1/13

Been focused on other things for a few days but a few thoughts on shares I hold, given the perceived turmoil.

Main focuses for me for a while now, has been shares exposed to Covid, battery metals (incl. energy storage) and gold.

#HZM #BCN #ACP #GDR #AVCT #SRB #BMN

Been focused on other things for a few days but a few thoughts on shares I hold, given the perceived turmoil.

Main focuses for me for a while now, has been shares exposed to Covid, battery metals (incl. energy storage) and gold.

#HZM #BCN #ACP #GDR #AVCT #SRB #BMN

2/13

The events of the last few days if anything strengthen that stance.

In terms of Covid (and I tread carefully because both my stocks have other things in their locker), its a waiting game on both.

I think 1 strong update from #GDR and it moves much higher from here.

The events of the last few days if anything strengthen that stance.

In terms of Covid (and I tread carefully because both my stocks have other things in their locker), its a waiting game on both.

I think 1 strong update from #GDR and it moves much higher from here.

3/13

In terms of #AVCT, an update, one way or the other is pending, whereby the exact progress of BAMS/LFT tests, should be made clearer.

I see no reason for concern and the lockdown measures announced today in the UK, only go to strengthen that argument. Nothing has changed.

In terms of #AVCT, an update, one way or the other is pending, whereby the exact progress of BAMS/LFT tests, should be made clearer.

I see no reason for concern and the lockdown measures announced today in the UK, only go to strengthen that argument. Nothing has changed.

4/13

#AVCT need to deliver on their implied promises on quality and back it with the manufacturing capacity.

I stand by my 7m sales per month target and given sufficient time, I think such an achievement, will create a far more successful company with diagnostics as its enabler.

#AVCT need to deliver on their implied promises on quality and back it with the manufacturing capacity.

I stand by my 7m sales per month target and given sufficient time, I think such an achievement, will create a far more successful company with diagnostics as its enabler.

5/13

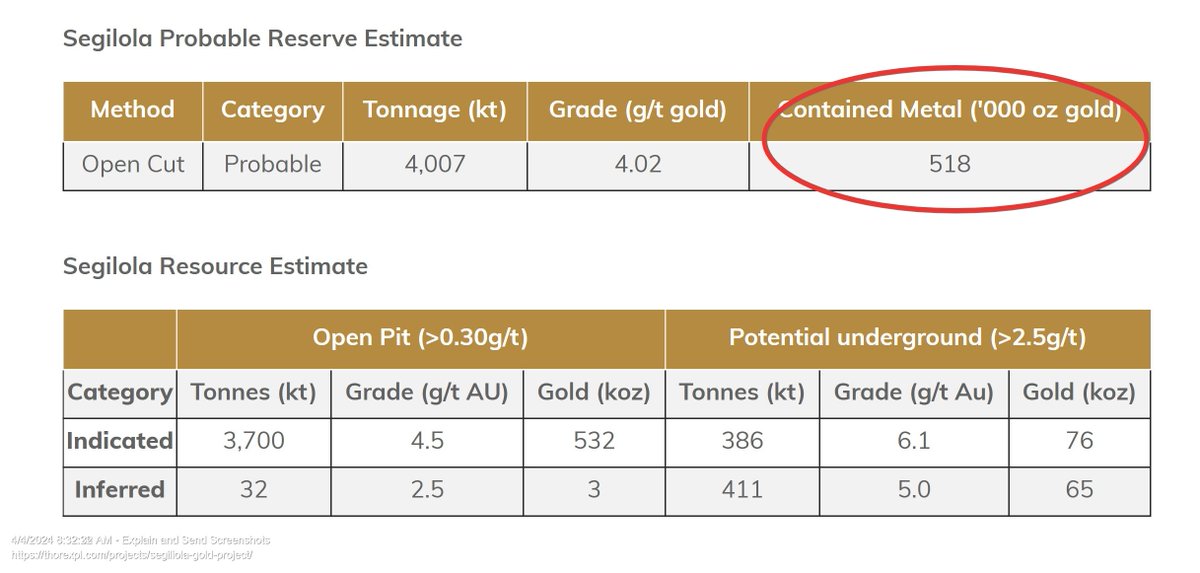

From a gold perspective, I believe #SRB has much going for it, simply because I believe progress is far ahead of what the market is prepared accept just yet.

