There's a thread by @Mitch198509 about $NFIN, a SPAC for a trade finance platform. It uses blockchain and at that point in the presentation I stopped. Forget it, of course.

But I read it again, then the proxy, then I put it in front of a trade finance lawyer. Could be something

But I read it again, then the proxy, then I put it in front of a trade finance lawyer. Could be something

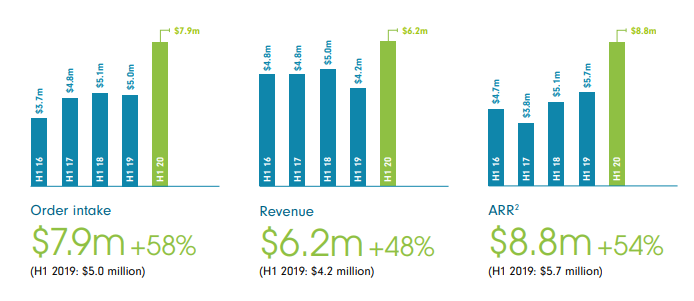

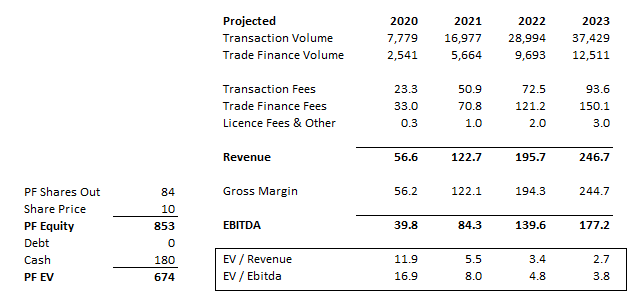

Those numbers are projections I pulled from the proxy. Earn-outs on either share price X by certain dates, or 90% of the above EBITDA being achieved.

Doesn't need to get a $NCNO to $MKTX multiple to work from here but we can dream.

HY20: Revenue $24M / Ebitda: $17M / Net $14M

Doesn't need to get a $NCNO to $MKTX multiple to work from here but we can dream.

HY20: Revenue $24M / Ebitda: $17M / Net $14M

What they do in 1 tweet:

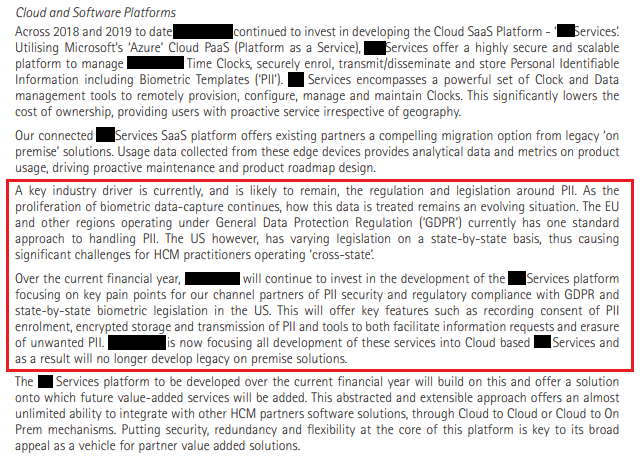

Platform for trade finance. TF is slow, paper-intensive, expensive and inaccessible for little fish: company says $1.5T unmet need with 60% of requests refused. Triterras (the biz NFIN is SPACing) brings KYC pre-qualified borrowers and lenders together.

Platform for trade finance. TF is slow, paper-intensive, expensive and inaccessible for little fish: company says $1.5T unmet need with 60% of requests refused. Triterras (the biz NFIN is SPACing) brings KYC pre-qualified borrowers and lenders together.

How they make money in 1 tweet: charge a fee, less than others. It's a marketplace platform so no balance sheet exposure.

Right, so trade finance is a pretty specialist sector and a very old friend is an experienced City trade finance lawyer so I asked him to look over it and see what he thought, does it smell right? Are small players disadvantaged? Is fraud a thing? Blockchain, srsly?

In short his answers: fraud is a thing and pointed to this below. Elsewhere SPAC-nerd/guru @RodriGo_ethe pointed me to this reuters article mentioning commodity fraud, the same $1.5T shortfall figure above and Singapore as a home for peers to Triterras

es.reuters.com/article/idUSKC…

es.reuters.com/article/idUSKC…

On the company he wrote to say he had no qualms as to their expertise and that their descriptions of trade product were correct, "they definitely know what they're talking about"

Speaking later, he called out specifically this partnership with Marsh as very credible in his eyes

Speaking later, he called out specifically this partnership with Marsh as very credible in his eyes

Here is the big problem in his view: the industry is very old school. He pointed out that in the UK at least, trade finance is still governed by an Act of Parliament from 1882. He sees the industry as ripe for change and moves are afoot towards platforms.

According to him, two large banks in UK are trying to do something non-blockchain along these lines and there is interest from others, so Triterras isn't pie in the sky - but for the time being, everyone's wedded to paper and blockchain for the big boys, "a decade away" if ever

This below governs the rules for Letters of Credit, it is called UCP. He explained it to me that they've tried to update it for the modern age - the eUCP. His words: "nobody has ever looked at it"

It's difficult for me to see the word blockchain and maintain any credibility but hopefully this is some useful background information and an intro to a company that, as a very risky punt, could be an interesting one to follow and if they continue to execute, who knows?

• • •

Missing some Tweet in this thread? You can try to

force a refresh