Started reading the A complete Guide to Volume Price Analysis

#book #VPA

Based on my understanding created below patterns

1. Price and volume raising

> Bullish: price closes above the previous candle and volume is greater than previous candle.

@PAVLeader

#book #VPA

Based on my understanding created below patterns

1. Price and volume raising

> Bullish: price closes above the previous candle and volume is greater than previous candle.

@PAVLeader

2. Price and volume falling

> Bullish: price closes below the previous candle and volume is less than previous candle.

3. Price falling and volume raising

> Bearish: price closes below the previous candle and volume is greater than previous candle.

> Bullish: price closes below the previous candle and volume is less than previous candle.

3. Price falling and volume raising

> Bearish: price closes below the previous candle and volume is greater than previous candle.

4. Price raising and volume falling

> Bearish: price closes above the previous candle but volume is less than previous candle.

- For intraday, look for daily pattern.

- For short term, look for weekly pattern

- For long term, look for monthly pattern

> Bearish: price closes above the previous candle but volume is less than previous candle.

- For intraday, look for daily pattern.

- For short term, look for weekly pattern

- For long term, look for monthly pattern

Dear friends,

Very good strategy/pattern from "A complete Guide to Volume Price Analysis"

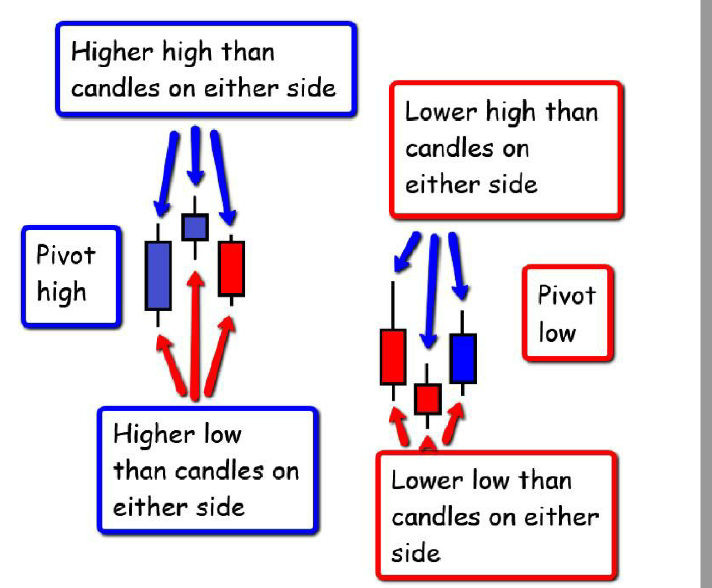

1. Bullish U turn price reversal

Higher high and Higher low than candles on either side. Possible short term reversal in the price.

Very good strategy/pattern from "A complete Guide to Volume Price Analysis"

1. Bullish U turn price reversal

Higher high and Higher low than candles on either side. Possible short term reversal in the price.

2. Bearish U turn price reversal

Lower high and Lower low than candles on either side. Possible short term reversal in the price.

Will be added these patterns to the system today.

Lower high and Lower low than candles on either side. Possible short term reversal in the price.

Will be added these patterns to the system today.

• • •

Missing some Tweet in this thread? You can try to

force a refresh