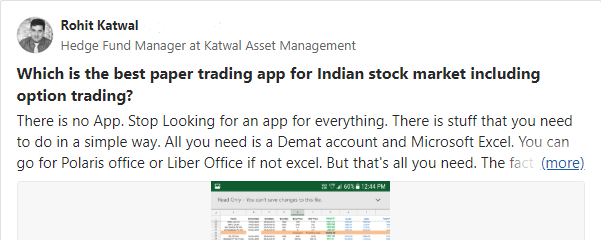

What is the best #PaperTrading app for Indian Stock Market including OptionsTrading?

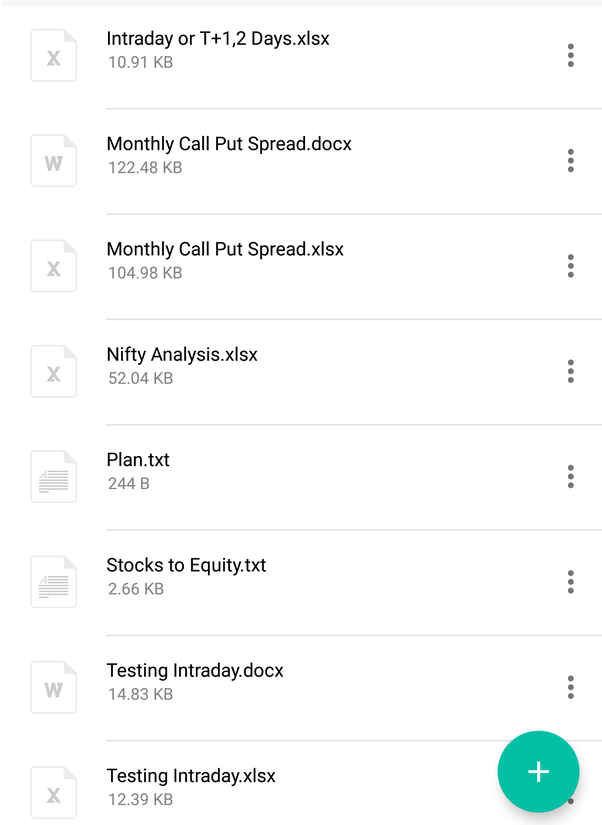

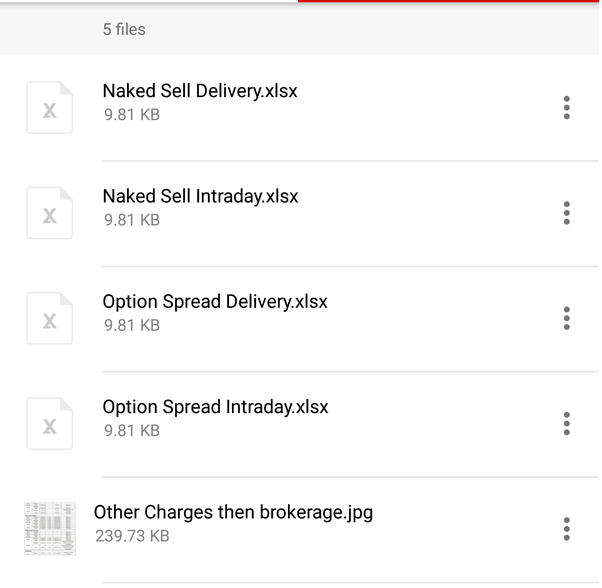

Stop Looking for an app for everything. There is stuff that you need to do in a simple way. All you need is a Microsoft Excel & Trading Account.

