1/ Creating Definitive Truth, a thread giving insight on Sergey's recent presentation at #SmartCon 2020 covering how @Chainlink generates definitive truth about the real world, the acquisition of deco.works from @Cornell, and much more

#Chainlink $LINK

#Chainlink $LINK

2/ It's key to understand the importance of definitive truth, the indisputable state of reality

Without it, you have information asymmetry, disproportionately benefiting a select group who have access to privileged information

In essence, definitive truth is data you can trust

Without it, you have information asymmetry, disproportionately benefiting a select group who have access to privileged information

In essence, definitive truth is data you can trust

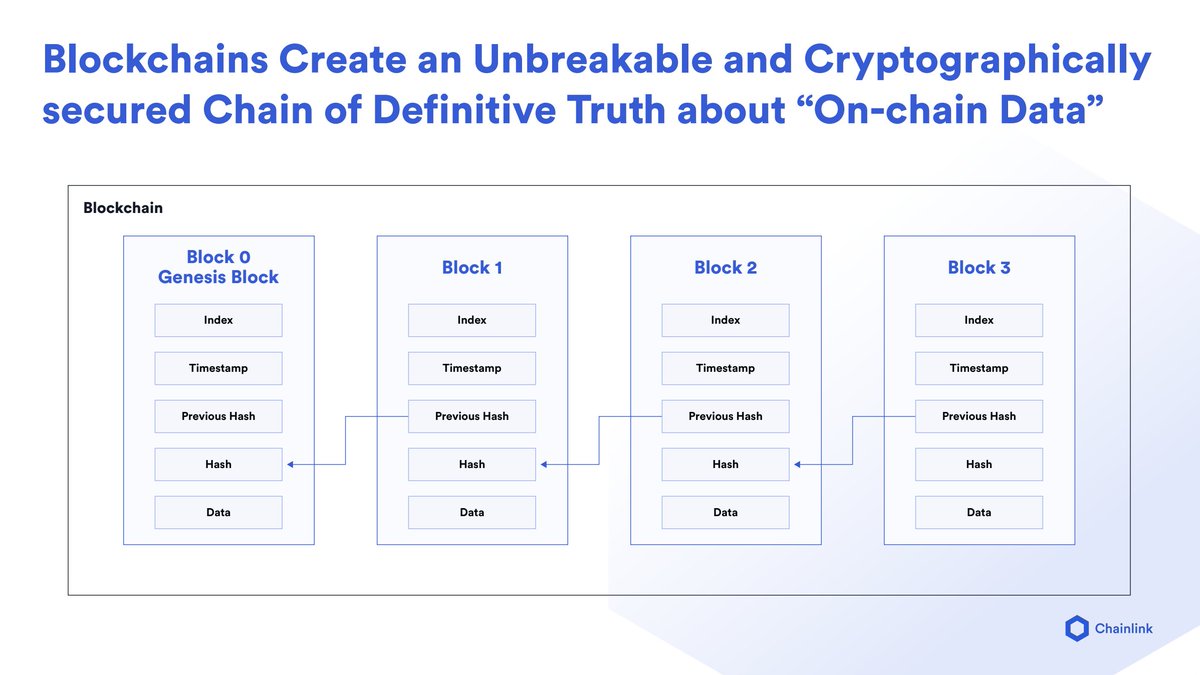

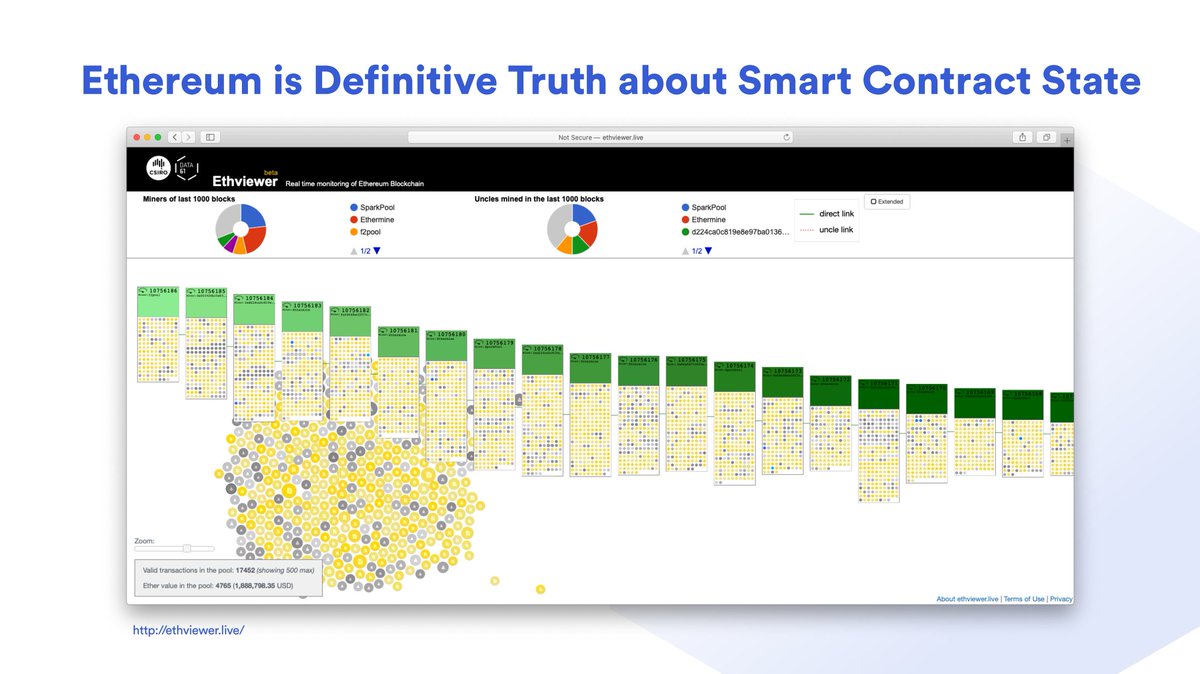

3/ Blockchains generate definitive truth about on-chain data

This is achieved with an immutable ledger that cannot be tampered with or manipulated to benefit any one party

Each block in the chain has a cryptographic hash of the previous, creating indisputable definitive truth

This is achieved with an immutable ledger that cannot be tampered with or manipulated to benefit any one party

Each block in the chain has a cryptographic hash of the previous, creating indisputable definitive truth

