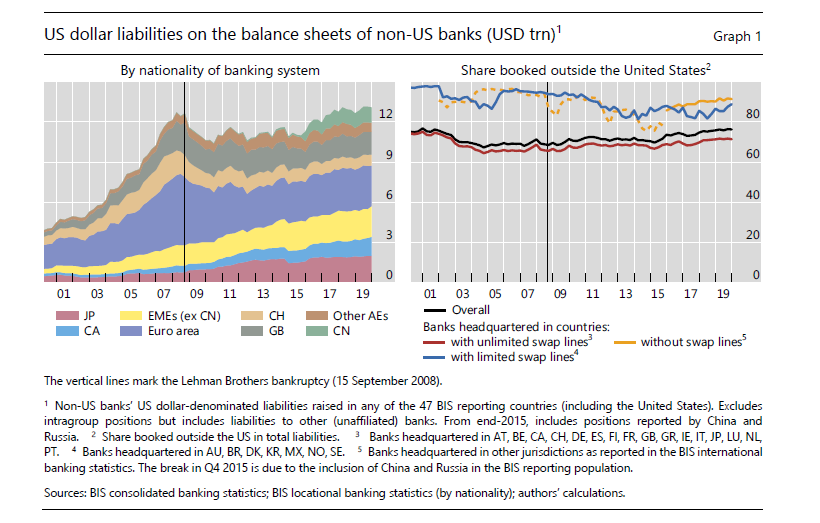

Today's #BIS_Bulletin sorts through the cases

bis.org/publ/bisbull28…

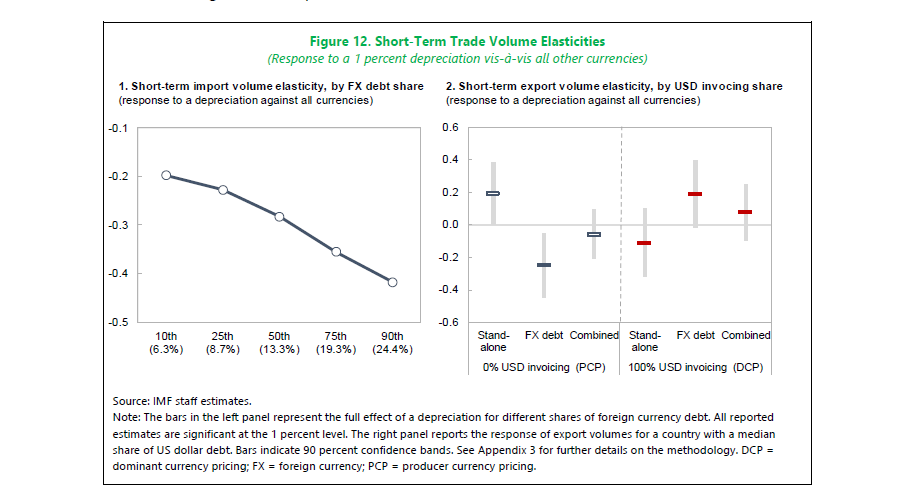

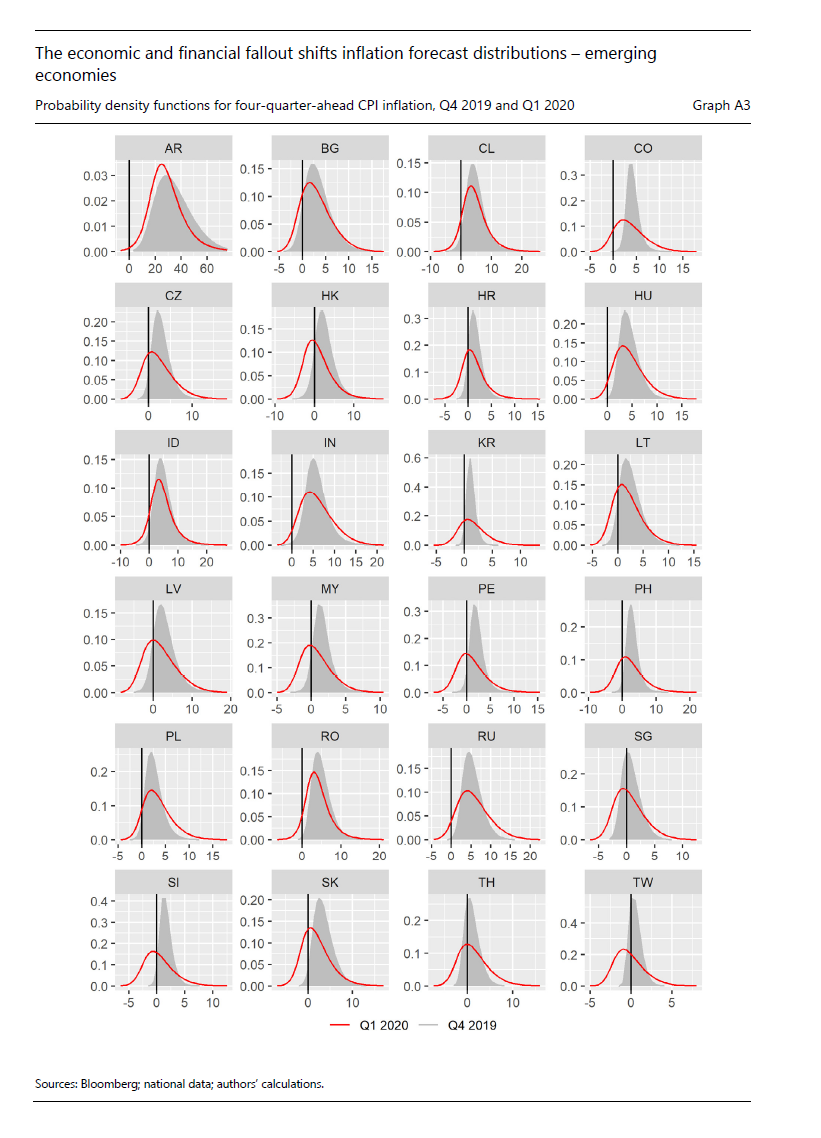

Emerging markets are familiar with these episodes

