In 1895, an 18-year-old Russian immigrant in Alabama started selling bananas out of train boxcars.

This is the tale of how a boy from humble beginnings became one of the most powerful men in the world. This is the tale of The Banana King.

Who's up for a story?

👇👇👇

This is the tale of how a boy from humble beginnings became one of the most powerful men in the world. This is the tale of The Banana King.

Who's up for a story?

👇👇👇

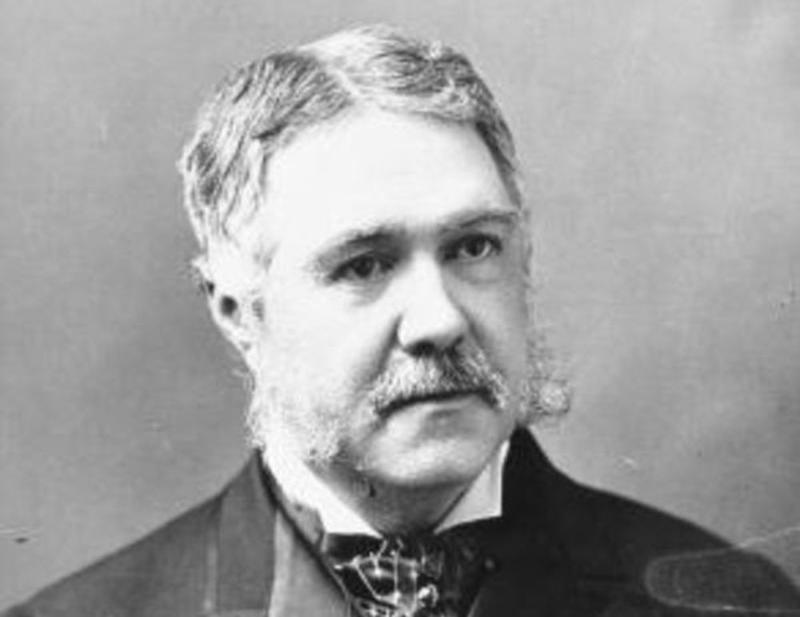

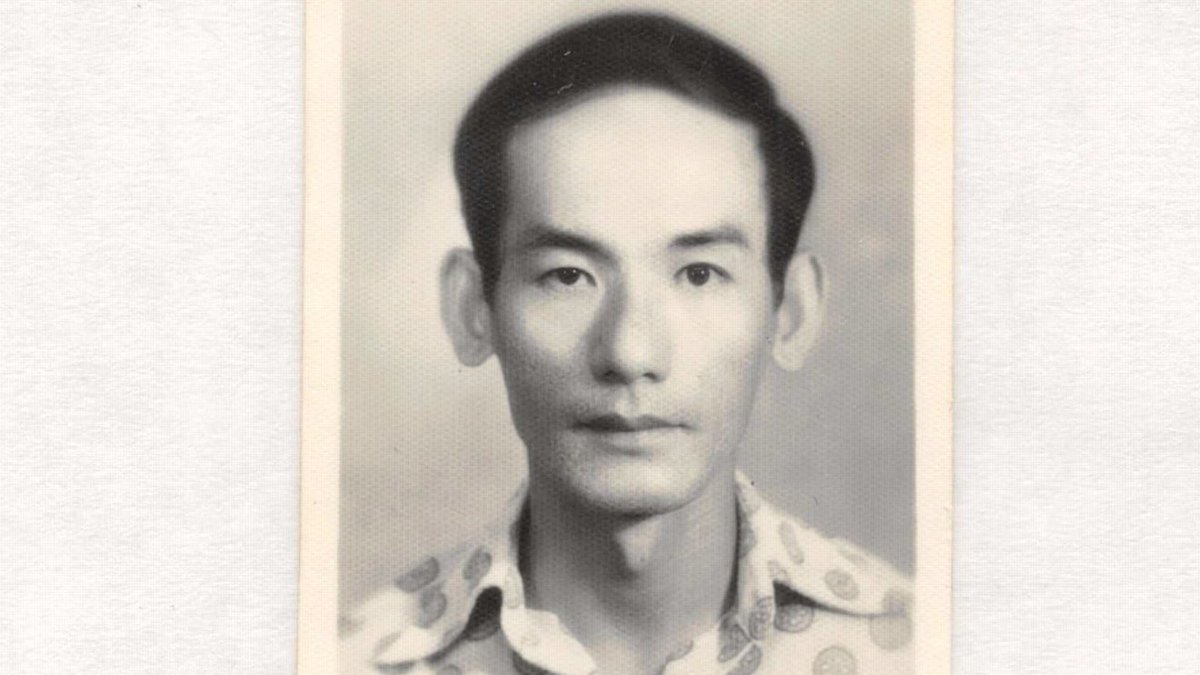

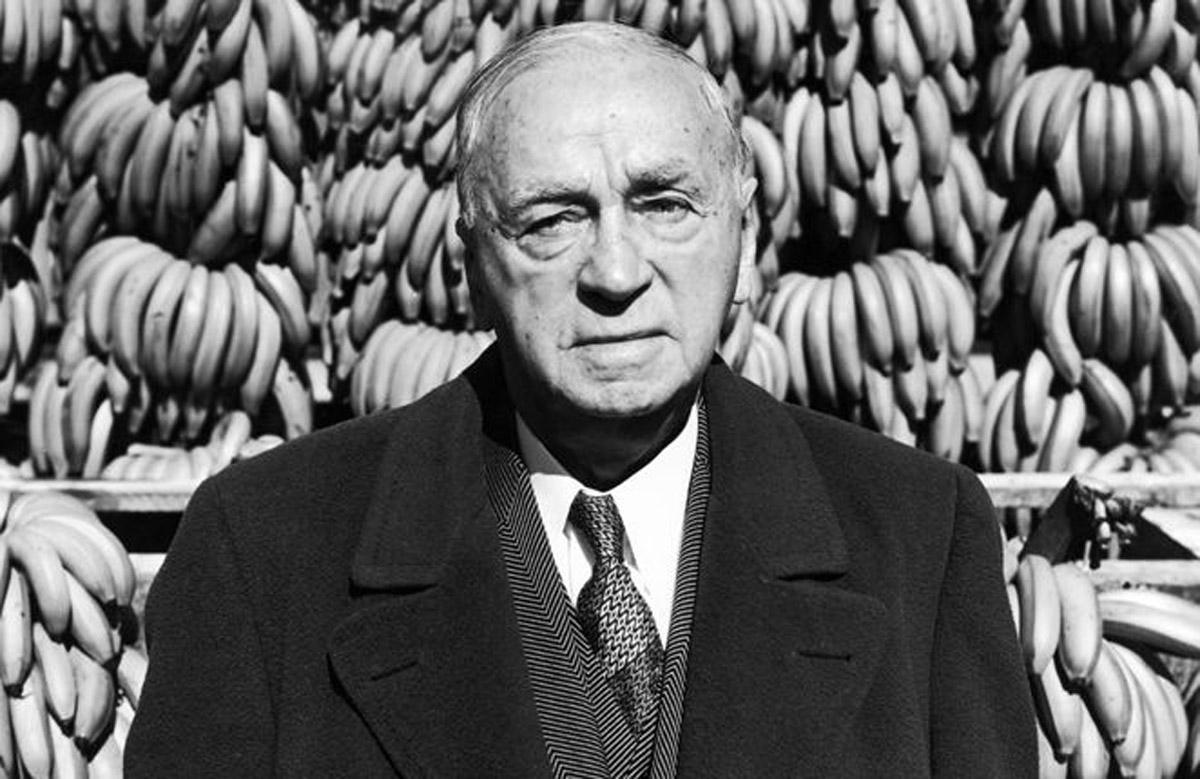

1/ Samuel Zemurray was born in 1877 to a poor Jewish family in Kishinev, a large city in the Russian Empire (present-day Moldova).

