who participates in in capital markets? finance pro's and traders are focused on optimizing the opportunity cost of capital and (1) preserving principal while (2) optimizing growth

you usually start with a goal in mind

if you have 100 bitcoin, your opportunity cost of capital could be 8% income from lending it. or it could be the 20,000% APY you could earn by wrapping it and farming.

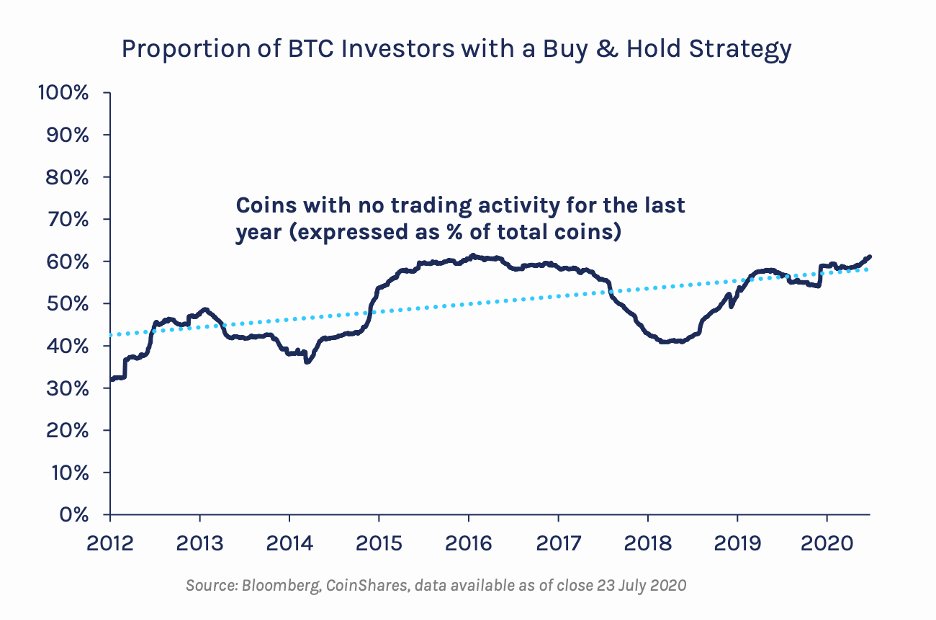

crypto is a $300B market. a lot of ppl who are fundamentally long (holding assets) want to make money while waiting for "number go up"

financialization is inevitable

leverage. in the last few years, more borrow capacity coming online.

wrote about it here: medium.com/coinshares/und…

for traders, it's a great way to minimize opportunity cost of being long

it's a useful frame for anyone who is fundamentally long BTC, ETH, or other highly liquid assets

helps w/ understanding market behavior

first - understanding financial relativity (risk free rate, market rate, etc) and the art of performance in investing - medium.com/what-grinds-my…

medium.com/what-grinds-my…

understanding these systems and their mechanics is a good investment of time, especially if u plan to participate in some way, shape, or form. DYOR and stay SAFU!