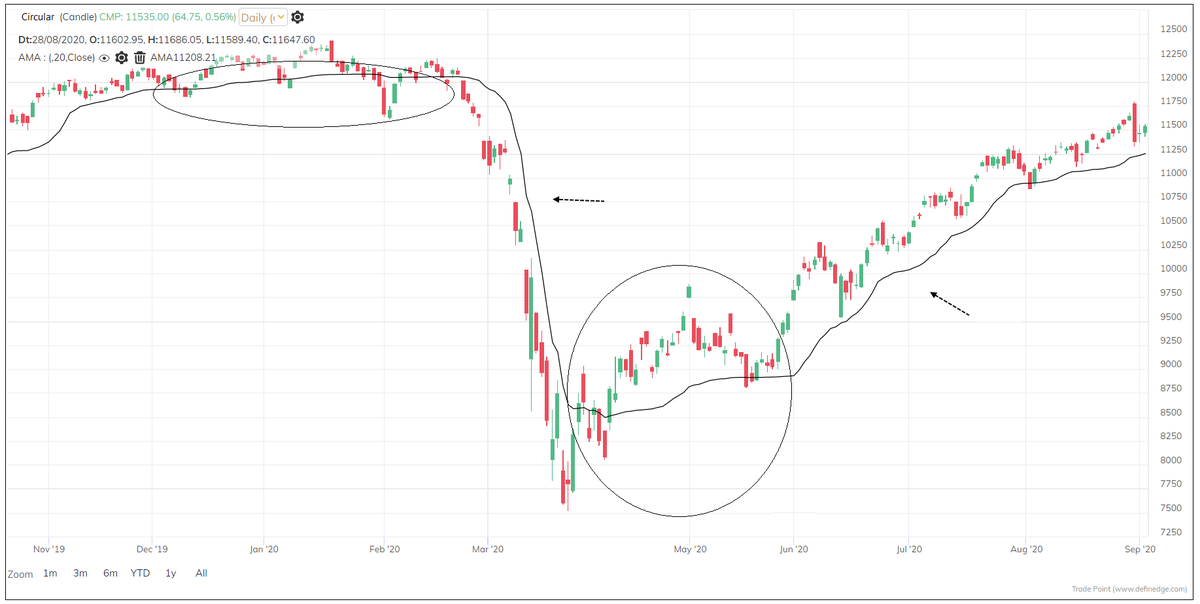

AMA is an indicator devised by Perry Kaufman explained in his book Trading System and Methods. It is also known as Kaufman’s Adaptive Moving Average (KAMA).

#AMA #Adaptivemovingaverage #indicators #definedge

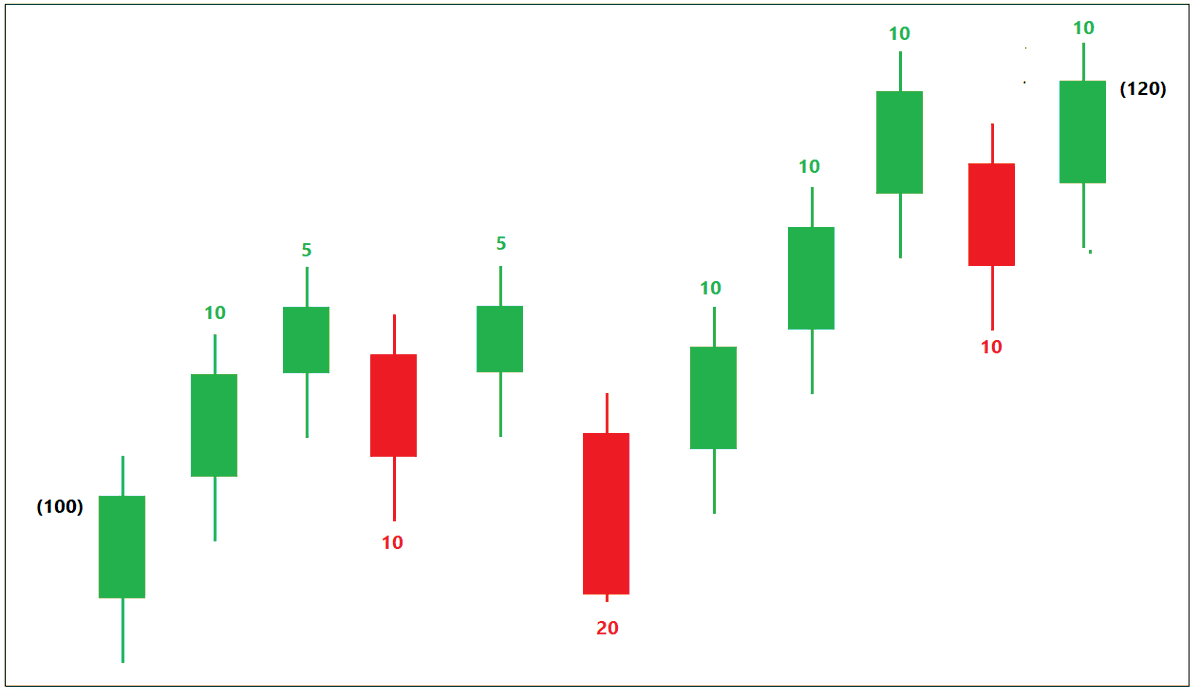

Meaning,

Price went up or down by 10 points = trend

Price moved by 10 points = volatility

100 = (10+5+10+5+20+10+10+10+10+10)

So, during last 10 sessions, total of daily movement is 100 points. Volatility? Let's call it Noise.

Total movement was of 100 points. But over the 10 sessions price went up from 100 to 120.

Trend?

Total move up & down was 100 points but what was the outcome? Price moved up by 20 points. This is known as Efficiency Ratio (ER).

ER = Trend / Noise

ER in above example is 20. It took move of 100 points to gain 20 points.

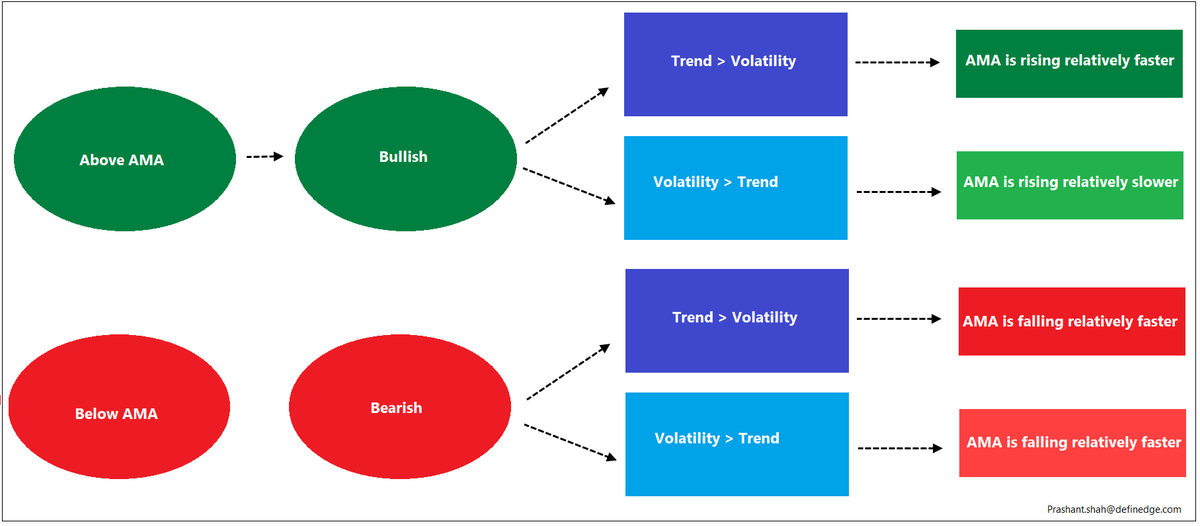

If price is falling & ER is rising = strong downtrend

This means there is more of a trend in daily fluctuation.

If ER is falling, noise is more.

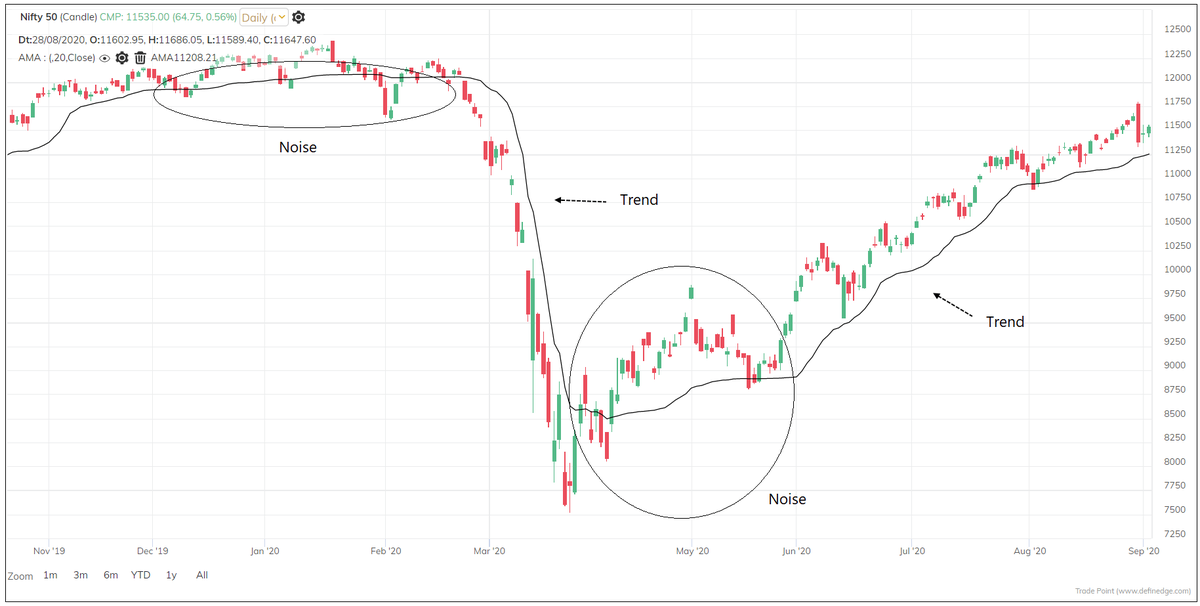

We can plot the ER indicator on the chart.

ER

What will make ER rise?

Trend

What is trend?

ROC > Volatility

When will ROC go up?

Drop-off effect or strong price action

So, while crossing price or when AMA rising – a strong close or bullish price action is more reliable. Vice versa whn AMA falling

Any strategy would have favorable and unfavorable phases. Remaining consistent with a strategy and accept its bad phase brings success over a period.

We can also develop a strategy that adopts to different market conditions.

Principle of AMA is that smoothing can be temporarily reduced when price is moving in a certain direction. That's a major takeaway.

Perry Kaufman created AMA --

The motive of these threads is to promote logical understanding & make you think abt different concepts. Thanks for your likes & comments that hv encouraged me to share more