At age 14, his family emigrated to Alabama in search of opportunity.

Young Sam had no education and very little grasp of the English language.

At age 14, his family emigrated to Alabama in search of opportunity.

Young Sam had no education and very little grasp of the English language.

2/ But Sam Zemurray had dreams. He wouldn't let minor obstacles block his path.

Still in his teens, he went to Mobile, Alabama, where he watched the large fruit company ships offload their product at the port.

This was where he first saw the banana, then a rare, exotic fruit.

Still in his teens, he went to Mobile, Alabama, where he watched the large fruit company ships offload their product at the port.

This was where he first saw the banana, then a rare, exotic fruit.

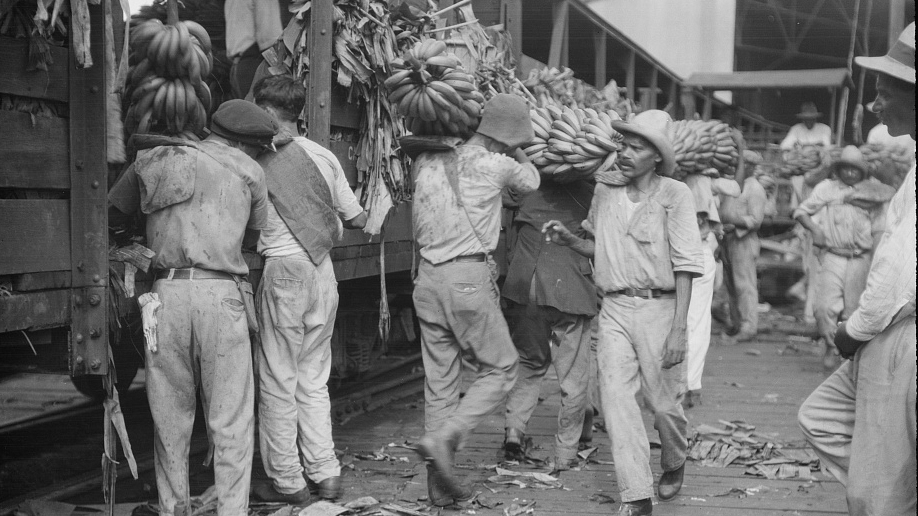

3/ After being offloaded, the fruit would be inspected prior to being sent to market.

The rule: one freckle and they were called "turning," two freckles and they were called "ripe."

Freckled bananas were discarded, as you couldn't get them to market before they became rotten.

The rule: one freckle and they were called "turning," two freckles and they were called "ripe."

Freckled bananas were discarded, as you couldn't get them to market before they became rotten.

4/ Where the fruit inspectors saw a banana that wouldn't survive the long journey to market, Sam Zemurray saw opportunity.

He negotiated with the local heads of the fruit companies and agreed to buy the "bad" bananas off of them.

They thought him a sucker, but Sam had a plan.

He negotiated with the local heads of the fruit companies and agreed to buy the "bad" bananas off of them.

They thought him a sucker, but Sam had a plan.

5/ He bought the bananas cheap.

But the real challenge was getting them to market before they passed ripe and became rotten.

So he rented containers on The Illinois Central Railroad, loaded up the boxcars, and began selling the bananas straight out of the train along the route.

But the real challenge was getting them to market before they passed ripe and became rotten.

So he rented containers on The Illinois Central Railroad, loaded up the boxcars, and began selling the bananas straight out of the train along the route.

6/ To make sure the bananas made it to market, Zemurray paid the train conductors and telegraph operators to help him.

The telegraph operators would wire the store and market owners in towns along the route so they would come out to meet the train.

Business was booming.

The telegraph operators would wire the store and market owners in towns along the route so they would come out to meet the train.

Business was booming.

