Borussia Dortmund 2019/20 accounts cover a season when they once again finished second behind Bayern Munich in the Bundesliga and reached the Champions League last 16. However, COVID-19 meant it was “an unprecedented, difficult and challenging year.” Some thoughts follow #BVB

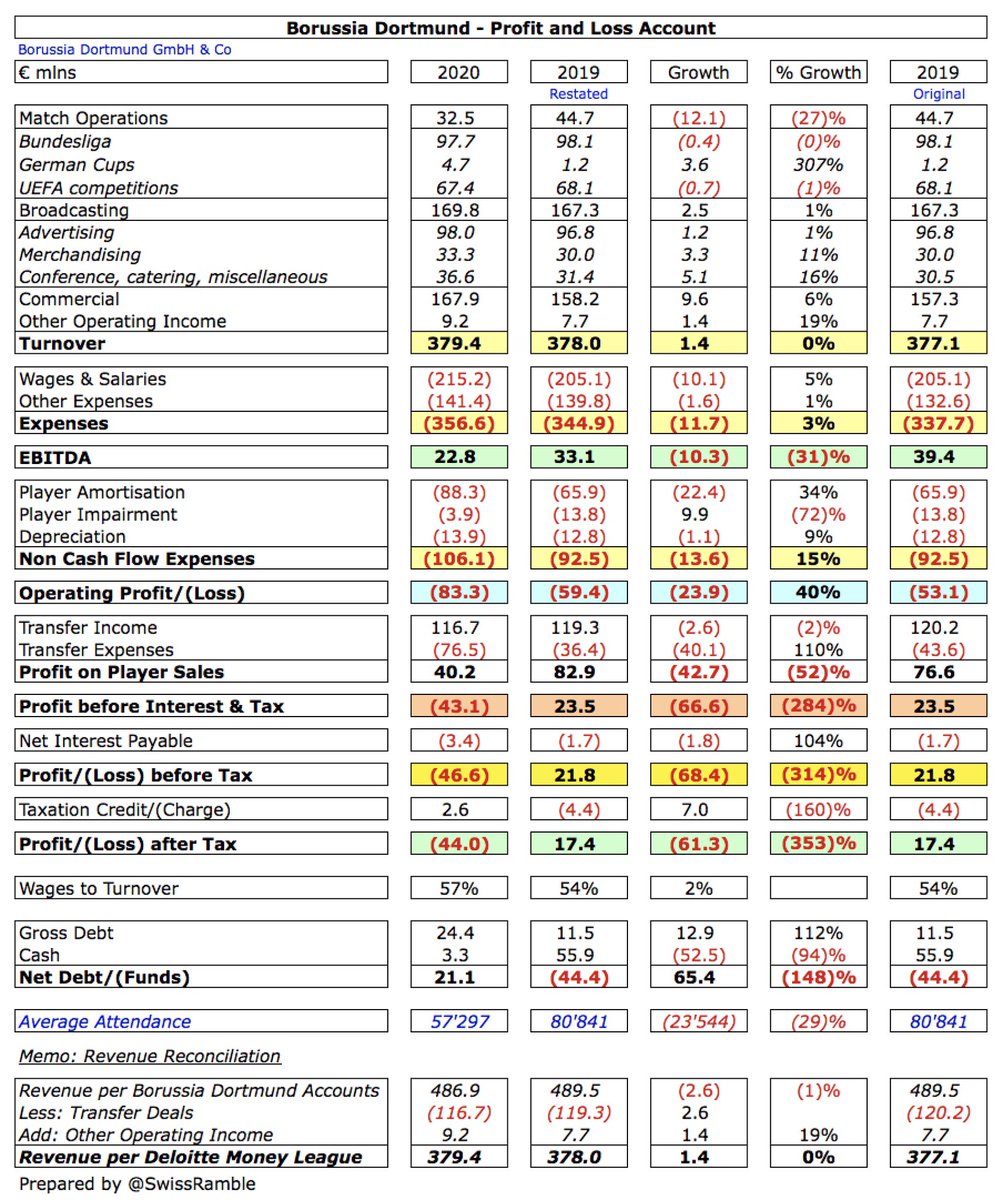

#BVB went from €22m profit before tax to €47m loss (€44m after tax), mainly due to profit on player sales falling €43m to €40m. Despite the COVID restrictions, revenue was basically flat at €379m, but operating expenses rose €25m and net interest payable was €2m higher.

The only #BVB revenue item to decrease was match operations, down €12m (27%) to €33m, but the pandemic restricted growth in broadcasting, up €3m (1%) to €170m, commercial, up €10m (6%) to €168m, and other operating income, up €1m to €9m.

As a technical aside, #BVB also notes that their definition of revenue, I.e. operating proceeds, only fell €3m (1%) from €490m to €487m. This includes €117m from player sales, but excludes €9m other operating income.

Investment in the squad meant #BVB wages increased €10m (5%) from €205m to €215m, while player amortisation (including impairment) rose €12m (16%) to €92m. There were also small increases in other expenses, up €2m to €141m, and depreciation, up €1m to €14m.

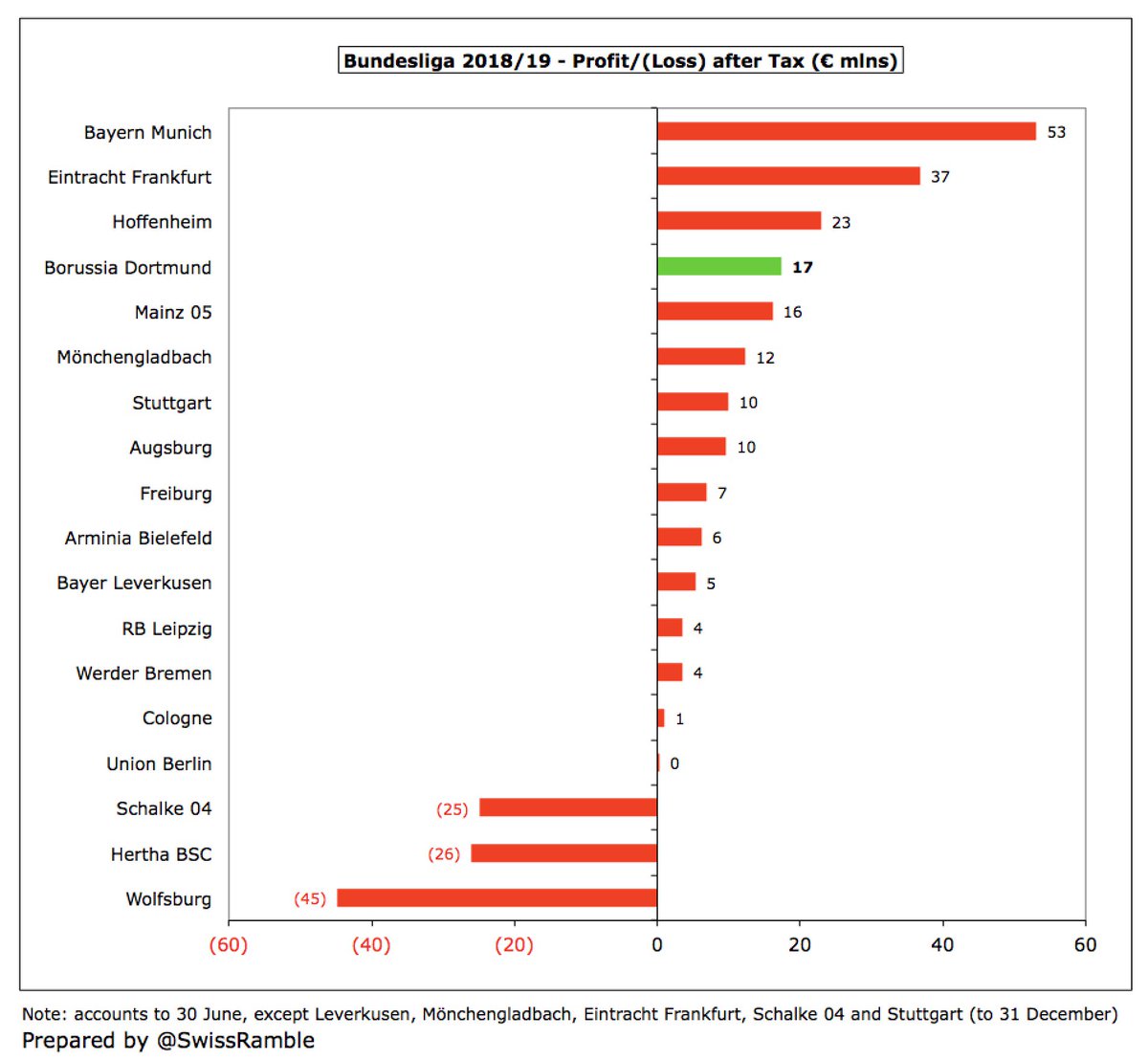

In 2018/19, i.e. before the pandemic, #BVB €22m pre-tax profit was fifth highest in the Bundesliga, only surpassed by Bayern Munich €75m, Eintracht Frankfurt €56m, Hoffenheim €26m and Mainz 05 €25m. Their €17m after tax was fourth best.

