Is yield farming over?

Is dead?

A brain dump.

Is dead?

A brain dump.

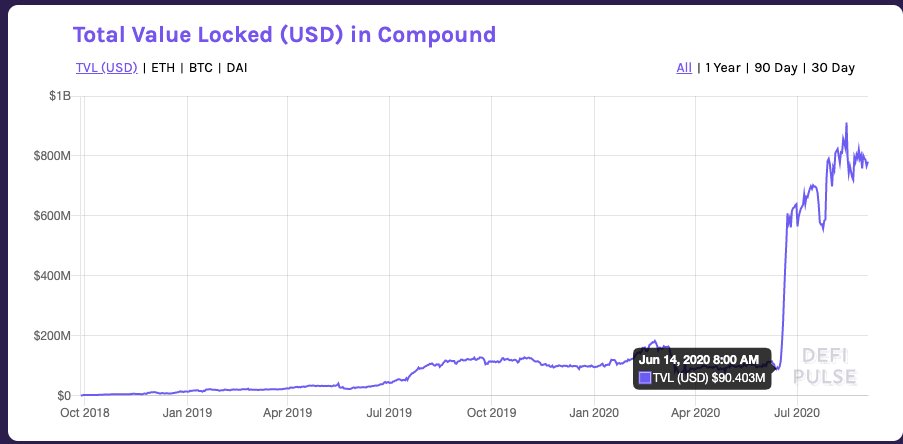

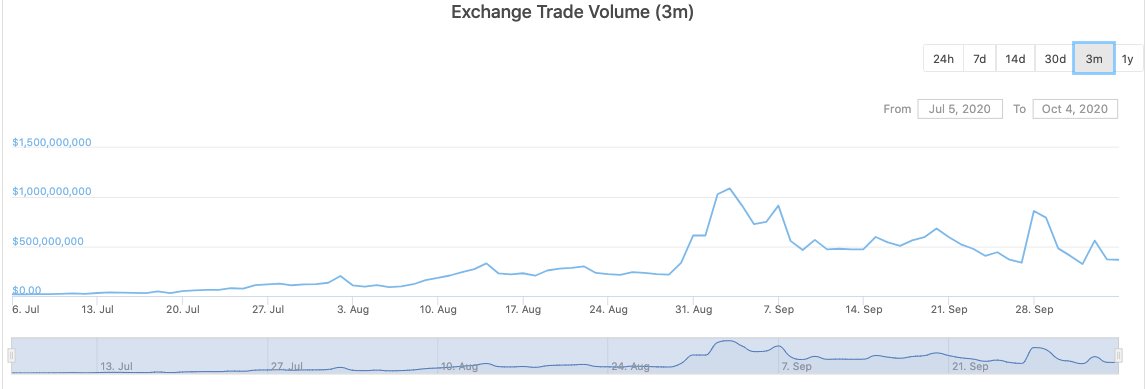

1/ First let's set the stage: August has been a phenomenal month for DeFi bulls.

Now we're in the hangover phase of the DeFi party, with the DeFi perp on @FTX_Official pretty much completely retracing the August froth back to square one.

Now we're in the hangover phase of the DeFi party, with the DeFi perp on @FTX_Official pretty much completely retracing the August froth back to square one.

