TRREB has released its September #torontorealestate numbers. They like to accentuate the stats that would indicate everything is awesome, but let me point out 5⃣ STATS SHOWING MARKET COOLING ❄️ /1

First let me say it's not a COLD market yet by any means. But problem is everyone just likes to look at YoY change. When you think about it, 12 months is a somewhat arbitrary period to compare to. So September sales are way ⬆️(42%) and average prices are also ⬆️ (14%) /2

1⃣ AVERAGE YoY PRICE GROWTH IS SLOWING.

In July it was +16.9%

In August it was +20.1%

In September that slowed right down to +14.0%

Note a good chunk of the price growth is due to mix (less condo apts, more detached). /3

In July it was +16.9%

In August it was +20.1%

In September that slowed right down to +14.0%

Note a good chunk of the price growth is due to mix (less condo apts, more detached). /3

2⃣ 416 COMPOSITE HPI FELL LAST MONTH

Okay, we're talking $300 which is basically even on $971,500. While Single Family Detached and SF Attached both edged higher, Townhouses stopped growing and Condo Apts fell $2,000 and are now $14,400 off the May high of $633,600. /4

Okay, we're talking $300 which is basically even on $971,500. While Single Family Detached and SF Attached both edged higher, Townhouses stopped growing and Condo Apts fell $2,000 and are now $14,400 off the May high of $633,600. /4

3⃣ 416 CONDO APT HPI PRICE GROWTH SLOWEST SINCE 2016

The Home Price Index is now +6.79% YoY. That's nothing to cry about. But the first 5 months this year were all >10%, with a peak of 12.86% in March. This is the lowest mark since April 2016 (overdue regression to the mean) /5

The Home Price Index is now +6.79% YoY. That's nothing to cry about. But the first 5 months this year were all >10%, with a peak of 12.86% in March. This is the lowest mark since April 2016 (overdue regression to the mean) /5

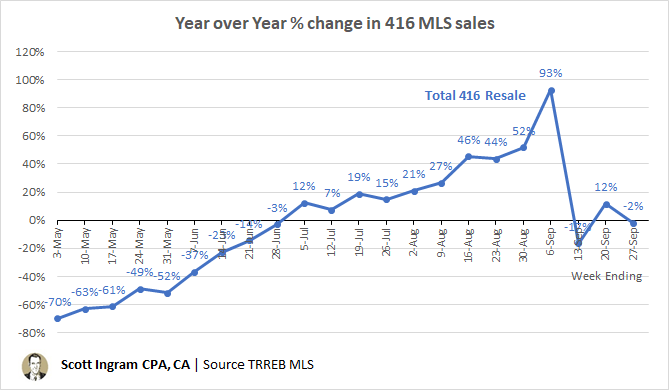

4⃣ SALES WERE ⬇️5% IN THE MONTH ON A SEASONALLY ADJUSTED BASIS

TRREB seems to mention seasonally adjusted numbers when it suits its narrative, and not when it doesn't. Still second highest month this year, but may show corner has been turned. Only Mar/Apr SA MoM were worse. /6

TRREB seems to mention seasonally adjusted numbers when it suits its narrative, and not when it doesn't. Still second highest month this year, but may show corner has been turned. Only Mar/Apr SA MoM were worse. /6

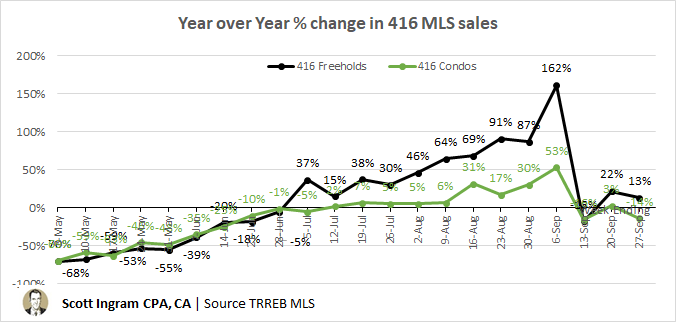

5⃣ 416 SNLR BORDERING ON BUYER'S MARKET

In 🔥 February the highlighted number was 70% (905 was at 67%). 905 still heated. Here's last 3 months:

416: 52%, 46%, 41%

905: 68%, 67%, 64%

This is all condo-driven. 416 Detached was 50.1%, 416 Condo Apt was 32.4% (buyer's market). /7

In 🔥 February the highlighted number was 70% (905 was at 67%). 905 still heated. Here's last 3 months:

416: 52%, 46%, 41%

905: 68%, 67%, 64%

This is all condo-driven. 416 Detached was 50.1%, 416 Condo Apt was 32.4% (buyer's market). /7

I don't like this stat because there's too much junk in new listings (If the same property gets listed and re-listed twice in the same month, that counts as 3 "new listings"). People say 40%-60% is balanced market, <40% favours buyers, >60% favours sellers but not that simple. /8

Anyway, higher is hotter, lower is colder. But TRREB's not saying CONDOS IN BUYER'S MARKET! Only mention in the press release was "The relatively better supplied condominium apartment segment experienced a comparatively slower pace of price growth." /9

As per usual, this is just my first-take. My more in-depth analysis of the 416 market with my custom market charts is to follow... /10

• • •

Missing some Tweet in this thread? You can try to

force a refresh