More updates on below 103 stocks total short interest after the close.

for July 15 reporting.

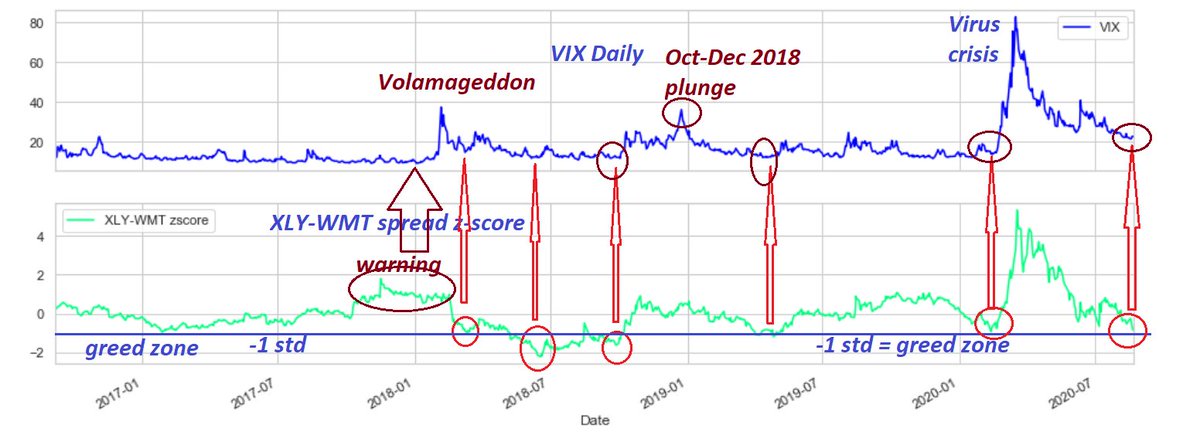

A great contrarian indicator for stocks.

for July 15 reporting.

A great contrarian indicator for stocks.

https://twitter.com/kerberos007/status/1283071925342875650

TSLA short interest as of July 15

total capitulation from the TSLA shorts:

from 6.5 short ratio last year to 1 (short ratio) days to cover

from almost 40 million shares short last year this time to 12 million shares short. 🧐

total capitulation from the TSLA shorts:

from 6.5 short ratio last year to 1 (short ratio) days to cover

from almost 40 million shares short last year this time to 12 million shares short. 🧐

Total SI of 103 stocks as of July 15 reporting

Total SI continued its decline as catapults to all time high

Lowest short interest in more than a year.

notice:

1 total capitulation in Jan 15 & 31

2 what happened in Feb/Mar?

3 then Mar 31 and recent capitulation

Total SI continued its decline as catapults to all time high

Lowest short interest in more than a year.

notice:

1 total capitulation in Jan 15 & 31

2 what happened in Feb/Mar?

3 then Mar 31 and recent capitulation

QQQ 103 stocks: top 52 stocks

This table contains tons of information:

1 today's price & chg

2 short interest & days to cover

3 market cap as of today

4 % weight as of today

ranked by short ratio (days-to-cover)

top SI 52 stocks

This table contains tons of information:

1 today's price & chg

2 short interest & days to cover

3 market cap as of today

4 % weight as of today

ranked by short ratio (days-to-cover)

top SI 52 stocks

QQQ 103 stocks: bottom 51 stocks in term of short-ratio

This table contains tons of information:

1 today's price & chg

2 short interest & days to cover

3 market cap as of today

4 % weight as of today

ranked by short ratio (days-to-cover)

bottom 51 stocks

This table contains tons of information:

1 today's price & chg

2 short interest & days to cover

3 market cap as of today

4 % weight as of today

ranked by short ratio (days-to-cover)