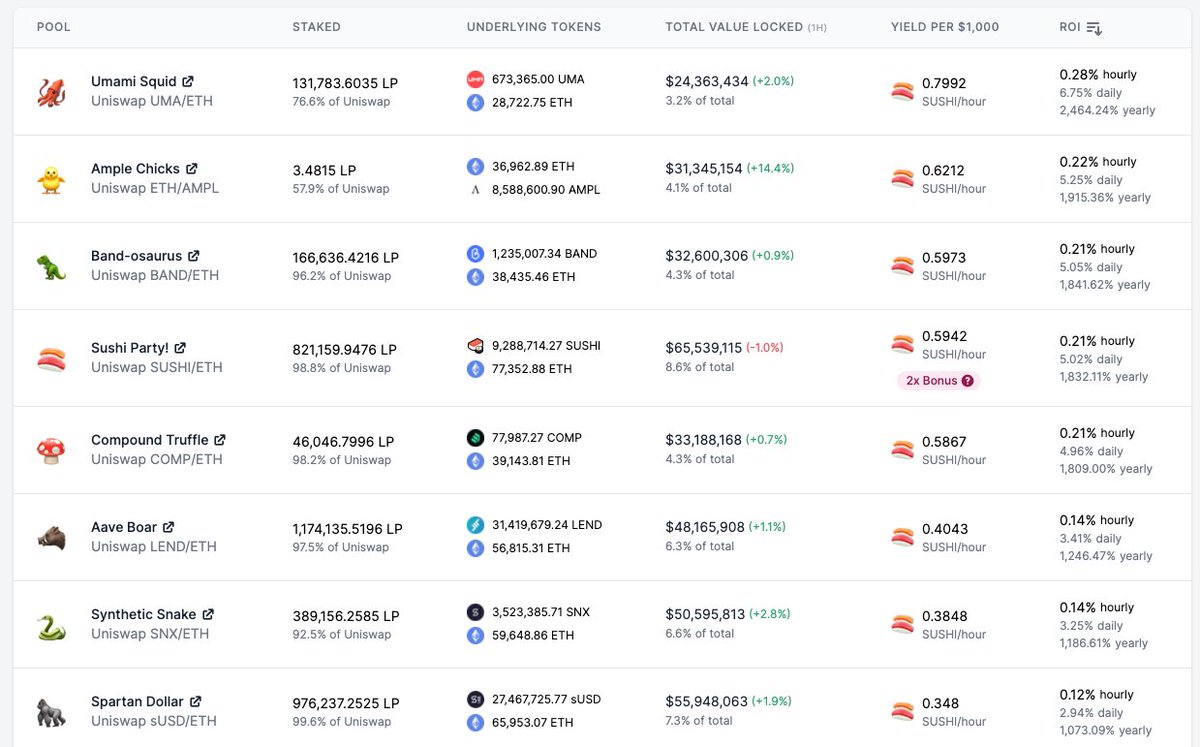

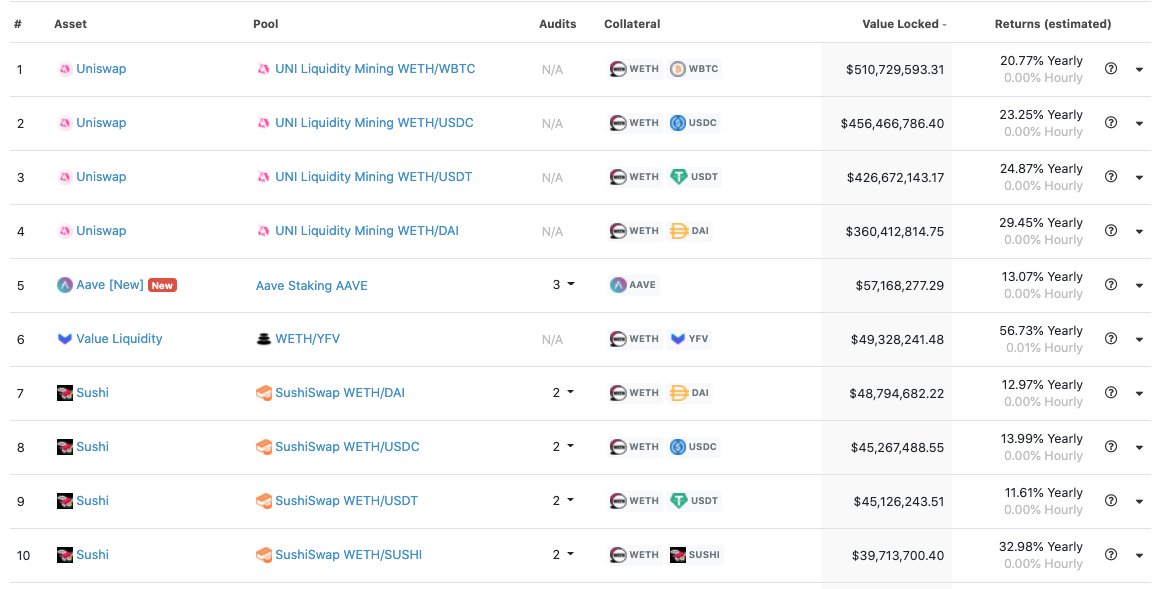

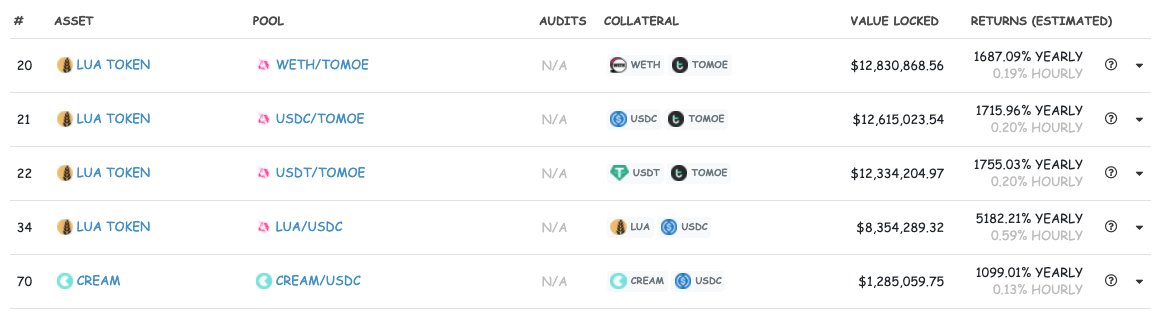

2/ Amidst the rout, there's clear signs of flight to quality in yield farming.

Despite the modest returns of "only" 20-30% APY, Uniswap accounts for ~70% of all TVL in yield farms even as a new farm.

Despite the modest returns of "only" 20-30% APY, Uniswap accounts for ~70% of all TVL in yield farms even as a new farm.

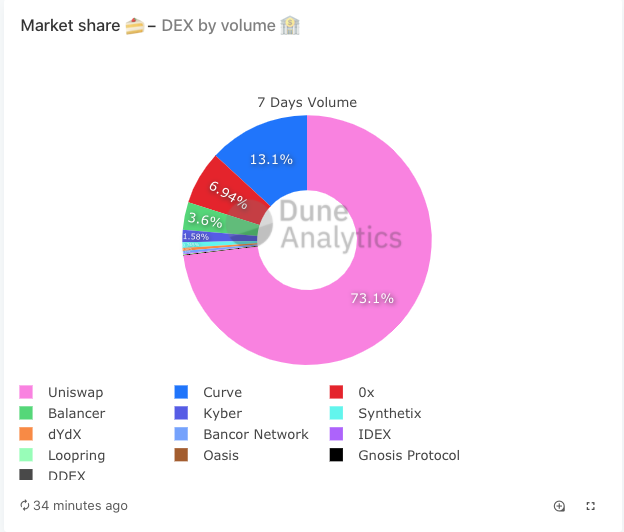

3/ Side note: given the most prolific farmers used @UniswapProtocol to dump their crops, the cool off in farming did have an impact on Uniswap volumes, but only marginally.

Uniswap is still processing 2-3x daily volumes compared to 2 months ago and owns 70%+ of dex market (!)

Uniswap is still processing 2-3x daily volumes compared to 2 months ago and owns 70%+ of dex market (!)

4/ Back to farming: the shift in sentiment was rapid.

Even "degen" farms offering north of 1500% APY are only attracting ~1/10th of the TVL they did just a month ago.

Even "degen" farms offering north of 1500% APY are only attracting ~1/10th of the TVL they did just a month ago.

5/ The drop is risk appetite and collapse in APY is a direct result of -ve price performance of new crop tokens.

Past 7 days alone:

- Basket of 84 top DeFi tokens fell by a median of 14%

- Basket of 33 yield farming tokens fell by 33%, more than double

Past 7 days alone:

- Basket of 84 top DeFi tokens fell by a median of 14%

- Basket of 33 yield farming tokens fell by 33%, more than double

6/ An easier way to visualize this - .