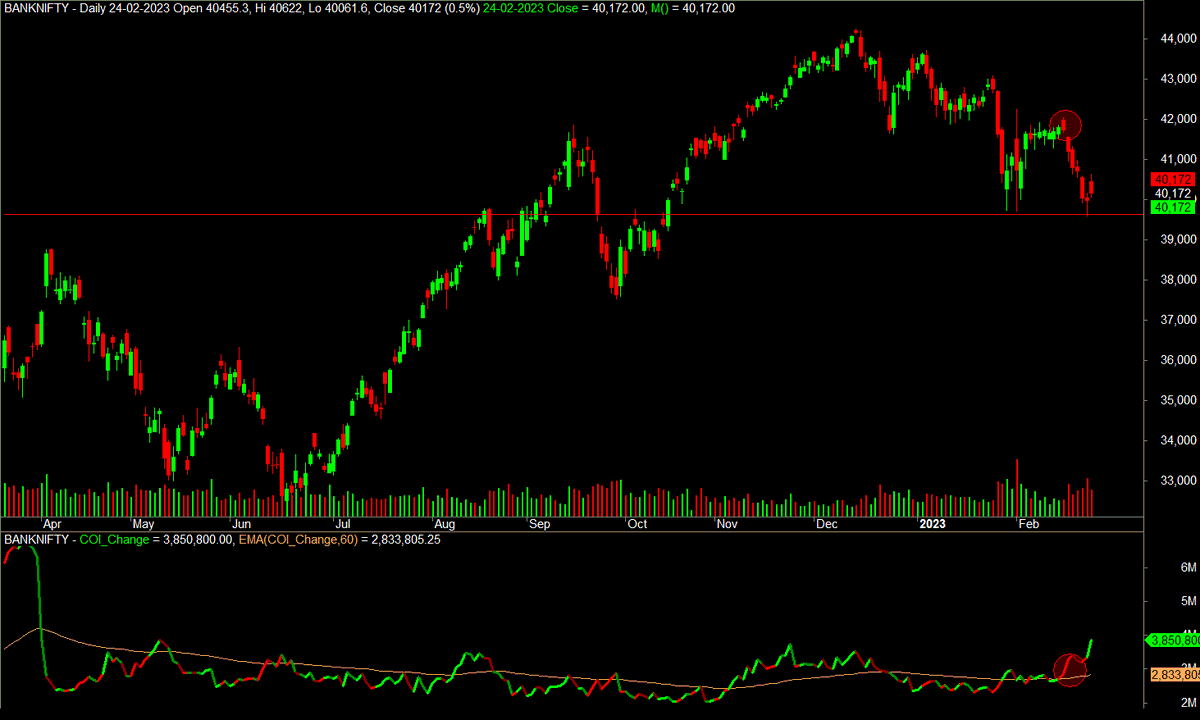

#Nifty #BankNifty

1/n...

Stop Looking for an app for everything. There is stuff that you need to do in a simple way. All you need is a Microsoft Excel & Trading Account.

#Nifty #BankNifty

1/n...

@rohit_katwal ...The fact that you are looking for an app shows you are looking for a quick fix. Paper trading is not a 3 or 4 days work. It takes years to develop profitable attitude to markets.

I started paper trading in 2012 before I blew my account several times. 2/n...

I started paper trading in 2012 before I blew my account several times. 2/n...

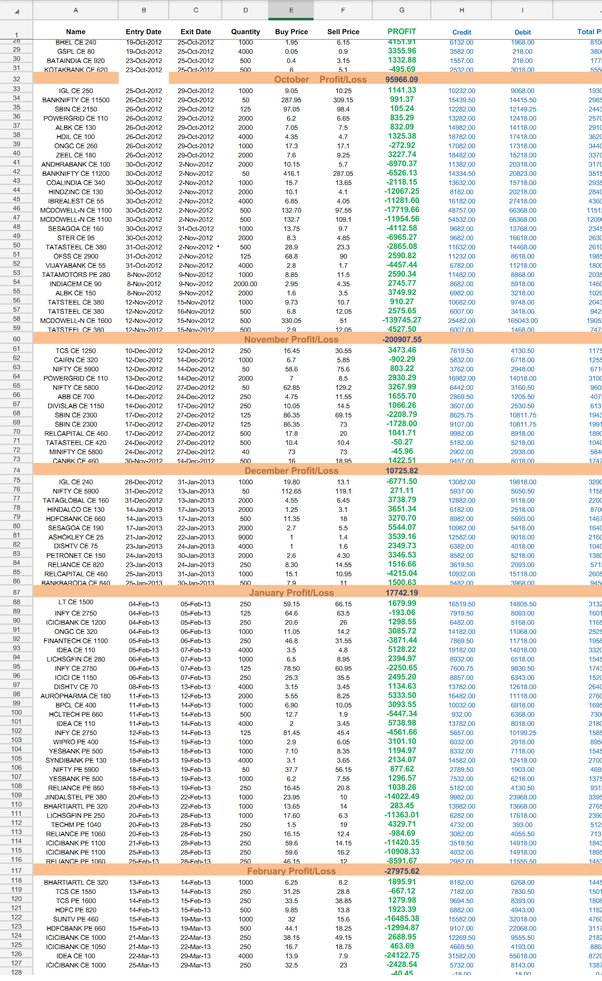

@rohit_katwal ...This is a glimpse of my paper trading back in 2012. You can see that I did it at end of the day after job. Let me assure you that this went on till 2017 March. Day in Day out until I developed an attitude for trading. 3/n...

@rohit_katwal ...Did you notice that I did it every day? I had to record every stoploss. Every target. And if my strategy was not working then why it wasn't working and I had to start from a scratch on some new theory. Analysing data for what is working and what is not. 4/n...

@rohit_katwal ...Am I hitting too many stop losses, or my targets are low? Is it right sticking to a loss or sticking to profit? Should I exit mid-way or not? What kind of trading suits my needs? All of this after 5 years of paper trading & doing job side by side. 5/n...

@rohit_katwal ...And then I finally understood what was required.

Now I am not saying that you will have to do the same or devote same time. There are many intelligent people who have achieved their paper trading goals in lesser time frame. 6/n...

Now I am not saying that you will have to do the same or devote same time. There are many intelligent people who have achieved their paper trading goals in lesser time frame. 6/n...

@rohit_katwal ...But it needs patience. To see theories, fail and evolve. By asking that there is some app for it, you are going in all wrong. There are tools available these days to back test your strategies. 7/n...

...But it cannot train your mind to survive the psychological grind that is associated with trading. So all you need is microsoft excel, trading account, theory and commitment to work on it everyday tilly you find your holy grail of trading. 8/n...

...PS - For me it is: 1. Risk Management, & 2. Position Sizing Happy Trading. End of Thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh