#Nifty Trading plan for tomorrow is simple. Holding a bull put spread of -11500/+11150 PE spread and -11550/+11400PE next week spread. Eyes on for 11700CE/11600PE with #IntradayExplosion. If buy on 11700CE then no action. If buy on 11600PE then will cover 11500/11150PE Spread 1/2

and will add 11700/12000 CE Spread with same quantity. Will also add -11550CE/+11700CE Next week spread. #OptionsTrading

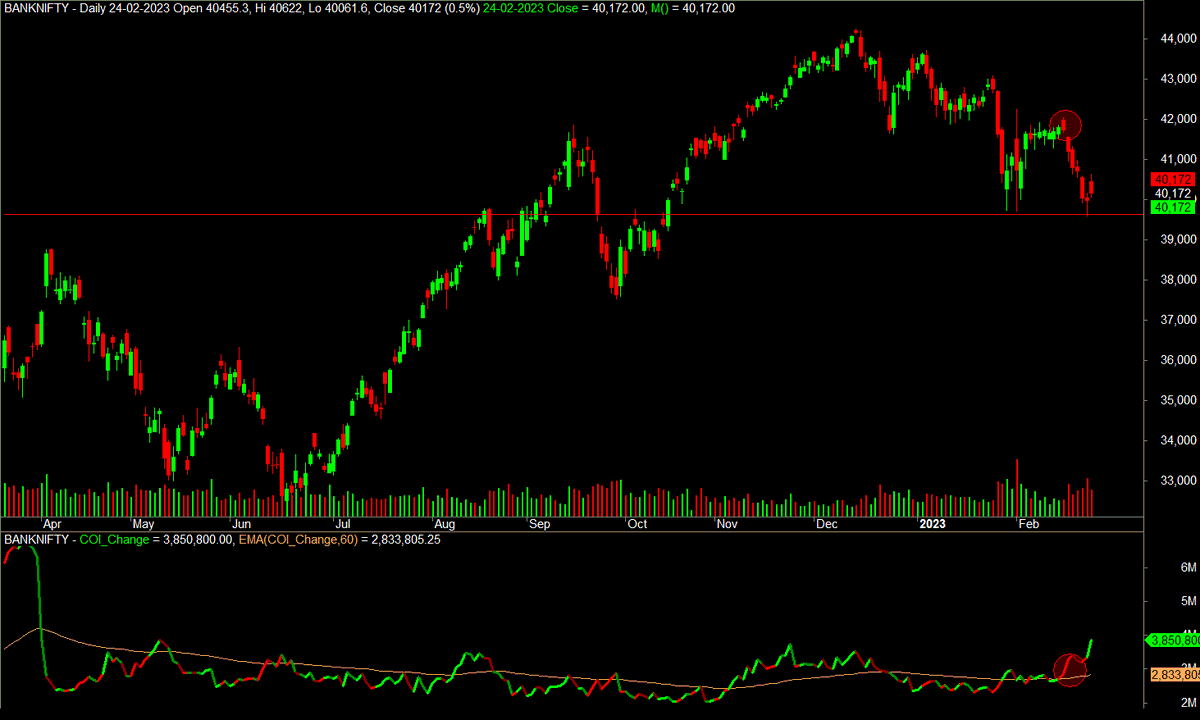

If buy on 11700CE came, then will probably look for position on #BankNifty too.

If buy on 11700CE came, then will probably look for position on #BankNifty too.

Last week was I complacent and carried forward losses. This week I was vigilant. So got saved. Here is my initial thought process for today.

1. At Gap Up at 11750, I created Iron Calendar. Spread of 11600, 11750, 11900. At 11680, I covered the losing put part at minor loss.1/n

1. At Gap Up at 11750, I created Iron Calendar. Spread of 11600, 11750, 11900. At 11680, I covered the losing put part at minor loss.1/n

As market fell, 11750, 11900 spread came into profit. Later at end of day, I covered 11900 CE at 28 and for hedging cost sake took 12100 CE at 3 rs. To reduce margin. Otherwise 11750 would have counted naked.

2. Now time to save 11550, 11400 Put Calendar. 2/n

2. Now time to save 11550, 11400 Put Calendar. 2/n

Through #IntradayExplosion I got a further buy signal on 11600 PE which I bought at 86. With trail sl at 104, I got stopped out of this complete trade at profit. 2nd trade managed successfully. I converted sold part of calendar spread into bear put spread for profit. 3/n

3. At 11570, I though market will now go sideways and again created a 11300, 11600, 11900 iron fly. Target of 60 points. Market again tanked to 11510. I covered the losing part. Got saved and market tanked to 11400. So now 11600, 11900 was at profit.

4. At 11400, 4/n

4. At 11400, 4/n

I created a put calendar of 11400, 11300. Hoping that this will go to 0 and 50 and in pofit. Combined position now offsetting loss of last week. Hoping for best. This is Options Management I did.

#Nifty #BankNifty #OptionsTrading

#Nifty #BankNifty #OptionsTrading

• • •

Missing some Tweet in this thread? You can try to

force a refresh