One of my followers asked this Query:

A thread

1/n

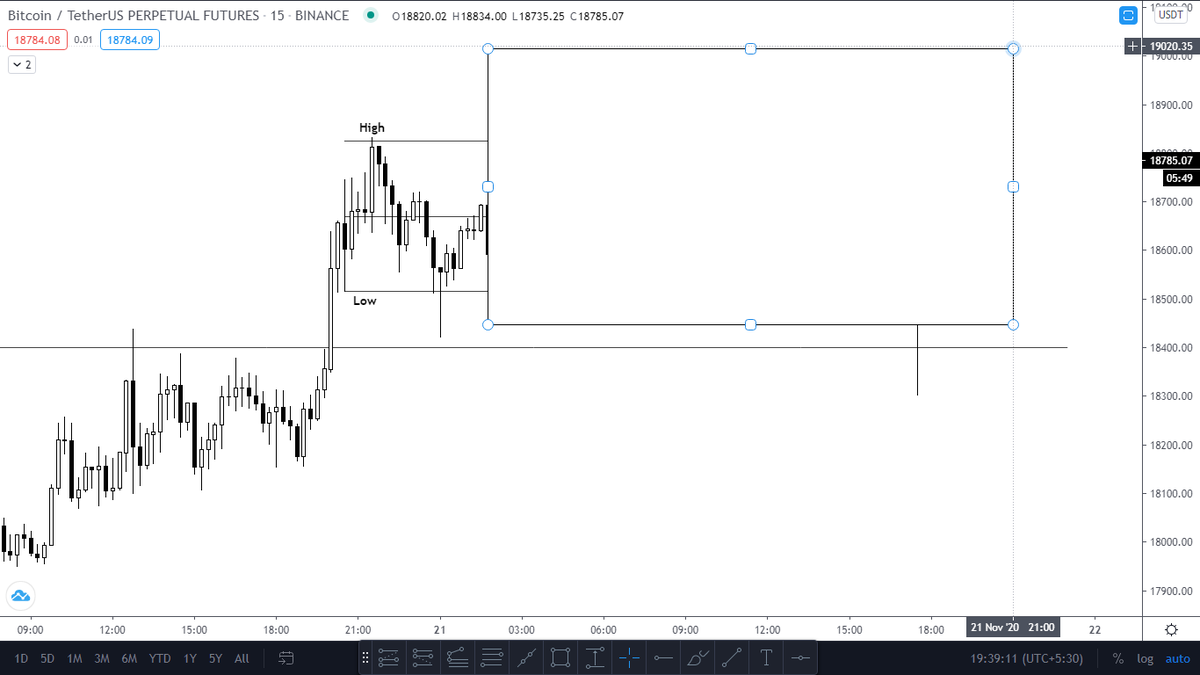

Query: Hi bro. today taken this trade but SL hit. please share your view

My Response: First of all, Congratulations for trying stuff out. You will get a lot better in next 6 months.

A thread

1/n

Query: Hi bro. today taken this trade but SL hit. please share your view

My Response: First of all, Congratulations for trying stuff out. You will get a lot better in next 6 months.

2/n

I encourage everyone to practice this way by taking trades and then analysing what mistakes you did/things which could have been better

1. When you see gaps in the chart, they also act as Support/Resistance. Why? Because gaps mostly fill and then reverse (Read about Gaps)

I encourage everyone to practice this way by taking trades and then analysing what mistakes you did/things which could have been better

1. When you see gaps in the chart, they also act as Support/Resistance. Why? Because gaps mostly fill and then reverse (Read about Gaps)

3/n

Hence there was resistance around 374, so not a good place to long

2. You can long at 2 places,

a. At previous lows, where price takes Support

b. On Breakout of previous Highs with Volume and strong candles.

Hence there was resistance around 374, so not a good place to long

2. You can long at 2 places,

a. At previous lows, where price takes Support

b. On Breakout of previous Highs with Volume and strong candles.

4/n

Here when you went Long, it did break day's high But it was not a big established resistance. Resistance was at 374.

Now when I would go long if I was following this stock?

1. If price came back again to 370 after 9:30, formed a tail and Strong Bullish candles

Here when you went Long, it did break day's high But it was not a big established resistance. Resistance was at 374.

Now when I would go long if I was following this stock?

1. If price came back again to 370 after 9:30, formed a tail and Strong Bullish candles

n/n

2. Price broke 374 with very high volumes and very strong candles. Why "Very"? Because price would be already 1.5% up by then and to go even higher, it will need "Very" high Volumes and strong candles

End of thread.

2. Price broke 374 with very high volumes and very strong candles. Why "Very"? Because price would be already 1.5% up by then and to go even higher, it will need "Very" high Volumes and strong candles

End of thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh