our immediate boss gave us a call. 6/n

He said - Sir, Lets Resign.

I said - Okay

We wrote our resignation with 3 month notice period and immediately sent it. Our colleague thought it was a PJ for next hour or so when finally our immediate boss gave us a call. 6/n

After that we strolled in campus, worry free for the day. We were finally free from god forsaken job.

Next day my wife also resigned as a teacher from the college. I took a leave next day and started visiting banks for a loan to raise money for trading. 7/n

Next day my wife also resigned as a teacher from the college. I took a leave next day and started visiting banks for a loan to raise money for trading. 7/n

It took me 15 to 20 days to arrange money. Another 25 days when my college itself released me from service. I never looked back to that place ever since. Rest is history. Now #OptionsTrading is my sole bread and butter.

When I look back, this was the best resignation ever.

When I look back, this was the best resignation ever.

• • •

Missing some Tweet in this thread? You can try to

force a refresh