Q3 is going to come out at +$,1900 prices and so a positive update on Covid safety measures and so a

From a gold perspective, I believe #SRB has much going for it, simply because I believe progress is far ahead of what the market is prepared accept just yet.

Q3 is going to come out at +$,1900 prices and so a positive update on Covid safety measures and so a

6/13

signal that something close to normal production (c. +10,000 oz), can be achieved in Q4, when added to a solid (+8,500oz) Q3, should put us in good stead for a more sustained rise in the valuation.

The recent pullback in gold is for me, an opportunity rather than threat.

signal that something close to normal production (c. +10,000 oz), can be achieved in Q4, when added to a solid (+8,500oz) Q3, should put us in good stead for a more sustained rise in the valuation.

The recent pullback in gold is for me, an opportunity rather than threat.

7/13

On the battery metal front, whatever happens over the shorter term, it is now abundantly clear that EV is going to expand at a rapid rate and that means lower 1st quartile cost mines, are going to be in demand.

There are of course other pressures such as local politics etc

On the battery metal front, whatever happens over the shorter term, it is now abundantly clear that EV is going to expand at a rapid rate and that means lower 1st quartile cost mines, are going to be in demand.

There are of course other pressures such as local politics etc

8/13

So each opportunity should be taken on its own merits.

When it went under 6.5p, #HZM for me became the pick of the bunch with #ACP not too far behind, be it they have more to prove right now.

#BCN is quiet but is still in a very good place financially and progress wise.

So each opportunity should be taken on its own merits.

When it went under 6.5p, #HZM for me became the pick of the bunch with #ACP not too far behind, be it they have more to prove right now.

#BCN is quiet but is still in a very good place financially and progress wise.

9/13

So there will come a time when I will look to add because its a really good lower 1st quartile project, that should go on to create great returns from these levels.

#BMN is perhaps a slower burner because V prices are suffering and much of its valuation is based on

So there will come a time when I will look to add because its a really good lower 1st quartile project, that should go on to create great returns from these levels.

#BMN is perhaps a slower burner because V prices are suffering and much of its valuation is based on

10/13

what it does in the steel sector space and there lies much uncertainty.

However, it has energy storage cards up its sleeve and so for me, it was a buy at 13p and is certainly so at closer to 11p because at some point prices recover and BMN as a big producer, will benefit.

what it does in the steel sector space and there lies much uncertainty.

However, it has energy storage cards up its sleeve and so for me, it was a buy at 13p and is certainly so at closer to 11p because at some point prices recover and BMN as a big producer, will benefit.

11/13

I have others which I very much like such as #TILS, which I think is great value at 140p, considering how much news flow it has on offer, these next 6-9 months.

#YU for me is another one, be it again perhaps a slower burner but I am not buying to make a buck tomorrow,

I have others which I very much like such as #TILS, which I think is great value at 140p, considering how much news flow it has on offer, these next 6-9 months.

#YU for me is another one, be it again perhaps a slower burner but I am not buying to make a buck tomorrow,

12/13

I am buying for what I believe it will deliver over the next 2-3 years. I don't see them being as adversely affected by Covid lockdowns, as the market would have us believe, because I think UK Gov support + more M&A, will see them come out better than the £12m MC,

I am buying for what I believe it will deliver over the next 2-3 years. I don't see them being as adversely affected by Covid lockdowns, as the market would have us believe, because I think UK Gov support + more M&A, will see them come out better than the £12m MC,

13/13

I see right now.

Again, all of my investments are approached with this 2-3 year projection in mind.

In time, I wish to delve into more detail on these and other ideas, through more detailed written analysis (not 25 post long tweets). Hopefully it will be of worth to some.

I see right now.

Again, all of my investments are approached with this 2-3 year projection in mind.

In time, I wish to delve into more detail on these and other ideas, through more detailed written analysis (not 25 post long tweets). Hopefully it will be of worth to some.

• • •

Missing some Tweet in this thread? You can try to

force a refresh