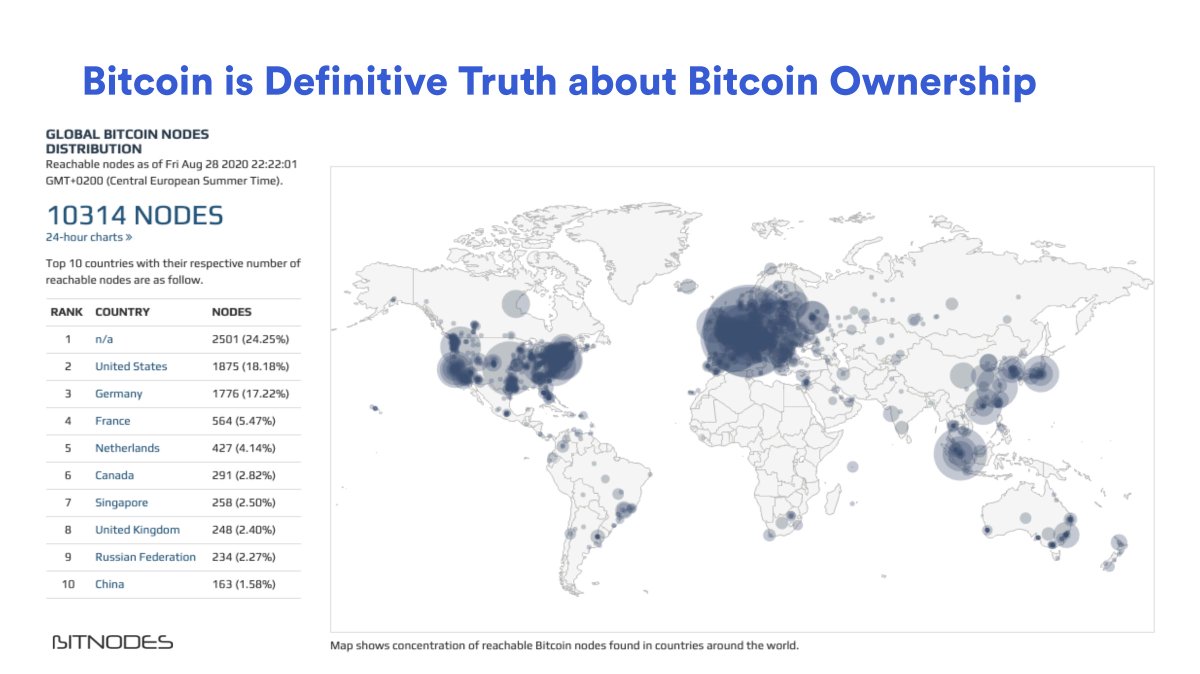

4/ This definitive truth is then confirmed by numerous independent machines around the world that generate consensus, ensuring this truth is always valid and available to all

The Bitcoin Blockchain has 10,000 nodes that continually verify the true ownership and transfers of $BTC

The Bitcoin Blockchain has 10,000 nodes that continually verify the true ownership and transfers of $BTC

5/ The Ethereum blockchain is similarly decentralized but the definitive truth generated is not just about the ownership and transfers of $ETH

But also definitive truth regarding other on-chain data like ERC20 token balances and the state of each smart contract on the network

But also definitive truth regarding other on-chain data like ERC20 token balances and the state of each smart contract on the network

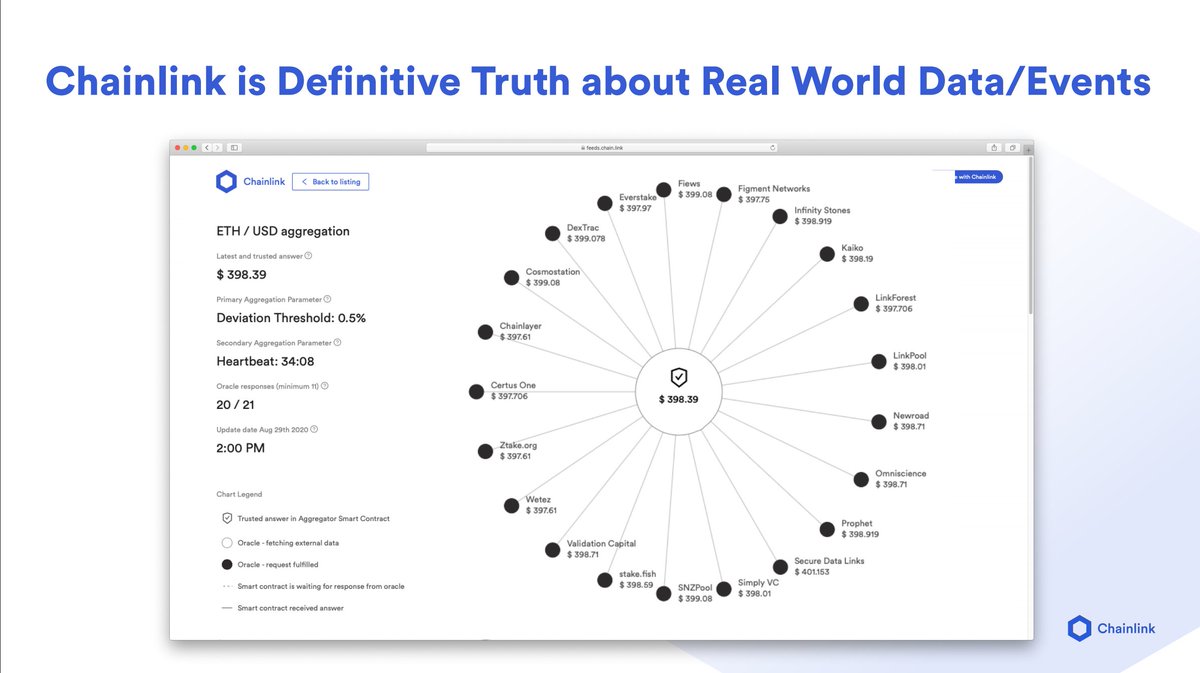

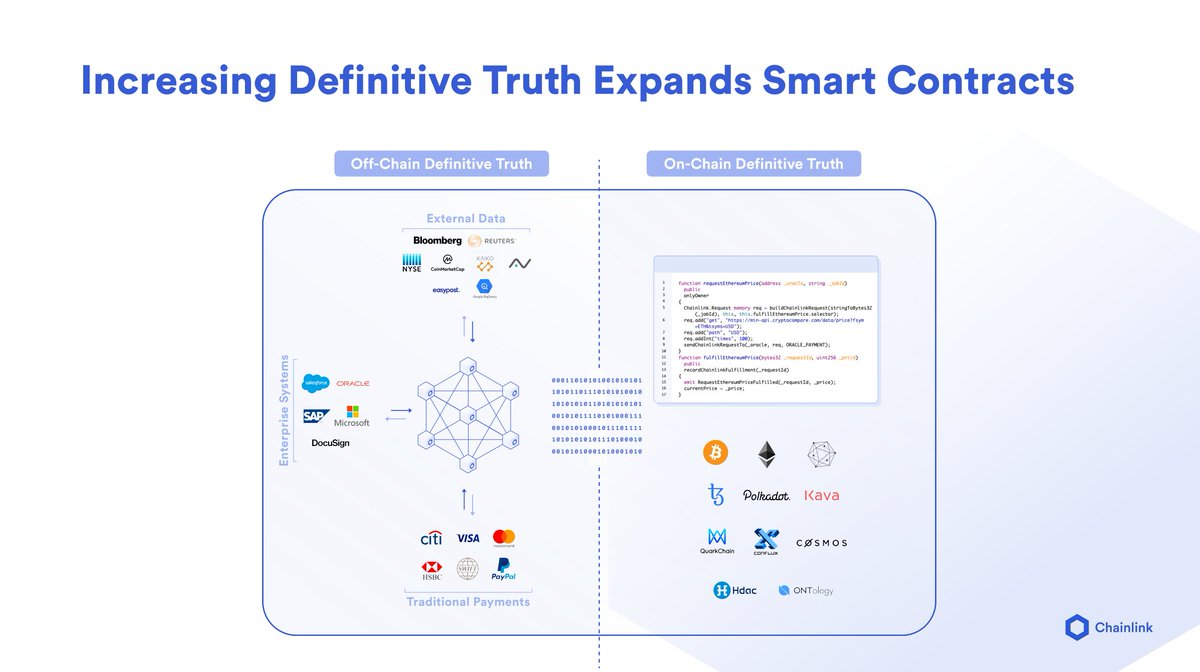

6/ #Chainlink extends this by providing blockchains definitive truth regarding real world data and events