Although #BVB have reported solid profits, they were a fair way below others in Europe. In 2018/19 five of the Money League top 20 clubs posted profits more than twice as much as Dortmund’s €22m, namely #THFC €99m, Bayern €75m, Real Madrid €53m, Napoli €48m and #LFC €48m.

#BVB benefited from €40m profit on player sales, mainly Diallo to PSG, Alacer to Villarreal, Weigl to Benfica, Philipp to Dynamo Moscow and Bruun Larsen to Hoffenheim, though €43m lower than prior year, which included Pulisic to #CFC, Sokratis to #AFC and Yarmolenko to #WHUFC.

#BVB have been increasing their profits from player sales, especially in 2017/18 when they generated €126m, and they were in the top 10 in Europe in 2018/19 with €83m, though a fair way below the leading Italian clubs, led by Roma €129m and Juventus €127m.

#BVB 2020 €47m loss was their first since 2010. In the nine years up to 2019, they generated €227m profits, averaging €25m a season. In light of the high degree of uncertainty related to all revenue streams, the board expects a net loss in 2021 between €70m and €75m.

Transfer deals have become an important part of #BVB business with average annual profits on player sales up from €13m in 2011-15 to a hefty €72m in last 5 years. However, club expects “a rather subdued transfer window”, due to economic uncertainties, leading to lower income.

#BVB EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered as cash operating profit, fell from €33m to €23m,. Including player sales, has slumped from record €137m in 2018 to €63m. One of the lowest in Europe in 2019 (16th in Money League top 20).

#BVB operating loss has been on a downward trend, falling from €59m to €83m, though not as bad as the €(87)m reported in 2018. Firmly in the bottom half of European operating profitability, but much better than huge losses at #CFC €185m, #EFC €144m and Juventus €142m.

#BVB ongoing revenue has grown by €95m (33%) in last 4 years from €285m to €379m, largely driven by broadcasting, which has more than doubled, rising by €87m to €170m. For 2020/21 club forecasts 5% decline in revenue (implying €360m) with operating proceeds down to €388m.

Broadcasting is (just) the most important revenue stream at #BVB with 45%, having overtaken commercial (44%) in the last two years. TV share has more than doubled since 2010, while commercial has fallen from 57%. Match operations has also declined from 22% to 9%.

The revenue gap between #BVB and #FCBayern narrowed in 2018/19, but was still €283m. Put another way, Bayern’s €660m revenue was 75% higher than Dortmund’s €377m, which is a huge difference between the first and second ranked clubs.

For the third year in a row #BVB retained 12th place in the Deloitte Money League, based on £377m revenue in 2018/19. They were €69m behind 11th placed #AFC, but were in a tight band with Atletico Madrid €368m, Inter €365m and Schalke 04 €325m, before big gap to Roma €231m.

#BVB commercial income rose €10m (6%) to €168m, though conferencing, catering and advertising were hit by 5 games played behind closed doors. Offset by €7m increase in player loans. In 2019 Dortmund had 12th highest revenue in Europe, but more than €200m less than Bayern.

In 2019/20 #BVB had the following two main sponsors: Evonik shirt €20m and Puma kit supplier €10m (signed back in 2012). Also €9m Opel sleeve sponsor to 2022 and €5.8m Signal Iduna stadium naming rights partner to 2026. That was pretty good, but far below #FCBayern.

However, before the pandemic struck #BVB managed to sign much higher sponsorships from 2020/21. Puma kit deal was extended to 2028 at €31m (triple previous €10m). They also have two shirt sponsors up to 2025 at a combined €40m: 1&1 – Bundesliga; Evonik – Europe and DFB Cup.

