1/ Highlights and Takeaways from TMO's Analyst Day, 9/10/2020, below

https://twitter.com/bizalmanac/status/1295391385672196097?s=20

2/TMO expects to generate $4.5B of Covid-19 related revenues in FY2020, 17.6% of their FY2019 revenues

The Company is guiding to 13-16% y/y revenue growth in FY2020,

more than double their estimate of 5-7% organic revenue growth in the medium term

The Company is guiding to 13-16% y/y revenue growth in FY2020,

more than double their estimate of 5-7% organic revenue growth in the medium term

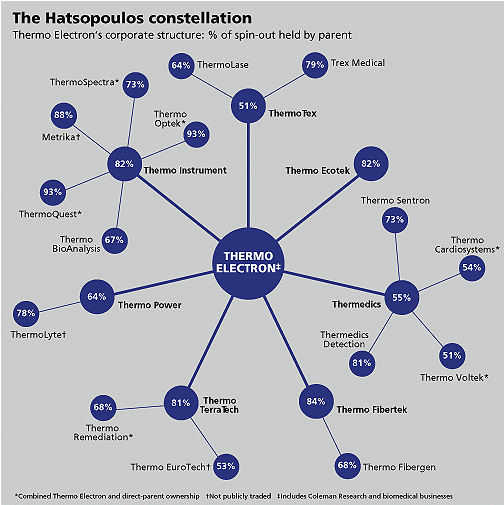

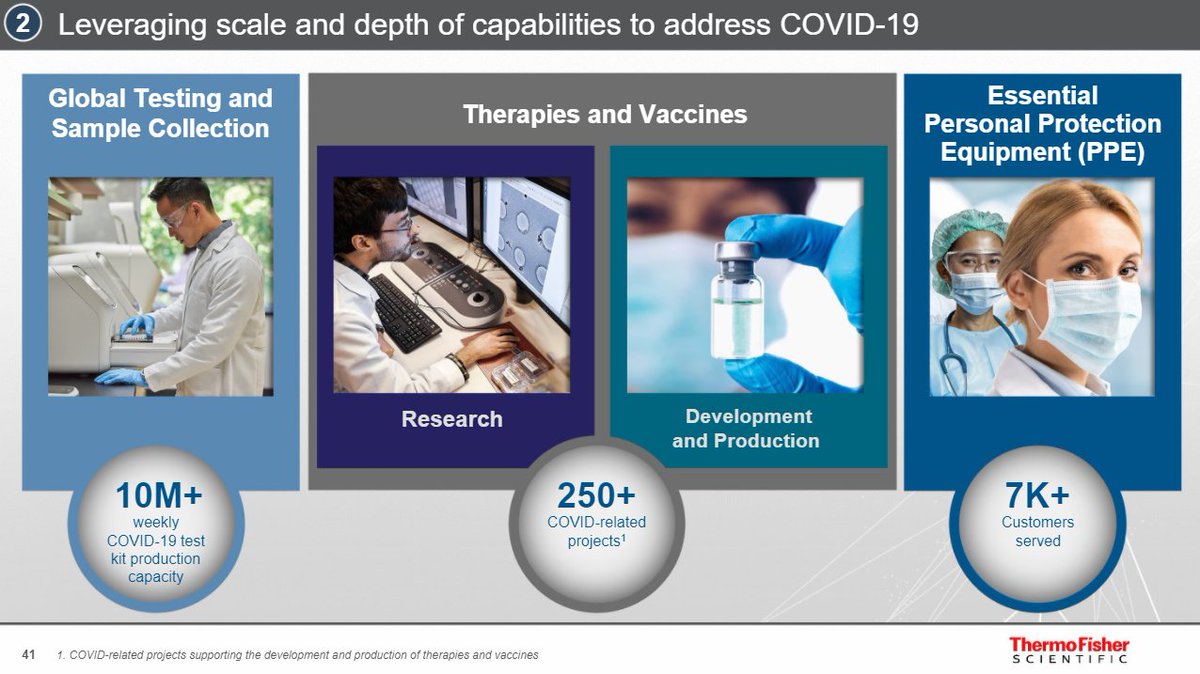

3/ The Company's response to Covid-19 demonstrates the breadth of their offerings

