#Quora Question: How can 20X or 10x leverage for Option Selling be a risk If I follow Risk Management?

So this is about #Intraday #ExpiryTrading #OptionsTrading

This is inspired from traders with 70k+ followers. These traders and trainers recommend selling dirt cheap options. 1/n

So this is about #Intraday #ExpiryTrading #OptionsTrading

This is inspired from traders with 70k+ followers. These traders and trainers recommend selling dirt cheap options. 1/n

These traders started trading in expiry weekly options when volatility was less. Now the volatility is extreme.

You are asked to follow a portfolio stoploss of 1% so I suppose that is fine.

You are asked to sell cheap options of #Nifty 1 -2 rupee and #BankNifty 5-6 rupee 2/n

You are asked to follow a portfolio stoploss of 1% so I suppose that is fine.

You are asked to sell cheap options of #Nifty 1 -2 rupee and #BankNifty 5-6 rupee 2/n

You will sell in small lots so that is fine too. Consider this scenario.

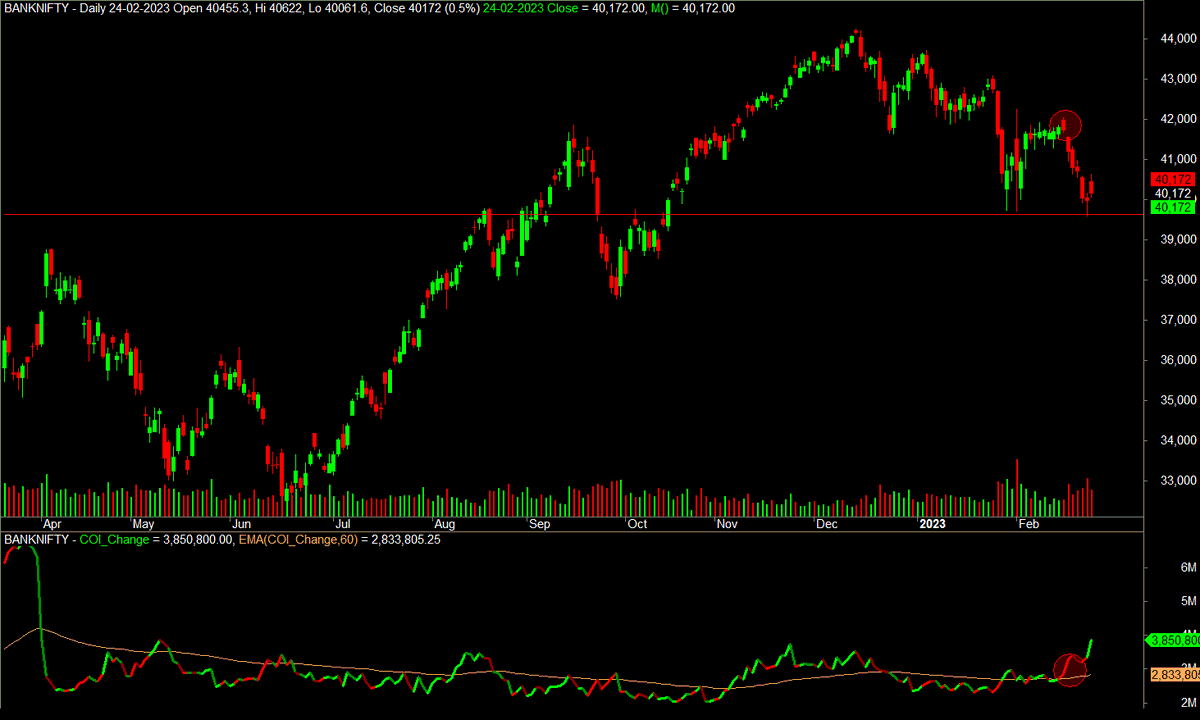

On 26 September 2019 at around 10 am I sold cheap options of #BankNifty at ₹6/- only 20 lots which was i think 4 to 5% of my capital. What bad can happen. When I was putting stoploss at ₹15/- 3/n

On 26 September 2019 at around 10 am I sold cheap options of #BankNifty at ₹6/- only 20 lots which was i think 4 to 5% of my capital. What bad can happen. When I was putting stoploss at ₹15/- 3/n

And midway BankNifty started jumping. It went to 50 in one spike. I cancelled the sl order. And went to net positions to square it off. Price was at 350 now. When I squared off and I am fast, price touched ₹700/-. 4/n

All of this happened in 5 to 7 minutes.

My target was 6, I ended up losing 700.

With 4-5% capital deployed, capital eroded 10% of total.

Now did I follow risk management? Yes

Did I follow position sizing? Yes

Still it happened. For 100 days i won ₹6/- but 5/n

My target was 6, I ended up losing 700.

With 4-5% capital deployed, capital eroded 10% of total.

Now did I follow risk management? Yes

Did I follow position sizing? Yes

Still it happened. For 100 days i won ₹6/- but 5/n

In one day I lost 700/- points and a net loss of 100/- points. That is why selling option on leverage is bad. If this doesn't convince you, then nothing can. All it took is 10 minutes for market to screw 6 month of profits. Thats why it is not worth it.

My recommendation 6/n

My recommendation 6/n

Trade with a proven system for expiry on leverage if you want to. Some thing like #IntradayExplosion

Traders recommending leverage selling are living off the brokerage you generate. They themselves do it in very less quantity. That should be a warning sign. 7/n

Traders recommending leverage selling are living off the brokerage you generate. They themselves do it in very less quantity. That should be a warning sign. 7/n

There is one fellow #PRSundar who wants people to sell ₹1 options. People dont realize they are just getting net 0.66 paise. Few expiries back I saw 1 rs. Option go to 158. If you are ready for that R:R then best of luck. Happy Trading.

• • •

Missing some Tweet in this thread? You can try to

force a refresh