The web is such a treasure trove.. Bessemer Venture Partners shared some of their deal memos.

Check out Shopify $SHOP

2010: "BVP to invest $5mm at $25mm pre-money"

2020 market cap: $115 billion

bvp.com/memos/shopify

Check out Shopify $SHOP

2010: "BVP to invest $5mm at $25mm pre-money"

2020 market cap: $115 billion

bvp.com/memos/shopify

"Profitable and largely bootstrapped"

"Shopify sells a simple SaaS solution that enables a business to quickly setup and run an online retail store. A typical customer signs up using their credit card and is up and running in a few hours"

"Shopify sells a simple SaaS solution that enables a business to quickly setup and run an online retail store. A typical customer signs up using their credit card and is up and running in a few hours"

@tobi

"We don’t feel like there is any immediate need to replace him as CEO"🧐

"He has a clear vision for building the business and recognizes his own shortcomings."

"We don’t feel like there is any immediate need to replace him as CEO"🧐

"He has a clear vision for building the business and recognizes his own shortcomings."

Cost advantage:

"Based on Shopify’s reputation as a local startup success story, and Tobi’s reputation among the developer community, the company has been able to recruit talent in Ottawa at 60%-70% of the cost of similar talent in Silicon Valley or NY"

"Based on Shopify’s reputation as a local startup success story, and Tobi’s reputation among the developer community, the company has been able to recruit talent in Ottawa at 60%-70% of the cost of similar talent in Silicon Valley or NY"

Lessons from $WIX and TeamViewer investments

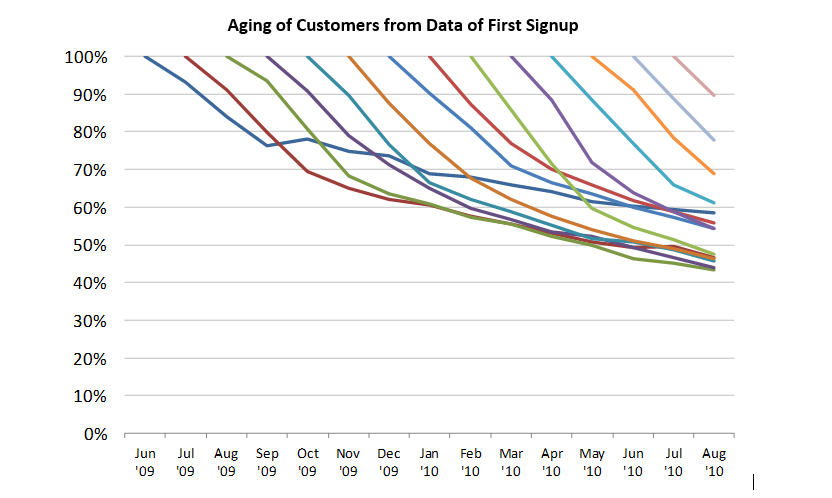

"A 5% monthly logo churn likely scared off other investors"

"retention curve looks quite similar to that of Wix"

Low CAC and "customers that do stick around end up making up for the ones that churn"

"A 5% monthly logo churn likely scared off other investors"

"retention curve looks quite similar to that of Wix"

Low CAC and "customers that do stick around end up making up for the ones that churn"

Ben Thompson:

"The more companies that use Shopify and fail is a positive indicator because that means they’re getting more rolls of the dice at that one that hits it big.

In a world of abundance, it’s all about increasing your rolls of the dice."

investorfieldguide.com/thompson/

"The more companies that use Shopify and fail is a positive indicator because that means they’re getting more rolls of the dice at that one that hits it big.

In a world of abundance, it’s all about increasing your rolls of the dice."

investorfieldguide.com/thompson/

App store flywheel:

"Shopify exposes an open API that allows software developers to integrate into its platform. In the early days it was difficult to attract developers. They resorted to running contests for the best app, taking a page from our portfolio company Twilio"

"Shopify exposes an open API that allows software developers to integrate into its platform. In the early days it was difficult to attract developers. They resorted to running contests for the best app, taking a page from our portfolio company Twilio"

"There’s so much to love about the simplicity of Shopify.

One of our colleagues described it as “minutes to learn, a lifetime to master” because it was both so simple to set up but the app store made ecommerce powerful and robust."

One of our colleagues described it as “minutes to learn, a lifetime to master” because it was both so simple to set up but the app store made ecommerce powerful and robust."

• • •

Missing some Tweet in this thread? You can try to

force a refresh