TMO produces test kits and machines,

supports vaccine development and manufacturing

and sells personal protective equipment

TMO produces test kits and machines,

supports vaccine development and manufacturing

and sells personal protective equipment

4/ The Company’s Life Science (LSS) segment and contract drug manufacturing (CDMO) services together form a full service partner to the drug development industry

Based on comparable company valuations, ~90% of TMO’s equity value is attributable to their LSS and CDMO businesses

Based on comparable company valuations, ~90% of TMO’s equity value is attributable to their LSS and CDMO businesses

5/ In June 2020, TMO announced a deal to lease CSL's biomanufacturing facility which The Company will operate within their CDMO business

CSL will be first customer, but TMO expects to attract additional clients

and that the facility contribute $300M in revenues by 2024

CSL will be first customer, but TMO expects to attract additional clients

and that the facility contribute $300M in revenues by 2024

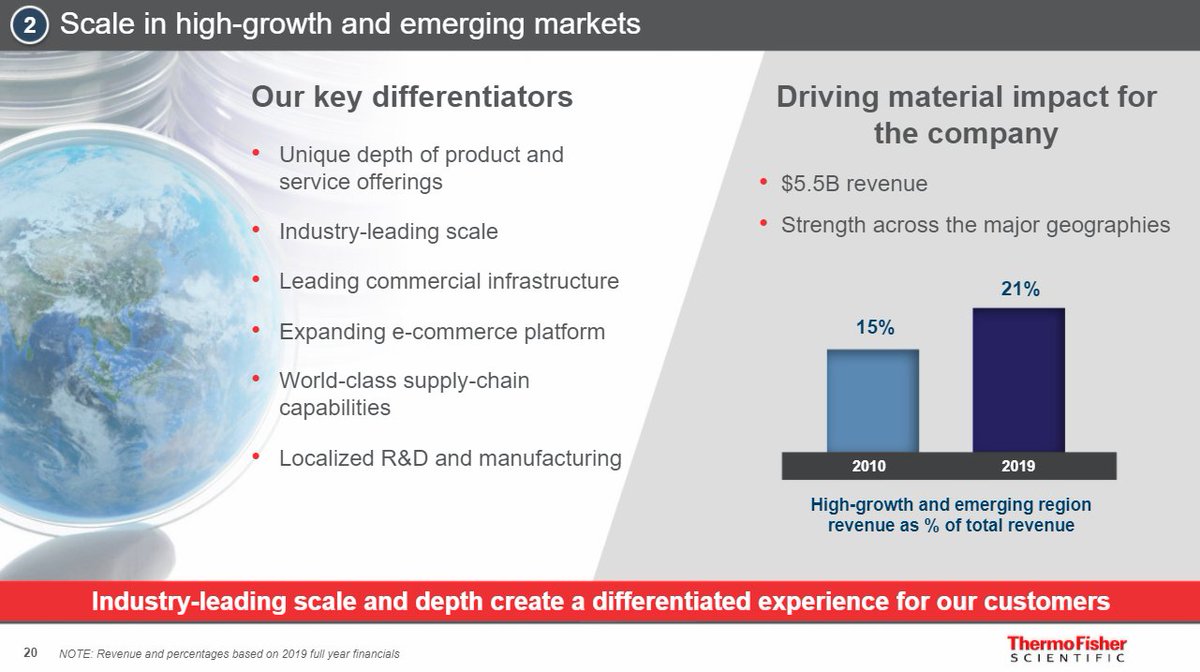

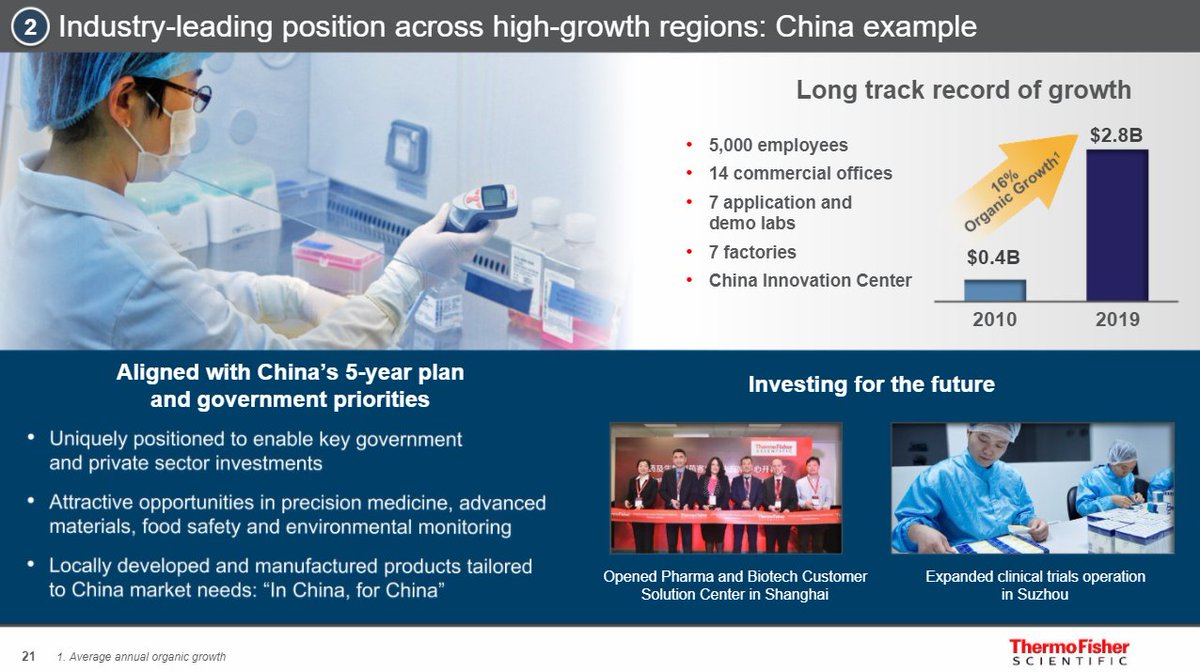

6/ The Company has increased revenues from high-growth and developing markets by ~33% since 2010

Revenues from China and Korea respectively have grown 16% and 14% p.a. from 2010-2019

Revenues from China and Korea respectively have grown 16% and 14% p.a. from 2010-2019