With #DeFi, there is a large demand for Price Feeds, but Chainlink oracles are able to generate definitive truth regarding any off-chain data

With #DeFi, there is a large demand for Price Feeds, but Chainlink oracles are able to generate definitive truth regarding any off-chain data

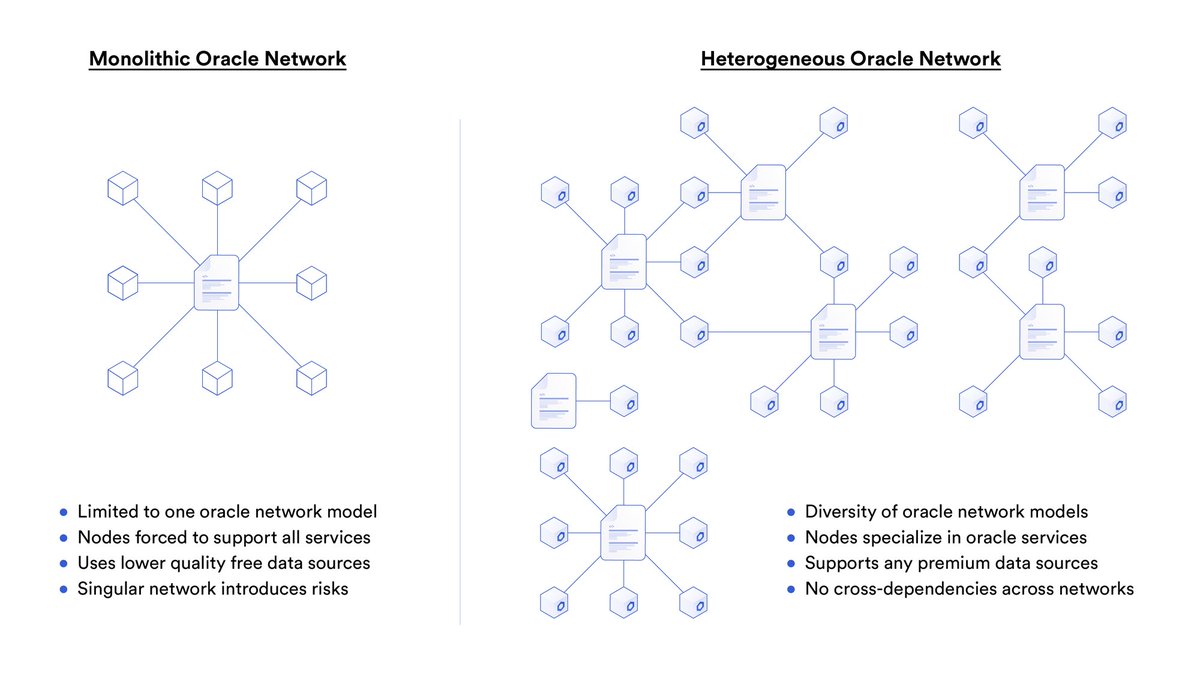

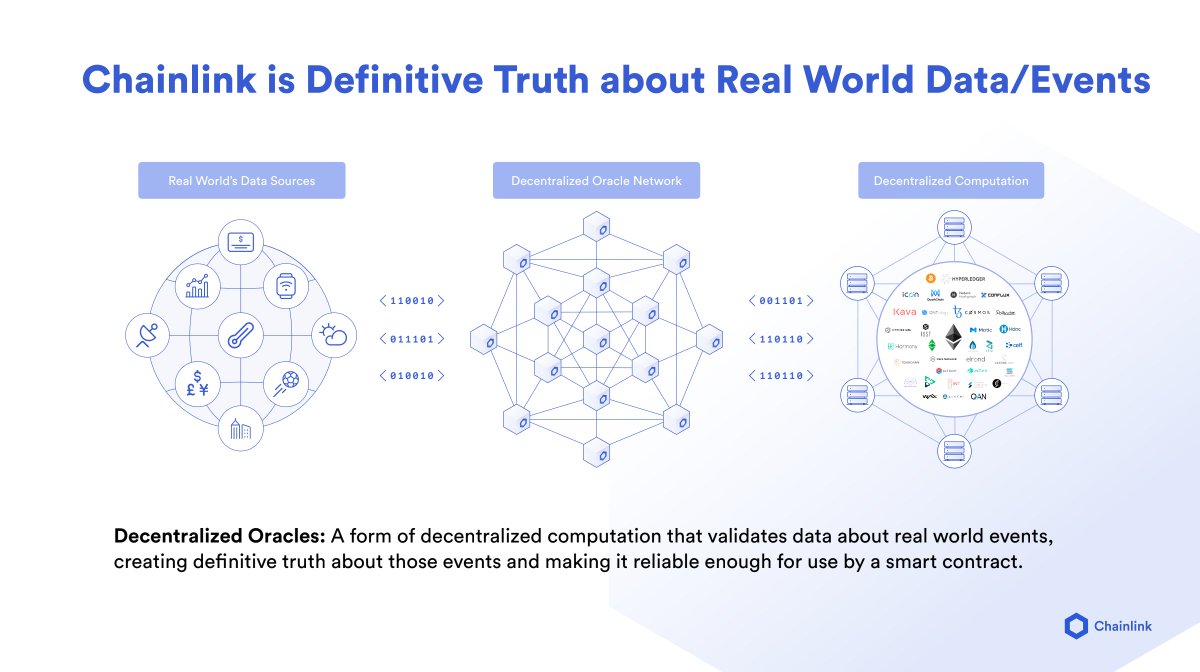

7/ Chainlink creates definitive truth regarding the real world through a decentralized network of oracle nodes

These nodes can fetch data from any off-chain API, aggregate it into a single reference point, and deliver it on-chain to any blockchain for smart contracts to consume

These nodes can fetch data from any off-chain API, aggregate it into a single reference point, and deliver it on-chain to any blockchain for smart contracts to consume

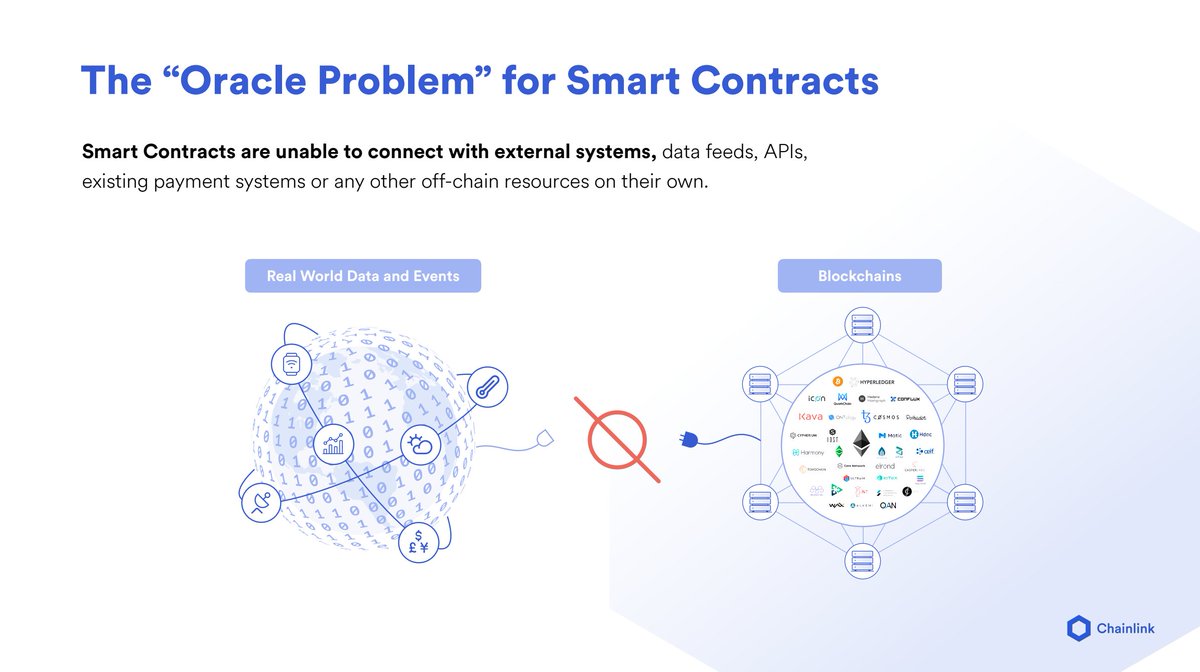

8/ The reason we need an oracle is that blockchains cannot connect to external off-chain systems without sacrificing the reliability and security properties that make the blockchain useful in the first place

This is an inherent problem for all blockchain networks

This is an inherent problem for all blockchain networks

9/ Chainlink solves this problem and expands the capabilities of smart contracts by providing definitive truth regarding any off-chain resource

By combining the truth about both the on-chain and off-chain worlds, the vast majority of agreements can be trustlessly automated

By combining the truth about both the on-chain and off-chain worlds, the vast majority of agreements can be trustlessly automated

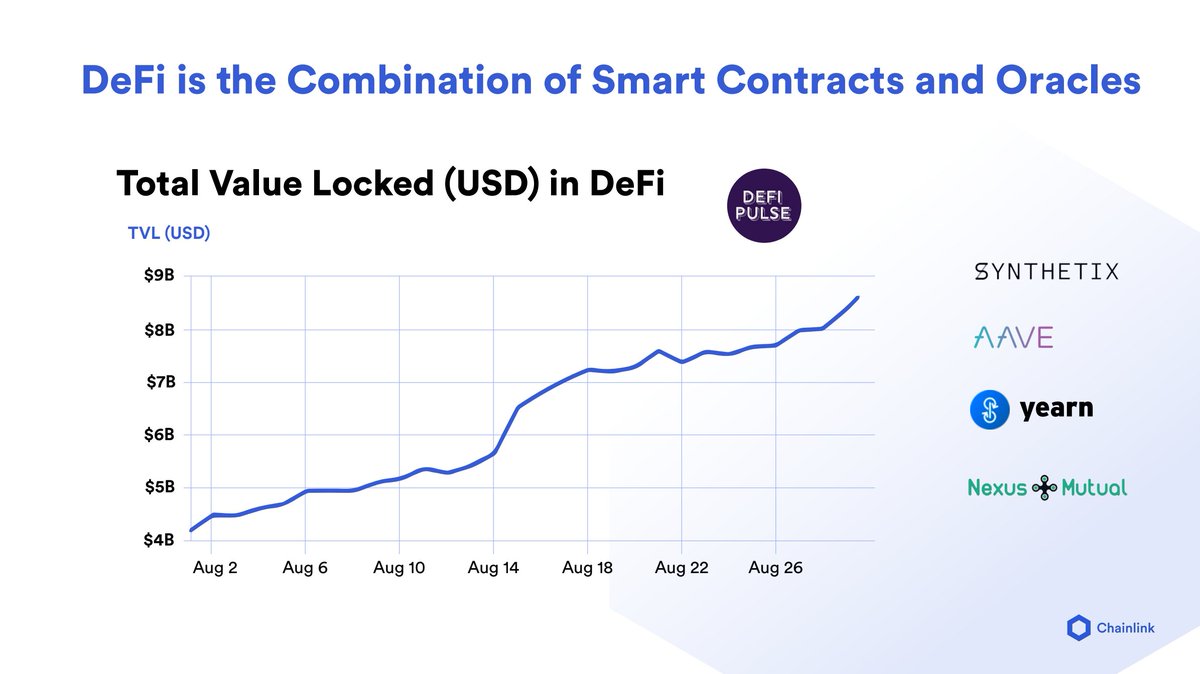

10/ The first major application of this duel-sided definitive truth has been the creation and growth of the Decentralized Finance (#DeFi) economy

Many of the most adopted and innovative DeFi projects are powered by Chainlink oracle networks, securing over $3B+ in value

Many of the most adopted and innovative DeFi projects are powered by Chainlink oracle networks, securing over $3B+ in value

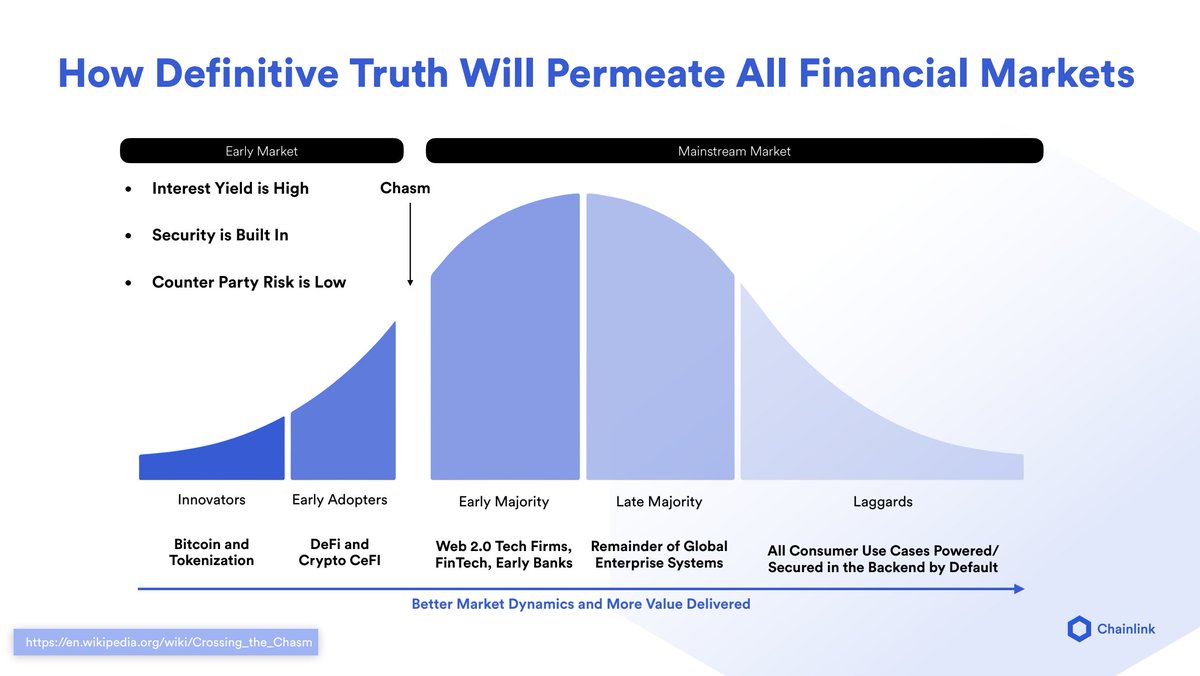

11/ However to be clear, definitive truth goes far beyond crypto and will permeate all financial markets

