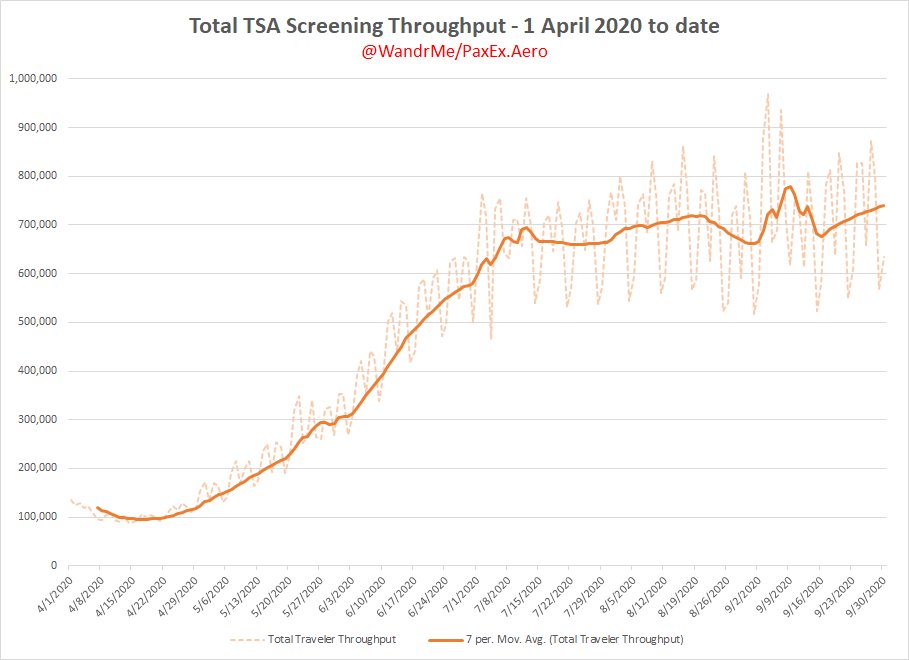

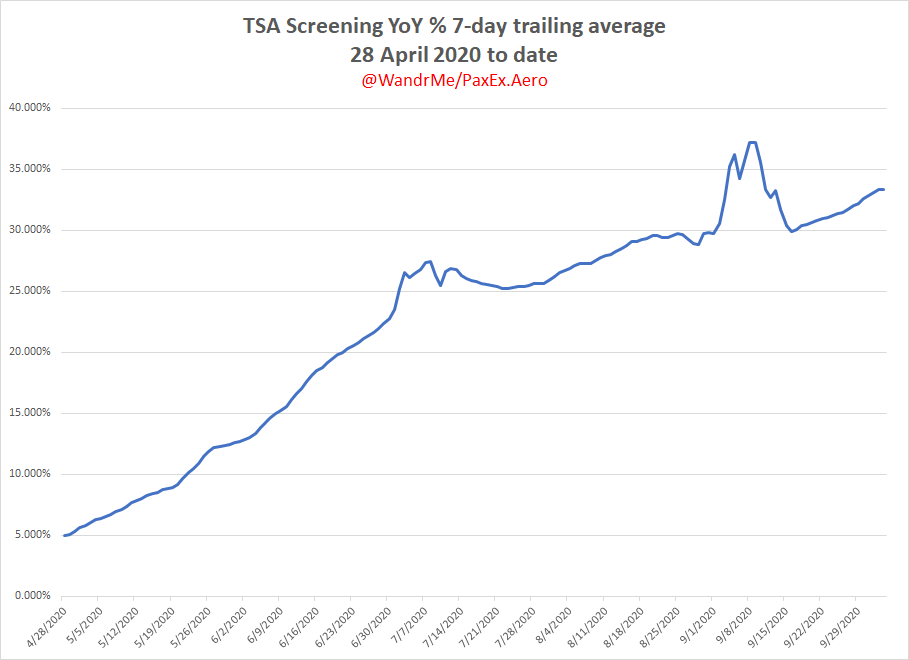

Been away from the TSA screening data for a few days but the trend marches steadily onward. Week to week numbers increasing at a ~3% clip in recent days (down from 5% last week) and YoY % holding in the low 30s.

#PaxEx

#PaxEx

TSA screening topped 900k for the first time on a non-holiday weekend since April on Sunday. T/W/S growth is slower than M/R/F/U but if these trends hold (~30k/day increase per week) could hit 800k on the 7-day moving average in a couple weeks. #PaxEx

Can you spot my trips in the TSA screening data from this week?

Daily pax count continues to trend relatively linearly in the post-Labor Day period, now over 766k. YoY % growth is tapering off, still below 35%.

#PaxEx

Daily pax count continues to trend relatively linearly in the post-Labor Day period, now over 766k. YoY % growth is tapering off, still below 35%.

