Algorithm Trading Expert who is building option trading algorithms since 2021. Expert in traditional discretionary trading.

9 subscribers

How to get URL link on X (Twitter) App

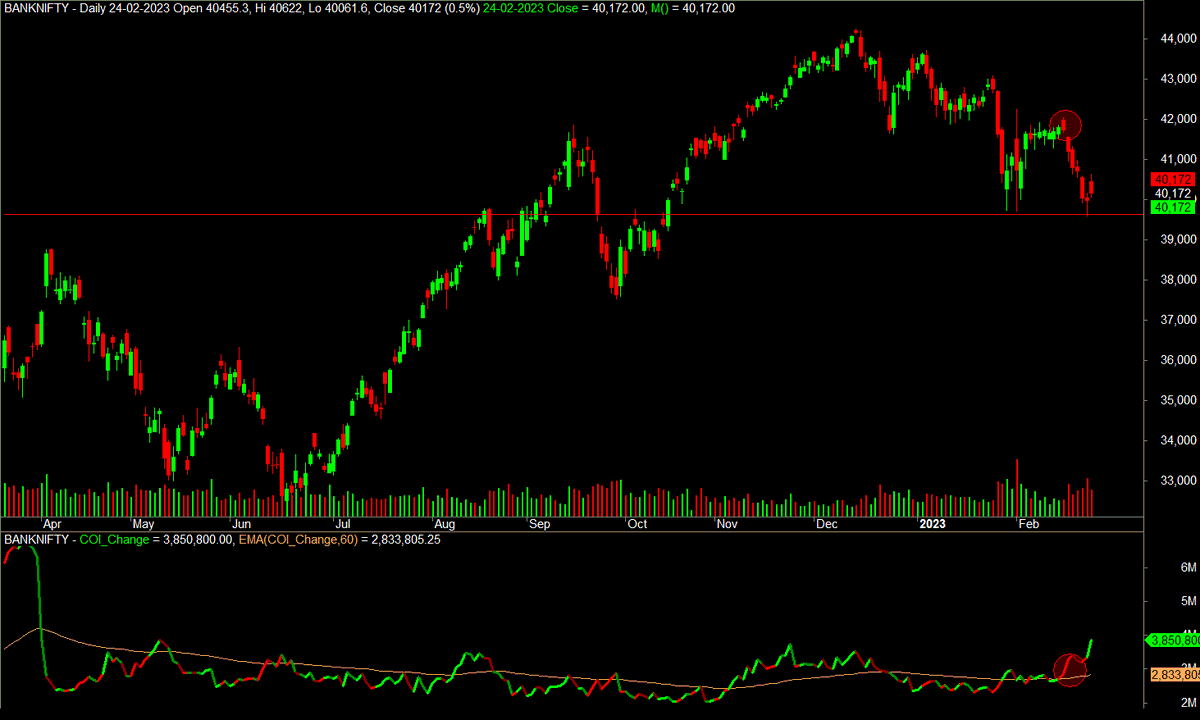

On Daily Charts, we are standing at a support and gave a dead cat bounce. COI did not recede from this point but as you can see there has been continuous selling. At support, either this gives a bounce or indicative of incoming sell off.

On Daily Charts, we are standing at a support and gave a dead cat bounce. COI did not recede from this point but as you can see there has been continuous selling. At support, either this gives a bounce or indicative of incoming sell off.

Why William's Alligator can be a great tool for traders?

Why William's Alligator can be a great tool for traders?

A lot of ideas were worked upon on Amibroker may it be ITM Selling of Option, Option Doublers in 2 - 3 days, Intraday Option Buying, Future Holygrail and what not. In the process we were able to make Option Chain on Amibroker, calculate option greeks on Amibroker and what not.

A lot of ideas were worked upon on Amibroker may it be ITM Selling of Option, Option Doublers in 2 - 3 days, Intraday Option Buying, Future Holygrail and what not. In the process we were able to make Option Chain on Amibroker, calculate option greeks on Amibroker and what not.

Put an Alligator on at least 1HR time Frame. If

Put an Alligator on at least 1HR time Frame. If

Why William's Alligator can be a great tool for traders?

Why William's Alligator can be a great tool for traders?

Key to good trading is understanding your:

Key to good trading is understanding your:

What is a Covered Call ?

What is a Covered Call ?

...Second, his expectations of returns from the market are unrealistic. I cannot remember how many instances I have had of chatting with traders wanting to double there money in a month or expecting a 100% return in an year or expecting a 20% return over a trade....2/n

...Second, his expectations of returns from the market are unrealistic. I cannot remember how many instances I have had of chatting with traders wanting to double there money in a month or expecting a 100% return in an year or expecting a 20% return over a trade....2/n

What is the root cause of Over Trading? In my opinion, the root cause is

What is the root cause of Over Trading? In my opinion, the root cause is

start with a fresh breakout. Whatever happens, Monday will be a gamble as far as positional trading is concerned. The way Wednesday sell-off was negated today, I am expecting a range from 37500 to 3900 for the 2nd week of October.

start with a fresh breakout. Whatever happens, Monday will be a gamble as far as positional trading is concerned. The way Wednesday sell-off was negated today, I am expecting a range from 37500 to 3900 for the 2nd week of October.