The poster boy of the yield farming craze, has been facing its 8th consecutive day of selling following a spectacular 1400% run within a month.

Every buyer at the first peak ($35K) is now underwater based on AVWAP.

The poster boy of the yield farming craze, has been facing its 8th consecutive day of selling following a spectacular 1400% run within a month.

Every buyer at the first peak ($35K) is now underwater based on AVWAP.

7/ Some on Twitter attribute this to @bluekirbyfi moving his funds/ Eminence degeneracy...but pikers will always try to find someone to blame when prices go down 🤷♂️

More likely reason for correction is continued suppression of APYs in yield farming.

Let's take a look...

More likely reason for correction is continued suppression of APYs in yield farming.

Let's take a look...

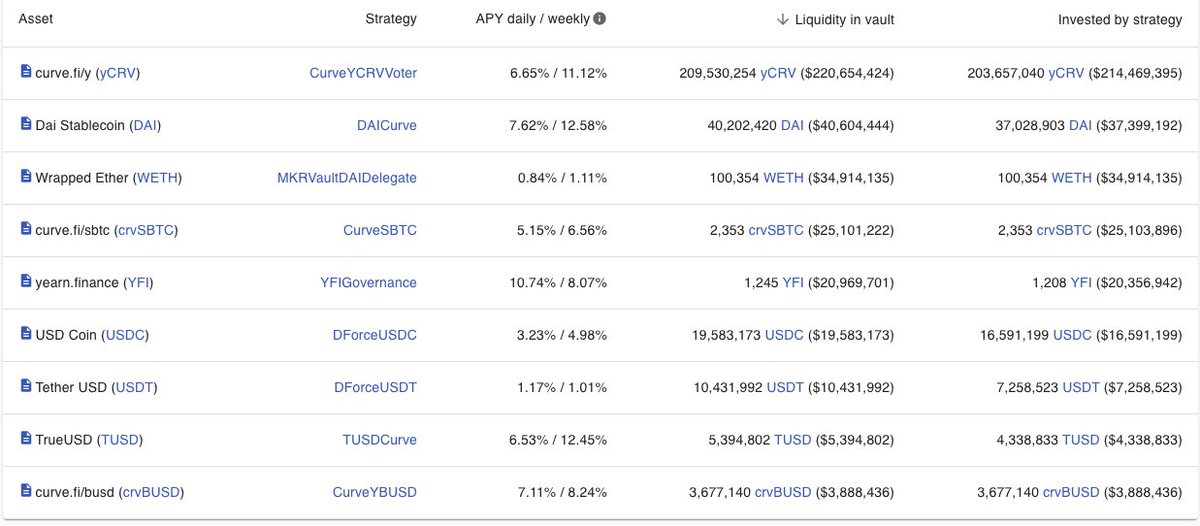

8/ As the DeFi roboadvisor, @iearnfinance offers 9 vaults - or collections of automated strategies - to make users money.

Today, ~60% of assets on yearn are locked in the yCRV vault.

What does that mean?

Today, ~60% of assets on yearn are locked in the yCRV vault.

What does that mean?

9/ That means the $220M in capital is deployed to the stablecoin pool (yPool) on @CurveFinance.

It farms with your stablecoins, dumps for more stablecoins, and thus generate a USD-denominated yield.

You can see the strategy live here:

etherscan.io/address/0xc999…

It farms with your stablecoins, dumps for more stablecoins, and thus generate a USD-denominated yield.

You can see the strategy live here:

etherscan.io/address/0xc999…

10/ Some back of the envelope math:

Currently the yCRV vault ($220M) accounts for roughly 40% ($589M) of the TVL of the y pool.

The y pool in turn accounts for 48% of the total TVL ($1.22B) on Curve.

i.e. @iearnfinance is earning + selling ~20% of all rewards daily.

Currently the yCRV vault ($220M) accounts for roughly 40% ($589M) of the TVL of the y pool.

The y pool in turn accounts for 48% of the total TVL ($1.22B) on Curve.

i.e. @iearnfinance is earning + selling ~20% of all rewards daily.

11/ The bigger point here is that a higher price benefits @iearnfinance APYs, and hence revenues + price...as long as yCRV vault remains a dominant strategy.

But the bigger the yCRV vault gets, the more sell pressure there is for ...

But the bigger the yCRV vault gets, the more sell pressure there is for ...

12/ Moreover, the outlook for is shit.

As I have stated since the launch of the token, @CurveFinance is a phenomenal product, one that I love and use personally.

But given the insane inflation, hard not to be bearish .

As I have stated since the launch of the token, @CurveFinance is a phenomenal product, one that I love and use personally.

But given the insane inflation, hard not to be bearish .

https://twitter.com/lawmaster/status/1295103619101069313?s=20

13/ tl;dr so far - is buckling under continual inflation sell pressure, which impacts yCRV APYs on @iearnfinance, and since it accounts for 60% of activity on Yearn, it's impacting projections for price...

So now what?

So now what?

14/ Imo, the key questions for bulls now are:

- Can @iearnfinance meaningfully diversify away from ?

- Can @iearnfinance innovate to beyond simply yield farming strategies?

- Can capture revenue streams from new strategies?

My prediction: yes, yes and yes.

- Can @iearnfinance meaningfully diversify away from ?

- Can @iearnfinance innovate to beyond simply yield farming strategies?

- Can capture revenue streams from new strategies?

My prediction: yes, yes and yes.

15/ On the first point, the biggest catalyst for @iearnfinance currently is the launch of new vaults and strategies - which will ideally diversify away from @CurveFinance-dependent strats.

In fact, anyone will be able to submit a strategy.

In fact, anyone will be able to submit a strategy.

https://twitter.com/fubuloubu/status/1311735846412967938?s=20

16/ Second, @iearnfinance is not "the yield farming index".

It is a bet on DeFi markets.

More specifically, I see it as a capital allocator. Farming strat is one, but once you have deposits you can deploy it anywhere (e.g. keeper + arb strats?)

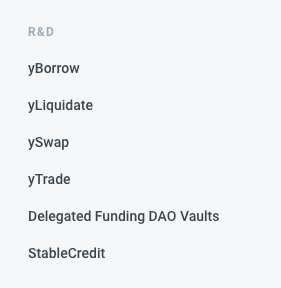

Their R&D docs...

It is a bet on DeFi markets.

More specifically, I see it as a capital allocator. Farming strat is one, but once you have deposits you can deploy it anywhere (e.g. keeper + arb strats?)

Their R&D docs...

17/ As an aside, @iam__vance summed this up succinctly from a higher level

https://twitter.com/iam__vance/status/1288508930771968000?s=20

18/ Third - on value accrual - is up to the community.

holders can seek to capture value from future @iearnfinance affiliated projects - StableCredit, Snowswap, Eminence etc. - from fee split/ airdrops.

I expect a mixture of both to create diversified revenue streams.

holders can seek to capture value from future @iearnfinance affiliated projects - StableCredit, Snowswap, Eminence etc. - from fee split/ airdrops.

I expect a mixture of both to create diversified revenue streams.

19/ Final point: the prevailing perception that @iearnfinance is @AndreCronjeTech's 1-man-show and valuation is only because of the "Dre premium" ....is wrong.

Yearn team is 20 person strong, not counting community organizers like @bluekirbyfi

Yearn team is 20 person strong, not counting community organizers like @bluekirbyfi

https://twitter.com/iearnfinance/status/1302888876302913536

20/ I don't call bottoms, but my take:

Macro is uncertain (for every asset). YFI dump sucks. Part of that is because of price. But Yearn has plans to diversify out of yCRV. Team has grown 20x in 3 months. New products are coming.

Bullish

Macro is uncertain (for every asset). YFI dump sucks. Part of that is because of price. But Yearn has plans to diversify out of yCRV. Team has grown 20x in 3 months. New products are coming.

Bullish

It's 1:30 am so I probably got some stuff wrong, but welcome all feedback from my big brain friends @santiagoroel @Darrenlautf @Rewkang @Arthur_0x @HassanBassiri @QwQiao

• • •

Missing some Tweet in this thread? You can try to

force a refresh