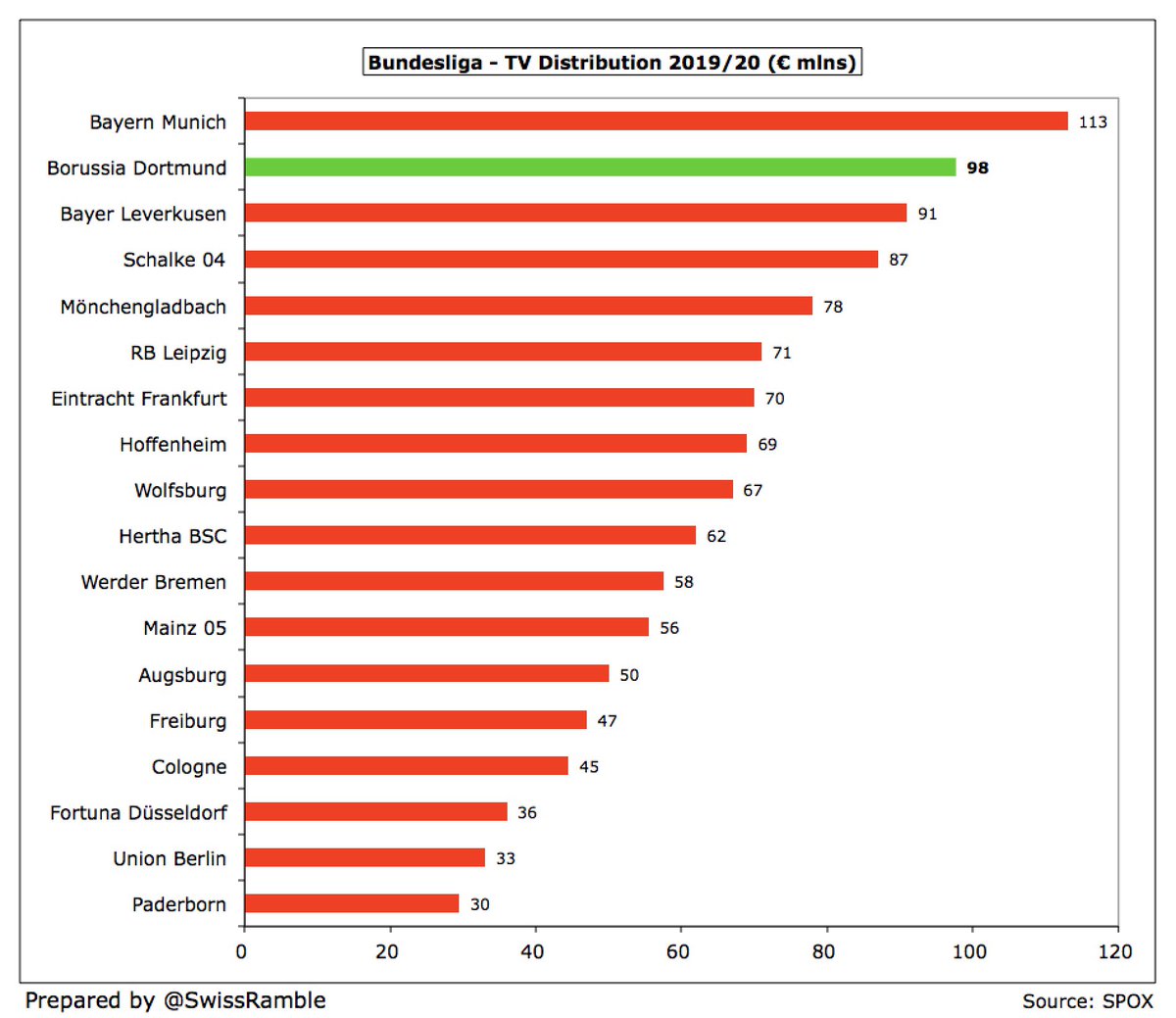

#BVB broadcasting income increased by €3m (1%) to €170m, mainly due to DFB-Pokal up €4m to €5m. Bundesliga revenue was flat at €98m, while Europe TV money fell €1m to €67m. Dortmund’s €167m the prior season was 12th highest in Money League, €44m behind #FCBayern €211m.

Bundesliga TV money distribution uses 4 criteria: 5-year league performance ranking (70%); 5-year ranking for both divisions (23%); 20-year ranking (5%); and playing time of Germany U23s (2%). #BVB received €98m, though this was expected to be 10% higher without COVID rebate.