Through all the advantages provided by definitive proof based technologies, the global economy will inevitably shift to data-driven smart contracts

Through all the advantages provided by definitive proof based technologies, the global economy will inevitably shift to data-driven smart contracts

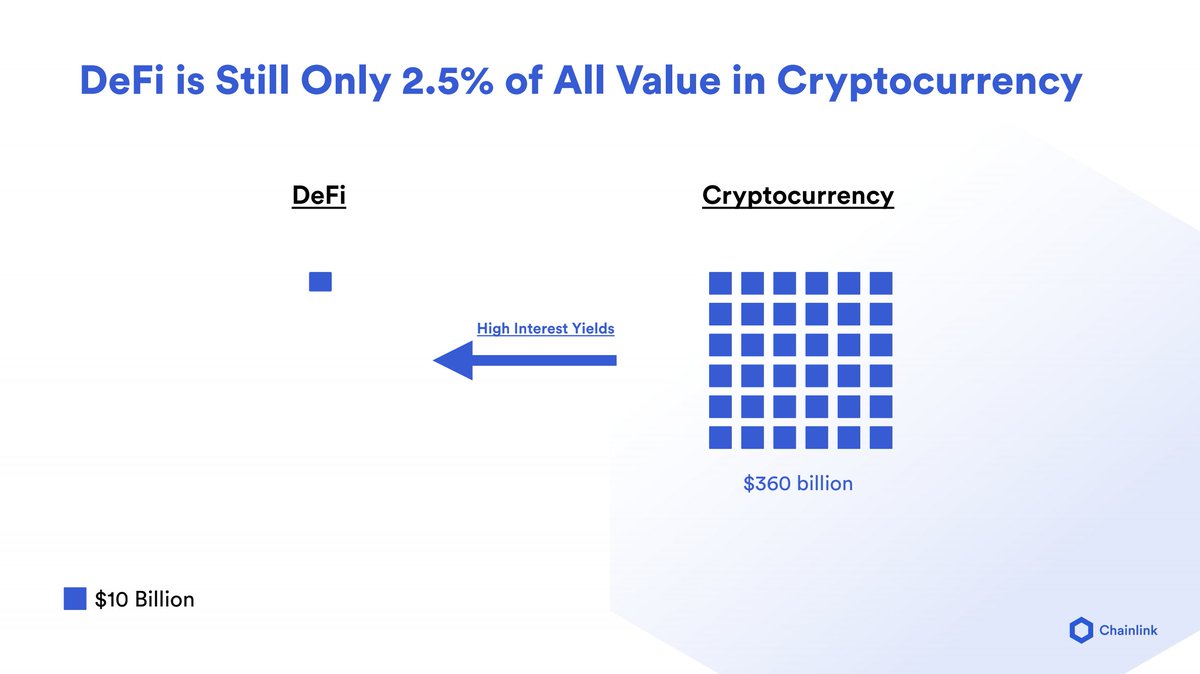

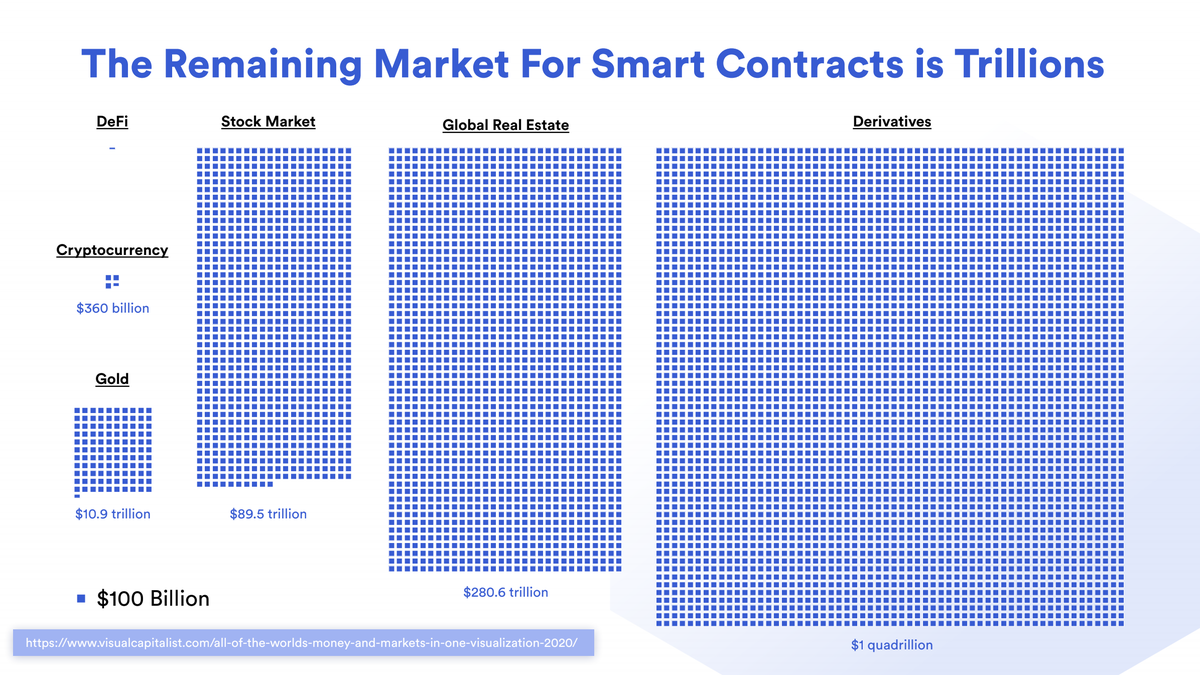

12/ To put into perspective just how much potential for growth there is, consider that the entire #DeFi ecosystem is only 2.5% of all value in cryptocurrency

To say we're still early is the understatement of the decade

To say we're still early is the understatement of the decade

13/ The remaining market size for #DeFi and other definitive truth based smart contracts is in the trillions

$10Bn - DeFi (1x)

$360Bn - Crypto (36x)

$1,100Bn - Gold (110x)

$90,000Bn - Stock Market (9,000x)

$281,000Bn - Real Estate (28,100x)

$1,000,000Bn - Derivatives (100,000x)

$10Bn - DeFi (1x)

$360Bn - Crypto (36x)

$1,100Bn - Gold (110x)

$90,000Bn - Stock Market (9,000x)

$281,000Bn - Real Estate (28,100x)

$1,000,000Bn - Derivatives (100,000x)