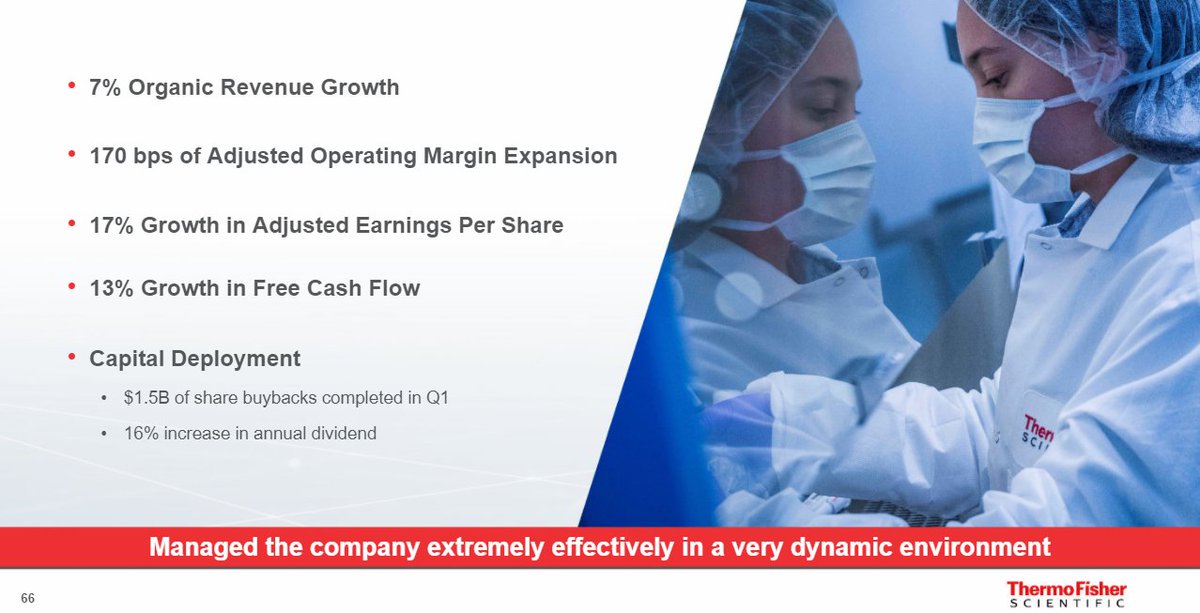

7/ TMO spent $1.5B buying back shares in the first quarter of 2020, when many companies suspended their share repurchases

Shares were bought back at an average price of $331.76, ~21% less than current prices

Shares were bought back at an average price of $331.76, ~21% less than current prices

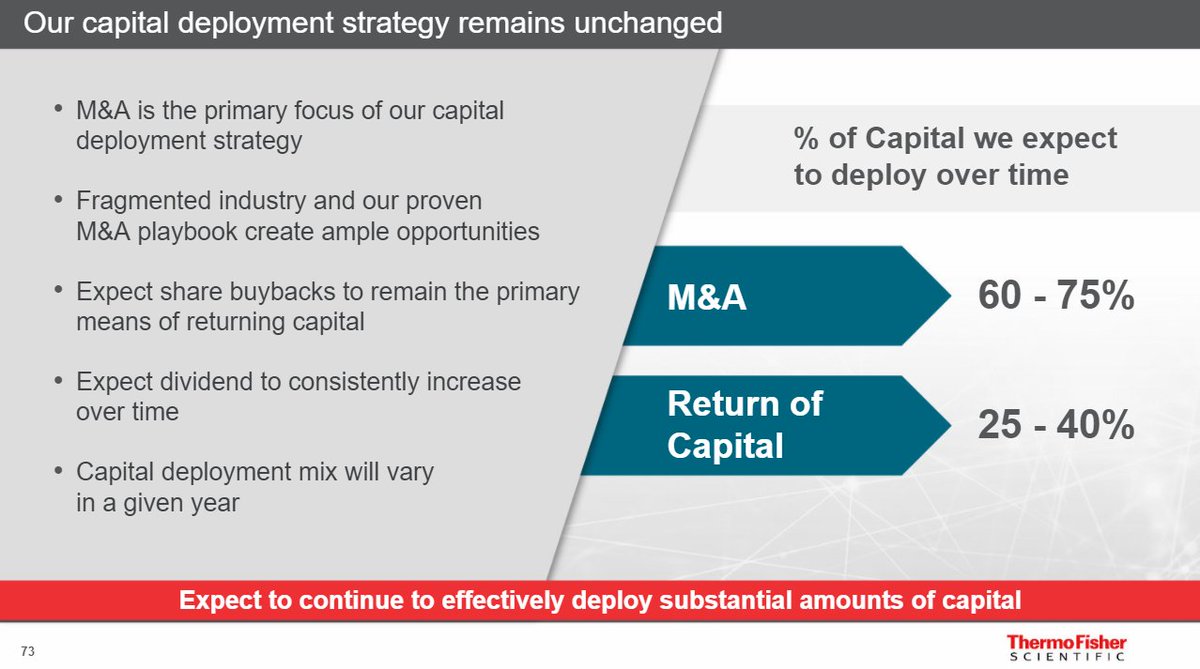

8/ The Company projects spending 60-75% of their FCF on M&A going forward

Less than the ~130% of FCF spent on M&A in the last 10 years, but a similar dollar amount due to increased earnings

Less than the ~130% of FCF spent on M&A in the last 10 years, but a similar dollar amount due to increased earnings

https://twitter.com/bizalmanac/status/1295391777046900747?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh