Buckle up for a tale of gun-toting senators, people being angry about mail, slow government regulators and Maxine Waters . . .

Folks are angry due to the horrible incident with Jacob Blake. Regardless of how you feel about BLM or democrats, I bet you do have feelings about people.

I bet we can all agree keeping people alive is good, and US people should have the same rights.

My six year old daughter asked me “why do police shoot so many black people?”

And maybe ask yourself how we can stop this from being a question in the future.

You know, the thing where a credit card company mails you some blank checks. You use them, and bingo! You’ve opened a credit card (on purpose or not).

federal register to die a . . .

slow . . .

administrative . . .

death.

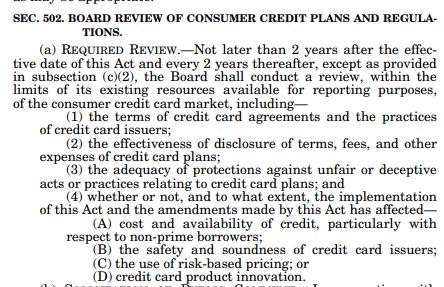

But there’s a twist on this year's request for information . . .

They’re asking what parts of the rules should be repealed.

The statute and regs seem too intertwined, and anything they try to remove will ultimately be backstopped by the statute.

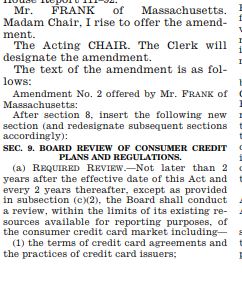

In the House, things must relate or be “germane” to be a valid amendment.

There’s no germaneness requirement in the Senate, so Senators can stick all sorts of wacky things into must-pass bills.

(I'm for this, btw - SMBs are hurting and need the help)

Moderate Dems and GOP members combined to make it a thing. The Tea Party would eat most of those Dem seats in 2010.

media.mofo.com/files/uploads/…

files.consumerfinance.gov/f/documents/cf…