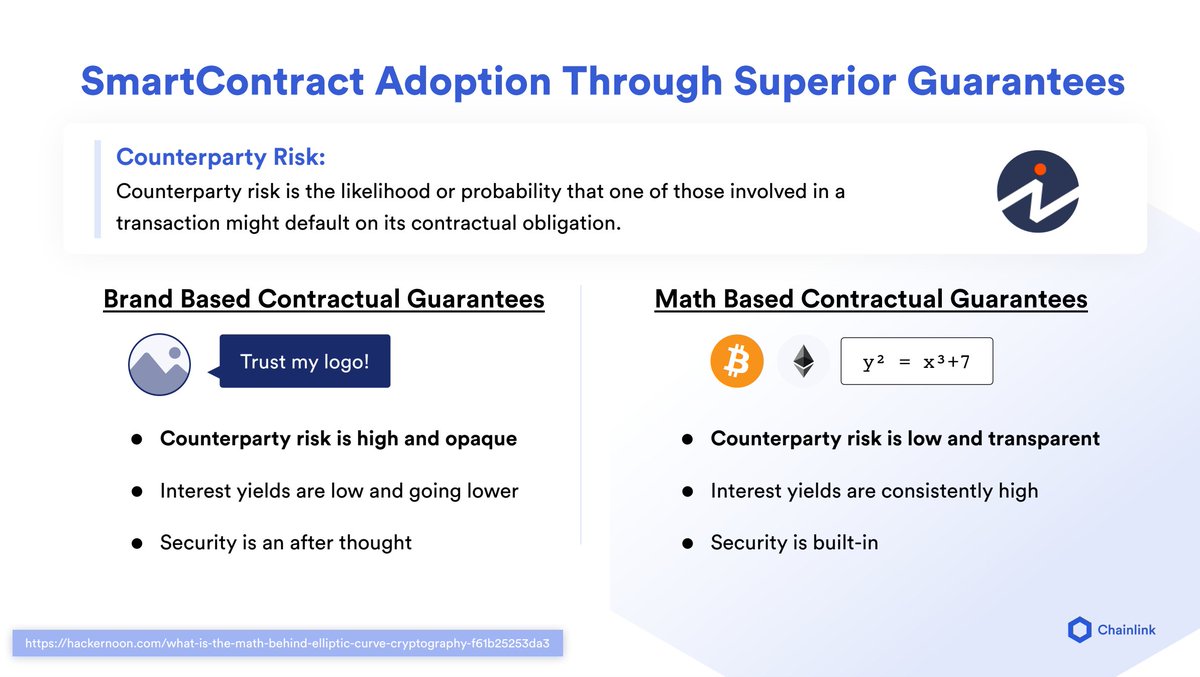

14/ What this boils down to is a global systemic shift from brand-based contracts to math-based smart contracts

High counterparty risk -> Low counterparty risk

Low and dropping yields -> Consistently high yields

Security non-existent -> Built-in security

It's a no-brainer move

High counterparty risk -> Low counterparty risk

Low and dropping yields -> Consistently high yields

Security non-existent -> Built-in security

It's a no-brainer move

15/ Some Web 2.0 firms aren't waiting around and are already making the switch to becoming a 'crypto native' company

Through decreased counterparty risk, higher yield, and hedge against fiat inflation, they are the initial pioneers in what will become the universal standard

Through decreased counterparty risk, higher yield, and hedge against fiat inflation, they are the initial pioneers in what will become the universal standard

16/ To further this goal of generating definitive truth about the real world, @Chainlink announced three major things at #SmartCon 2020

The acquisition of @Cornell's DECO

Launch of the Chainlink Labs Research Program

Hiring of academic genius @AriJuels as Chief Scientist

The acquisition of @Cornell's DECO

Launch of the Chainlink Labs Research Program

Hiring of academic genius @AriJuels as Chief Scientist

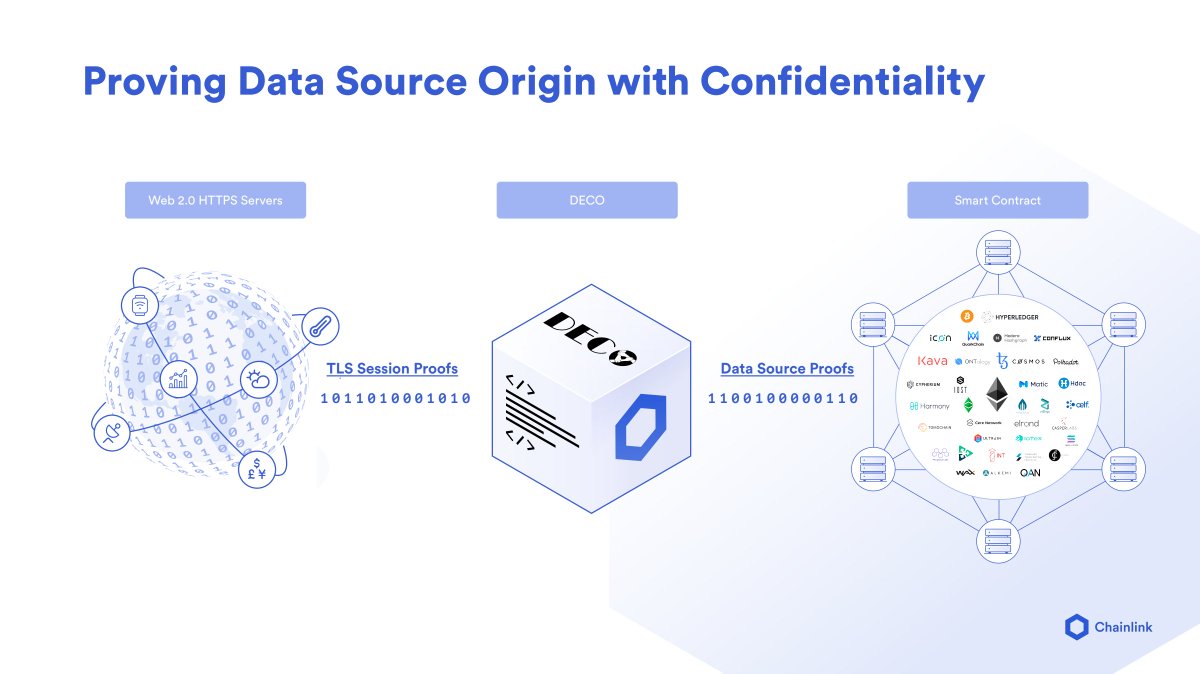

17/ DECO is a privacy preserving oracle technology developed at Cornell University & IC3 under Ari Juels

DECO allows all data transmitted over HTTPS/TLS to be confidentially attested to without revealing the data or requiring any server-side modifications for data providers

DECO allows all data transmitted over HTTPS/TLS to be confidentially attested to without revealing the data or requiring any server-side modifications for data providers