#PaxEx

TSA screening topped 900k again on Thursday, with 936k pax passing through checkpoints headed into the holiday weekend. Even a slight bump in the YoY comparison, up to 36% of 2019 numbers.

#PaxEx

#PaxEx

Friday's TSA screening numbers came in just 128 behind Labor Day Friday, a 13% jump from the prior week.

If Saturday hits 717,506, just a 6% jump from last week, the 7-day moving average will top 800k for the first time in the recovery.

#PaxEx

If Saturday hits 717,506, just a 6% jump from last week, the 7-day moving average will top 800k for the first time in the recovery.

#PaxEx

On Saturday TSA screening hit 769k, moving the 7-day average above 800k for the first time since March 22.

On Sunday a new high water mark for total pax screened, at 984k.

YoY still below 35% on the 7-day avg, but getting close to passing that. #PaxEx

On Sunday a new high water mark for total pax screened, at 984k.

YoY still below 35% on the 7-day avg, but getting close to passing that. #PaxEx

Monday saw 958k pax pass through TSA screening, a 17% boost over the prior week. Looks like the holiday weekend delivered a strong boost for air travel.

YoY 7-day average also topped 35%.

#PaxEx

YoY 7-day average also topped 35%.

#PaxEx

Tuesday and Wednesday both saw higher numbers through the TSA screening checkpoint, including the first W >700K since March (718k). But also the sequential weekly growth slowed compared to the weekend. YoY numbers tapering a bit, too.

#PaxEx

#PaxEx

Thursday's TSA screening numbers topped 950k, up 13k from the week prior. That's only 1.5% growth week-over-week, suggesting that maybe the 3-day weekend shifted the recovery path a bit rather than truly accelerating it. Still strong numbers being put up, though. #PaxEx

Friday's TSA screening throughput was 973k, flat from the prior week. Again, this suggests that the 3-day weekend was slightly anomalous to the otherwise relatively linear recovery path.

#PaxEx

#PaxEx

Saturday's TSA screening throughput was 788k, up a couple % from last week's holiday weekend number.

But the big milestone is likely to be today. If Sunday increases just 1.7% from last week we'll have our first million pax day since March. And that seems likely.

#PaxEx

But the big milestone is likely to be today. If Sunday increases just 1.7% from last week we'll have our first million pax day since March. And that seems likely.

#PaxEx

As expected, the TSA checkpoint screening hit 1 million on Sunday for the first time since 16 March, up 4.8% from the prior week. That's just under 40% of the prior year number. #PaxEx

What causes a week over week decrease in TSA screening numbers? Coming off a holiday weekend will do it. Monday's 921k was a 3.9% drop from last week. But the 2-day Sun/Mon total held steady, so it isn't really a retreat.

#PaxEx

#PaxEx

Another sequential weekly drop in TSA screening numbers on Tuesday, down 2.7% to 662k through checkpoints. But not as bad as 2019 where it dropped 8.1% following the 3-day weekend. So the YoY % average trends a little higher, even with the lower pax numbers. #PaxEx

Wednesday saw a 3.3% drop in TSA screening from the prior week, again likely tied to a holiday weekend boost earlier in the month.

YoY just under 31% for the day, just under 36% over the past 7 days.

#PaxEx

YoY just under 31% for the day, just under 36% over the past 7 days.

#PaxEx

Thursday's 934k passengers passing through TSA screening checkpoints was down 1.6% from the week prior (950k) and also down from the (likely holiday-fueled) 937k two weeks prior.

#PaxEx

#PaxEx

Friday (958k), Saturday (755k), and Sunday (983k) TSA screening numbers all decreased from the week prior. And from two weeks prior. The marginally good news is that they didn't drop relatively as much as last year, so the YoY % climbed a smidgen.

#PaxEx

#PaxEx

Another weekly decline in TSA screening numbers on Monday, down 2.4% to 898k. YoY continues to hold, though.

#PaxEx

#PaxEx

Tuesday's 645k count passing through TSA screening is down 2.1% from the prior week, the 9th consecutive day of declines. All but 2 were smaller declines than 2019, though, so YoY % continues to increase, now 36.6% over the past week. #PaxEx

Wednesday (667k) and Thursday (873k) extended the streak of week-over-week declines in TSA screening to 11 days. But, again, not as steep in 2019. Thursday pushed back over the 40% YoY threshold; rare outside of holiday timing.

How much water is in that glass, then??

#PaxEx

How much water is in that glass, then??

#PaxEx

I don't know what caused the dramatic shift, but Saturday's TSA screening number came in at just 618k, an **18%** drop from the week prior. That's huge. Even dragged the 7-day average back under 800k after 3 weeks above. Way worse than 2019 numbers, too.

Ouch.