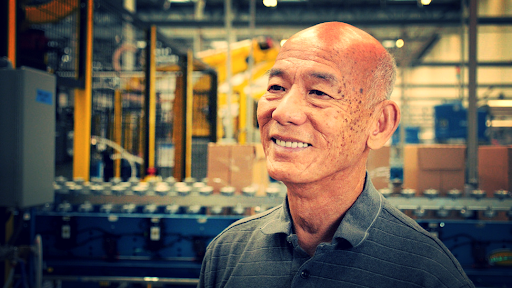

7/ By the time he turned 21, the recently penniless immigrant had amassed a fortune of $100K (~$3M today).

He became known locally as "Sam the Banana Man."

But over time, as others wisened to this arbitrage that Zemurray had exploited, Sam the Banana Man began to think bigger.

He became known locally as "Sam the Banana Man."

But over time, as others wisened to this arbitrage that Zemurray had exploited, Sam the Banana Man began to think bigger.

8/ Zemurray knew that South America was where the big fruit companies were growing their crop. To compete, he would have to be vertically-integrated.

In 1910, Sam Zemurray bought a steamship and sailed for Honduras. He purchased 5,000 acres of land on the Cuyamel River.

In 1910, Sam Zemurray bought a steamship and sailed for Honduras. He purchased 5,000 acres of land on the Cuyamel River.

9/ The Cuyamel Fruit Company was officially born.

Zemurray ran Cuyamel with a maniacal efficiency and Machiavellian ethos. No amount of bribes was too much if it allowed him to beat United Fruit, the industry giant.

The chip on his shoulder drove him to win at all costs.

Zemurray ran Cuyamel with a maniacal efficiency and Machiavellian ethos. No amount of bribes was too much if it allowed him to beat United Fruit, the industry giant.

The chip on his shoulder drove him to win at all costs.

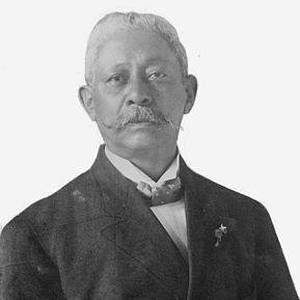

10/ At one point, with the Honduran economy on the verge of collapse (bad for Cuyamel!), Zemurray became the shadow architect of a coup.

He backed ex-Honduran President Manuel Bonilla, who ousted the existing regime, took over, and then gave Cuyamel a plethora of concessions.

He backed ex-Honduran President Manuel Bonilla, who ousted the existing regime, took over, and then gave Cuyamel a plethora of concessions.

11/ After a while, United Fruit could no longer stand the bruising competition from the better-run Cuyamel. Competition was bad for business!

So in 1930, United Fruit bought Cuyamel Fruit Company for $31.5 million in stock (~$500 million today).

Sam the Banana Man retired...

So in 1930, United Fruit bought Cuyamel Fruit Company for $31.5 million in stock (~$500 million today).

Sam the Banana Man retired...

12/ As a major holder of United Fruit stock (from the all stock deal), Zemurray became concerned about the performance of the business and its eroding margins.

Voicing his concerns to the board, he was blown off. They didn't respect him.

That chip on his shoulder was back.

Voicing his concerns to the board, he was blown off. They didn't respect him.

That chip on his shoulder was back.

13/ In 1933, he got sick of it.

Gathering enough proxy votes from other shareholders, Zemurray entered the headquarters, threw the bag of votes on the table, and told the board and CEO that he was now in charge. They were all fired.

The Banana Man became The Banana King.

Gathering enough proxy votes from other shareholders, Zemurray entered the headquarters, threw the bag of votes on the table, and told the board and CEO that he was now in charge. They were all fired.

The Banana Man became The Banana King.

14/ And so it was that Samuel Zemurray, a penniless immigrant, came to own and run one of the most powerful companies in the world.

If you're interested in learning more, I recommend this book by @richcohen2003. It is one of my favorites of all time! amzn.to/2RdEQ2y

If you're interested in learning more, I recommend this book by @richcohen2003. It is one of my favorites of all time! amzn.to/2RdEQ2y

15/ And for more educational threads on finance, money, business, and economics, check out my meta-thread below.

https://twitter.com/SahilBloom/status/1284583099775324161?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh