I trade Crypto and Stock markets || Price Action trader || Posts about my trades and logic behind them || DYOR || Not SEBI Registered || No financial advice

5 subscribers

How to get URL link on X (Twitter) App

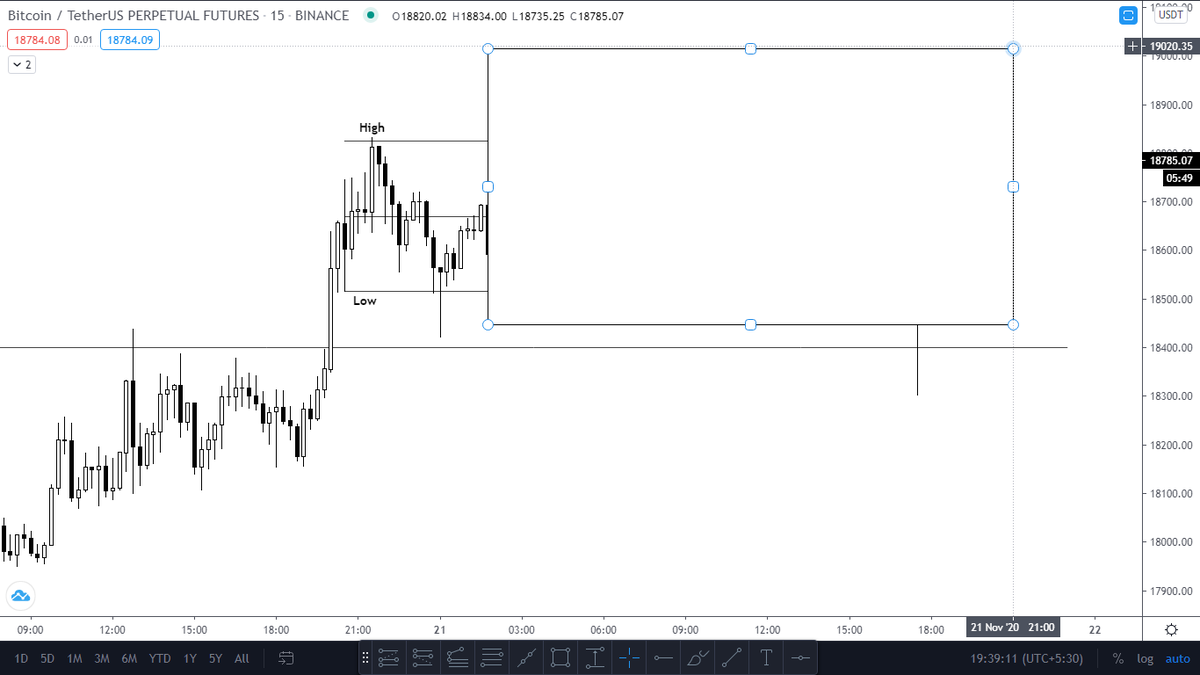

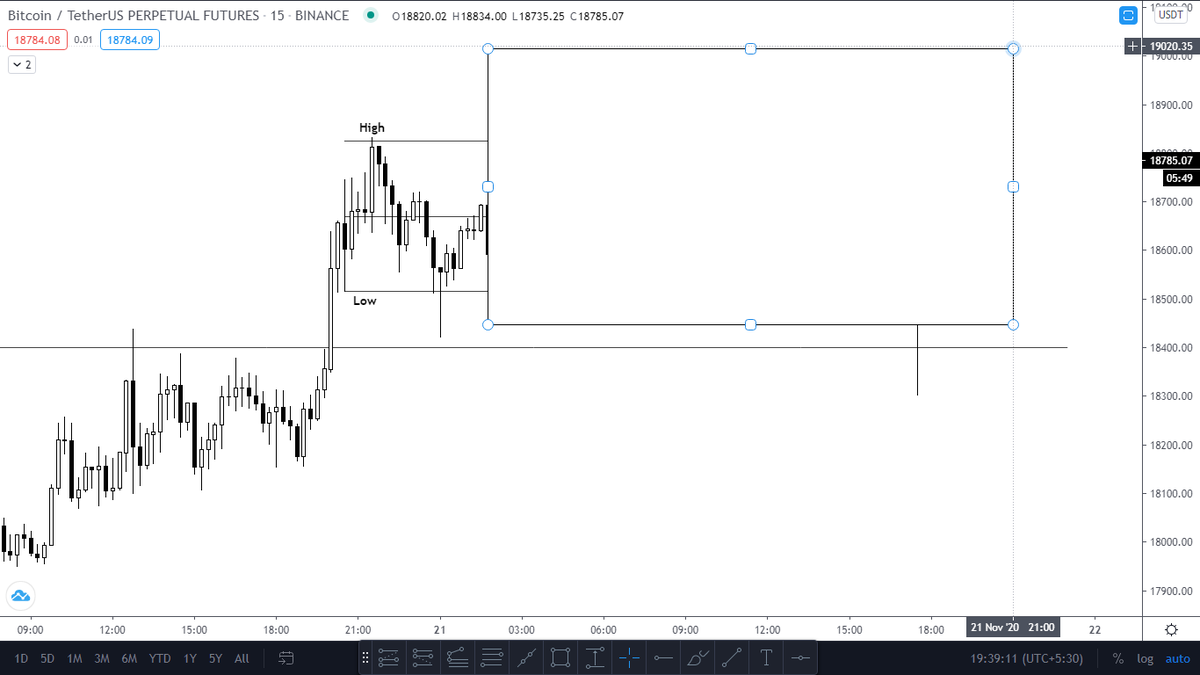

#2. Price deviates on one of the boundaries and closes back in the range. This logically means that price will likely visit the next extreme boundary of the range

#2. Price deviates on one of the boundaries and closes back in the range. This logically means that price will likely visit the next extreme boundary of the range

2/n

2/n

2/n

2/n

https://twitter.com/Swapniltrader/status/1303915232587210752

https://twitter.com/Swapniltrader/status/1298540109730471936

Stocks which were at 13 Week High:

Stocks which were at 13 Week High:

https://twitter.com/Swapniltrader/status/1298844429885640706

https://twitter.com/ST_PYI/status/1282671653424529408?s=20

Stocks at 13 week high:

Stocks at 13 week high: