With our annual Intergenerational Audit published tomorrow, we look back at recent research from our Intergenerational Centre on the impact of the crisis so far. Lot more to come in the Audit!

Employment and pay: Even three years after having left full-time education, we estimate that the employment rate of this year’s graduates could be 13 per cent lower than it would have been absent the crisis.

Employment and pay: Moreover, a large proportion of nongraduate leavers tend to begin their careers in sectors that were largely shut in the lockdown and are likely to suffer declines over the medium-to-longer term, such as retail and hospitality.

Housing: Living conditions differ markedly between age groups: younger people are more likely to live in a damp home; and are more likely to live in a derelict or congested neighbourhood than older people.

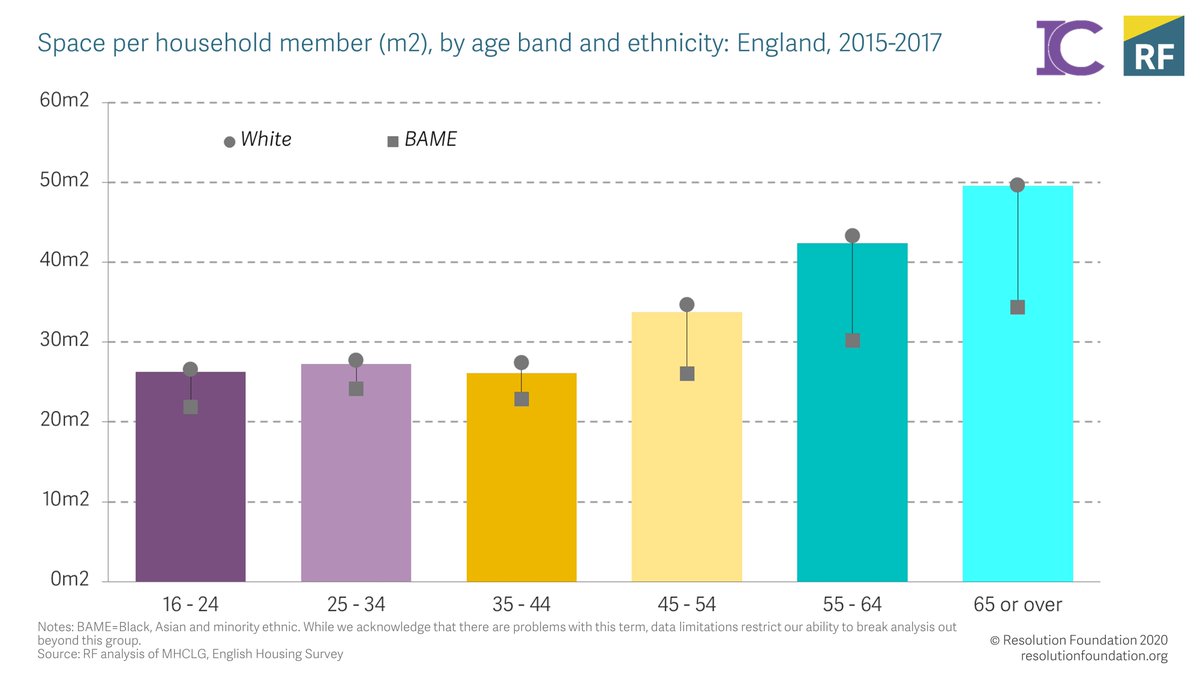

Housing: There are also widespread inequalities within age groups, particularly in terms of ethnicity and income. People aged 55 and older from black, Asian and minority ethnic backgrounds occupy homes with 30 per cent less useable space than white people of the same age.

Taxes, benefits and household income: Our analysis of the age distribution of money spent on the JRS, SEISS and UC and tax credit boost shows that support was fairly evenly spread across those aged 25 to 55.

Taxes, benefits and household income: JRS spending is more evenly distributed across different age groups because younger furloughed workers tend to earn less -the average furloughed employee received £1,400 per month compared to less than £1,000 per month for those aged under 25

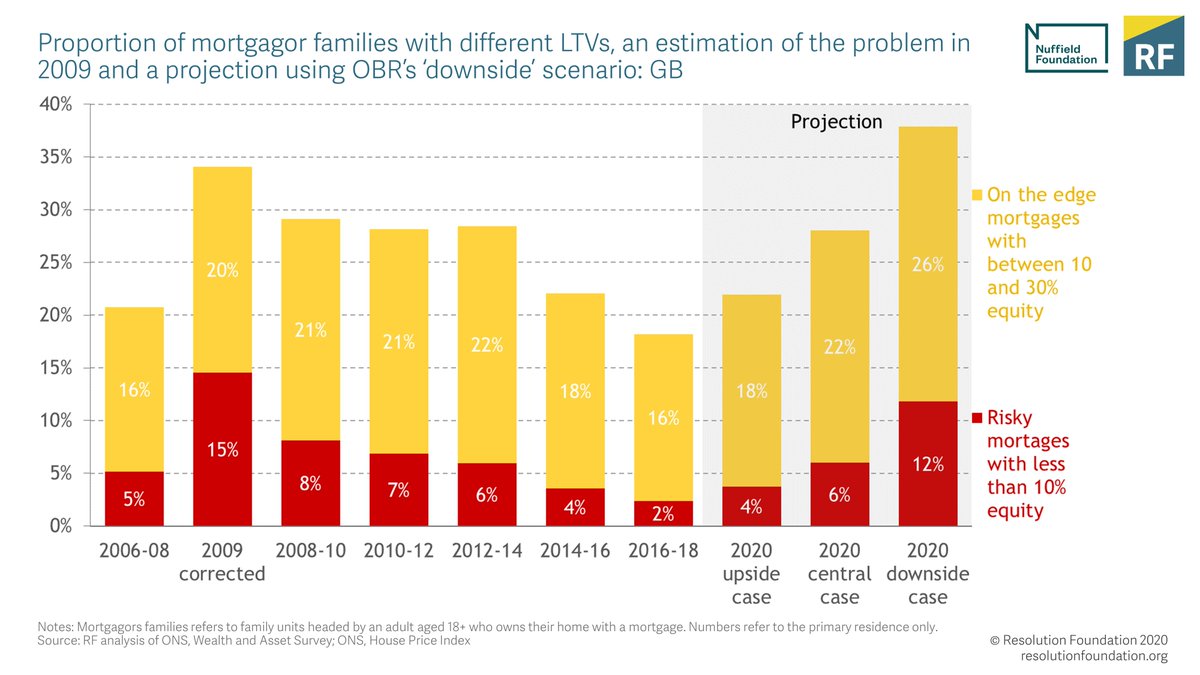

Wealth and assets: The negative equity problem looks to be smaller today than after the financial crisis. Even in the OBR’s ‘downside’ scenario with respect to house price falls, 12% of mortgagors could fall into low or negative equity compared to 15% after the financial crisis.

Wealth and assets: Compared with the financial crisis, negative equity risks have moved up the age distribution, and families with equity risks now have higher incomes and wealth than those at risk after the financial crisis.

Read the full Intergenerational Audit tomorrow with lots of new analysis providing the first comprehensive assessment of how the crisis has affected different generations across society. Join our launch event for the report here: resolutionfoundation.org/events/lives-l…

• • •

Missing some Tweet in this thread? You can try to

force a refresh