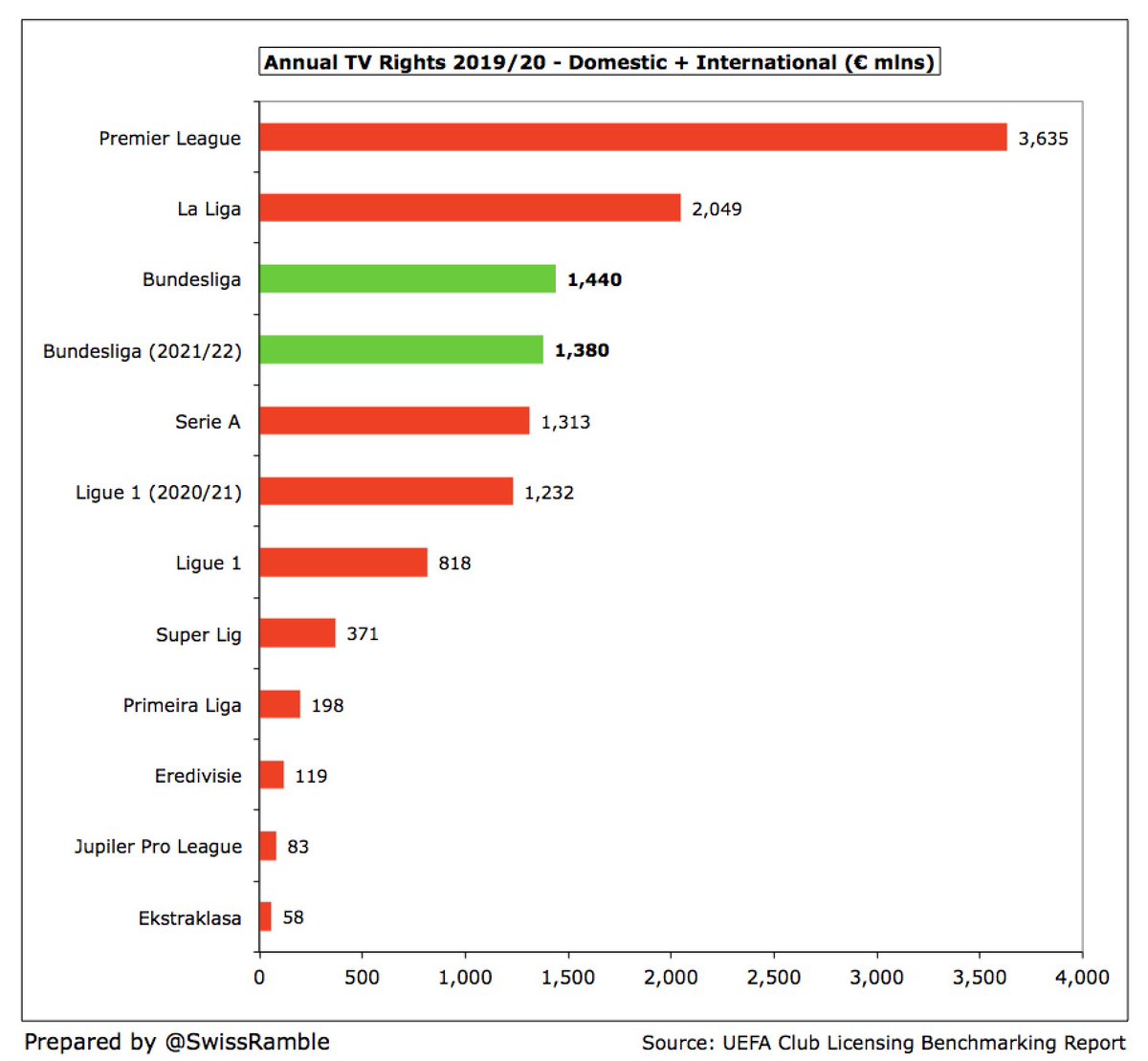

Bundesliga clubs including #BVB benefited from the new TV deal in 2017/18, which shot up 85%, but the new deal from 2021/22 will see a 4% reduction. Still third best in Europe, though a long way below Premier League and La Liga, while Ligue 1 will narrow the gap.

Based on my estimate, #BVB earned €69m from the Champions League after going out in the last 16, a bit higher than prior season’s €66m. Other German clubs: winners #FCBayern €130m, semi-finalists RB Leipzig €72m and Leverkusen €41m. These figures are before any COVID rebate.

Worth noting the influence on Champions League money of UEFA coefficient payment (based on performances over 10 years), where #BVB have 10th highest ranking of clubs competing this season, giving them €25m. From 2021/22 German TV rights will be 70% higher (DAZN, Amazon & ZDF).