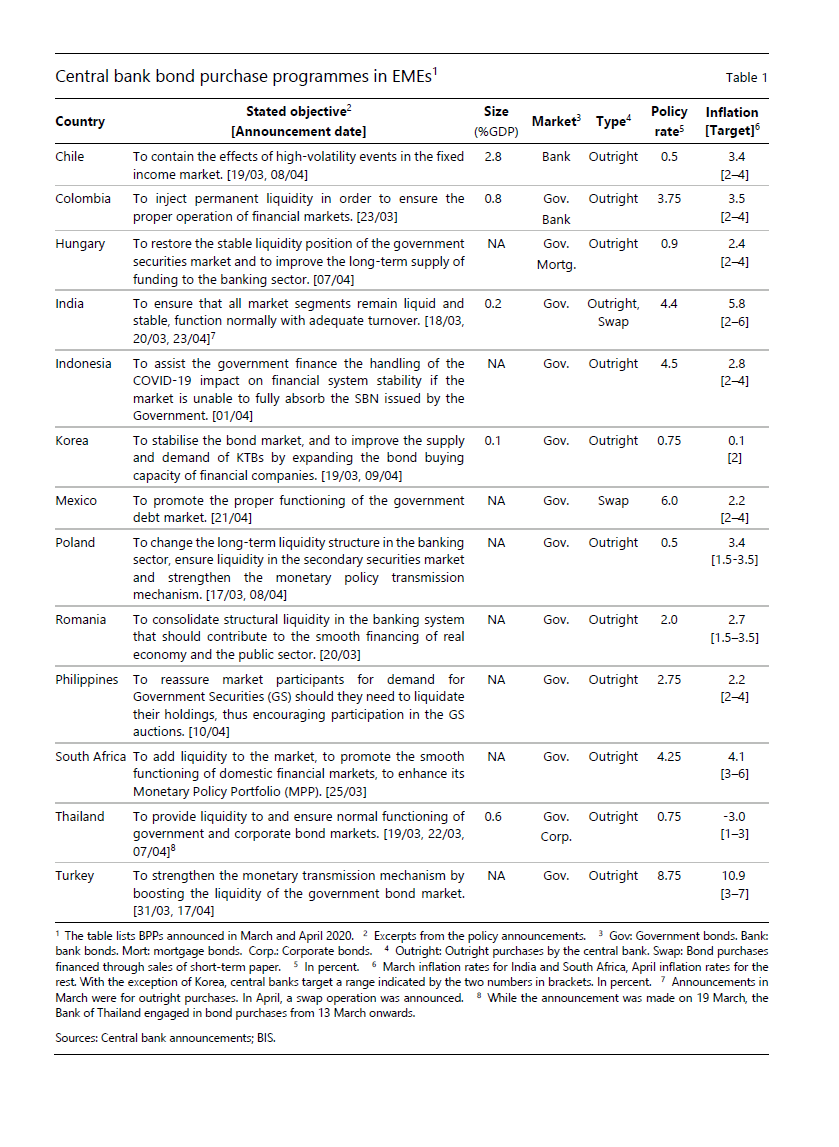

(Spoiler: monetary financing by central banks don't end well in emerging markets...)

bloomberg.com/news/audio/202…

See this earlier #BIS_Bulletin bis.org/publ/bisbull23…

This classic by Ito and Sato is worth re-reading nber.org/papers/w12395.…