Some weekly #torontorealestate sales numbers in this thread. Firstly, week over week pattern this year continued to follow same as last year (only couple of deviations on here, main one being Labour Day one week later this year). /1

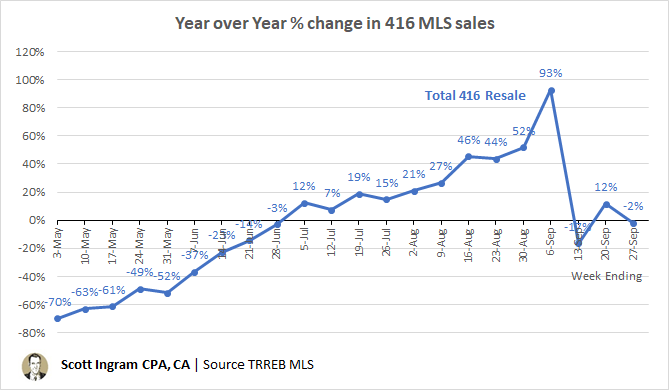

The total sales in the 416 in the past 4 weeks cumulative have been just 1% below 2019, with this week being flat. /2

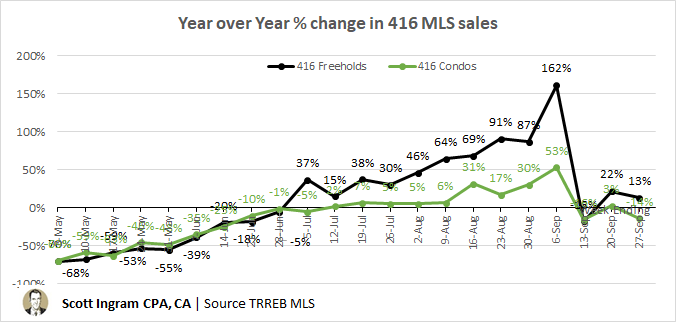

But "tale of two cities" continues, with freehold (lowrise houses) selling stronger than last year and condos (apts and townhouses combined) selling weaker of late (and didn't show the huge "pent-up demand" that houses did. /3

Here are the absolute numbers, with freeholds higher than condos the last 3 weeks. Fall is usually a boost period for houses (condos aren't as seasonal), but still it's abnormal for house sales to be > condos (full year numbers usually 60/40 for condos). /4

Here's what I mean with freehold seasonality. Can see is transacting at higher volumes than 2019, but should be on the way down now until end of year. /5

• • •

Missing some Tweet in this thread? You can try to

force a refresh