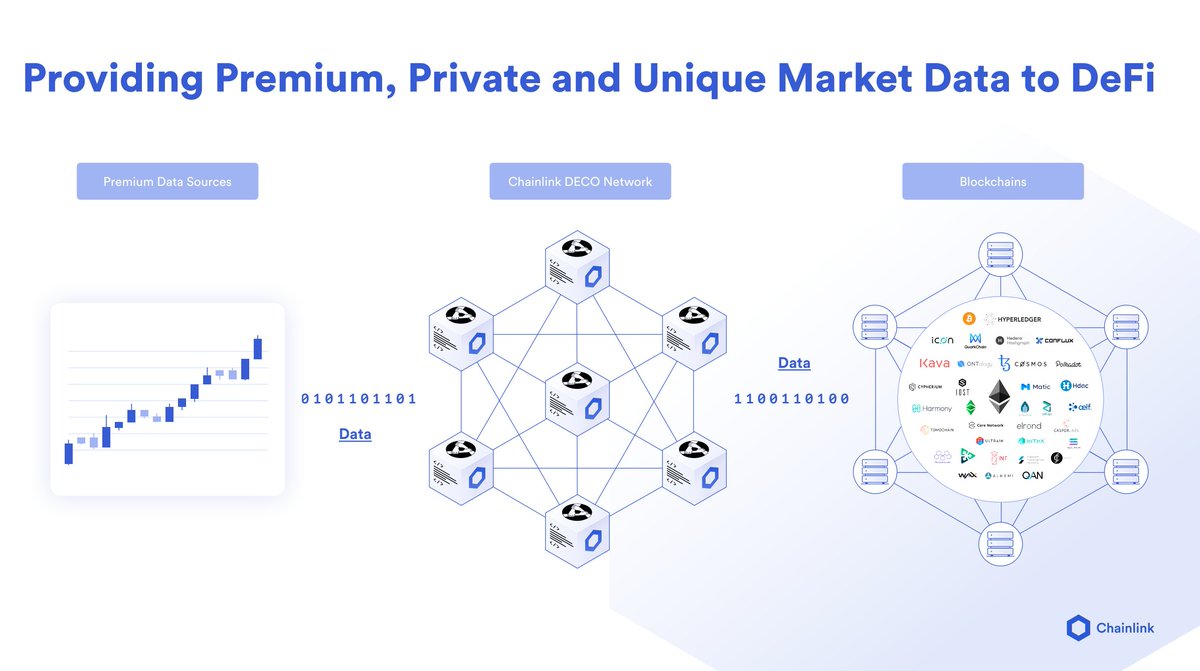

18/ The data privacy + integrity guarantees provided by DECO are even more powerful when combined with #Chainlink's network of decentralized oracles

This allows for a wide array of datasets to be brought on-chain, including premium, private and unique market datasets for #DeFi

This allows for a wide array of datasets to be brought on-chain, including premium, private and unique market datasets for #DeFi

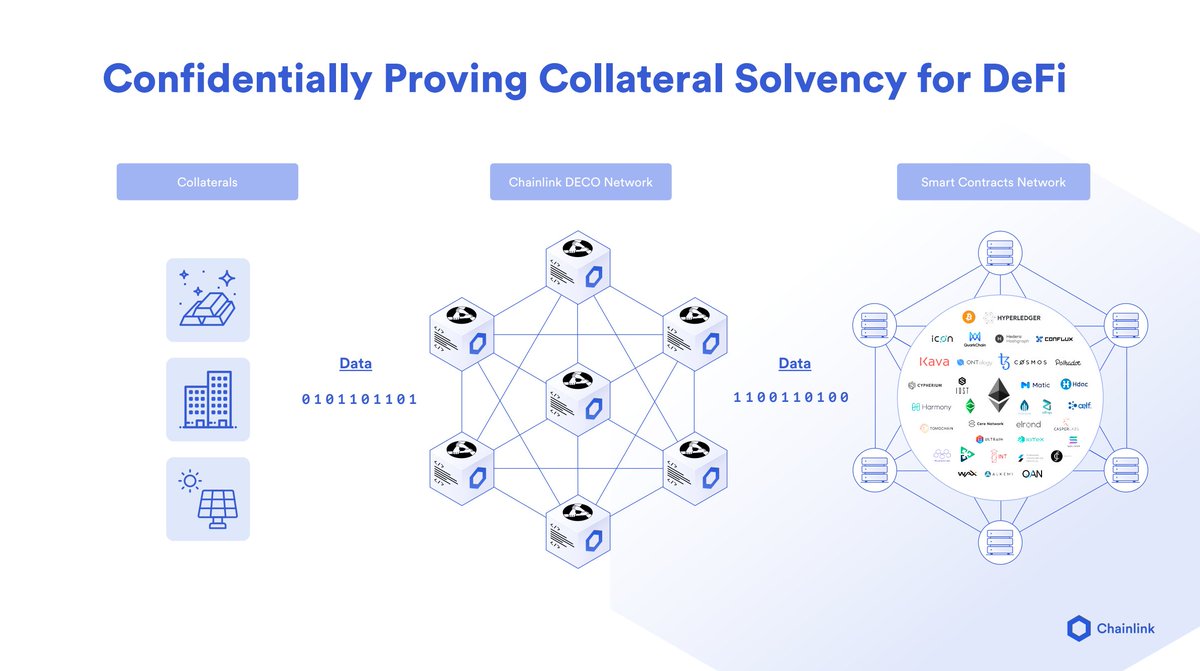

19/ DECO can be used to confidentially prove collateral solvency for DeFi

In this regard, Chainlink has recently partnered with @BitGo to create a $WBTC Proof of Reserve Reference Contract

Imagine such a reference contract for stablecoins and tokenized real world assets 👀

In this regard, Chainlink has recently partnered with @BitGo to create a $WBTC Proof of Reserve Reference Contract

Imagine such a reference contract for stablecoins and tokenized real world assets 👀

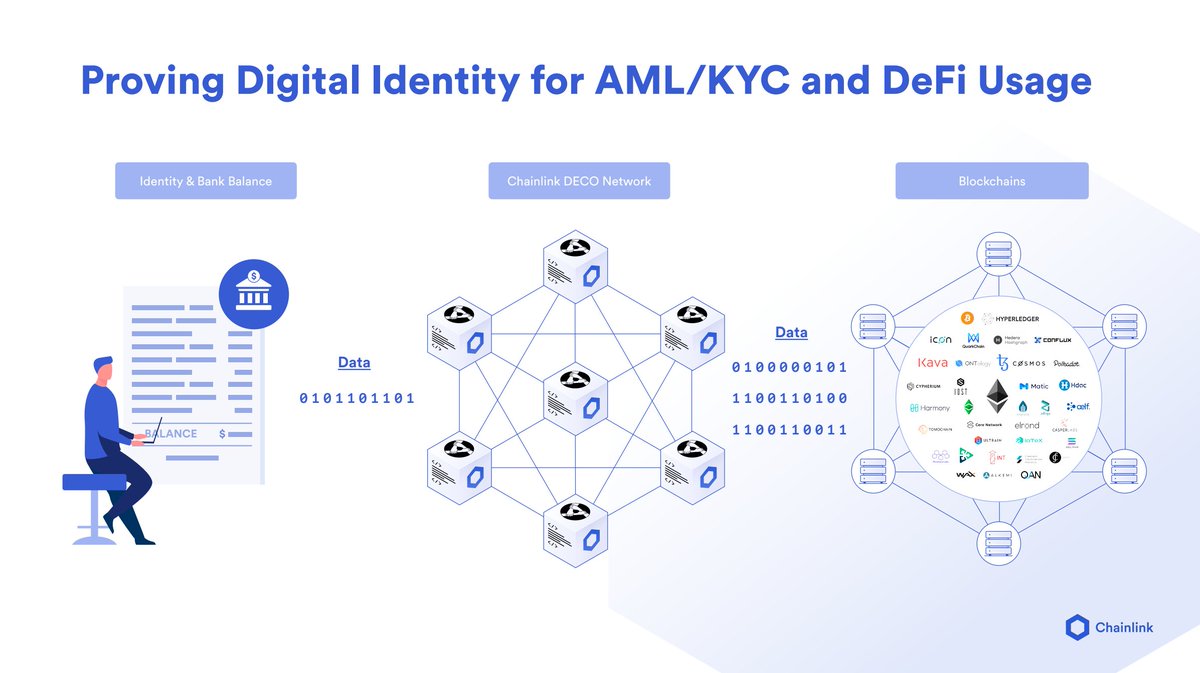

20/ DECO allows users to confidentially prove their identity and bank balance for DeFi applications that follow AML/KYC laws

This is critically important for institutions wanting to benefit from smart contract and DeFi technology, while being able to ensure their compliance

This is critically important for institutions wanting to benefit from smart contract and DeFi technology, while being able to ensure their compliance

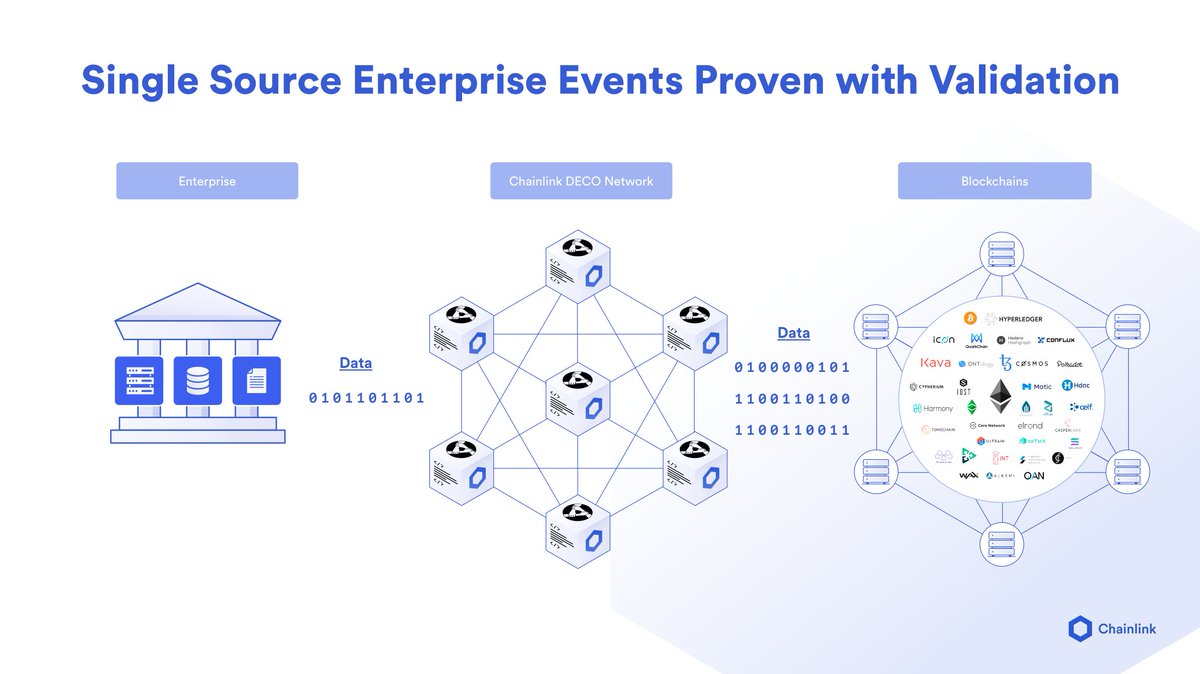

21/ Additionally, DECO is crucial in situations where there is only a single source for the data

Enterprises are able to monetize their confidential datasets without revealing the data itself through Zero Knowledge Proofs (ZKPs) that definitively prove the data's origin

Enterprises are able to monetize their confidential datasets without revealing the data itself through Zero Knowledge Proofs (ZKPs) that definitively prove the data's origin

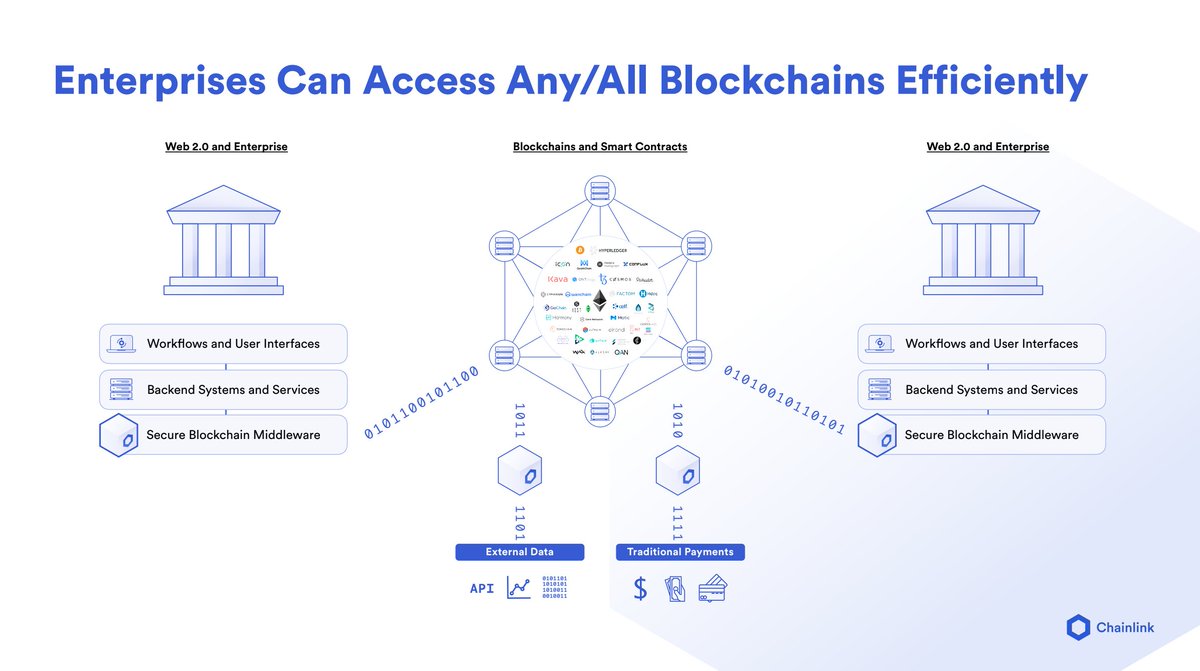

22/ Additionally, Enterprises who utilize Chainlink are able to sell their datasets and APIs to smart contracts across every blockchain

This includes every blockchain that exists today and into the future, providing a futureproof solution

This includes every blockchain that exists today and into the future, providing a futureproof solution

Through this highly scalable approach, all of the world's data can be brought on-chain to be consumed by a growing collection of smart contracts

By using Chainlink as a blockchain abstraction layer, enterprises are able to support all the environments where commerce occurs

By using Chainlink as a blockchain abstraction layer, enterprises are able to support all the environments where commerce occurs

That's the thread my frens, enjoy the knowledge bomb

By generating definitive truth regarding real world events and data, Chainlink exponentially increases the capabilities of the smart contract economy, which will inevitably scale up to become the global economy

You Just $LINK

By generating definitive truth regarding real world events and data, Chainlink exponentially increases the capabilities of the smart contract economy, which will inevitably scale up to become the global economy

You Just $LINK

• • •

Missing some Tweet in this thread? You can try to

force a refresh