boj.org.jm/uploads/news/b…

This is significant. I explain below.

#FinanceTwitterJa

Every day, buyers & sellers (i.e. Financial Institutions including Cambios) buy & sell foreign exchange with each other.

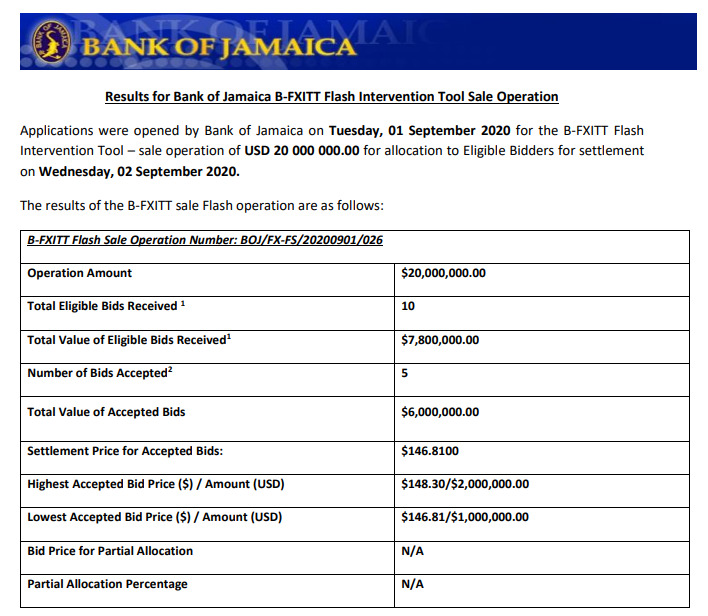

BOJ has begun publishing this activity daily, for example:

It doesn't show any transactions with BOJ.

BOJ doesn't do regular, daily, transactions with the F/X market.

Many years ago they used to intervene regularly and some market participants used to do that and make money.

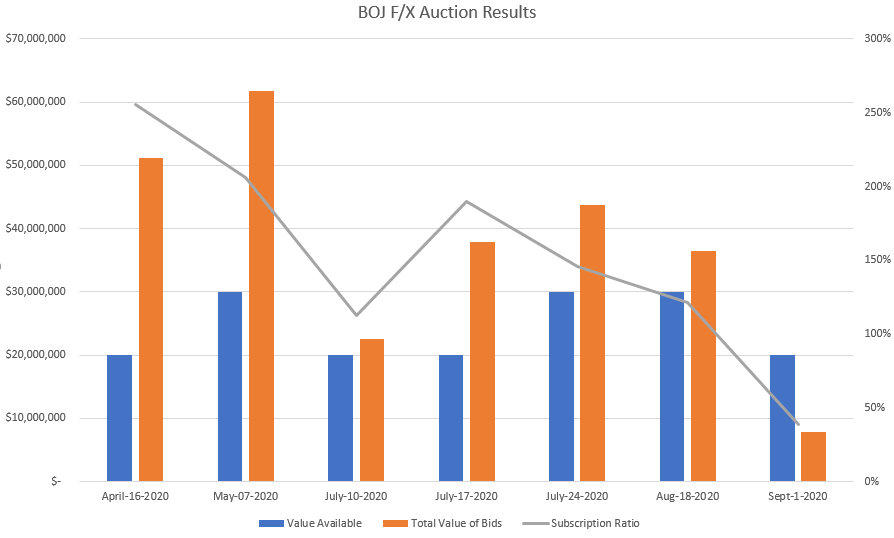

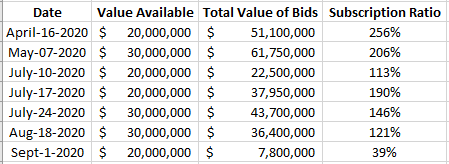

That is showing that the market would like to buy more than BOJ is selling.

Remember, BOJ only does this when the market...

If market conditions continue as is, then BOJ won't necessarily need to do another Flash Auction as quickly as they have.

If they do, the subscription rate is not likely to be oversubscribed.

So the fact that the market only took up 39% of the lower amount is further indication that the market has enough F/X.

jamaica-gleaner.com/article/busine…

So generally speaking, we can expect the JMD to continue to strengthen over the next few weeks.

I obviously can't predict the exact movements of the dollar, but just doing an analysis of the fundamentals...

If the JMD dips a few days in the near term, please don't tag me (lol) because I am making no guarantees that it won't. Just saying that the conditions are ripe for JMD strengthening.

This will bring a lot of cash that is sitting on the sidelines out of caution, back into the equity markets, which should begin a rebound.

loopjamaica.com/content/tropic…

Said another way, say I am sitting on US$20M and I know I will want to sell US$2M within 2 weeks. Also assume that the latest price today is $145.60.

Knowing that the USD is likely to lose value within the next few weeks...

That simple fact, will encourage profit-maximizing market participants to sell sooner than later, which causes the price to fall.