#BVB have earned a healthy €232m from European competition in the last 5 years, though Bayern Munich €402m is almost twice as much. By the same token, Dortmund are a fair way above Leverkusen €130m, RB Leipzig €123m, Schalke €93m, Mönchengladbach €69m and Wolfsburg €66m.

#BVB match operations revenue fell €12m (27%) to €33m, as they played 5 games behind closed doors due to the pandemic. In 2018/19 Dortmund had the 12th highest revenue in the Money League (€60m per Deloitte’s definition), but still €32m lower than #FCBayern.

Due to COVID, #BVB average attendance fell from 80,841 to 57,297. For once, this was below Bayern, but only because the Bavarians played one game less without fans. Dortmund still had most season tickets in Germany with 55,500 (capped to ensure ticket availability on match day).

#BVB wage bill rose €10m (5%) from €205m to €215m, which means wages have grown by almost €100m since 2015 with wages to turnover ratio worsening from 42% to 57% (still very respectable). Players and coaching staff have taken pay cuts, saving “a double-digit millions amount”.

Despite the growth over this period, #BVB wage bill is still significantly lower than #FCBayern: in 2018/19 the gap was higher than it has ever been at €151m (€205m vs. €356m). That said, Dortmund’s wages were in turn €68m more than the next highest, Bayer Leverkusen €137m.

This point is even more relevant in Europe, where #BVB had the 12th highest wage bill of the Money League clubs in 2018/19. Their €205m was nearly €300m lower than Barcelona’s incredible €501m, but maybe more pertinently also €37m behind 11th placed Atletico Madrid €242m.

However, that season’s 54% wages to turnover ratio for #BVB was pretty low (good) for a Money League club and the same as German rivals #FCBayern. Much better than the likes of Roma 78%, Juventus 71% and #CFC 63%.

The other #BVB staff cost, player amortisation, shot up €22m (34%) from €66m to €88m, reflecting investment in the playing squad, though player impairment (write-downs of certain player values) decreased from €14m to €4m.

Even before the steep increase in 2019/20, #BVB had the highest player amortisation and depreciation charges in the Bundesliga. Their 2018/19 total of €92m was significantly higher than all other clubs with the closest being #FCBayern €70m, Schalke €69m and RB Leipzig €61m.

#BVB are currently following “an extremely passive transfer policy” due to COVID. In the previous four years, gross spend averaged €117m, though they ended up with net sales, thanks to €156m sales. 2019/20 purchases included Hummels, Schulz, Hazard, Brandt, Alcacer and Haaland.