bottom 51 stocks

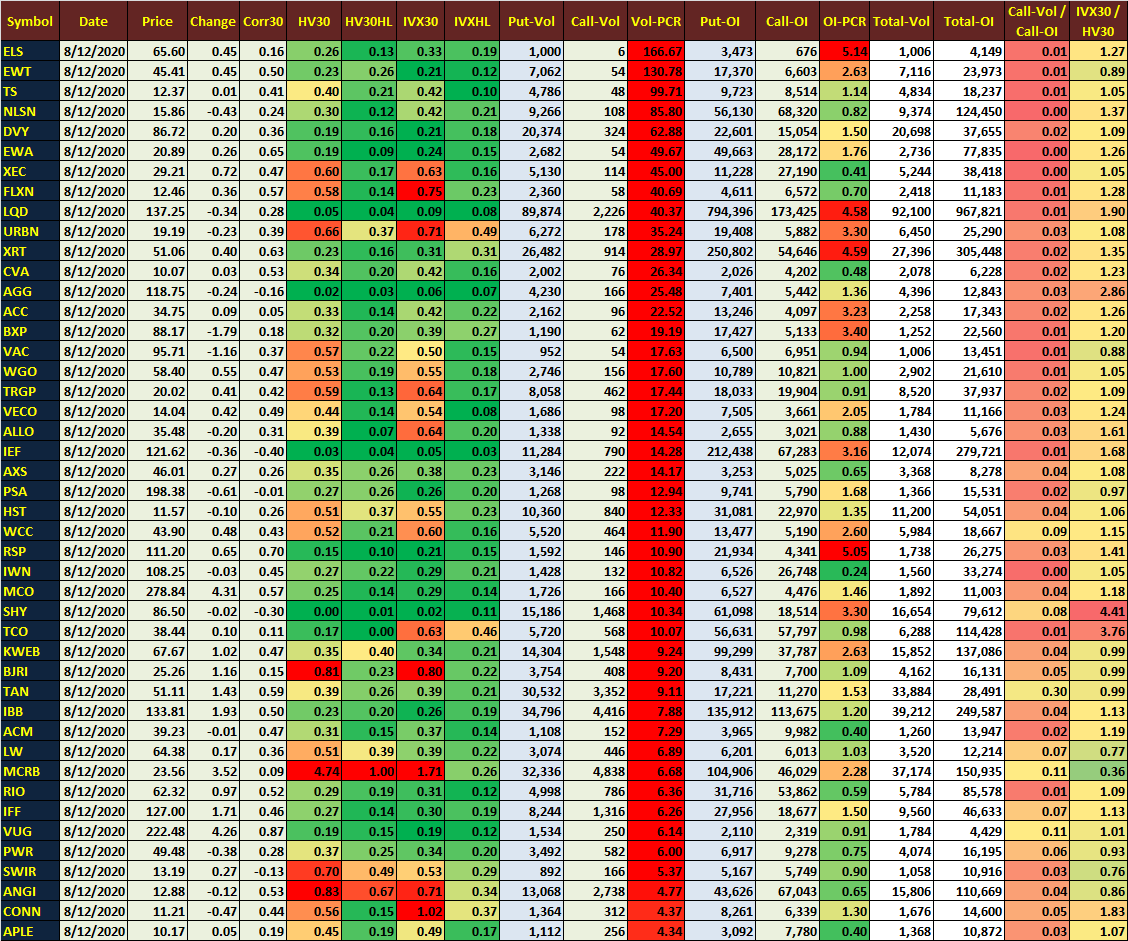

sharing some of my favorite screeners

I just don't have the time to monitor myself

super euphoria screen: last column

total call volume / total OI call vol

> 1 = FOMO (TSLA? deep OTM calls)

> 0.75 =euphoria

> 0.5 =greed

Useful? anything interesting, let us know

I just don't have the time to monitor myself

super euphoria screen: last column

total call volume / total OI call vol

> 1 = FOMO (TSLA? deep OTM calls)

> 0.75 =euphoria

> 0.5 =greed

Useful? anything interesting, let us know

Screener:

high Implied volatility vs low historical volatility

IVX30 / HV30 ratio

> 2 ==> extreme fear (pending scandals? drug approval?)

> 1.5 ==> fear (pending bad earnings?)

high Implied volatility vs low historical volatility

IVX30 / HV30 ratio

> 2 ==> extreme fear (pending scandals? drug approval?)

> 1.5 ==> fear (pending bad earnings?)

Screener:

Highest volume Put/Call Ratio from yesterday:

Vol-PCR column (red) in the middle:

> 50 ==> extreme bearish (sky is falling, all-in puts)

> 20 ==> super-duper bearish

> 5 ==> bearish

Highest volume Put/Call Ratio from yesterday:

Vol-PCR column (red) in the middle:

> 50 ==> extreme bearish (sky is falling, all-in puts)

> 20 ==> super-duper bearish

> 5 ==> bearish

Highest OI Put/Call Ratio

OI-PCR column in the middle:

> 10 ==> extreme bearish (sky is falling, all-in puts)

> 4 ==> super-duper bearish

> 2 ==> bearish

OI-PCR column in the middle:

> 10 ==> extreme bearish (sky is falling, all-in puts)

> 4 ==> super-duper bearish

> 2 ==> bearish

Conditions for the above screens:

1 share price > $10

2 total options volume traded daily > 1,000 contracts

3 total OI > 4,000 contracts

down from 3,200 stocks/ETFs to about 900 tickers.

1 share price > $10

2 total options volume traded daily > 1,000 contracts

3 total OI > 4,000 contracts

down from 3,200 stocks/ETFs to about 900 tickers.

My best "pending news" screen

1 Implied volatility (IV) highest increase in 5 days =fear

2 Vol-PCR also increase in last 1 day & 5 days =fear

3 looking for "red" cells across the rows

looks interesting:

5-day IV increased by 38%

Vol_PCR-1d up 203%

Vol-PCR-5d up 190%

1 Implied volatility (IV) highest increase in 5 days =fear

2 Vol-PCR also increase in last 1 day & 5 days =fear

3 looking for "red" cells across the rows

looks interesting:

5-day IV increased by 38%

Vol_PCR-1d up 203%

Vol-PCR-5d up 190%

Wow... shocking.. extreme bearish tickers.

The highest 1-day & 5-day % change in Vol-PCR

along with the high Put-Volume > 2000 contracts.

The highest 1-day & 5-day % change in Vol-PCR

along with the high Put-Volume > 2000 contracts.

• • •

Missing some Tweet in this thread? You can try to

force a refresh