Few ways I add stocks to watchlist basis my rules for #TechnoFunda. Works well for position trades too #Just4Trade, per ur time frame

In @moneycontrolcom Pro App:

MARKETS menu:

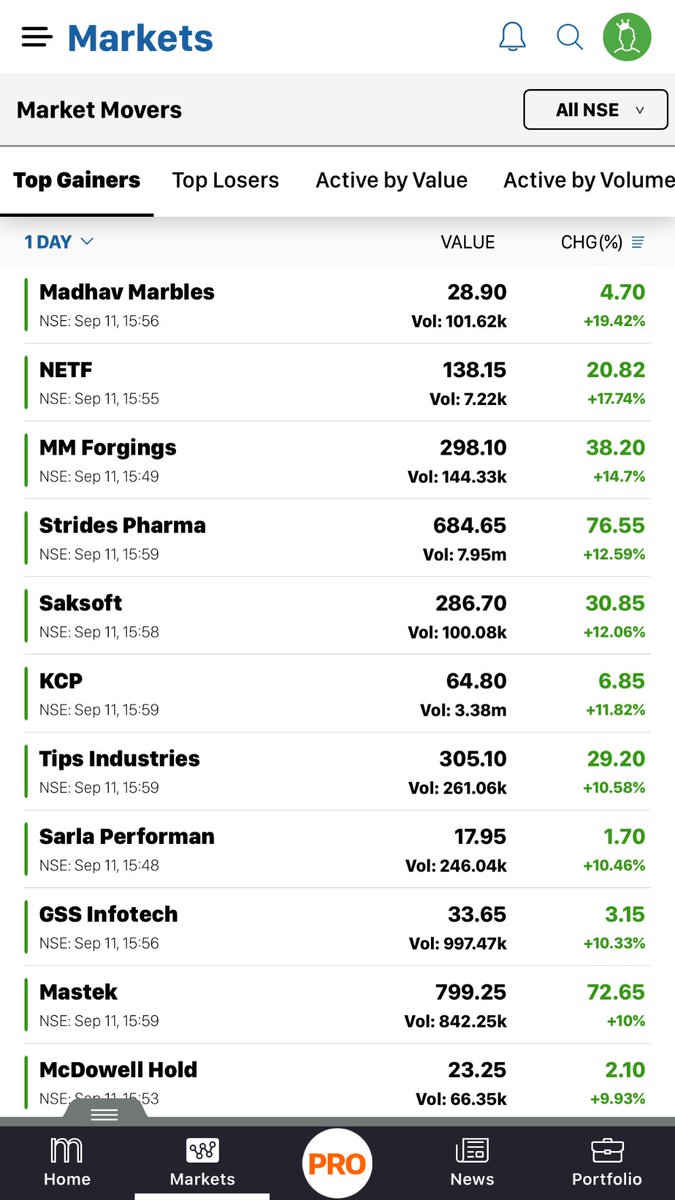

1. Daily after mkt hrs, Choose "Top Gainers" & "1 DAY"

"All NSE"

Scan the list, add that interest U

In @moneycontrolcom Pro App:

MARKETS menu:

1. Daily after mkt hrs, Choose "Top Gainers" & "1 DAY"

"All NSE"

Scan the list, add that interest U

An indicative list of my AVOIDS (exceptions exist for few mkt leaders):

Commodity stocks like Cement, Most PSU, Most Textiles, Leather, Most capital goods, Liquor, Road EPC, Jewelry etc

Price < 50, MktCap < 250, [ add more per your rules ]

Add your likes to watchlist

Commodity stocks like Cement, Most PSU, Most Textiles, Leather, Most capital goods, Liquor, Road EPC, Jewelry etc

Price < 50, MktCap < 250, [ add more per your rules ]

Add your likes to watchlist

Next, Select the below indices that you like and repeat the process with the same "Top Gainers" & "1 Day"

NIFTY 500

NIFTYMIDSML400

NIFTY 200

NIFTY SMALLCAP100

NIFTY XXX

NIFTY YYY

NIFTY 500

NIFTYMIDSML400

NIFTY 200

NIFTY SMALLCAP100

NIFTY XXX

NIFTY YYY

1.1 Friday after mkt hrs, Choose "Top Gainers" & "1 WEEK"

Select an index, Skim stocks, add to watchlist

1.2 Last trading day of the month, repeat the process with

"1 MONTH" time frame

Select an index, Skim stocks, add to watchlist

1.2 Last trading day of the month, repeat the process with

"1 MONTH" time frame

2. Daily after mkt hrs, Choose "52 wk High"

Select an index eg: "All NSE"

Scroll....

Repeat the process for the indices you like

Select an index eg: "All NSE"

Scroll....

Repeat the process for the indices you like

3. Daily after mkt hrs, Choose "Only Buyers"

Select an index eg: "NIFTY NEXT 50"

Scroll....

Repeat the process for the indices you like

Select an index eg: "NIFTY NEXT 50"

Scroll....

Repeat the process for the indices you like

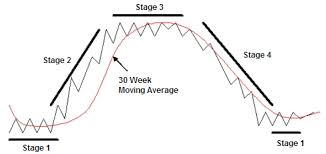

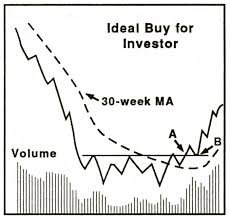

For stocks added to watchlist

1. Save them on charting tool

2. Apply ur technical analysis rules

3. Breaks any rules? Worthy to Delete from watchlist?

3. Apply Fundamental filters per your rules

4. Refine watchlist

5. Wait like a hawk for buy set up!

1. Save them on charting tool

2. Apply ur technical analysis rules

3. Breaks any rules? Worthy to Delete from watchlist?

3. Apply Fundamental filters per your rules

4. Refine watchlist

5. Wait like a hawk for buy set up!

Scan charts on weekends, make note of buy stocks for upcoming week.

Your stocks to AVOID list [either fundamental or technical] is critical. Else you end up with problem of plenty.

My rule is <50 stocks in watchlist.

Your stocks to AVOID list [either fundamental or technical] is critical. Else you end up with problem of plenty.

My rule is <50 stocks in watchlist.

Coming next...

How to create watchlist in @moneycontrolcom app using the "Combi scan" in @mystockedge app!

Combi scan allows you to custom create #TechnoFunda screens👍

If this tweet was useful, pls #retweet to benefit others.

How to create watchlist in @moneycontrolcom app using the "Combi scan" in @mystockedge app!

Combi scan allows you to custom create #TechnoFunda screens👍

If this tweet was useful, pls #retweet to benefit others.

• • •

Missing some Tweet in this thread? You can try to

force a refresh