#PaxEx

Ouch.

#PaxEx

Turns out it is just that no one travels on Halloween. Go figure. 🤷♂️

A Halloween hangover? TSA screening of 936k pax on Sunday down 5% compared to the prior week.

#PaxEx

#PaxEx

There's always an aviation angle.™

Election day appears to have depressed US air travel, with TSA screening down to just 575k, an 11% drop from the prior week. A 5-7% decline is more normal these days. #PaxEx

Election day appears to have depressed US air travel, with TSA screening down to just 575k, an 11% drop from the prior week. A 5-7% decline is more normal these days. #PaxEx

Wednesday's 636k screened was lower than every humpday in October, and also back below 30% of the comparable day in 2019. Maybe a little election hangover, but the trend seems pretty clear: recovery has stalled outside of holiday travels.

#PaxEx

#PaxEx

A mild TSA screening surprise on Thursday: the 867k pax through is less than 1% down from the prior week.

#PaxEx

#PaxEx

The past three days all showed weekly sequential increases on TSA screening throughput. Saturday benefitted from a weak Halloween comp but the other two are legit gains. YoY share also showing a rebound. #PaxEx

Tuesday's 596k pax through TSA screening was up 3.6% from the prior week while Monday's 836k was down 1.1%. The 7-day YoY average continues to hover just above 34%.

#PaxEx

#PaxEx

A hair under 675k pax through TSA screening on Wednesday is a nice bump up from post-Election day and even the week prior.

YoY holding just under 35% still, though.

#PaxEx

YoY holding just under 35% still, though.

#PaxEx

TSA screening of 866k on Thursday was flat compared to a week ago (off by just 426). Bigger question to me is if it will top 1mm on Sunday. There's a decent chance based on trends, but not guaranteed. #PaxEx

Sunday hit 978k pax through TSA screening, essentially flat to last week. Friday and Saturday were pretty flat, too. Gotta think that pre-Thanksgiving Sunday will cross the (not really) magic 1mm mark, though. YoY average still hovering around 35%.

#PaxEx

#PaxEx

Monday's 883k pax through TSA screening was a strong performance, up 5.6% from the prior week. Pushing the YoY 7-day average very close to 36%, too.

#PaxEx

#PaxEx

Another improvement in TSA screening numbers on Tuesday, up 2.5% from last week. And the 7-day YoY level is back over 36%. I expect more records/impressive stats over the next two weeks owing to Thanksgiving travel. #PaxEx

Wednesday's TSA screening was up 4.2% from the prior week at 703k. Also nudged the 7-day moving average back above 800k for the first time since Halloween (it first crossed that mark on 10 Oct).

All signs still indicate a strong Thanksgiving week to come.

#PaxEx

All signs still indicate a strong Thanksgiving week to come.

#PaxEx

Since the pandemic started the TSA screening count has exceeded 900k only 18 times, mostly on Sundays. Thursday's 907k (up 4.7% from last week) kicks off what is likely several days of the peak demand. Saturday will be really interesting to watch IMO. #PaxEx

Friday's TSA screening topped 1 million pax while Saturday came in just under. Both are massive boosts from the prior week and the best consecutive days of YoY numbers (40%, 44.9%) since the pandemic began.

I guess the CDC guidance to stay home to be safe didn't work. #PaxEx

I guess the CDC guidance to stay home to be safe didn't work. #PaxEx

TSA screening back over a million again on Sunday, with a pandemic-era record 1,047,934 pax handled. That's 45.1% of 2019 pre-Thanksgiving Sunday. Up 7.1% from the prior week against a 3.1% drop in 2019, presumably less biz travel around the holiday; all leisure now. #PaxEx

Thanksgiving air travel demand remains relatively robust.

Monday's 917k pax through TSA screening was up 3.9% from the prior week and the 4th consecutive day above 40% YoY.

#PaxEx

Monday's 917k pax through TSA screening was up 3.9% from the prior week and the 4th consecutive day above 40% YoY.

#PaxEx

Yesterday saw the largest week over week boost of pax screening numbers, at 912k, 49.2% more than week prior. That number is only 37.5% of 2019's Thanksgiving Tuesday, a lower rate than the past 4 days but 5% more than last week. Also, share of holiday week travel shown. #PaxEx

Ugh...I broke the thread yesterday so adding that back in here.

https://twitter.com/WandrMe/status/1332305991694753792

Friday's TSA screening of 820k was 41.7% of the 2019 number, making for 6 of the last 8 days above 40% YoY and extending the 7-day YoY % streak. More than 7mm pax screened since the holiday push started last Friday.

#PaxEx

#PaxEx

In 2019 Thanksgiving Saturday had a higher TSA screening number than even the Wednesday of that week (by 1%). This year, not so much, even dropping below last Saturday. At 964k the 7-day average moves back below 900k and the 7-day YoY & back under 40%. #PaxEx #AvGeek

A COVID-era record of 1,176,091 pax through TSA screening on Sunday, 40.8% of the 2019 number (which was an all-time high for the agency). And the 7-day YoY % dropped a tiny bit as a result.

#PaxEx

#PaxEx

Monday's TSA screening hit 981,912 pax, up 7% from last week but only 37.9% of last year's post-turkey flyaway. And despite predictions that this year the holiday would be more smoothly distributed in air travel my review of the data suggests that was not the case. #PaxEx

Tuesday's 780k pax screened is a 14.5% drop from the prior week, but the prior week was a huge increase because holiday week travel shifted a bit in 2020 v 2019. Just 34.2% of the 2019 number but that's actually pretty good for a non-holiday Tuesday.

#PaxEx

#PaxEx

Well, Thanksgiving weekend is definitely over. Just 632k pax through TSA screening on Wednesday, dropping to a level not seen since late September. Just 30.8% of 2019 throughput, dragging that average down as well. #PaxEx

Half empty or half full? TSA screening on Thursday was up 31.6% from last week to 738k pax, but that's the lowest Thursday since late August if you exclude Thanksgiving day. Also just 32.6% of the 2019 number, dragging the YoY 7-day average down.

#PaxEx

#PaxEx

More signs of retreat in the TSA screening throughput numbers. Over the weekend the 7-day avg pax count fell below 35% of 2019's numbers.

People really are avoiding travel, other than holidays.

#PaxEx

People really are avoiding travel, other than holidays.

#PaxEx

Just 703k pax through TSA screening yesterday, the slowest Monday since the end of July. And 31.6% YoY is the lowest since the end of August.

#PaxEx

#PaxEx

The TSA screened just 501,513 travelers on Tuesday. That is the lowest absolute number since July 4th and just 26.4% of the corresponding day in 2019, a YoY ratio not seen since around Labor Day. Bad for airlines, but maybe people are finally heeding the call to stay home? #PaxEx

TSA screening numbers continue to drop, with Wednesday at 564k, the lowest hump day number since 26 Aug. And just 27.9% of the 2019 count. The 7-day moving average is back below 700k, down 200k/day from a 980k peak the day before thanksgiving. #PaxEx

The 754k pax through TSA screening on Thursday appears to have slowed the travel retreat a bit. Still much lower than September/October numbers and just 31.9% of last year's count.

#PaxEx

#PaxEx

It looks like the freefall of the TSA screening numbers from the past couple weeks has arrested, with numbers ticking back up a bit over the weekend. Still just 35% YoY over the past few days, though.

#PaxEx

#PaxEx

Another day of steadying TSA screening levels. Some 752k pax yesterday, 33.4% of the 2019 number.

Will the new pace match mid-September's growth? Or more varied thanks to upcoming Christmas travel??

#PaxEx

Will the new pace match mid-September's growth? Or more varied thanks to upcoming Christmas travel??

#PaxEx

Tuesday saw 542k pax through TSA screening and Wednesday 642k. Both numbers remain below 30% of the YoY rates, but a point ahead of last week's comps.

#PaxEx

#PaxEx

With 847k pax through TSA screening on Thursday the pace of increase from the last bottoming out appears to be stronger than the previous post-holiday drop (see 1st image). And we're now headed in to another holiday travel period that will likely boost traffic. #PaxEx

Consecutive days of TSA passenger screening numbers over 1 million, and above 40% of 2019 comp's. People may have been slightly willing to not travel at non-holidays, but they're not willing to skip Christmas, despite CDC and other public health guidance. #PaxEx

It seems a large portion of Americans are excited to give #COVID19 as a gift this Christmas. The TSA reports a third consecutive day of more than a million pax (and >40% YoY) through screening on Sunday. #PaxEx

"Only" 954,782 passengers through TSA screening on Monday, dropping just below 1mm for the first time in 4 days though the average for those 4 days remains above that magical milestone.

And last year the holiday was mid-week.

#PaxEx

And last year the holiday was mid-week.

#PaxEx

At 992k passengers yesterday was the busiest Tuesday for TSA screening since the pandemic started (912k pre-T'giving 2d). It also topped 50% YoY for the first time, though the comp is Xmas eve last year. Past 5 days still averaging >1mm pax/day. #PaxEx

December 23rd saw 1,191,123 travelers pass through TSA screening, the most since the pandemic began. The 7-day average is now over 1mm pax/day for the first time. YoY topped 60%, but the comp was Xmas day '19.

CDC & public health warnings be damned.

#PaxEx #COVID19

CDC & public health warnings be damned.

#PaxEx #COVID19

• • •

Missing some Tweet in this thread? You can try to

force a refresh