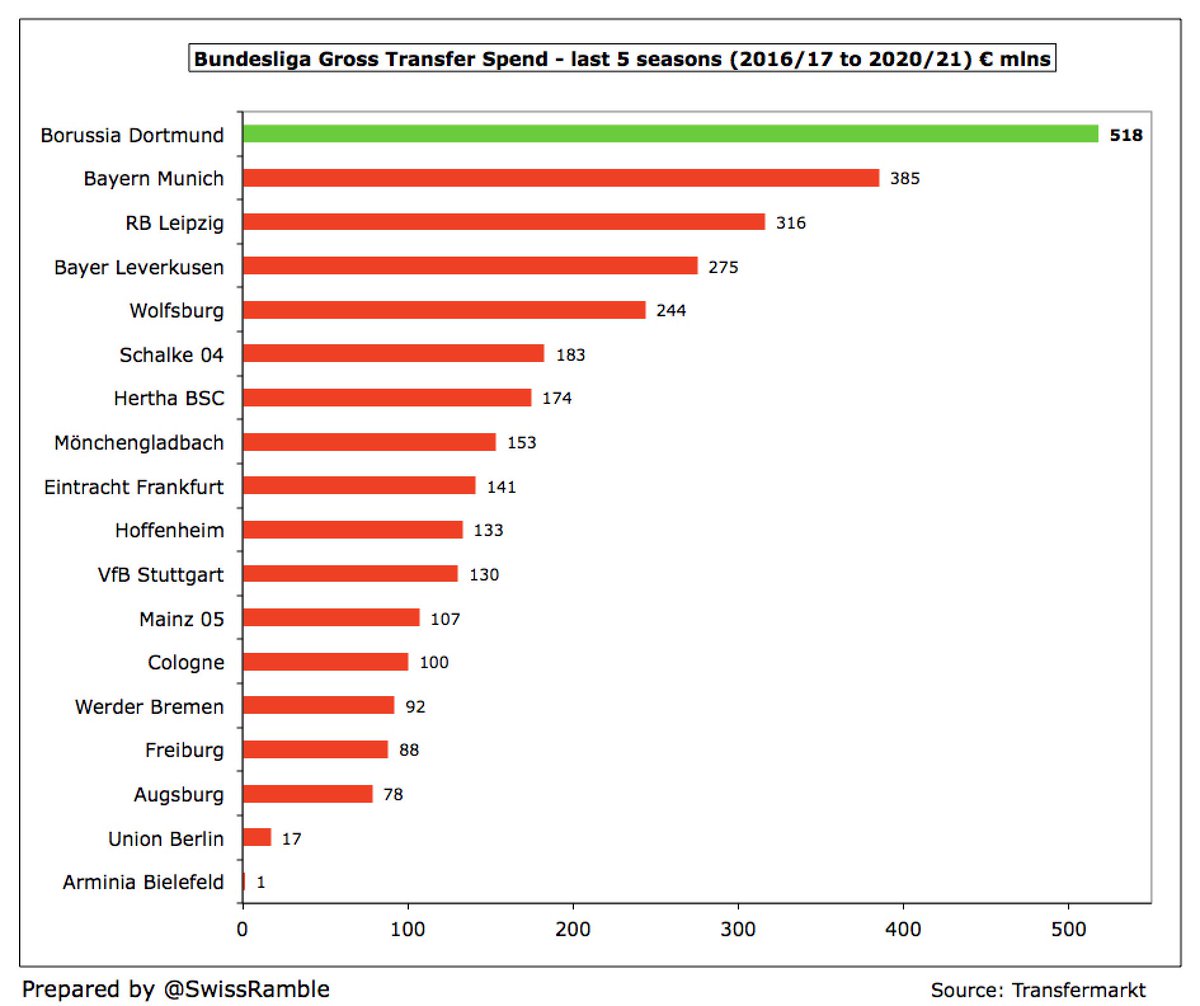

As a result, #BVB had the highest net sales in the Bundesliga over the last five seasons of €110m, just ahead of Hoffenheim €91m. In the same period, Bayern Munich €132m, RB Leipzig €114m and Hertha BSC €103m all had net spend over €100m.

However, it’s a very different story in gross spend with #BVB €518m in the last five seasons being €133 more than Bayern Munich €385m, followed by RB Leipzig €316m, Bayer Leverkusen €275m and Wolfsburg €244m.

#BVB have done incredibly well to eliminate almost all financial debt with the exception of €24m finance leases (though these are up from €12m the previous year). In 2006 their gross debt had been as high as €196m.

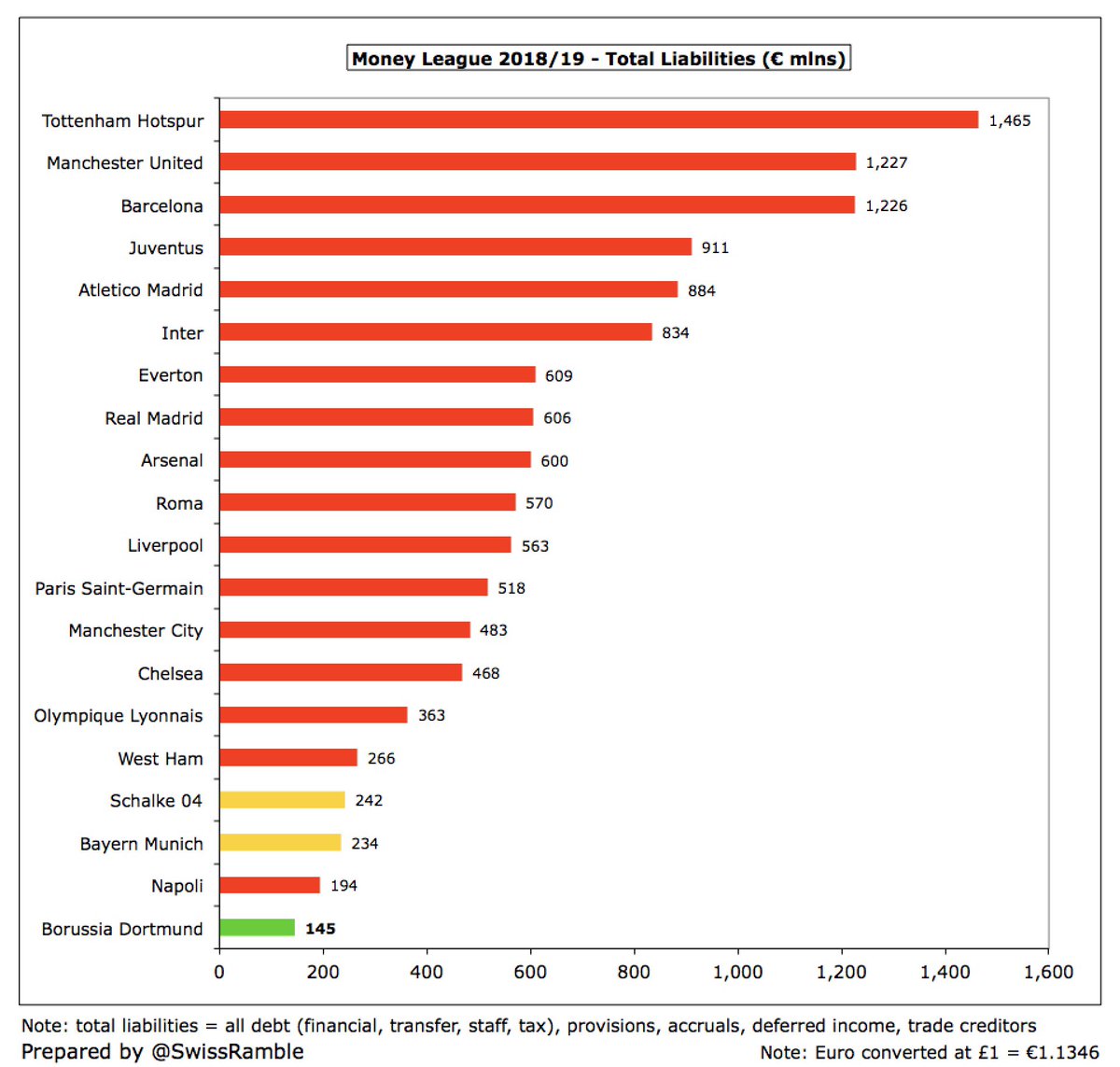

In fact, #BVB debt of €12m in 2018/19 was one of the lowest in all of Europe. To place this into perspective, four clubs had more than €450m debt: #THFC €746m, #MUFC €580m, Juventus €473m and Inter €461m.

#BVB had to commit as much as 9.1% (€10.5m) of their revenue to paying interest in 2008, but this has now been slashed to just 0.9% (€3.4m) in 2020, mainly for expenses from finance leases.

The low amount of interest payable (€2m in 2019) has helped #BVB in the turnaround from their former financial problems. In stark contrast, five leading clubs had net interest above €25m in 2018/19: Inter €29m, #THFC €29m, Roma €25m, Atletico Madrid €28m and #MUFC €26m.

However, the amount #BVB owe in transfer debt shot up from €49m to €120m (net €87m after considering €33m owed to Dortmund by others) That said, this is still very low compared to other European clubs, e.g. in 2018/19 Barcelona owed €261m, Juventus €221m and #MUFC €213m.

Total liabilities include bank debt, transfer debt, tax liabilities, trade creditors, staff debt, provisions, accrued expenses and even deferred income. Here, #BVB €145m was the lowest in the 2018/19 Money League. The likes of #THFC, #MUFC and Barcelona owed more than €1.2 bln.

In 2019 #BVB had €61m net cash outflow, much worse than the previous season’s €(4)m. The decline is a combination of lower cash from operating activities and higher net spend on players. Have paid €43m dividends to shareholders in last 8 years (none to be paid in 2021).

Interestingly, #BVB shareholders include three of their most important sponsors, namely Evonik (though they have recently reduced their stake from 14.78% to 9.83%), Signal Iduna (5.43%) and Puma (5%). This is similar to Bayern, whose owners include Adidas, Audi and Allianz.

#BVB continue to outperform all other German clubs financially – with the notable exception of #FCBayern. They “have been hit hard by the effects of the pandemic”, but chief executive Hans-Joachim Watzke said Dortmund had the financial resources to weather the crisis.

Watzke noted that #BVB would benefit from “operating very conservatively” in the past, so warned off any clubs interested in the likes of Jadon Sancho. Despite the challenges posed by the pandemic, Watzke cautioned that “there won’t be even a one cent discount”. Time will tell.

• • •

Missing some Tweet in this thread? You can try to

force a refresh